Rentokil Initial 3Q Pretax Profit More Than Doubles

06 November 2009 - 6:52PM

Dow Jones News

Pest control and cleaning specialist Rentokil Initial PLC

(RTO.LN) Friday reported third-quarter pretax profit more than

doubled amid difficult trading conditions and said in the fourth

quarter it would continue to focus on delivering service, cutting

costs and generating cash.

Chief Executive Alan Brown said he would continue to drive

operational excellence through service productivity and reducing

administration and overhead costs but, above all, "we are focusing

on the development of a strong growth agenda."

Third-quarter pretax profit rose to GBP24 million from GBP11.1

million in the same period a year ago while revenue fell 3.2% to

GBP583 million. Rentokil's earnings were boosted by the

strengthening of the euro against sterling as some 70% of its

earnings are denominated in the common currency.

The company revised its guidance for its troubled parcels

business City Link, which is expected to make an operating loss of

GBP7 million for the full year, compared with GBP12 million

previously forecast.

Rentokil is undergoing a three- to five-year restructuring

process after the performance of its City Link business sparked

several profit warnings and a change of management. The company cut

its dividend as part of this process but CEO Brown said in July

that the company would reconsider its dividend in 2010.

Rentokil shares closed Thursday at 112 pence, giving the company

a market capitalization of GBP2.03 billion. They have more than

doubled in value since the start of the year on optimism about the

company's turnaround strategy.

-By Anita Likus, Dow Jones Newswires; +44 20 7842 9407;

anita.likus@dowjones.com

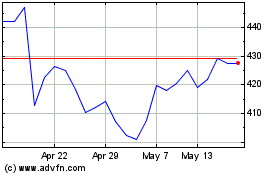

Rentokil Initial (LSE:RTO)

Historical Stock Chart

From Apr 2024 to May 2024

Rentokil Initial (LSE:RTO)

Historical Stock Chart

From May 2023 to May 2024