TIDMSFOR

RNS Number : 8626S

S4 Capital PLC

09 November 2023

RNS Number:

S(4) Capital PLC

9 November 2023

S(4) Capital plc

Third Quarter Trading Update

("S(4) Capital", "the Company" or "the Group")

Third quarter reported net revenue(2) down 15.4%,

like-for-like(3) down 10.0% reflecting lower activity in Content

and Data&Digital media

Two and three year third quarter like-for-like net revenue

stacks 19.3% and 61.6%

Year to date reported net revenue growth of 5.1%, down 0.3%

like-for-like

Two and three year nine month like-for-like net revenue stacks

28.1% and 74.7%

Continued client conversion at scale, with year to date

like-for-like revenue growth from top 20 clients of 2.9% and top 50

clients of 4.6%

Full year like-for-like net revenue expected below prior year,

with an operational EBITDA(1) margin now around 10-11%(8)

Free cash flow in 2024 will be available for buybacks and

dividends with no further merger payments scheduled

Key financials

GBP millions Three months Three months change change change

ended ended Reported Like-for-like(3) Pro-forma(4)

30 Sep 2023 30 Sep 2022

===================== ============= ============= ========== ================== ==============

Billings(5) 450.3 484.2 (7.0%) (1.4%) (1.4%)

Revenue

Content 160.9 208.2 (22.7%) (18.2%) (18.2%)

Data&Digital media 49.6 58.0 (14.5%) (8.7%) (8.7%)

Technology services 35.4 33.9 4.4% 12.4% 12.4%

--------------------- ------------- ------------- ---------- ------------------ --------------

Total 245.9 300.1 (18.1%) (13.0%) (13.0%)

Net revenue

Content 127.2 159.7 (20.4%) (15.6%) (15.6%)

Data&Digital media 48.9 57.0 (14.2%) (8.4%) (8.4%)

Technology services 35.4 33.2 6.6% 14.9% 14.9%

--------------------- ------------- ------------- ---------- ------------------ --------------

Total 211.5 249.9 (15.4%) (10.0%) (10.0%)

Net revenue by

Geography(7)

Americas 167.6 19 6.1 (14.5%) (8.3%) (8.3%)

EMEA 30.4 3 7.5 (18.9%) (18.5%) (18.5%)

Asia-Pacific 13.5 16. 3 (17.2%) (9.4%) (9.4%)

--------------------- ------------- ------------- ---------- ------------------ --------------

Total 211.5 249.9 (15.4%) (10.0%) (10.0%)

GBP millions Nine months Nine months change change change

ended ended Reported Like-for-like(3) Pro-forma(4)

30 Sep 202 30 Sep 2022

3

===================== ============ ============= ========== ================== ==============

Billings(5) 1,375.6 1,264.1 8.8% 6.2% 6.2%

Revenue

Content 495.7 527.2 (6.0%) (9.3%) (9.3%)

Data&Digital media 157.7 160.3 (1.6%) (1.5%) (1.5%)

Technology services 109.6 59.0 85.8% 36.0% 36.0%

--------------------- ------------ ------------- ---------- ------------------ --------------

Total 763.0 746.5 2.2% (3.1%) (3.1%)

Net revenue

Content 392.0 409.9 (4.4%) (7.2%) (7.2%)

Data&Digital media 155.5 157.7 (1.4%) (1.3%) (1.3%)

Technology services 109.5 57.6 90.1% 38.6% 38.6%

--------------------- ------------ ------------- ---------- ------------------ --------------

Total 657.0 625.2 5.1% (0.3%) (0.3%)

Net revenue by

Geography(7)

Americas 521.3 480.6 8.5% 1.4% 1.4%

EMEA 96.5 100.8 (4.3%) (5.7%) (5.7%)

Asia-Pacific 39.2 43.8 (10.5%) (7.8%) (7.8%)

--------------------- ------------ ------------- ---------- ------------------ --------------

Total 657.0 625.2 5.1% (0.3%) (0.3%)

Sir Martin Sorrell, Executive Chairman of S (4) Capital Plc

said:

"Trading in the third quarter was difficult, reflecting the

global macroeconomic conditions with continued client caution to

commit and extended sales cycles, particularly for larger projects

and to some extent clients in the Technology sector. Despite the

slowdown in Q3, we continue to see year to date growth from our top

clients with like-for-like revenue growth at our top 20 clients up

2.9% and at the top 50 up 4.6%. We expect, as usual, Q4

profitability to be the strongest quarter of the year - stimulated

by the usual seasonal levels of client activity and the Artificial

Intelligence initiatives and use cases we are developing with our

clients, along with the actions taken on cost management. We remain

confident our strategy, business model and talent, together with

scaled client relationships position us well for above average

growth in the longer term, with an emphasis on deploying free cash

flow to dividends and share buybacks, especially as in 2024 will

have no further merger payments."

Notes (in this document):

1. Operational EBITDA is EBITDA adjusted for acquisition related

expenses, non-recurring items and recurring share-based payments,

and includes right-of-use assets depreciation. It is a non-GAAP

measure management uses to assess the underlying business

performance.

2. Net revenue is revenue less direct costs.

3. Like-for-like is a non-GAAP measure and relates to 2022 being

restated to show the unaudited numbers for the previous year of the

existing and acquired businesses consolidated for the same months

as in 2023, applying currency rates as used in 2023.

4. Pro-forma numbers relate to unaudited full year non-statutory

and non-GAAP consolidated results in constant currency as if the

Group had existed in full for the year and have been prepared under

comparable GAAP with no consolidation eliminations in the

pre-acquisition period.

5. Billings is gross billings to client including pass through costs.

6. Net debt comprises cash minus gross bank loans (excluding transaction costs).

7. The prior period geographical split of net revenue has been

re-presented to be consistent with the internal reporting provided

to the Group's Board of Directors in the current period.

8. This is a target and not a profit forecast.

Q3 Trading Update

The challenging trading conditions we saw in the first half have

intensified in Q3. Billings were GBP450.3 million down 7.0%

reported and 1.4% like-for-like. Revenue was down 18.1% reported to

GBP245.9 million, down 13.0% like-for-like. Net revenue declined

15.4% on a reported basis, or 10.0% like-for-like. Reported revenue

and net revenue were impacted by FX, in particular the USD to GBP.

Two year and three year third quarter like-for-like net revenue

stacks were 19.3% and 61.6%.

Q3 earnings before interest, tax, depreciation and amortisation

(EBITDA), both on a reported basis and like-for-like principally re

ect lower activity levels in Content and Data&Digital media. We

have continued to take action on the cost base, particularly in

Content and have seen a significant reduction in headcount across

the Company.

The number of people in the rm was 8,187 at the end of the third

quarter down 4% compared to 8,551 at the end of the first half, and

9% lower than our June 2022 figure of 9,041, reflecting the

progress that has been made on aligning our cost base to the demand

we are seeing from our clients. Further actions are being taken in

Q4, with significant focus on managing our cost base and driving

efficiency across the Company.

Performance by Practice

Reported Content practice revenue was down 22.7% in the third

quarter to GBP160.9 million, with like-for-like down 18.2% whilst

there was some growth across the scaled and managed clients overall

demand was lower particularly in the newer regional and local

clients and the technology sector. Third quarter net revenue was

down 20.4% to GBP127.2 million reported and 15.6% like-for-like.

Two year and three year like-for-like net revenue stacks are at

12.5% and 53.7% for the quarter.

Year-to-date the Content practice reported revenue was down 6.0%

to GBP495.7 million and 9.3% like-for-like. Content reported net

revenue was down 4.4% to GBP392.0 million and 7.2% like-for-like.

Year to date like-for-like net revenue two year and three year

stacks are at 19.5% and 66.5%.

We have made changes to the leadership structure of the Content

practice, which includes a new co-CEO Bruno Lambertini, and new

leadership in several key markets including APAC to accelerate

growth from local and regional clients.

Data&Digital media practice third quarter reported revenue

was down 14.5% to GBP49.6 million and 8.7% like-for-like reflecting

lower activity particularly in the activation and performance

business lines. Third quarter reported net revenue was down 14.2%

to GBP48.9 million and down 8.4% like-for-like. Two and three year

third quarter like-for-like net revenue stacks are 6.8% and

51.3%.

Year-to-date Data&Digital media practice reported revenue

was down 1.6% to GBP157.7 million and 1.5% like-for-like. Net

revenue was down 1.4% to GBP155.5 million and 1.3% like-for-like.

Year to date two and three year Data&Digital media

like-for-like net revenue stacks are at 18.8% and 64.6%.

Technology services practice third quarter reported revenue was

up 4.4% to GBP35.4 million with lower growth than the first half

reflecting timing on major client projects weighted to the first

six months. Revenue was up 12.4% like-for-like. Third quarter

reported net revenue was up 6.6% to GBP35.4 million, up 14.9%

like-for-like. Two year third quarter like-for-like net revenue

stacks are industry leading at 88.7%.

Year-to-date Technology services reported revenue was up 85.8%

to GBP109.6 million, like-for-like up 36.0%. Reported net revenue

was up 90.1% to GBP109.5 million, with like-for-like up 38.6%. Year

to date two year like-for-like net revenue stacks are industry

leading at 118.6%.

On October 31(st) Technology services practice combined with

Formula Consultants, a leading enterprise software supplier.

Formula Consultants provides mission-critical solutions that keep

core mainframe infrastructure running for major enterprises and

large public sector clients around the World, including United

Airlines, Arconic, Lloyds, Carnival Cruise Line, the IRS, and over

twenty more. This combination enables the Company to cross-sell our

consulting, digital transformation, and product engineering

capabilities into a portfolio of blue-chip brands. Formula

Consultants generated revenues of around $2.5m in their last

financial year, and the combination values the company at up to

$2.5m in an all cash deal based on performance to the end of 2024.

Whilst large scale M&A is not in our current plans we will

continue to look for opportunities like Formula Consultants to

boost our capability set and opportunities for growth.

Performance by Geography

The Americas, our largest market is seeing the impact of the

slowdown in activity and the impact of FX with third quarter

reported net revenue down 14.5% to GBP167.6 million and 8.3%

like-for-like. Year-to-date, the Americas reported net revenue was

up 8.5% to GBP521.3 million and 1.4% like-for- like.

Europe, the Middle East and Africa also saw a reduction in

demand, with reported net revenue down 18.9% to GBP30.4 million and

like-for-like 18.5%. Year-to-date reported net revenue was down

4.3% to GBP96.5 million and like-for-like 5.7%.

Asia Paci c, our smallest region also saw lower activity and FX

impact, with reported net revenue down 17.2% to GBP13.5 million in

the third quarter and 9.4% like-for-like. Year-to-date reported net

revenue declined 10.5% to GBP39.2 million and like-for-like was

down 7.8%.

Balance Sheet

Net debt ended the third quarter at GBP185 million, or 1.7x net

debt/12 month proforma operational EBITDA. The trailing 12 months

proforma EBITDA was GBP107.2 million. The balance sheet has

sufficient liquidity and long-dated debt maturities to facilitate

growth and our key covenant, being net debt not to exceed 4.5x the

12 month proforma EBITDA.

Client Development and Momentum

Our stated 'whopper' or portfolio client strategy of building

broad scaled relationships with leading enterprise clients

continues to be the focus. Year to date revenues from our top 20

clients grew 2.9% on a like-for-like basis and the average size of

our top 20 clients increased approximately 10% from GBP20.3 million

to GBP22.9 million. Our top 50 client cohort delivered year to date

revenue growth of 4.6% on a like-for-like basis and their average

size increased also by approximately 10% from GBP9.8 million to

GBP11.1 million. We will likely have eight "whoppers" this year,

with a further two almost reaching $20 million of revenue in

2023.

People and ESG

Our talented people have responded positively to the challenging

trading conditions and our drive for efficiency. We have continued

to make progress in the three areas of our ESG strategy: zero

impact workspaces, sustainable work, and diversity, equity and

inclusion (DE&I).

Current Trading

Given slower than expected trading in Q3 and current client

activity levels, we expect that like-for-like net revenue for 2023

will be below the prior year, with an operational EBITDA margin now

of around 10-11%(8) .

As in recent years, we continue to expect the full year profits

to be heavily Q4 weighted, reflecting our seasonality and

anticipated client activity, along with the impact of cost actions

already taken.

Our net debt is expected to rise in Q4 reflecting further

payments for prior year combinations, after which virtually all the

existing contingent consideration due will have been satisfied. We

expect to end the year around the top of our previously guided

range of GBP180-220 million. We aim for financial leverage of

around 1.5 times operational EBITDA over the medium term. Over the

longer term we continue to expect our growth to outperform our

addressable markets and operational EBITDA margins to return to

historic levels of 20%+.

Webcast and conference call

A video webcast and conference call covering the trading update

will be held today at 09.00 GMT, followed by another webcast and

call at 08.00 EST / 13.00 GMT.

09:00 GMT webcast (watch only):

Webcast: https://brrmedia.news/SFOR_Q323

Conference call:

UK: +44 (0) 33 0551 0200

US: +1 786 697 3501

Confirmation code: Quote 'S (4) Capital Results' when prompted

by operator

08:00 E S T / 13:00 GMT webcast (watch only):

Webcast: https://brrmedia.news/SFOR_Q323US

Conference call:

UK: +44 (0) 33 0551 0200

US: +1 786 697 3501

Confirmation code: Quote 'S (4) Capital Results US' when

prompted by operator

Enquiries to:

S(4) Capital plc +44 (0)20 3793 0003

Sir Martin Sorrell (Executive

Chairman)

Powerscourt (PR Advisor) +44 (0)7970 246 725

Elly Williamson/ Pete Lambie

About S (4) Capital

S (4) Capital plc (SFOR.L) is the tech-led, new age/new era

digital advertising, marketing and technology services company,

established by Sir Martin Sorrell in May 2018.

Our strategy is to build a purely digital advertising and

marketing services business for global, multinational, regional,

and local clients, and millennial-driven influencer brands. This

will be achieved by integrating leading businesses in three

practices: Content, Data&Digital Media and Technology Services,

along with an emphasis on 'faster, better, cheaper, more' execution

in an always-on consumer-led environment, with a unitary

structure.

Victor Knaap, Wesley ter Haar, Christopher S. Martin, Scott

Spirit and Mary Basterfield all joined the S (4) Capital Board as

Executive Directors. The S (4) Capital Board also includes Rupert

Faure Walker, Paul Roy, Daniel Pinto, Sue Prevezer, Elizabeth

Buchanan, Naoko Okumoto, Margaret Ma Connolly, Miles Young and

Colin Day.

The Company now has approximately 8, 2 00 people in 32 countries

with approximately 80 % of net revenue across the Americas, 15 %

across Europe, the Middle East and Africa and 5 % across

Asia-Pacific. The longer-term objective is a geographic split of

60%:20%:20%. Content currently accounts for approximately 6 0 % of

net revenue, Data&Digital Media 2 5 % and Technology Services 1

5 %. The long-term objective for the practices is a split of

50%:25%:25%.

Sir Martin was CEO of WPP for 33 years, building it from a GBP1

million 'shell' company in 1985 into the world's largest

advertising and marketing services company, with a market

capitalisation of over GBP16 billion on the day he left. Prior to

that Sir Martin was Group Financial Director of Saatchi &

Saatchi Company Plc for nine years.

Disclaimer

This announcement includes 'forward-looking statements'. All

statements other than statements of historical facts included in

this announcement, including, without limitation, those regarding

the Company's financial position, business strategy, plans and

objectives of management for future operations (including

development plans and objectives relating to the Company's

services) are forward-looking statements.

Forward-looking statements are subject to risks and

uncertainties and accordingly the Company's actual future financial

results and operational performance may differ materially from the

results and performance expressed in, or implied by, the

statements. These factors include but are not limited to those

described in the Company's prospectus dated 8 October 2019 which is

available on the news section of the Company's website. These

forward- looking statements speak only as at the date of this

announcement. S(4) Capital expressly disclaims any obligation or

undertaking to update or revise any forward-looking statements

contained herein to reflect actual results or any change in the

assumptions, conditions or circumstances on which any such

statements are based unless required to do so.

No statement in this announcement is intended to be a profit

forecast and no statement in this announcement should be

interpreted to mean that earnings per share of the Company for the

current or future years would necessarily match or exceed the

historical published earnings per share of the Company.

Neither the content of the Company's website, nor the content on

any website accessible from hyperlinks on its website for any other

website, is incorporated into, or forms part of, this announcement

nor, unless previously published by means of a recognised

information service, should any such content be relied upon in

reaching a decision as to whether or not to acquire, continue to

hold, or dispose of, shares in the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKFBKDBDBNDK

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

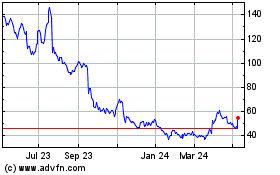

S4 Capital (LSE:SFOR)

Historical Stock Chart

From Apr 2024 to May 2024

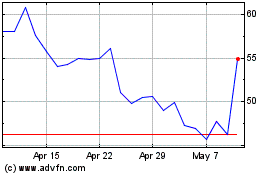

S4 Capital (LSE:SFOR)

Historical Stock Chart

From May 2023 to May 2024