SEGRO PLC BIG BOX WAREHOUSE ACQUIRED IN SWAP TRANSACTION (1623V)

01 November 2017 - 6:00PM

UK Regulatory

TIDMSGRO

RNS Number : 1623V

SEGRO PLC

01 November 2017

1 November 2017

SEGRO ACQUIRES PRIME MIDLANDS BIG BOX WAREHOUSE

IN ASSET SWAP TRANSACTION

SEGRO plc ("SEGRO" or "the Company") has acquired a fully let

390,000 sq ft big box warehouse in the Midlands region of the UK

from LGIM Real Assets ("Legal & General"), in exchange for

Kingsland Business Park, which is a multi-let industrial estate in

Basingstoke, and a balancing cash payment.

The warehouse is located in Crick, a prime location close to

junction 18 of the M1 motorway. It is let to Butcher's Pet Care

Limited, one of the UK's leading producers of pet food, and is the

company's only facility in the UK, having been located in the area

since 1976. The warehouse, which was constructed in two stages

between 2010 and 2016, is leased for a further 19 years without

break. The acquisition price of GBP41.3 million reflects a net

initial yield of 5.0 per cent and offers reversionary potential

compared to current rental levels for modern warehousing in the

area.

Kingsland Business Park comprises 50 buildings totalling 676,300

sq ft and is located two miles from Basingstoke town centre and

three miles from the M3 motorway. The estate has an average lease

length of approximately three years and a vacancy rate of less than

5 per cent. The disposal price of GBP70.0 million reflects a net

initial yield of 5.9 per cent and is ahead of book value at 30 June

2017.

Phil Redding, Chief Investment Officer of SEGRO, commented:

"This is SEGRO's ninth asset swap, enabling us to focus our

portfolio on our core areas and asset types, in particular on big

box warehouses in the Midlands and urban warehouses in London and

the Thames Valley, whilst mitigating the impact of a disposal on

income."

DTRE acted for SEGRO and JLL acted for Legal & General.

ENDS

For further information, please contact:

SEGRO plc

Harry Stokes (Head of Investor Relations and Research)

Tel: +44 (0) 20 7451 9124 / harry.stokes@segro.com

Lizzie Humphreys (External Communications Manager)

Tel: +44 (0) 20 7451 9129 / lizzie.humphreys@segro.com

Richard Sunderland / Claire Turvey / Eve Kirmatzis (FTI

Consulting)

Tel: +44 (0) 20 3727 1000

Notes to Editors:

ABOUT SEGRO

SEGRO is a UK Real Estate Investment Trust (REIT), and a leading

owner, manager and developer of modern warehouses and light

industrial property. It owns or manages 6.3 million square metres

(68 million square feet) of space valued at over GBP8 billion,

serving customers from a wide range of industry sectors. Its

properties are located in and around major cities and at key

transportation hubs in the UK and in nine other European

countries.

See www.SEGRO.com for further information.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQQFLFXDBFEFBZ

(END) Dow Jones Newswires

November 01, 2017 03:00 ET (07:00 GMT)

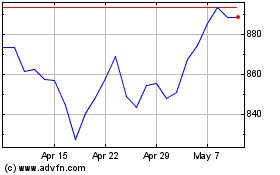

Segro (LSE:SGRO)

Historical Stock Chart

From Apr 2024 to May 2024

Segro (LSE:SGRO)

Historical Stock Chart

From May 2023 to May 2024