Tetragon Financial Group Ltd Agreement & Notification of a tender offer

19 December 2018 - 7:18PM

UK Regulatory

TIDMTFG

Tetragon Financial Group Limited Announcement of GreenOak Real Estate merger

with Sun Life Financial's real estate and property management firm Bentall

Kennedy and Intention to Conduct Tender Offer

LONDON, Dec. 19, 2018 /PRNewswire/ --

GreenOak Real Estate merger with Bentall Kennedy:

Tetragon Financial Group Limited today announces the merger of its GreenOak

Real Estate joint venture with Bentall Kennedy, Sun Life Financial Inc.'s

leading North American real estate and property management firm. The combined

Bentall Kennedy and GreenOak entity will be named Bentall GreenOak and will be

part of Sun Life Investment Management. Bentall GreenOak will remain a key

strategic investment of TFG Asset Management, Tetragon's diversified

alternative asset management business that owns majority and minority private

equity stakes in asset management companies.

As part of the merger, Sun Life Financial has agreed to contribute its interest

in Bentall Kennedy and pay GreenOak shareholders U.S.$146 million in cash in

exchange for a 56% interest in the combined entity of Bentall GreenOak.

GreenOak Co-Founders, John Carrafiell and Sonny Kalsi, TFG Asset Management and

existing GreenOak senior management will hold the remaining interest. As part

of the transaction, Sun Life will have an option to acquire the remaining

interest in Bentall GreenOak approximately seven years from the closing.1

The merger values Bentall GreenOak at U.S.$940 million. Tetragon will receive

approximately U.S.$42.5 million upon the closing of the merger. TFG Asset

Management will continue to own nearly 13% of the combined entity and will

receive a series of fixed quarterly payments as well as a portion of Bentall

GreenOak's earnings over the next seven years. Alongside other GreenOak owners

and team members, TFG Asset Management will retain its current ownership of

carried interest in existing GreenOak funds and will participate in carried

interest in new Bentall GreenOak funds.

TFG Asset Management will serve on the Board of Directors of Bentall GreenOak,

will continue to participate in investment committees for funds in which TFG

Asset Management will hold carried interest and expects to invest in new

Bentall GreenOak funds.

"Tetragon partnered with the GreenOak Co-Founders on the launch of GreenOak,

providing working capital, co-investment capital and operating infrastructure

to the joint venture. We are particularly proud of its growth and performance

and are pleased to have found a strong strategic platform to fuel the next

generation of business growth while also delivering an attractive return to

shareholders," said Stephen Prince, Head of TFG Asset Management.

"Tetragon has been a valuable partner to us and we look forward to continuing

to partner with them in the evolution of our real estate asset management

business," said John Carrafiell and Sonny Kalsi, the Co-Founders of GreenOak.

"This merger is a logical next step in our growth, expanding our capabilities

and providing stability and capital for the future."

The combined Bentall GreenOak investment platform will serve over 700

institutional clients with approximately U.S.$47 billion in assets under

management. Bentall GreenOak will offer a broad range of complementary real

estate investment strategies that include Core, Core Plus and Value Add/

Opportunistic equity, as well as senior and tactical real estate debt

strategies. With investment professionals in 14 offices in North America, and

seven offices internationally, Bentall GreenOak will have deep local knowledge

and strong, long-standing investment track records across the United States,

Canada, Europe and Asia.

Tetragon's Net Asset Value (NAV) for 31 October 2018 is U.S.$2.08 billion.

Taking into account the GreenOak merger and other portfolio gains and losses

through 30 November 2018, it is estimated that Tetragon's NAV will increase by

approximately 4%, with the GreenOak valuation uplift portion being reflected in

December.

The merger of GreenOak and Bentall Kennedy is subject to customary closing

conditions, including required regulatory approvals. It is expected to close by

the end of the first half of 2019.

Intention to Conduct a Tender Offer:

Tetragon intends to conduct a tender offer for a number of Tetragon non-voting

shares with a maximum value of up to U.S.$50 million, to be held as treasury

shares. J.P. Morgan Securities plc (which conducts its U.K. investment banking

business as J.P. Morgan Cazenove) will act as dealer manager in the tender

offer, which will use a modified Dutch auction structure. Details of this

planned tender offer will be announced shortly. A repurchase of Tetragon

shares at a price below NAV will be accretive to its fully diluted NAV per

share.

About Tetragon:

Tetragon is a closed-ended investment company that invests in a broad range of

assets, including bank loans, real estate, equities, credit, convertible bonds,

private equity, infrastructure and TFG Asset Management, a diversified

alternative asset management business. Where appropriate, through TFG Asset

Management, Tetragon seeks to own all, or a portion, of asset management

companies with which it invests in order to enhance the returns achieved on its

capital. Tetragon's investment objective is to generate distributable income

and capital appreciation. It aims to provide stable returns to investors

across various credit, equity, interest rate, inflation and real estate cycles.

The company is traded on Euronext in Amsterdam N.V. and on the Specialist Fund

Segment of the main market of the London Stock Exchange. For more information

please visit the company's website at www.tetragoninv.com.

Tetragon: Press Inquiries:

Yuko Thomas Prosek Partners

Investor Relations Andy Merrill and Ryan FitzGibbon

ir@tetragoninv.com +1 212 279 3115 ext. 216 and ext. 234

Pro-tetragon@prosek.com

This release contains inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

This release does not contain or constitute an offer to sell or a solicitation

of an offer to purchase securities in the United States or any other

jurisdiction. The securities of Tetragon have not been and will not be

registered under the U.S. Securities Act of 1933 and may not be offered or sold

in the United States or to U.S. persons unless they are registered under

applicable law or exempt from registration. Tetragon does not intend to

register any portion of its securities in the United States or to conduct a

public offer of securities in the United States. In addition, Tetragon has not

been and will not be registered under the U.S. Investment Company Act of 1940,

and investors will not be entitled to the benefits of such Act. Tetragon is

registered in the public register of the Netherlands Authority for the

Financial Markets under Section 1:107 of the Financial Markets Supervision Act

as a collective investment scheme from a designated country.

J.P. Morgan Securities plc, which is authorised by the U.K. Prudential

Regulation Authority and regulated by the U.K. Financial Conduct Authority and

the Prudential Regulation Authority in the United Kingdom, is acting

exclusively for Tetragon and for no one else in connection with the tender

offer and will not be responsible to anyone (whether or not recipient of the

tender offer) other than Tetragon for providing the protections afforded to the

clients of J.P. Morgan Securities plc or for providing advice in relation to

the tender offer.

1 The transaction includes a put option that entitles TFG Asset Management and

the other minority owners of Bentall GreenOak to sell their 44% interest to Sun

Life approximately 8.5 years from the close of the transaction.

END

(END) Dow Jones Newswires

December 19, 2018 03:18 ET (08:18 GMT)

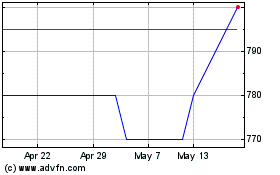

Tetragon Financial (LSE:TFGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

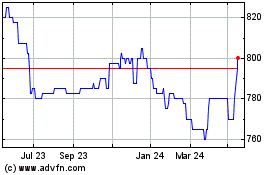

Tetragon Financial (LSE:TFGS)

Historical Stock Chart

From Apr 2023 to Apr 2024