TIDMTIR

RNS Number : 6786M

Tiger Royalties and Investments PLC

25 May 2022

For immediate release 25 May 2022

TIGER ROYALTIES AND INVESTMENTS PLC

(FORMERLY TIGER RESOURCE PLC)

("Tiger" or the "Company")

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2021

AND

NOTICE OF ANNUAL GENERAL MEETING

The Company is pleased to announce its audited results for the

year ended 31 December 2021 and to confirm that the 2022 Annual

Report and Financial Statements ("Annual Report"), together with a

Notice of AGM ("Notice") will be posted to shareholders on 1 June

2022. Pursuant to Rule 20 of the AIM Rules for Companies, copies of

both the Annual Report and the Notice will thereafter be available

for inspection at www.tiger-rf.com.

The AGM will be convened at the Company's registered address

being 2(nd) Floor, 7/8 Kendrick Mews, London SW7 3HG on Monday 27

June 2022 at 12:00 pm.

Notes:

Extracts from the Annual Report are set out below. The financial

information set out below does not constitute the Company's

statutory accounts for the periods ended 31 December 2020 or 31

December 2021 but it is derived from those accounts. Statutory

accounts for 31 December 2020 have been delivered to the Registrar

of Companies and those for 31 December 2021 will be delivered

following the Company's Annual General Meeting. The auditors have

reported on those accounts, their reports were unqualified and did

not contain statements under section 498(2) or (3) of the Companies

Act 2006.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please contact:

Tiger Royalties and

Investments Plc Raju Samtani, Director +44 (0)20 7581 4477

Beaumont Cornish Roland Cornish

(Nomad) Felicity Geidt +44 (0)20 7628 3369

Novum Securities Ltd Jon Belliss +44 (0)20 7399 9425

(Broker)

CHAIRMAN'S STATEMENT

Dear Shareholder

The year under review has seen Tiger's net asset value per share

(NPV) decrease by 26% to 0.17 from 0.23 pence per share as at 31

December 2021.

During the period under review, the natural resource market was

buoyant predominantly for the larger cap producers in the sector.

However, this trend did not fully migrate to smaller cap businesses

and junior exploration companies in the natural resource industry.

Smaller company stocks were generally volatile and share prices of

some companies in this class of investment declined over the year.

This trend stabilised towards the year-end and has shown some

improvement in the first quarter of 2022.

Tiger sold its balancing holding in WisdomTree Copper (ETFS

Copper) and 2,700 shares in Royal Dutch Shell Plc. Additionally,

the Company made an investment of GBP100,603 in Caerus Minerals

Resources Plc, a copper-gold resource development and exploration

company with mineral exploration licences located in Cyprus.

However, the major "value add" to the Company's portfolio during

the year was the re-listing of African Pioneer plc and this

transaction along with the cash funds raised by the company

delivered an opportunistic African metal exploration business to

the public markets.

It is our view that the somewhat subdued mood in the junior

resource sector in recent months resulted mainly from an excess of

IPO's and secondary placings during the first half of 2021. The

Covid pandemic was also partly to blame but did not have a negative

impact commensurate to the sector's performance. However, the

prognosis has probably never been better for commodities,

particularly for metals relevant to the renewable energy sector and

used in the production of Electric Vehicle ("EV") batteries. This

scenario would normally result in smaller companies being a "call

option" for such commodities. However, this was not the case

despite the number of record prices seen in various commodities

during the year, and junior explorers have not yet experienced the

full might of the commodities super cycle being talked about in the

investment community.

Global markets have been under pressure in recent months mainly

due to geopolitical uncertainty caused by the war in Ukraine and

excess global inflationary pressures currently slowing down

economic performance. This trend is forecast to persist for the

foreseeable future. Despite of and to some extent because of these

events, there exists a compelling case for the emerging resource

sector to enjoy share price increases seen mainly by the major

mining and oil and gas companies during 2021 and, which have

extended into 2022 (particularly in the energy sector given the

supply issues and the West's dilemma with Russian supply). This is

further supported by the fact that shortages exist in almost every

commodity as the conglomerates in the industry have largely

scrapped their exploration departments in recent years.

We firmly believe that a "perfect storm" is brewing in the

supply chain and this can only be addressed by major investment

from all sources (capital markets, central Governments and

end-users) into the explorers and developers. The EV targets for

2030 will only be realised if Governments worldwide support

entrepreneurs and promoters of innovative solutions in their quest

to discover and extract the so called "green metals". A favourable

regulatory environment will help reduce investment pressures and

support frontliners in our industry who are chasing the prized

assets, which are needed to effect the change to net zero carbon

footprint that is being heralded worldwide.

We anticipate a resolution of the Ukraine War in the medium

term, which will probably result into a divided Ukraine, and we

also believe that ongoing sanctions will continue to disrupt the

supply of materials and commodities resulting in further imbalances

in the availability of certain key commodities. Demand is also

forecast to soar following commitments made by global governments

to invest in infrastructure post the pandemic as well as the rising

popularity of low carbon emission energy sources. Tiger's

investment portfolio is made up of companies which have exposure to

such commodities and the re-listing of African Pioneer plc will

further add our exposure to investment in copper.

We remain focussed to use our expertise in the sector to add

interesting and innovative deals to Tiger's portfolio to rebuild

shareholder value. I would like to thank both my colleagues and

shareholders for their patience and support in what has been an

uncertain year with a major disconnect between actuality and

expectations.

Colin Bird

Chairman

24 May 2022

PORTFOLIO REVIEW

The table below includes investments held by the Company, and

are disclosed in note 6 to the financial statements.

Number Cost Valuation Valuation Valuation

31/12/21 31/12/21 31/12/21 31/12/20 31/03/22

GBP GBP GBP GBP

African pioneer Plc 8,810,056 100,000 190,297 - 255,492

Bezant Resources Plc 83,870,371 326,885 125,806 138,889 159,354

Block Energy Plc 625,000 25,100 5,625 20,312 7,500

Caerus Mineral Resources

Plc 1,000,000 100,603 140,000 - 132,500

Corallian Energy Limited 13,618 20,427 20,427 30,000 20,427

Galileo Resources Plc 6,516,667 78,335 63,863 107,525 65,167

Goldquest Mining Corporation 173,500 30,259 13,437 28,142 30,260

Jubilee Metals Group Plc 1,169,600 100,219 190,060 149,124 171,463

Kendrick Resources Plc 2,500,000 50,216 - - -

Pantheon Resources Plc 31,500 30,340 24,349 13,702 -

Reabold Resources Plc 3,025,068 9,573 5,445 - 10,890

Royal Dutch Shell Plc B - - - 34,004 -

Shares

WisdomTree Copper (ETFS - - - 17,497 -

Copper)

TOTAL 871,957 779,309 539,195 853,053

------------ ---------- ---------- ----------

-- African Pioneer Plc's ("APP") shares comprising 189,459,550

ordinary shares of zero par value each in the capital of the

company ("Ordinary Shares") were admitted to the Official List

(Standard Segment) and to trading on the Main Market for listed

securities of the London Stock Exchange on 1 June 2021. Tiger's

current holding in APP is 8,810,056 Ordinary Shares representing a

4.65% interest in APP following Admission. APP ceased to be a

subsidiary of the Company effective from 1 June 2021.

-- The Company acquired 1,000,000 Caerus Minerals Resources Plc

shares in the current financial year.

-- Kendrick Resources Plc has now acquired projects in Sweden

and Finland and an option to acquire three nickel projects in

Norway and the company's shares were admitted to the Official List

(Standard Segment) on 6 May 2022.

-- The Company sold 760 WisdomTree Copper shares and 2,700 Royal

Dutch Shell shares during the current financial year.

-- Reabold Resources Plc ("Reabold") acquired Corallian Energy

limited ("Corallian") shares from existing Corallian shareholders

in exchange for Reabold shares, at a ratio of 474 Reabold shares

for 1 Corallian share on 10 May 2021. As part of this offer, the

Company disposed 6,382 Corallian shares in exchange for 3,025,068

shares in Reabold Resources Plc.

-- The investment in AustralGold Corp. was written off in the current financial year.

Details of changes in the fair value of investments are shown in

note 6 of the Financial Statements.

PORTFOLIO REVIEW

African Pioneer Plc (LSE: AFP) www.africanpioneerplc.com

African Pioneer Plc's (APP's) principal business is to explore

opportunities within the natural resources sector in Sub-Saharan

Africa with a focus on base and precious metals including but not

limited to copper, nickel, lead and zinc. APP shares comprising

189,459,550 ordinary shares of zero par value each in the capital

of the company ("Ordinary Shares") were admitted to the Official

List (Standard Segment) and to trading on the Main Market for

listed securities of the London Stock Exchange on 1 June 2021.

Tiger's current holding in APP is 8,810,056 Ordinary Shares

representing a 4.65% interest in APP following Admission.

Bezant Resources Plc (AIM - BZT: LN) www.bezantresources.com

Bezant Resources Plc ("Bezant") is a mineral exploration and

development company quoted on AIM and focused on developing a

pipeline of copper-gold projects to provide a new generation of

economically and socially sustainable mines. The company's

portfolio of assets includes the Hope Copper-Gold project in

Namibia which covers a significant portion of the highly

prospective Matchless Copper Belt. On 11 November 2021 Bezant

entered into a joint venture agreement with Caerus Mineral

Resources focused on the Troulli Mine Development Project and

various other copper-gold JV targets in Cyprus. Bezant also has a

30% stake in the Kalengwa copper and silver project. The company

has an interest in the Mankayan Project in the Philippines which is

a porphyry system via its 27.5% shareholding in IDM, a company

incorporated in Australia with the balancing 72.5% owned by

established investors in the mining sector. The company's Kanye

Manganese Project in Botswana comprises a collection of prospecting

licenses covering a total area of approximately 4,043km2, located

in south-central Botswana south of the town of Jwaneng. Kanye has

the potential for the discovery of high-quality manganese deposits

suitable for supplying the valuable battery market.

Block Energy Plc (AIM - BLOE: LN) www.blockenergy.co.uk

Block Energy Plc ("Block Energy") is an AIM-listed exploration

and production company which has a strategy of applying innovative

technology to realise the full potential of previously discovered

fields in Georgia. In November 2020, Block Energy concluded a sale

and purchase agreement with Schlumberger to acquire its subsidiary

Schlumberger Rustaveli Company Limited (SRCL) representing a major

milestone towards its objective of becoming the leading independent

oil and gas producer in Georgia. Recent production results

demonstrate that the company is delivering operationally, which

combined with improved commodity prices, is producing robust

financial result. This gives Block Energy a strong platform to

deliver on the inherent value of its assets and monetise the wider

reserves and resources within the company's portfolio.

Caerus Mineral Resources Plc (LSE: CMRS)

www.caerusmineralresources.co m

Caerus Mineral Resources Plc ("Caerus") is a European-focused

exploration and development company targeting mineral resources to

supply the global Clean Energy Transition whose shares were

admitted to the main market of the London Stock Exchange under the

Standard Segment of the Official List on 19 March 2021. The company

was established to target Mineral Resources in Europe in response

to the transition and drive towards Clean Energy economies globally

with the current focus being on copper-gold opportunities in

Cyprus, a region with a long mining history and significant

untapped value. Caerus recently announced the results of an

independent Initial Mineral Resource Estimate in accordance with

JORC (2012) in respect of the Troulli Cu-Au project ("Troulli"").

This resource estimate has been prepared by Addison Mining Services

Limited and at a selected cut-off grade of 0.5% Cu comprises of a

hard rock resource estimate of approximately 2.7 million tonnes at

a Cu equivalent grade of 0.74% CuEq (0.51% Cu and 0.26 g/t Au). The

company plans to focus on a number of priorities including the

upgrading and expansion of this mineral resource, completion of

metallurgical test work, environmental baseline studies and the

Environmental and Social Impact Assessment, continuing development

of a mine plan and submission of a Mining Licence application

Corallian Energy Limited www.corallian.co.uk

Corallian Energy Limited ("Corallian") is a private UK oil and

gas exploration and appraisal company. The Company holds interests

in 4 basins in the UK; West of Shetland, Central Graben, Inner

Moray Firth and Viking Graben. A proportion of the Corallian

investment was been exchanged in 2021 for a direct equity interest

in Reabold Resources plc, an AIM listed investment company.

Galileo Resources Plc (AIM - GLR - LN)

www.galileoresources.com

Galileo Resources PLC ("Galileo") is an AIM quoted natural

resource exploration company specializing in the acquisition and

development of base metal projects with a focus on copper. The

company announced on 30 December 2021 that it has entered into a

Joint Venture Agreement with Statunga Investments Limited covering

the Luansobe Copper Project, Zambia comprising of a small-scale

exploration Licence. Galileo has appointed consultants Addison

Mining Services who are currently progressing with modelling the

historic drill data at Luansobe which comprises of drill data for

154 holes (drilled in the period 1921 to 2007). Two concurrent

development options are being considered by Galileo for this

project including the potential for a small open pit mine of circa

3 - 5 million tonnes to exploit the up-dip portion of the copper

deposit in the northwest of the licence area as well as the

prospect for a larger mine by developing the resource down-dip and

along strike to the southeast where drill data is more limited.

More recently, the company has entered into an assignment agreement

which assigned an option to Galileo to acquire a 51% interest in

B.C. Ventures Limited which is the owner of the highly prospective

lithium Kamativi Project in Southwest Zimbabwe and two gold

licenses close to Bulawayo owned through its wholly owned Zimbabwe

subsidiary Sinamatella Investments (Private) Limited.

Jubilee Metals Group Plc (AIM - JLP: LN)

www.jubileemetalsgroup.com

Jubilee Metals Group Plc ("Jubilee") is a diversified metal

recovery business with a world-class portfolio of projects in South

Africa and Zambia. Jubilee's shares are traded on the AIM Market of

the London Stock Exchange (JLP) and the South African Alt-X of JSE

Limited (JBL). The company's business model focuses on the

retreatment and metals recovery from mine tailings, waste, slag,

slurry and other secondary materials generated from mining

operations. Effectively, whilst extracting maximum financial

returns from its operations, Jubilee responsibly rehabilitates

environments scarred by the surface footprint of historical mining

operations and solving air and water pollution issues associated

with those installations. The company's expanding multi-project

portfolio across South Africa and Zambia provides exposure to a

broad commodity basket including Platinum Group Metals ('PGMs'),

chrome, lead, zinc, vanadium, copper and cobalt.

STATEMENT OF COMPREHENSIVE INCOME YEARED 31 DECEMBER 2021

Notes 2021 2020

GBP GBP

Change in fair value of investments 6 26,695 194,216

Revenue:

Investment income 1,610 1,989

Interest receivable - 37

Other income 32,864 -

Administrative expenses 2 (313,214) (345,755)

LOSS BEFORE TAXATION (252,045) (149,513)

Taxation 4 - -

TOTAL COMPREHENSIVE LOSS FOR THE YEAR (252,045) (149,513)

---------- ----------

Basic earnings per share 5 (0.06)p (0.06)p

Diluted earnings per share 5 (0.06)p (0.06)p

All profits are derived from continuing operations.

The notes on pages 28 to 41 are an integral part of these

financial statements.

STATEMENT OF CHANGES IN EQUITY YEARED 31 DECEMBER 2021

Other components of equity

Share capital Share Capital Retained Total

premium redemption earnings Equity

reserve

GBP GBP GBP GBP GBP

As at 1 January 2020 1,474,334 1,669,216 1,100,000 (3,648,442) 595,108

Shares issued during the

year 250,596 280,655 - 531,251

Total comprehensive income

for the year (149,513) (149,513)

As at 31 December 2020 1,724,930 1,949,871 1,100,000 (3,797,955) 976,846

---------- ---------- ------------ ------------ ----------

As at 1 January 2021 1,724,930 1,949,871 1,100,000 (3,797,955) 976,846

Shares issued during the

year 8,500 36,550 45,050

Total comprehensive income

for the year (252,045) (252,045)

As at 31 December 2021 1,733,430 1,986,421 1,100,000 4,050,000 769,851

---------- ---------- ---------- ---------- ----------

The notes on pages 28 to 41 are an integral part of these

financial statements.

STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2021

Notes 2021 2020

GBP GBP

NON- CURRENT ASSETS

Investments in financial assets at

fair value through profit or loss 6 779,309 539,195

------------ ------------

Total Non-Current Assets 779,309 539,195

CURRENT ASSETS

Trade and other receivables 7 4,723 169,486

Cash and cash equivalents 34,394 420,699

------------ ------------

Total Current Assets 39,117 590,185

------------ ------------

TOTAL ASSETS 818,426 1,129,380

------------ ------------

CURRENT LIABILITIES

Trade and other payables 9 (48,575) (152,534)

Total Current Liabilities (48,575) (152,534)

------------ ------------

NET ASSETS 769,851 976,846

------------ ------------

EQUITY

Share capital 10 1,733,430 1,724,930

Share premium 1,986,421 1,949,871

Capital redemption reserve 1,100,000 1,100,000

Retained earnings (4,050,000) (3,797,955)

------------ ------------

EQUITY ATTRIBUTABLE TO THE OWNERS 769,851 976,846

TOTAL EQUITY 769,851 976,846

------------ ------------

The notes on pages 28 to 41 are an integral part of these

financial statements.

The financial statements of Tiger Royalties and Investments Plc

(registered number 02882601) were approved by the Board on 24 May

2022 and signed on its behalf by:

Colin Bird - Executive Chairman R Samtani - Finance Director

CASH FLOW STATEMENTS YEARED 31 DECEMBER 2021

Notes 2021 2020

GBP GBP

CASH FLOW FROM OPERATIONS

Loss before taxation (252,045) (149,513)

Adjustments for:

Interest receivable - (37)

Dividends receivable (1,610) (1,989)

Other income (32,864) -

Change in fair value of investments (26,695) (194,216)

Negative goodwill -

----------- -----------

Operating loss before movements in

working capital (313,214) (345,755)

(Increase)/Decrease in receivables 18,513 (28,246)

Increase/(Decrease) in payables (58,909) 126,789

NET CASH OUTFLOW FROM OPERATING ACTIVITIES (353,610) (247,212)

----------- -----------

CASH FLOW FROM INVESTING ACTIVITIES

Interest received - 37

Other income 2,664 -

Dividends received 1,610 1,989

Sale of investments 63,634 23,491

Purchase of investments (100,603) -

----------- -----------

NET CASH INFLOW FROM INVESTING ACTIVITIES (32,695) 25,517

----------- -----------

CASH FLOW FROM FINANCING ACTIVITIES

Issue of shares - 500,000

NET CASH INFLOW FROM FINANCING ACTIVITIES - 500,000

----------- -----------

Net decrease in cash and cash equivalents

in the year (386,305) 278,305

Cash and cash equivalents at the beginning

of the year 420,699 142,394

----------- -----------

Cash and cash equivalents at the end

of the year 34,394 420,699

----------- -----------

The notes on pages 28 to 41 are an integral part of these

financial statements.

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEARED 31 DECEMBER

2021

1. ACCOUNTING POLICIES

Basis of preparation

Tiger Royalties and Investments Plc ("Tiger" or the "Company")

is a public investment company limited by shares incorporated and

domiciled in England and Wales. Tiger's principal activities are

discussed in the Strategic Report and the address of the registered

office is included on page 1 of the annual report. T he functional

currency for the Company is Sterling as that is the currency of the

primary economic market in which the Company operates. The

financial statements have been prepared under the historical cost

convention except for the measurement of certain non-current asset

investments at fair value. The measurement bases and principal

accounting policies of the Company are set out below. The financial

statements have been prepared using International Financial

Reporting Standards (IFRS) issued by the International Accounting

Standards Board (IASB) and endorsed by the European Union.

The Company held a 50.75% equity stake in African Pioneer Plc

("APP" or "the subsidiary") on 31 December 2020, and prepared

consolidated financial statements incorporating the subsidiary's

financial statements for the year ended 31 December 2020. On 1 June

2021, the subsidiary's shares comprising 189,459,550 Ordinary

shares of zero par value each ("Ordinary Shares") were admitted to

the Official List (Standard Segment), and to trading on the Main

Market for listed securities of the London Stock Exchange.

Consequently, the Company's shareholding in the subsidiary company

was reduced to 4.65% and APP is no longer a subsidiary of the

Company as at 31 December 2021. Hence, only company financial

statements have been prepared for the year ended 31 December 2021.

Tiger's current holding in APP is 8,810,056 Ordinary Shares, which

have been included in the Company's balance sheet at market

valuation under investment in financial assets at fair value

through profit or loss.

New and amended IFRS Standards that are effective for the

current year

A number of new standards and interpretations have been adopted

by the Company for the first time in line with their mandatory

adoption dates, but none are applicable to the Company and hence

there would be no impact on the financial statements.

New and revised IFRS Standards in issue but not yet

effective

At the date of approval of these financial statements, the

Company has not applied the following new and revised IFRS

Standards that have been issued but are not yet effective:

IFRS 17 (including Insurance Contracts

the June 2020 amendments

to IFRS 17)

--------------------------------------------------------

IFRS 10 and IAS Sale or Contribution of Assets between an Investor

28 (amendments) and its Associate or Joint

Venture

--------------------------------------------------------

Amendments to IFRS Interest rate benchmark

9, IAS 39, IFRS

7, IFRS 4 and IFRS

16

--------------------------------------------------------

Amendment to IFRS Covid rent concessions

16

--------------------------------------------------------

IFRS 3 Conceptual framework

--------------------------------------------------------

Amendments to IAS Classification of Liabilities as Current or Non-current

1

--------------------------------------------------------

Amendments to IFRS Reference to the Conceptual Framework

3

--------------------------------------------------------

Amendments to IAS Property, Plant and Equipment-Proceeds before Intended

16 Use

--------------------------------------------------------

Amendments to IAS Onerous Contracts - Cost of Fulfilling a Contract

37

--------------------------------------------------------

Amendments to IAS Disclosure of Accounting Policies

1 and IFRS

Practice Statement

2

--------------------------------------------------------

Amendments to IAS Definition of Accounting Estimates

8

--------------------------------------------------------

Amendments to IAS Deferred Tax related to Assets and Liabilities arising

12 from a Single Transaction

--------------------------------------------------------

Amendments to IAS Agriculture

41

--------------------------------------------------------

The directors do not expect that the adoption of the Standards

listed above will have a material impact on the financial

statements of the Company in future periods.

Going concern

The operations of the Company have been financed mainly through

operating cash flows. As at 31 December 2021, the Company held cash

balances of GBP34,394 (2020: GBP420,699) and an operating loss has

been reported. Historically, the Company has generated cash flow

from the appreciation and subsequent sale of investments in quoted

natural resource companies. The Directors anticipate net operating

cash flows to be neutral for the Company in the next twelve months

from the date of signing these financial statements.

The Directors have assessed the working capital requirements for

the forthcoming twelve months and have undertaken assessments which

to consider cash forecasts until June 2023. Upon reviewing those

cash flow projections for the forthcoming twelve months, the

Directors consider that the Company should not require additional

financial resources in the twelve-month period from the date of

approval of these financial statements to enable the Company to

fund its current operations and to meet its commitments.

Notwithstanding the above and given the ongoing geopolitical

uncertainties, the Directors may require to raise some funds

through equity fund raising depending on economic circumstances and

on opportunities available to the Company for acquiring additional

investments. To this end, the Board has substantial experience with

capital markets within the smaller cap space and would be in a

position to access markets in such a scenario. Nevertheless, after

making enquiries and considering the uncertainties described above,

the Directors have a reasonable expectation that the Company has

adequate ability to manage its portfolio and raise resources, if

necessary, to continue in operational existence for the foreseeable

future. The Directors therefore continue to adopt the going concern

basis of accounting in preparing the annual financial statement

s.

Valuation of available-for-sale Investments and adoption of

IFRS9

Available-for-sale investments under both IFRS9 and IAS39 are

initially measured at fair value plus incidental acquisition costs.

Subsequently, they are measured at fair value in accordance with

IFRS 13. This is either the bid price or the last traded price,

depending on the convention of the exchange on which the investment

is quoted.

All gains and losses are taken to profit and loss. In proceeding

periods gains and losses on available-for-sale investments were

recognised in other comprehensive income and accumulated in the

available-for-sale assets reserve except for impairment losses,

until the assets are derecognised, at which time the cumulative

gains and losses previously recognised in other comprehensive

income are recognised in profit or loss.

Revenue

Dividends receivable from equity shares are taken to profit or

loss on an ex-dividend basis. Income from bank interest received is

recognised on a time-apportionment basis. Dividends are stated net

of related tax credits.

Expenses

All expenses are accounted for on accruals basis.

Cash and cash equivalents

This consists of cash held in the Company's bank accounts.

Foreign currency

Assets and liabilities denominated in foreign currency are

translated into sterling at the rates of exchange ruling at balance

sheet date. Exchange gains or losses on monetary items are recorded

in profit or loss. Exchange gains or losses on investments in

financial assets are recorded in other comprehensive income.

Treasury shares

The cost of purchasing treasury shares and the proceeds from the

sale of treasury shares up to the original price is taken to the

retained earnings reserve; any surplus on the disposal of treasury

shares (measured against the weighted average purchase price) is

taken to the share premium account.

Reserves

Share premium account

The share premium account is used to record the aggregate amount

or value of premiums paid in excess of the nominal value of share

capital issued, less deductions for issuance costs.

Capital Redemption Reserve

The Capital redemption reserve is used to redeem or purchase of

Company's own shares.

Geographical segments

The internal management reporting used by the chief operating

decision maker consists of one segment. Hence in the opinion of the

Directors, no separate disclosures are required under IFRS 8. The

Company's revenue in the year is not material and consequently no

geographical segment information has been disclosed.

Deferred tax

Deferred tax liabilities are generally recognised for taxable

temporary differences and deferred tax assets are generally

recognised for all deductible temporary differences to the extent

that it is probable that taxable profits will be available against

which those deductible temporary differences can be utilised except

for differences arising on investments in subsidiaries where the

Company is able to control the timing of the reversal of the

difference and it is probable that the difference will not reverse

in the foreseeable future.

Deferred tax is also based on rates enacted or substantively

enacted at the reporting date and expected to apply when the

related deferred tax asset is realised or liability settled.

Deferred tax is charged or credited in the statement of

comprehensive income, except when it relates to items charged or

credited directly to equity, in which case the deferred tax is also

dealt within equity.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from profit as reported in the income

statement because it excludes items or expenses that are taxable or

deductible in other years and it further excludes items that are

never taxable or deductible. The Company's liability for current

tax is calculated using tax rates that have been enacted or

substantively enacted by the end of the reporting period.

Significant management judgement in applying accounting policies

and estimation uncertainty

When preparing the financial statements, management makes a

number of judgements, estimates and assumptions about the

recognition and measurement of assets, liabilities, income and

expenses.

Fair value of financial assets

Establishing the fair value of financial assets may involve

inputs other than quoted prices. As is further disclosed in note 6,

all of the Company's financial assets which are measured at fair

value are based on level 1 inputs, which reduces the level of

estimation involved in their valuation.

Recognition of deferred tax assets

The extent to which deferred tax assets can be recognised is

based on an assessment of the probability of the Company's future

taxable income against which the deductible temporary differences

can be utilised. In addition, significant judgement is required in

assessing the impact of any legal or economic limits or

uncertainties in various tax jurisdictions. In the opinion of the

directors a deferred tax asset has not been recognised as future

profits cannot be forecasted with reasonable certainty.

2. OPERATING EXPENSES

Operating profit is stated after charging:

2021 2020

GBP GBP

Auditor's remuneration:

* Audit of the financial statements 12,750 15,000

* Taxation compliance services 1,500 1,500

-------------------- ---------

14,250 16,500

-------------------- ---------

Notes

Legal fees 1,200 13,536

Corporate finance costs 33,402 27,600

Directors' fees 3 109,000 99,000

Director of subsidiary company - -

Occupancy and support costs 72,000 72,000

Other administrative overheads 68,267 101,677

Stock Exchange costs 15,095 15,442

Administrative expenses 313,214 345,755

-------------------- -----------

3. DIRECTORS' EMOLUMENTS

2021 2020

GBP GBP

Directors' fees 109,000 99,000

-------------------------- ----------

Other than directors, there were no employees in the current or

prior year. No pensions or other benefits were paid to the

Directors in the current or prior period.

The emoluments of each director during the year were as follows:

2021 2020

GBP GBP

Colin Bird 36,000 39,500

Michael Nolan 25,000 27,500

Raju Samtani 30,000 31,250

Alex Borrelli 18,000 750

4. TAXATION

2021 GBP 2020

GBP

Corporation tax:

Current year - -

------------ ------------

The major components of tax expense and the reconciliation of the expected

tax expense based on the domestic effective tax rate of 19% (2020 - 19%)

and the reported tax expense in the statement of comprehensive income are

as follows:

2021 2020

GBP GBP

Loss on ordinary activities before

tax (252,045) (149,513)

------------ ------------

Expected tax charge at 19% (2020 -

19%) (47,889) (28,407)

Effects of:

Exempt dividend income (306) 378

Difference between accounting gain

and taxable gain on investment (5,072) 7,803

Excess management expenses carried

forward 53,267 17,749

Non-trade loan relationship deficit

carried forward - 2,478

Actual tax charge - -

------------ ------------

5. EARNINGS PER SHARE

Basic 2021 2020

Loss after tax for the purposes of earnings

per share attributable to equity shareholders (252,045) (149,513)

Weighted average number of shares 445,817,308 241,054,411

Basic earnings per ordinary share (0.06)p (0.06) p

Diluted

Loss for year after tax (252,045) (149,513)

Weighted average number of shares 445,817,308 241,054,411

Dilutive effect of options - -

Diluted weighted average number of shares 445,817,308 241,054,411

Diluted earnings per ordinary share (0.06)p (0.06) p

potentially dilutive options - -

There were no share options outstanding at 31 December 2021 or

31 December 2020.

6. INVESTMENTS IN FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

2021

Listed Investments Other Investments Total

(Quoted/Others)

Canada 13,437 - 13,437

UK 330,297 435,575 765,872

343,734 435,575 779,309

--------------------- ------------------ ---------------

2020

Listed Investments Other Investments Total

(Quoted)

GBP GBP GBP

Canada 28,142 - 28,142

UK 51,501 459,552 511,053

79,643 459,552 539,195

--------------------- -------------------- -------------

Listed Investments Other Investments Total

(Quoted/Others)

GBP GBP GBP

Opening book cost 179,354 564,646 744,000

Opening unrealised depreciation (99,711) (105,094) (204,805)

------------------- ------------------ ----------

Valuation at 1 January 2021 79,643 459,552 539,195

Movements in the year :

Purchase at cost 200,603 86,023 286,626

Sales proceeds (63,634) (9,573) (73,207)

Realised gains/(losses) on sales

based on historic cost (85,461)* - (85,461)

Increase/(Decrease) in unrealised

depreciation 212,584 (100,428) 112,156

343,735 435,574 779,309

------------------- ------------------ ----------

Book cost at year end 230,861 641,096 871,957

Closing unrealised depreciation 112,873 (205,521) (92,648)

Valuation at 31 December 2021 343,734 435,575 779,309

------------------- ------------------ ----------

2021 2020

GBP GBP

Realised (loss)/gain based on historical cost (85,461) (93,477)

Realised (loss)/gain based on carrying value

at previous balance sheet date (85,461) (93,477)

Unrealised fair value movement for the year 112,156 287,693

Total recognised (losses)/gains on investments

in the year 26,695 194,216

--------- ------------

*Includes write off of AustralGold

Analysis of gains/(losses) relating to the Company's Investments

The gains/(losses) on the Company's investments are analysed below. Accounting standards

prohibit the recognition of uplifts in the value of impaired assets in profit and loss.

Security 31 December 31 December

2021 2020

Profit and Profit

loss and loss

African Pioneer Plc 90,297 -

------------ ------------

Bezant Resources Plc (89,534) 27,778

------------ ------------

Block Energy Plc (14,687) (7,813)

------------ ------------

Caerus Minerals Plc 39,398 -

------------ ------------

Corallian Energy Ltd - -

------------ ------------

WisdomTree Copper (ETFS Copper) 3,301 1,633

------------ ------------

Galileo Resources Plc (43,662) 74,942

------------ ------------

Goldquest Mining Corporation (14,705) 13,750

------------ ------------

Jubilee Metals Group Plc 40,936 103,510

------------ ------------

Pantheon Resources Plc 10,647 8,505

------------ ------------

Australgold (Formerly Revelo Resources Corp) - (637)

------------ ------------

Reabold resources (4,128) -

------------ ------------

Royal Dutch Shell Plc 8,832 (26,462)

------------ ------------

Barkby Group Plc - (990)

------------ ------------

Total movements 26,695 194,216

------------ ------------

Financial instruments measured at fair value

The following table presents financial assets and liabilities

measured at fair value in the statement of financial position in

accordance with the fair value hierarchy. This hierarchy groups

financial assets and liabilities into three levels based on the

significance of inputs used in measuring the fair value of the

financial assets and liabilities. The fair value hierarchy has the

following levels:

- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

- Level 2: inputs other than quoted prices included within Level

1 that are observable for the asset or liability, either directly

(i.e., as prices) or indirectly (i.e., derived from prices);

and

- Level 3: inputs for the asset or liability that are not based

on observable market data (unobserved inputs).

The level within which the financial asset or liability is

classified is determined based on the lowest level of significant

input to the fair value measurement.

The financial assets and liabilities measured at fair value in

the statement of financial position are grouped into the fair value

hierarchy as follows:

Level 1 Level Level Total

31 December 2021 GBP 2 3 GBP

GBP GBP

758,882 20,427 779,309

Assets

Investments held at fair

value

-------- -------- ------- --------------------------

Total 758,882 20,427 779,309

Level 1 Level 2 Level Total

GBP GBP 3 GBP

31 December 2020 GBP

Assets

Investments held at fair value 509,195 - 30,000 539,195

-------- -------- ------- --------------------------

Total 509,195 - 30,000 539,195

There have been no significant transfers between levels in the

reporting period.

Reconciliation of Level 3 fair value measurements of financial

instruments

Level 3 investments

GBP

Balance at 1 January 2020 30,000

--------------------

Total gains or (losses) in other comprehensive income -

--------------------

Purchases/(Sales) -

--------------------

Transfers in/(out) -

--------------------

Balance at 1 January 2021 30,000

--------------------

Total gains or (losses) in other comprehensive income -

--------------------

Purchases/(Sales) (9,573)

--------------------

Transfers in/(out) -

--------------------

Balance at 31 December 2021 20,427

--------------------

Measurement of fair value

The methods and valuation techniques used for the purpose of

measuring fair value are outlined in note 1 and remain unchanged

compared to the previous reporting period. The fair values of

short-term receivables, cash and short-term payables do not differ

from their carrying values due to their short maturity

profiles.

Listed / quoted securities

Equity securities held by the Company are denominated in GBP and

CAD$, and are publicly traded on the main London Stock Exchange,

the Alternative Investment Market of the London Stock Exchange and

the Toronto Venture Exchange. Fair values have been determined by

reference to their quoted bid prices at the reporting date.

7. TRADE AND OTHER RECEIVABLES

2021 2020

GBP GBP

Other debtors 1,913 47,159

Amounts due from related parties - 118,385

Prepayments 2,810 3,942

------ --------

4,723 169,486

---------------------------------- ------ --------

An expected credit loss impact assessment under IFRS 9 is not

required, as the Company does not hold any trade or intercompany

debtors as at the balance sheet date.

8. DEFERRED TAX LIABILITIES

The Company has tax losses carried forward in respect of excess

management charges, non-trade deficits and capital losses of

GBP3,272,059 (2019: GBP2,965,014). Tax capital losses on the

Company's financial assets are at GBP92,648 (2020: GBP204,805). The

resulting potential deferred tax asset is GBP17,603 (2020:

GBP38,913). However, deferred tax assets are not recognised due to

the unpredictability of future profit streams arising from the

disposal of investments held by the Company. Tax losses may be

carried forward indefinitely and will only be recoverable if

suitable profits arise in the future. Deferred tax positions

arising from unrealised gains and losses on the company's financial

assets will vary depending on changes in the fair values of those

assets up until the date of disposal.

9. TRADE AND OTHER PAYABLES

2021 2020

GBP GBP

Trade payables 8,708 9,101

Other creditors 7,764 73,883

Accruals 32,103 69,550

------- --------

48,575 152,534

----------------- ------- --------

10. CALLED UP SHARE CAPITAL

The share capital of Tiger consists of fully paid ordinary

shares with a nominal value of 0.1p each and deferred shares with a

nominal value of 0.9p each. Ordinary shares of 0.1p are eligible to

receive dividends and the repayment of capital and represent one

vote at the shareholders' meeting of The Company. The deferred

shares carry no dividend or voting rights.

2021 2020

GBP GBP

Authorised:

Ordinary Share Capital 10,000,000 10,000,000

----------- -----------

142,831,939 (2020: 142,831,939) deferred shares of

0.9 p each 1,285,487 1,285,487

----------- -----------

2021 2020

GBP GBP

Opening Ordinary shares - 439,442,308 at 0.1p each

(2020: 188,847,070 Ordinary shares of 0.1p each) 439,443 188,847

Issued during the year

8,500,000 shares at issue price of GBP0.0053 (nominal 8,500 -

value 0.1p each) - (i)

238,095,238 at issue price of GBP0.21p each (nominal

value 0.1p each) - 238,096

12,500,000 shares at issue price of GBP0.25p each

(nominal value 0.1p each) 12,500

Ordinary shares in issue as at 31 December 2021 -

447,942,308 at 0.1 p each (2020 : 439,442,308 shares

of 0.1p each) nominal value 447,943 439,443

----------- -----------

142,831,939 (2020: 142,831,939) deferred shares of

0.9p each 1,285,487 1,285,487

----------- -----------

1,733,430 1,724,930

----------- -----------

The Deferred shares have no income or voting rights.

Included in allotted called and fully paid share capital are

4,500,000 shares with a nominal value of GBP4,500 held by the

company in treasury.

(i) On 15 March 2021, The Company issued 8.5 million shares of

0.1 p each at an issue price of 0.53p each share each to settle a

corporate creditor, totalling GBP45,050.

11. RELATED PARTY TRANSACTIONS

(1) Lion Mining Finance Limited, a company in which Colin Bird

is director and shareholder, has provided administrative and

technical services to the Company amounting to GBP60,000 plus VAT

in the year (2020 - GBP60,000). There was an amount of GBP6,000

outstanding at 31 December 2021 (2020- nil). The Board considers

this transaction to be on an arms' length basis.

(2) The emoluments of the Directors are disclosed in note 3.

(3) Directors' shareholdings are disclosed in the Report of the Directors.

(4) On 18 February 2021, the Company received 28,314,815 shares

in Bezant Resources Plc (Mr Colin Bird and Mr Raju Samtani are

executive directors of the Company and also executive directors and

shareholders of Bezant. In addition, Mr Colin Bird held 2.7%

interest in Metrock), as settlement of outstanding loans of

GBP46,250 which the Company had advanced to Metrock Resources Ltd

during Q4 2020 and fee due of GBP30,200 from Metrock. Initially, on

12 October 2020, the Company negotiated an exclusive mandate to

facilitate an IPO for Metrock. However, subsequently on 22 December

2020, under a revised mandate, both parties mutually agreed not to

proceed with an IPO. Metrock was then acquired by Bezant. As part

of Bezant's Shareholders Purchase Agreement (SPA) with the

shareholders of Metrock, it was agreed that outstanding loans in

Metrock's books will be acquired by Bezant and settled in newly

issued Bezant ordinary shares of 0.002p each at a price of 0.27

pence per share on completion of the SPA ("Bezant Shares").

Accordingly, Tiger was issued 28,314,815 Bezant Shares on

completion of the SPA to settle loans of GBP46,250 which it has

made to Metrock and the GBP30,200 fee referred to above. Upon issue

of the 28,314,815 Bezant Shares, Tiger's total shareholding in

Bezant increased to 83,870,371 shares representing 2.37% of the

Bezant's enlarged issued share capital on completion.

(5) The Company held a 50.75% equity stake in African Pioneer

Plc ("APP"). On 1 June 2021, APP's shares comprising 189,459,550

Ordinary shares of zero par value each ("Ordinary Shares") were

admitted to the Official List (Standard Segment), and to trading on

the Main Market for listed securities of the London Stock Exchange.

Consequently, the Company's shareholding in APP was reduced to

4.65% and APP is no longer a subsidiary of the Company. Tiger's

current holding in APP is 8,810,056 Ordinary Shares, which have

been included in the Company's balance sheet at market valuation

under investment in financial assets at fair value through profit

or loss. Mr Colin Bird and Mr Raju Samtani, who are both Directors

of Tiger and African Pioneer Plc and co-vendors of African Pioneer

Zambia to APP, each received 15,000,000 APP Shares on Standard

Listing. Campden Park Trading, a company owned and controlled by Mr

Colin Bird, received 5,000,000 APP Shares on Standard Listing

carrying a total value of GBP700,000 attributable to Colin Bird and

related companies and GBP525,000 to Raju Samtani upon Standard

Listing.

(6) On 31 March 2021, African Pioneer Plc (Mr Colin Bird and Mr

Raju Samtani, are both Executive Directors & shareholders of

the Company and African Pioneer Plc) repaid GBP18,385 due to the

Company as at 31 December 2020 plus an interest amount of

GBP760.71. Under a loan agreement dated 28 January 2021, Tiger

advanced an unsecured loan of GBP112,981 to African Pioneer plc at

a coupon rate of 10%. African Pioneer Plc repaid this balance plus

an interest amount of GBP1,903.78 on 31 March 2021.

(7) On 1 June 2021, an amount of GBP100,000 due from African

Pioneer Plc to the Company (Mr Colin Bird and Mr Raju Samtani, are

both Executive Directors & shareholders of the Company and

African Pioneer Plc), was converted to 2,857,143 (zero nominal

value) shares of African Pioneer Plc.

12. POST-REPORTING DATE EVENTS

There are no events after the balance sheet date that may

warrant disclosure or may require adjustments to these financial

statements.

13. CONTINGENT LIABILITIES

There were no contingent liabilities at 31 December 2021 (2020 -

None).

There were no operating or financial commitments or contracts

for capital expenditure in place for the Company as at the

reporting date (2020: GBPnil).

14. FINANCIAL INSTRUMENTS

Management of Risk

The Company's financial instruments comprise:

-- Investments held at fair value through profit or loss

-- Cash, short-term receivables and payables

Throughout the period under review, it was the Company's policy

that no trading in derivatives shall be undertaken.

The main financial risks arising from the Company's financial

instruments are market price risk and liquidity risk.

Liquidity risk arises principally from cash and cash

equivalents, which comprise cash at bank (repayable on demand). The

Company has no overdraft facilities. The carrying amount of these

assets are approximately equal to their fair value.

Credit risk is not significant, but is monitored. The Board

regularly reviews and agrees policies for managing each of these

risks and they are summarised below. These policies have remained

constant throughout the period.

Market risk

Market risk consists of interest rate risk, foreign currency

risk and other price risk. It is the Board's policy to maintain an

appropriate spread of investments in the portfolio whilst

maintaining the investment policy and aims of the Company. The

Investment Committee actively monitors market prices and other

relevant information throughout the year and reports to the Board,

who is ultimately responsible for the Company's investment

policy.

Interest rate risk

Changes in interest rates would affect the Company returns from

its cash balances. A floating rate of interest, which is linked to

bank base rates, is earned on cash deposits. The exposure to cash

flow interest rate risk at 31 December 2021 for the Company was

GBP34,394 (2020: GBP420,699).

A sensitivity analysis based on a movement of 1% on interest

rates would have a GBP344 effect on the Company's' profit (2020:

GBP4,207).

As the Company does not have any borrowings and finances its

operations through its share capital and retained revenues, it does

not have any interest rate risk except in relation to cash

balances.

Foreign currency risk

The Company's total return and net assets can be affected by

currency translation movements as part of the investments held by

the Company are denominated in currencies other than GBP Sterling.

The Directors mitigate the individual currency risks through the

international spread of investments. Hedging transactions may be

used but none have been employed during the period under review

(2020: none).

The fair values of the Company's investments that have foreign

currency exposure at 31 December 2021 are shown below.

2021 2020

CAD CAD

GBP GBP

Investments in financial assets at fair value

through profit or loss 13,437 28,142

The Company accounts for movements in fair value of its

financial assets in other comprehensive income. The following table

illustrates the sensitivity of the equity in regard to the

Company's financial assets and the exchange rates for GBP/ Canadian

Dollar.

It assumes the following changes in exchanges rates:

- GBP/CAD +/- 20% - (2020: +/- 20%)

These percentages used reflect the high level of market

volatility experienced in exchange rates in recent years.

The sensitivity analysis is based on the Company's foreign

currency financial instruments held at each balance sheet date.

If GBP Sterling had weakened against the currencies shows, this

would have had the following effect:

2021 2020

CAD CAD

GBP GBP

Equity 2,687 5,628

If GBP Sterling had strengthened against the currencies shows,

this would have had the following effect:

CAD CAD

GBP GBP

Equity (2,240) (4,690)

Other price risk

Other price risk which comprises changes in market prices other

than those arising from interest rate risk or currency risk may

affect the value of quoted and unquoted equity investments. The

Board of directors manages the market price risks inherent in the

investment portfolio by regularly monitoring price movements and

other relevant market information.

The Company accounts for movements in the fair value of

investments in financial assets in other comprehensive income and

assets designated at fair value through profit or loss in

comprehensive income. The following table illustrates the

sensitivity to equity of an increase / decrease of 50% in market

prices. This level of change is considered to be reasonable based

on observation of current market conditions, in particular resource

stocks and junior mining companies. The sensitivity is based on the

Company's equities at each balance sheet date, with all other

variables held constant.

2021 2020

50% increase 50% decrease 50% increase 50% decrease

in fair in fair in fair in fair

value value value value

GBP GBP GBP GBP

Equity 389,655 (389,655) 269,597 (269,597)

Liquidity risk

The Company maintains appropriate cash reserves and the majority

of the Company's assets comprise realisable securities, most of

which can be sold to meet funding requirements if necessary. Given

the Company's cash reserves, it has been able to settle all

liabilities on average within 1 month.

Credit risk

The risk of counterparty's failure to discharge its obligations

under a transaction that could result in the Company suffering a

loss is minimal. The Company holds its cash balances with a

reputable bank and only transacts with regulated institutions on

normal market terms.

Included in total amounts receivable at 31 December 2021 is the

sum of GBP1,844 (2020 - GBP859) which was lodged with the Company's

brokers in relation to future investments.

Financial liabilities

There are no currency or interest rate risk exposures on

financial liabilities as they are denominated in GBP Sterling and

settled on average within one month.

Capital management

The Company actively reviews its issued share capital and

reserves and manages its capital requirements in order to maintain

an efficient overall financing structure whilst avoiding any

leverage. The capital structure of the Company consists of only

equity (comprising issued capital, reserves, and retained earnings

as disclosed below and the Statements of Changes in Equity) and no

debt.

The Board monitors the discount level of its issued shares,

which is the difference between its Net Asset Value (NAV) and its

actual share price. To improve NAV, the Company may purchase its

own shares in the market. During the current year, the Company has

not purchased any of its own shares (2020: Nil).

Company At 1 January Cash flows Other non-cash At 31 December

2021 changes 2021

Cash and cash equivalents GBP GBP GBP GBP

------------- ----------- --------------- ---------------

Cash 420,699 (386,305) - 34,394

------------- ----------- --------------- ---------------

Borrowings - - - -

------------- ----------- --------------- ---------------

Debt due within one - - - -

year

------------- ----------- --------------- ---------------

Debt due after one - - - -

year

------------- ----------- --------------- ---------------

Total 420,699 (386,305) 34,394

------------- ----------- --------------- ---------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SEEFWLEESEII

(END) Dow Jones Newswires

May 25, 2022 02:00 ET (06:00 GMT)

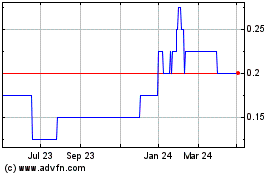

Tiger Royalties And Inve... (LSE:TIR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Tiger Royalties And Inve... (LSE:TIR)

Historical Stock Chart

From Jan 2024 to Jan 2025