3rd UPDATE: Apple Calls Out Google After Strong 4Q

19 October 2010 - 11:43AM

Dow Jones News

Apple Inc. (AAPL) fiscal fourth-quarter profit surged 70% as the

company posted strong iPhone and Mac computer sales that pushed

revenue above $20 billion for the first time.

However, the company's shares wilted in after-hours as gross

margins and iPad sales numbers failed to meet analyst

expectations.

Apple Chief Executive Steve Jobs also used the opportunity to

take a swipe at Google Inc.'s (GOOG) Android operating system and

hardware partners producing devices running on it.

The blowout earnings for the Cupertino, Calif.-based electronics

giant underscore Apple's continued transition to mobile devices.

That shift started nine years ago with the iPod and has picked up

pace with the iPhone and iPad, which Apple Chief Financial Officer

Peter Oppenheimer said is being tried at a majority of the world's

top companies.

For the quarter ended Sept. 25, Apple reported a profit of $4.31

billion, or $4.64 a share, up from $2.53 billion, or $2.77 a share,

a year earlier. Revenue jumped 67% to $20.34 billion, with 43%

coming from the U.S.

In July, the company projected earnings of about $3.44 on

revenue of about $18 billion. Wall Street's latest expectations

were $4.08 and $18.93 billion, respectively.

Gross margin fell to 36.9% from 41.8%, the second-straight

quarter that metric dropped on year, and behind average analyst

expectations of 38.1%. The company had previously indicated that it

expected margin compression.

The company's iPhone sold 14.1 million units, 91% more than a

year ago. The line of smartphones had an average selling price of

$610, which includes subsidies paid by wireless carriers, the

company said. Apple also reported it sold 4.2 million iPad devices

-- below expectations -- at an average selling price of $645.

Steve Jobs used a conference call after the earnings to bash

Google and its hardware partners. At one point, he declared devices

using Google's Android mobile operating system would fail,

particularly tablet computers competing with his company's

iPad.

"We think the current crop of (competing) tablets are going to

be DOA, dead on arrival," Jobs told analysts during a conference

call to discuss earnings, referring to them by their common size of

7-inches. "Their manufacturers will learn the painful lesson that

their tablets are too small and increase the size next year,

thereby abandoning both customers and developers who jumped on the

7-inch bandwagon with an orphan product."

Despite Apple's criticisms of its competitors, Google's software

continues to prove popular. Android recently surpassed iPhone in

terms of market share and Google indicated it was starting to see

significant revenue from mobile ads linked to Android in its

earnings last week. Analysts said Jobs's comments might indicate

his concern about Apple's continued leadership position.

"I was surprised by the degree to which he was willing to take

on Google," Gartner analyst Van Baker said. "It's clear he sees

this as a horse race with them and that he has to be

aggressive."

Job's comments come as the company's shares dropped nearly 6% in

after-hours trading following disappointing reports of the

company's gross margins and iPad sales.

Shares of Apple, which reached a record high of $319 during the

regular session Monday, dropped 5.7% in after-market trading, to

$299.83. Apple's share price has surged 51% this year, a move that

now makes it the second-most valuable company in the U.S. after

ExxonMobil Corp. (XOM), with a market capitalization of roughly

$295 billion.

The maker of computers and electronics devices, which is

notorious for giving conservative guidance, said it expects fiscal

first-quarter earnings of about $4.80 a share on revenue of about

$23 billion. Before the results, analysts polled by Thomson Reuters

had expected $5.07 and $22.4 billion, respectively.

Meanwhile, Apple on Wednesday will unveil a new version of its

computer operating software, as it moves to target corporate

customers, a market that has historically eluded Apple.

-By Ian Sherr and John Kell, Dow Jones Newswires; 212-416-2480;

john.kell@dowjones.com

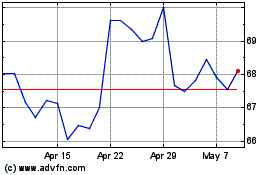

Vodafone (LSE:VOD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vodafone (LSE:VOD)

Historical Stock Chart

From Feb 2024 to Feb 2025