TIDMWCW

RNS Number : 3336T

Walker Crips Group plc

04 June 2009

4 June 2009

Walker Crips Group plc

Preliminary results for the year ended 31 March 2009

Walker Crips Group plc ("WCG", the "Company" or the "Group"), the integrated

financial services group, today announces its unaudited preliminary results for

the year ended 31 March 2009.

Financial highlights

* Total revenue of GBP15.9 million down 13.1% (2008: GBP18.3 million)

* Pre-tax profit down 52.2% to GBP1.1m (2008: GBP2.3 million)

* Shareholders' funds increased by 9.0% to GBP14.6 million (2008: GBP13.4 million)

* Proposed final dividend maintained at 1.60 pence per share (2008: 1.60 pence per

share)

* Basic earnings per share down 48.9% to 2.3 pence (2008: 4.5 pence)

* Net cash resources at year end remain healthy

* Successful growth in proportion of non-broking fee income, which represented

51.3% of total revenues (2008: 48.9%)

* No impairments or losses on goodwill and intangible balance sheet assets

Business highlights

* Healthy regulatory capital surplus maintained

* WCAM funds under management (FUM) decreased 5.4% to GBP383 million at the year

end (2008: GBP405 million), compared to a 31.2% decline in the FTSE 100.

* Cost saving measures implemented with the full benefit coming through in the

year to 31 March 2010.

* Encouraging start to the current year. WCAM FUM increased to GBP441 million at

31 May 2009.

Commenting on the results, David Gelber, Chairman, said:

"The results represent a relatively strong performance in the context of falling

global stock markets and the significant losses, impairments and write-downs

being reported by other market participants. However, we are continuing to

monitor overheads and make savings where possible."

"There are early signs of a possible market recovery reflected in an improvement

in our trading levels in recent weeks. Your Board maintains its conviction and

confidence in a return to higher levels of profitability if the increased market

activity is sustained."

For further information, please contact:

+----------------------------------------+----------------------------------------+

| Walker Crips Group plc | Tel: +44 (0)20 3100 8000 |

| Rodney FitzGerald, Chief Executive | |

| Stephen Bailey, Investment Director | |

| | |

+----------------------------------------+----------------------------------------+

| Altium | Tel: +44 (0)20 7484 4010 |

| Ben Thorne | |

| Tim Richardson | |

| | |

+----------------------------------------+----------------------------------------+

Further information on Walker Crips Group plc is available on the Group's

website: www.wcgplc.co.uk

CHAIRMAN'S STATEMENT

Market uncertainty, particularly in the second half of the year, continued to

have an impact on the Group's performance. Profit before tax for the year ended

31 March 2009 decreased 52% to GBP1.1m (2008: GBP2.3m) on revenue which fell by

13% to GBP15.9m (2008: GBP18.3m). Although disappointing, this result is a

creditable performance in the context of falling global stock markets and the

significant losses, impairments and write-downs being reported elsewhere. The

Group continued to implement cost reduction measures in the second half with

administrative expenses falling by 5% over the year to GBP11.9m (2008:

GBP12.5m). The full benefit of these cost saving initiatives will be felt in the

year to 31 March 2010.Our balance sheet, underpinned by healthy cash resources,

remains strong with net assets up 9% to GBP14.6m at the year end (2008:

GBP13.4m).

Business Performance Overview

WCAM, our asset management division, posted a robust performance for the year.

Funds under management (FUM) reduced only slightly to GBP383m (2008: GBP405m)

compared to a 31.2% decline in the FTSE 100 Index during the same period.

Since their respective launch dates, all of the WCAM funds have ranked in the

top quartiles of their respective peer groups, a testament to the established

investment strategy of our highly-rated fund management team. Since the year-end

WCAM has continued to attract new investors' funds, with FUM increasing to

GBP441m as at 31 May 2009.

During the year falling global stock markets and recessionary fears accelerated

migration away from equity based investments. As a result the stockbroking

division experienced sustained pressure on transaction volumes throughout the

year to 31 March 2009 and net commission revenue decreased by 14% to GBP5.6m

(2008: GBP6.5m).

A new product division, Walker Crips Structured Investments (WCSI) made a sound

contribution to Group profitability. Our experienced team successfully marketed

four structured investment plans during the second half of the year,

contributing net revenue in excess of GBP200,000.

Board Changes

On 31 December 2008, the Board accepted the resignation of Mr Howard Saunders as

a non-executive director. The Board would like to express its sincere thanks to

Howard for his support and advice for the last seven years, a period during

which the Group expanded rapidly, and wishes him well in his retirement.

Share Issue

In July 2008, 1.4 million new ordinary shares of 6 2/3 pence each were issued as

deferred consideration for the acquisition of the London York financial services

group (G&E Investment Services). This represented the maximum number of shares

due after a highly profitable earn-out period. Having achieved demanding earn

out targets, London York continues to deliver longer-term benefits by providing

a strong platform for further growth in the wealth management sector and

bringing important diversity to our revenues.

Dividend

I am pleased to announce that, in light of the Group's profitable performance

this year, together with a positive start to the new financial year, the Board

is proposing that the final dividend be maintained at 1.60 pence per share

(2008:1.60 pence per share) making a total dividend for the year of 2.54 pence

per share (2008: 2.54 pence per share). This decision has been taken with due

consideration of our established dividend policy which takes account of

longer-term performance and has historically rewarded shareholders with gradual

increases in dividend based on growth of shareholders' funds rather than on a

single year's results. The Group maintains a healthy level of regulatory capital

and distributable reserves and your Board believes that after nearly two years

of challenging trading there is a reasonable prospect of a favourable change in

conditions before the end of the current financial year.

It is proposed that the final dividend will be paid on 22 July 2009 to those

shareholders on the register at the close of business on 19 June 2009.

Outlook

We are continuing to monitor overheads and make savings where possible. There

are early signs of a possible market recovery reflected in an improvement in our

trading levels in recent weeks. Your Board maintains its conviction and

confidence in a return to higher levels of profitability if the increased market

activity is sustained.

D M Gelber

Chairman

4 June 2009

CHIEF EXECUTIVE'S REPORT

Results Overview

I am pleased to report that against declining market activity driven by further

unprecedented deterioration in global financial markets, the Group has achieved

a profit before tax for the year of GBP1.1 m (2008: GBP2.3m) helped by the cost

saving measures which have been implemented throughout the year. The growing

range of products across the Group also provided it with a solid base and helped

to contain the impact of the economic turmoil on annual Group revenue to a

modest decrease of 13.1% to GBP15.9m (2008: GBP18.3m).

Asset Management (WCAM)

The asset management division made another significant contribution to Group

profitability. With its relatively low cost base and sustained levels of

recurring annual income, WCAM provides a sound platform for the other Group

business units to add value in the current challenging climate.

Funds under management (FUM) fell 5.4 % over the year from GBP405m to GBP383m by

the year end, compared to the FTSE 100 Index which fell 31.2 % over the same

period. Since the year end, FUM have recovered to stand at GBP441m at 31 May

2009.

The expansion of the sales team during the year has resulted in an increase in

investor interest in WCAM's seven actively-managed funds, which have all ranked

in the top quartiles of their respective peer groups since launch.

The Board believes that these consistently high quality performance statistics

provide WCAM with opportunities to gain further significant market share.

Investment Management/Stockbroking (Walker Crips Stockbrokers Limited)

Income from investment management and stock broking continued to be the largest

component of Group revenue during the year at GBP11.9m (2008: GBP12.8m), a

modest reduction of just over 7% in extremely challenging conditions.

Total assets under management and administration stood at GBP1.4bn at year end,

a decrease of just 14.8% from the prior year and out performance relative to the

31.2% fall in the FTSE 100 index over the period.

In an effort to maintain profitability within the division whilst also trying to

keep a nucleus of talented staff together, personnel-related cost savings have

been gradually implemented during the past eighteen months, mainly from the back

office and principally through natural wastage. Back office headcount has been

reduced by 20% over the year.

During one of its most difficult years, the Private Client Fund Management

division had a satisfactory performance with fee-based revenues being sustained

at strong levels in spite of weaker stock markets. The York based stockbroking

operation is now fully integrated with London and overall Funds under Management

have grown to GBP138m of which GBP62m is managed on a Discretionary

basis.Volatile markets have provided the Company with the opportunity to use

appropriately collateralised derivative products to enhance portfolio offerings

to clients. This is likely to be a key growth area for the future for both the

London and York offices.

The Group's front office structure, with many advisers operating on a

self-employed commission sharing basis, has proved resilient in the difficult

economic environment. Unlike some of our competitors we have not been forced

into making painful and large-scale redundancies in order to reduce fixed salary

costs.

Following a benchmarking exercise, a comprehensive overhaul of the Group's fee

tariff was completed in mid-year. Fee increases for some of our fringe services

has had the impact of restoring our profit margins to realistic levels for those

services.

In keeping with our proud tradition of providing a tailored service to our

increasingly sophisticated client base, Walker Crips Structured Investments was

successfully launched during the year aimed at external intermediaries and

suitable discretionary or advisory customers. To date WCSI has successfully

issued four medium-term investment products, each attracting considerable

interest.

It is encouraging to report that the Company's less volatile non-broking fee

income, one of our key performance indicators, exceeded 50% of total revenue for

the first time this year.

Wealth Management (London York group)

Our Financial Services and Pension Management Division, based in York, has

performed robustly given the difficult market conditions although its

contribution to the Group's bottom line was significantly lower than in 2008.

The Ebor SIPP product had another successful year of growth. Plans now number

250 and funds under administration exceed GBP50m at the year end (2008: 223

plans and GBP44m). SSAS (Small Self Administered Scheme) plans numbered 184 at

the year end with funds under administration exceeding GBP200m (2008: 203 plans

and GBP175m). We envisage further growth this year for both these products,

despite recent Budget announcements. In particular, our SSAS offering has

already experienced a marked upturn in qualified enquiries.

One of our two joint venture companies, set up with large provincial accountancy

firms based in the North of England, has been wholly acquired by our joint

venture partner who exercised its right to buy us out after a mutually

profitable four year incubation period. However, our business relationship will

continue through the supply of compliance and other related services on a fixed

fee basis. Additionally, it has undertaken to continue to support our Unit Trust

Pension and Structured product range and to utilise our stockbroking services.

Corporate Finance (Keith Bayley Rogers & Co Limited)

The Corporate Finance division registered a small loss for the year as the

appetite for small cap transactions remained limited, particularly on the AIM

market where Keith Bayley Rogers is focused. There are few signs that the

appetite for small-cap transactions will increase in the immediate future and

the division has reduced its cost base accordingly in order to minimise future

losses.

Corporate Activity

While the Group's strategy of combining acquisitive and organic growth to drive

expansion remains unchanged, the Board has developed a more cautious attitude to

acquisitions in recent months.

We have instead concentrated on recruiting teams and individuals and are

delighted that a number of recent front office hires have already brought in

quality business.

Liquidity

Despite material swings in working capital arising from timing differences in

settlements with counterparties the current level of cash resources remains

sufficient and provides adequate headroom even when faced with the volatile

business flows of recent months. Much greater emphasis is being placed on the

credit risk of the banking institutions with whom we place funds, with financial

stability taking greater priority over rates of return.

Going Concern

The Group continues to have a strong balance sheet. The decrease in net cash at

31 March 2009 to GBP 3.3m (2008: GBP5.1m) arose primarily by reason of timing

differences in settlements.

Having conducted detailed forecasts and appropriate stress-testing, taking

account of possible adverse changes in trading performance, the Board has

sufficient grounds to believe the Group is well placed to manage its business

risks successfully and that it will be able to operate within the level of its

current financing arrangements, which includes a GBP3m overdraft facility.

Accordingly, the Board continues to adopt the going concern basis for the

preparation of the financial statements.

Regulation

The Retail Distribution Review is shortly to complete its consultation period

and a fundamental strand in the proposed regulation is the achievement of a

step-change in professionalism across the entire financial services sector by

way of minimum qualifications for all Approved Persons. The Group embraces the

proposed changes and implementation for which is planned for 2012. A plan to

assist our personnel in meeting the new requirements will be implemented to

ensure that they can acquire suitable qualifications well before this deadline.

Despite the inclusion of additional capital requirements to cover operational

risks as well as balance sheet risk under the Capital Requirements Directive,

the Group continues to hold significant surplus regulatory capital.

Directors, Account Executives and Staff

During a period when the Group has been looking to reduce costs and rationalise

personnel, the Board is aware of the inevitable increased workload borne by

those remaining. The degree of versatility of many members of staff has been

prominent and invaluable, particularly from the longer-serving members of our

very adaptable and efficient back office.In these exceptionally difficult times

I would like to thank all our Approved Persons, staff and my fellow directors

for their loyalty and commitment to the Group.

Outlook

The opening weeks of the new financial year have seen a marked improvement in

business activity compared to the final quarter of last year. The full impact of

cost saving initiatives and the revised fee tariff will be felt in the year to

March 2010. There have been signs of a return in investor confidence helped by

the rise in key UK equity indices. Despite general uncertainty about the

recovery of global economies, your Board believes that the Group is

well-positioned to benefit should this trend translate to a sustained recovery.

R. A. FitzGerald FCA

Chief Executive Officer

4 June 2009

Walker Crips Group plc

Consolidated income statement

Year ended 31 March 2009

+--------------------------------+----------+----------+----------+----------+----------+

| | Notes | | | 2009 | 2008 |

| | | | | GBP'000 | GBP'000 |

+--------------------------------+----------+----------+----------+----------+----------+

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Revenue | 5 | | | 15,865 | 18,312 |

+--------------------------------+----------+----------+----------+----------+----------+

| Commission payable | | | | (3,225) | (3,749) |

+--------------------------------+----------+----------+----------+----------+----------+

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Gross profit | | | | 12,640 | 14,563 |

+--------------------------------+----------+----------+----------+----------+----------+

| Share of after tax | | | | 175 | 69 |

| profits of joint | | | | | |

| ventures | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Administrative expenses | | | | (11,906) | (12,530) |

| - other | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Administrative expenses | 3 | | | - | (106) |

| - exceptional items | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Total administrative | | | | (11,906) | (12,636) |

| expenses | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Operating profit | | | | 909 | 1,996 |

+--------------------------------+----------+----------+----------+----------+----------+

| Investment revenues | | | | 193 | 324 |

| Finance costs | | | | (5) | (3) |

+--------------------------------+----------+----------+----------+----------+----------+

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Profit before tax | | | | 1,097 | 2,317 |

+--------------------------------+----------+----------+----------+----------+----------+

| Analysed as: | 3 | | | 1,097 | 2,423 |

| Profit before tax and | | | | - | (106) |

| exceptional items | | | | ________ | ________ |

| Administrative expenses | | | | 1,097 | 2,317 |

| - exceptional items | | | | | |

| Profit before tax | | | | | |

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Taxation | | | | (283) | (745) |

+--------------------------------+----------+----------+----------+----------+----------+

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Profit for the year | | | | 814 | 1,572 |

| attributable to equity | | | | | |

| holders of the company | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Earnings per share | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

| Basic | 4 | | | 2.3p | 4.5p |

+--------------------------------+----------+----------+----------+----------+----------+

| Diluted | 4 | | | 2.2p | 4.2p |

+--------------------------------+----------+----------+----------+----------+----------+

| | | | | | |

+--------------------------------+----------+----------+----------+----------+----------+

Walker Crips Group plc

Consolidated statement of recognised income and expense

Year ended 31 March 2009

+-------------------------------------------------+------------+----------+----------+

| | | 2009 | 2008 |

| | | GBP'000 | GBP'000 |

+-------------------------------------------------+------------+----------+----------+

| | | | |

+-------------------------------------------------+------------+----------+----------+

| Gain on revaluation of | | 248 | 282 |

| available-for-sale investments taken to | | | |

| equity | | | |

+-------------------------------------------------+------------+----------+----------+

| Deferred tax on gains on | | (70) | (62) |

| available-for-sale investments | | | |

+-------------------------------------------------+------------+----------+----------+

| Deferred tax on share options | | (120) | (148) |

+-------------------------------------------------+------------+----------+----------+

| | | | |

+-------------------------------------------------+------------+----------+----------+

| Net income recognised directly in equity | | 58 | 72 |

+-------------------------------------------------+------------+----------+----------+

| | | | |

+-------------------------------------------------+------------+----------+----------+

| | | | |

+-------------------------------------------------+------------+----------+----------+

| Profit for year | | 814 | 1,572 |

+-------------------------------------------------+------------+----------+----------+

| | | | |

+-------------------------------------------------+------------+----------+----------+

| Total recognised income and expense for | | 872 | 1,644 |

| the year attributable to equity holders | | | |

| of the company | | | |

+-------------------------------------------------+------------+----------+----------+

| | | | |

+-------------------------------------------------+------------+----------+----------+

Walker Crips Group plc

Consolidated balance sheet

31 March 2009

+----------------------------------------+----------+----------+----------+----------+

| | Note | | Group | Group |

| | | | 2009 | 2008 |

| | | | GBP'000 | GBP'000 |

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Non-current assets | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Goodwill | | | 5,121 | 5,121 |

+----------------------------------------+----------+----------+----------+----------+

| Other intangible assets | | | 691 | 806 |

+----------------------------------------+----------+----------+----------+----------+

| Property, plant and equipment | | | 1,203 | 1,451 |

+----------------------------------------+----------+----------+----------+----------+

| Investment in joint ventures | | | 28 | 93 |

+----------------------------------------+----------+----------+----------+----------+

| Available for sale investments | | | 1,418 | 1,170 |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| | | | 8,461 | 8,641 |

+----------------------------------------+----------+----------+----------+----------+

| Current assets | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Trade and other receivables | | | 31,907 | 40,864 |

+----------------------------------------+----------+----------+----------+----------+

| Trading investments | | | 316 | 216 |

+----------------------------------------+----------+----------+----------+----------+

| Cash and cash equivalents | | | 3,671 | 5,353 |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| | | | 35,894 | 46,433 |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Total assets | | | 44,355 | 55,074 |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Current liabilities | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Trade and other payables | | | (28,891) | (39,489) |

| Current tax liabilities | | | (292) | (524) |

| Bank overdrafts | | | (337) | (301) |

| Deferred tax liability | | | (134) | (84) |

| Shares to be issued | | | - | (1,105) |

| Cash consideration due under | | | (150) | - |

| acquisition agreements | | | | |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| | | | (29,804) | (41,503) |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Net current assets | | | 6,090 | 4,930 |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Non-current liabilities | | | - | (150) |

| Cash consideration due under | | | | |

| acquisition agreements | | | | |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Net assets | | | 14,551 | 13,421 |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Equity | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Share capital | | | 2,464 | 2,360 |

+----------------------------------------+----------+----------+----------+----------+

| Share premium account | | | 1,605 | 1,568 |

+----------------------------------------+----------+----------+----------+----------+

| Own shares | | | (173) | (173) |

+----------------------------------------+----------+----------+----------+----------+

| Retained earnings | | | 5,013 | 5,101 |

+----------------------------------------+----------+----------+----------+----------+

| Revaluation reserve | | | 967 | 789 |

+----------------------------------------+----------+----------+----------+----------+

| Other reserves | | | 4,675 | 3,776 |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

| Equity attributable to equity holders | 6 | | 14,551 | 13,421 |

| of the company | | | | |

+----------------------------------------+----------+----------+----------+----------+

| | | | | |

+----------------------------------------+----------+----------+----------+----------+

Walker Crips Group plc

Consolidated cash flow statement

Year ended 31 March 2009

+---------------------------------------------+------+----------+---------+----------+

| | | | 2009 | 2008 |

| | | | GBP'000 | GBP'000 |

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Operating activities | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Cash (used in) /generated by | | | (414) | 1,101 |

| operations | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Interest received | | | 150 | 295 |

+---------------------------------------------+------+----------+---------+----------+

| Interest paid | | | (5) | (3) |

+---------------------------------------------+------+----------+---------+----------+

| Tax paid | | | (581) | (657) |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Net cash (used in) /generated by | | | (850) | 736 |

| operating activities | | | | |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Investing activities | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Joint venture termination fee | | | 205 | - |

| Deferred consideration payment under | | | - | (302) |

| acquisition agreements | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Net Purchase of property, plant and | | | (195) | (700) |

| equipment | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Purchase of investments held for | | | (100) | (78) |

| trading | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Dividends received | | | 78 | 79 |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Net cash used in investing | | | (12) | (1,001) |

| activities | | | | |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Financing activities | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Proceeds on issue of shares | | | 46 | 25 |

+---------------------------------------------+------+----------+---------+----------+

| Dividends paid | | | (902) | (858) |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Net cash used in financing | | | (856) | (833) |

| activities | | | | |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Net (decrease) in cash and cash | | | (1,718) | (1,098) |

| equivalents | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Net cash and cash equivalents at | | | 5,052 | 6,150 |

| beginning of year | | | | |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Net cash and cash equivalents at end | | | 3,334 | 5,052 |

| of year | | | | |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| Cash and cash equivalents | | | 3,671 | 5,353 |

+---------------------------------------------+------+----------+---------+----------+

| Bank overdrafts | | | (337) | (301) |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

| | | | 3,334 | 5,052 |

+---------------------------------------------+------+----------+---------+----------+

| | | | | |

+---------------------------------------------+------+----------+---------+----------+

Notes

For the year ended 31 March 2009

1. The financial information set out in the announcement does not constitute

the company's statutory accounts for the years ended 31 March 2009 or 2008. The

financial information for the year ended 31 March 2008 is derived from the

statutory accounts for that year which have been delivered to the Registrar of

Companies. The auditors reported on those accounts; their report was unqualified

and did not contain a statement under s. 237(2) or (3) Companies Act 1985. The

statutory accounts for the year ended 31 March 2009 are yet to be signed but

will be finalised on the basis of the financial information presented by the

directors in this preliminary announcement and will be delivered to the

Registrar of Companies following the company's annual general meeting.

Going concern

The Group's business activities, together with the factors likely to affect its

future development, performance and position are set out in the Chairman's

Statement and Chief Executive's report.

The Group has healthy financial resources together with a long established, well

proven and tested business model. As a consequence, the directors believe that

the Group is well placed to manage its business risks successfully despite the

current difficult climate.

After conducting enquiries, the directors believe that the Company and the Group

have adequate resources to continue in existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in preparing the

financial statements.

2. Whilst the information as set out in this preliminary announcement is

prepared in accordance with International Financial Reporting Standards ('IFRS')

the announcement itself does not contain sufficient information to comply with

IFRS

The accounting policies are consistent with those applied in the full financial

statements and are consistent with those of the prior year.

3. Exceptional items

Last year, final judgement was awarded in the High Court in the Company's favour

against two clients' unauthorised transactions (as per the Group's announcement

of the 3 July 2007). Additional legal expenses of GBP106,000 were incurred

beyond the original exceptional provision made in the year to 31 March 2006 and

were charged to the income statement last year.

4. Earnings per share

The calculation of basic earnings per share for continuing operations is based

on the post-tax profit for the financial year of GBP814,000 (2008: GBP1,572,000)

and on 35,988,221 (2008: 34,920,683) ordinary shares of 6 2/3p, being the

weighted average number of ordinary shares in issue during the year.

The effect of options granted would be to reduce the reported earnings per

share. The calculation of diluted earnings per share is based on 37,067,260

(2008: 37,049,416) ordinary shares, being the weighted average number of

ordinary shares in issue during the period adjusted for dilutive potential

ordinary shares.

5. Segmental analysis

For management purposes the Group is currently organised into four operating

divisions - Investment Management/Stockbroking, Corporate Finance, Financial

Services and Fund Management. These divisions, all of which conduct business in

the United Kingdom only, are the basis on which the Group reports its primary

segment information.

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| 2009 | Investment | Corporate | Financial | Fund | Consolidated |

| | Management | Finance | services | Management | Year ended |

| | / | GBP'000 | GBP'000 | GBP'000 | 31 March |

| | Stockbroking | | | | 2009 |

| | GBP'000 | | | | GBP'000 |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Revenue | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| External | 11,922 | 311 | 1,056 | 2,576 | 15,865 |

| sales | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Total | 11,922 | 311 | 1,056 | 2,576 | 15,865 |

| revenue | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Result | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Segment | 109 | (174) | 180 | 1,464 | 1,579 |

| result | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Unallocated | | | | | (670) |

| corporate | | | | | |

| expenses | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Operating | | | | | 909 |

| profit | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Investment | | | | | 193 |

| revenues | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Finance | | | | | (5) |

| costs | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Profit | | | | | 1,097 |

| before | | | | | |

| tax | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Tax | | | | | (283) |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Profit | | | | | 814 |

| after | | | | | |

| tax | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Other | | | | | |

| information | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Capital | 183 | - | 12 | - | 195 |

| additions | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Depreciation | 354 | 18 | 48 | 23 | 443 |

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Balance | | | | | |

| sheet | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Assets | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Segment | 34,149 | 132 | 620 | 1,021 | 35,922 |

| assets | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Unallocated | | | | | 8,433 |

| corporate | | | | | |

| assets | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Consolidated | | | | | 44,355 |

| total assets | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Liabilities | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Segment | 28,779 | 51 | 259 | 565 | 29,654 |

| liabilities | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Unallocated | | | | | 150 |

| corporate | | | | | |

| liabilities | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Consolidated | | | | | 29,804 |

| total | | | | | |

| liabilities | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

5. Segmental analysis (continued)

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| 2008 | Investment | Corporate | Financial | Fund | Consolidated |

| (As | Management | Finance | services | Management | Year ended |

| restated) | / | GBP'000 | GBP'000 | GBP'000 | 31 March |

| | Stockbroking | | | | 2008 |

| | GBP'000 | | | | GBP'000 |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Revenue | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| External | 12,827 | 820 | 2,013 | 2,652 | 18,312 |

| sales | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Total | 12,827 | 820 | 2,013 | 2,652 | 18,312 |

| revenue | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Result | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Segment | 772 | 122 | 490 | 1,734 | 3,118 |

| result | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Unallocated | | | | | (1,122) |

| corporate | | | | | |

| expenses | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Operating | | | | | 1,996 |

| profit | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Investment | | | | | 324 |

| revenues | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Finance | | | | | (3) |

| costs | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Profit | | | | | 2,317 |

| before | | | | | |

| tax | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Tax | | | | | (745) |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Profit | | | | | 1,572 |

| after | | | | | |

| tax | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Other | | | | | |

| information | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Capital | 686 | 10 | 5 | - | 701 |

| additions | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Depreciation | 309 | 5 | 73 | 4 | 391 |

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Balance | | | | | |

| sheet | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Assets | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Segment | 42,800 | 841 | 1,213 | 1,579 | 46,433 |

| assets | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Unallocated | | | | | 8,641 |

| corporate | | | | | |

| assets | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Consolidated | | | | | 55,074 |

| total assets | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Liabilities | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Segment | 38,776 | 210 | 551 | 861 | 40,398 |

| liabilities | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Unallocated | | | | | 1,255 |

| corporate | | | | | |

| liabilities | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| Consolidated | | | | | 41,653 |

| total | | | | | |

| liabilities | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

| | | | | | |

+-------------------------------+--------------+-----------+-----------+------------+--------------+

As the Group's joint ventures are primarily engaged in financial services

activities, it has been decided that the results of these joint ventures will

now be reported under financial services. Consequently the result for financial

services in the year to 31 March 2008 has been restated to include the GBP69,000

share of after tax profits of the joint ventures.

6. Reconciliations of movements in shareholders funds

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| | Called | Share | Own | Capital | Other | Revaluation | Retained | Total |

| | up | premium | shares | Redemption | | | earnings | Equity |

| | share | | held | | | | | |

| | capital | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

| | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Equity | 2,356 | 1,547 | (173) | 111 | 3,796 | 569 | 4,387 | 12,593 |

| as at | | | | | | | | |

| 31 | | | | | | | | |

| March | | | | | | | | |

| 2007 | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Revaluation | - | - | - | - | - | 282 | - | 282 |

| of | | | | | | | | |

| investment | | | | | | | | |

| at fair | | | | | | | | |

| value | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Deferred | - | - | - | - | - | (62) | - | (62) |

| tax | | | | | | | | |

| charge | | | | | | | | |

| to | | | | | | | | |

| equity | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Movement | - | - | - | - | (148) | - | - | (148) |

| on | | | | | | | | |

| deferred | | | | | | | | |

| tax on | | | | | | | | |

| share | | | | | | | | |

| options | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Profit | - | - | - | - | - | - | 1,572 | 1,572 |

| for | | | | | | | | |

| the | | | | | | | | |

| year | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Dividends | - | - | - | - | - | - | (858) | (858) |

| paid | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Share | - | - | - | - | 17 | - | - | 17 |

| based | | | | | | | | |

| payments | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Issue | 4 | 21 | - | - | - | - | - | 25 |

| of | | | | | | | | |

| shares | | | | | | | | |

| on | | | | | | | | |

| exercise | | | | | | | | |

| of | | | | | | | | |

| options | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Equity | 2,360 | 1,568 | (173) | 111 | 3,665 | 789 | 5,101 | 13,421 |

| as at | | | | | | | | |

| 31 | | | | | | | | |

| March | | | | | | | | |

| 2008 | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Revaluation | - | - | - | - | - | 248 | - | 248 |

| of | | | | | | | | |

| investment | | | | | | | | |

| at fair | | | | | | | | |

| value | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Deferred | - | - | - | - | - | (70) | - | (70) |

| tax | | | | | | | | |

| charge | | | | | | | | |

| to | | | | | | | | |

| equity | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Movement | - | - | - | - | (120) | - | - | (120) |

| on | | | | | | | | |

| deferred | | | | | | | | |

| tax on | | | | | | | | |

| share | | | | | | | | |

| options | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Profit | - | - | - | - | - | - | 814 | 814 |

| for | | | | | | | | |

| the | | | | | | | | |

| year | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Dividends | - | - | - | - | - | - | (902) | (902) |

| paid | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Share | - | - | - | - | 9 | - | - | 9 |

| based | | | | | | | | |

| payments | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Issue | 95 | - | - | - | 1,010 | - | - | 1,105 |

| of | | | | | | | | |

| shares | | | | | | | | |

| as | | | | | | | | |

| deferred | | | | | | | | |

| consideration | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Issue | 9 | 37 | - | - | - | - | - | 46 |

| of | | | | | | | | |

| shares | | | | | | | | |

| on | | | | | | | | |

| exercise | | | | | | | | |

| of | | | | | | | | |

| options | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| Equity | 2,464 | 1,605 | (173) | 111 | 4,564 | 967 | 5,013 | 14,551 |

| as at | | | | | | | | |

| 31 | | | | | | | | |

| March | | | | | | | | |

| 2009 | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

| | | | | | | | | |

+---------------------------------+---------+---------+---------+------------+---------+-------------+----------+---------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UOOBRKORNRAR

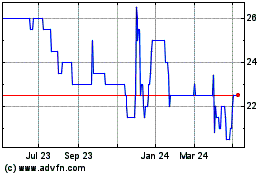

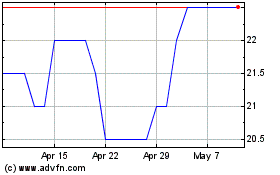

Walker Crips (LSE:WCW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Walker Crips (LSE:WCW)

Historical Stock Chart

From Jul 2023 to Jul 2024