Westmount Energy Limited Investment in JHI Associates Inc. (0005Z)

28 August 2018 - 7:46PM

UK Regulatory

TIDMWTE

RNS Number : 0005Z

Westmount Energy Limited

28 August 2018

The information contained within this announcement (the

"Announcement") is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014. Upon the publication of this Announcement via

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

28th August 2018

WESTMOUNT ENERGY LIMITED

("Westmount" or the "Company")

Investment in JHI Associates Inc.

The Board of Westmount is pleased to announce that it has

purchased 1,110,000 common shares in JHI Associates Inc. ("JHI")

commencing on 31(st) December 2016 and completing on 24(th) August

2018. The total consideration, including transaction costs, of

GBP809,840 has been funded from Westmount's existing cash

resources.

JHI is a private, Ontario registered, company established in

2014 and focused on oil exploration opportunities in the emerging

Guyana-Suriname Basin. The company's main asset is a 40% carried

interest (17.5% carried interest, subject to approval of Total

Farm-in transaction announced in February 2018) in the Canje Block

covering over 6,000 square kilometres, offshore Guyana. This block

is located adjacent to and in the same geologic basin as the

Stabroek Block which has delivered eight substantial oil

discoveries since 2015, with reported discovered recoverable

resources in excess of 4 billion oil-equivalent barrels to

date.

ExxonMobil, which is the operator of both blocks, acquired in

excess of 6100 km(2) of 3D seismic on the Canje Block in 2016 and

this dataset is currently undergoing processing and interpretation

with a view to evaluation of a future drilling program.

Westmount's holding in JHI represents less than 1% of the fully

diluted shares and, at cost, as of 31(st) December 2017, represents

approximately fifty-six per cent of Westmount's gross assets.

Westmount reported a loss for the Year End 30(th) June 2017 of

GBP200,500 (audited), whereas JHI incurred a loss of USD $5,203,852

(unaudited) for the Year End 31(st) December 2017.

This investment is consistent with Westmount's strategy of

seeking exposure to opportunities in the prolific Guyana-Suriname

Basin, which the Board considers to be a major emerging hydrocarbon

province.

Further disclosure with respect to JHI is available through

SEDAR and their website at www.jhiassociates.com.

For further information, please contact:

Westmount Energy Limited www.westmountenergy.com

David King, Director Tel: +44 (0) 1534 823133

Jane Vlahopoulou

Cenkos Securities plc (Nomad and Broker) Tel: +44 (0) 20 7397 8900

Nicholas Wells / Harry Hargreaves (Corporate Finance)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

AGRFKFDQCBKKDFB

(END) Dow Jones Newswires

August 28, 2018 05:46 ET (09:46 GMT)

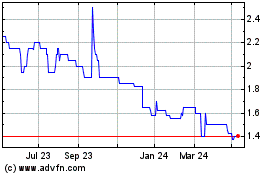

Westmount Energy (LSE:WTE)

Historical Stock Chart

From Apr 2024 to May 2024

Westmount Energy (LSE:WTE)

Historical Stock Chart

From May 2023 to May 2024