TIDMYOU

RNS Number : 2588F

YouGov PLC

06 July 2023

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN YOUGOV PLC OR ANY OTHER ENTITY IN

ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS

DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION

WITH, ANY INVESTMENT DECISION IN RESPECT OF YOUGOV PLC. PLEASE SEE

THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 596/2014 AS IT FORMS PART OF UK DOMESTIC

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMED

("MAR").

06 July 2023

YouGov plc

("YouGov" or "the Group" or "the Company")

YouGov to acquire GfK's Consumer Panel Business

Extends YouGov's Offering with Established Leader in European

Household FMCG Consumer Insights

Accelerating our strategic vision outlined at the Capital

Markets Day

Delivering mid-teens EPS accretion in the first full year of

ownership

YouGov plc (AIM: YOU) ("YouGov"), the international market

research and data analytics group, today announces the acquisition

of the Consumer Panel Business of GfK SE (the "Consumer Panel

Business") for a headline purchase price of EUR315 million (the

"Acquisition").

GfK's Consumer Panel Business is an established leader in

household purchase data, with panels across 16 European countries,

consisting of over 100,000 households. The Consumer Panel Business

extends the Company's offering into the FMCG sector, with its high

intensity users of market research, and provides an opportunity to

significantly enhance the Group's offering to US clients. The

Consumer Panel Business will strengthen the Group's customer value

proposition and add highly engaged panellists in Europe,

complementary capabilities, and longstanding relationships with

blue chip clients, helping to accelerate the Group's strategic

vision outlined at the YouGov Capital Markets Day on 17 May 2023

.

YouGov will fund the Acquisition through an equity placing of

new ordinary shares expected to raise gross proceeds of

approximately GBP 55 million (representing approximately 4.9% of

YouGov's issued share capital), with the remainder of the cash

consideration financed by a fully committed bridge debt facility

and existing cash on balance sheet. The terms of the placing were

announced separately today.

The Acquisition is subject to customary closing conditions

including any necessary regulatory approvals and works' council

consultations in certain jurisdictions. Completion is expected in

the second half of 2023.

Compelling Strategic and Financial Rationale

-- Extends YouGov's offering into the FMCG sector: The Consumer

Panel Business brings longstanding relationships with a complementary

blue-chip client base in the FMCG sector in which YouGov has,

to date, been underpenetrated.

-- Adds highly-engaged panellists in Europe : GfK's Consumer

Panel Business offers over 100,000 highly-engaged panellists

and rich data assets on consumer household purchases. The

Consumer Panel Business has a presence in 16 countries in

core continental Europe producing household purchase data

representing over 50% of European GDP and over 145 million

consumer households.

-- Enhances YouGov's customer value proposition : Opportunity

to provide a holistic 360-degree view of the consumer by connecting

data from the Consumer Panel Business with YouGov's profiling,

media consumption and brand data.

-- Opportunity to significantly enhance YouGov's US offering

: The Acquisition presents an exciting opportunity to bring

the Consumer Panel Business offering to the US using YouGov

Plus panels and adding expertise in building SKU data product

and barcode catalogue, creation and maintenance of household

samples, and specialist data science to enhance insights.

-- Resilient through-cycle financial profile, growing recurring

revenue share(1) and expanding YouGov's operating profit margins(2)

: The Consumer Panel Business contributes a resilient financial

profile to the Group, with average contract length of 3 years,

99% average gross revenue retention(3) within its largest

segment, and approximately 66% of revenues from recurring

subscription business(4) . The Acquisition is also expected

to enhance YouGov's operating profit margin(2) .

-- Acquisition is mid-teens EPS accretive : The Acquisition

is expected to result in mid-teens EPS accretion in the first

full year of ownership pre-synergies(5) . Additional upside

potential is provided by c urrently identified annual cost

synergies of approximately GBP4 million(6) , further potential

cost synergy realization during integration, and attractive

revenue synergies from cross-sell, upsell and the US expansion

opportunity.

-- Strong Cultural Alignment: YouGov sees strong cultural alignment

between the two organisations given the Consumer Panel Business'

rigorous approach to data, their use of data from highly-engaged

panels, and their deployment of technology to deliver rich

data and insights.

Consideration, Background to the Offer, and Timeline to Completion

-- YouGov plc has agreed to acquire the Consumer Panel Business

of GfK SE in an all-cash transaction for a headline purchase

price of EUR315 million.

-- Implies a sub-10x multiple on a trailing FY2022 EBITDA

basis pre-synergies.

-- The headline purchase price is subject to adjustments

to reflect a cash-free debt-free transaction, and assuming

a normalised level of working capital. The adjustments

are to be finalised using a completion accounts mechanism.

Based on the current estimate of completion adjustments,

the final cash consideration is expected to be lower

than the headline purchase price.

-- The opportunity to acquire the Consumer Panel Business has

arisen because the European Commission has required its divestment

to an independent third party as a clearance condition for

the merger of NielsenIQ and GfK SE announced in July 2022.

-- A transitional services agreement will remain in place

for 12 months following completion of the Acquisition

with an option to extend by an additional 6 months on

two occasions (maximum 24 months) to ensure a smooth

separation and integration process.

-- Consumer Panel Business management will remain with the

business to drive the integration and continued success

of the business.

-- The Acquisition is subject to customary closing conditions

including any necessary regulatory approvals and works' council

consultations in certain jurisdictions. Completion is expected

in the second half of 2023.

-- In the year to 31 December 2022, the Consumer Panel Business

generated revenues of EUR134 million and adjusted profit before

tax of EUR24 million and as of 31 March 2023 had gross assets

of EUR53 million(7) .

Financing & Capital Structure

-- YouGov will fund the Acquisition with a non-pre-emptive underwritten

equity placing of new ordinary shares expected to raise gross

proceeds of approximately GBP 55 million (representing approximately

4.9% of YouGov's issued share capital), with the remainder

of the cash consideration financed by a fully committed bridge

debt facility and cash on balance sheet. The terms of the

placing were announced separately today.

-- The Company expects net leverage at completion below 2x(8)

, with the strong combined cash flow profile de-levering by

approximately 0.5x per annum.

-- The Company's progressive dividend policy is expected to remain

unchanged following the Acquisition.

Morgan Stanley is acting as lead financial adviser to YouGov in

relation to the transaction with Numis acting as NOMAD. Citigroup

is acting as debt provider and financial adviser to YouGov. DLA

Piper is acting as legal adviser and KPMG is providing tax and

structuring advice.

Stephan Shakespeare, YouGov Chief Executive Officer and

Non-Executive Chair Designate, commented :

"We are delighted to be acquiring one of the leaders in European

household purchase data and to be welcoming their employees into

the YouGov fold. The business' approach to data collection and

their geographic coverage are highly complementary to YouGov and we

are fortunate to have been in a position to make this Acquisition,

which brings exciting future growth opportunities.

This transaction is important for us strategically, extending

our offering further into the under-penetrated FMCG sector,

bringing with it long-standing relationships with a blue-chip

client base. We are excited by the future potential of this

combination, as it provides us with the opportunity to super-charge

our customer value proposition by combining one of the richest data

sets on household purchases with YouGov's existing media

consumption and brand data.

We believe this transaction will support YouGov's stated

ambition of becoming the world's #1 market research company ."

Alex McIntosh, YouGov Chief Finance Officer, commented:

"We are thrilled to have the compelling opportunity to acquire

such a high-quality asset and YouGov's strong financial position

has made it possible for us to be agile during the assessment and

transaction process.

Throughout this process we have worked closely with the Consumer

Panel Business management team and have been very impressed with

the foundation they have built. It is clear the management team

share our ethos of using high quality panels and technology to

provide data rich insights to their customers. We are looking

forward to working with them over the coming months to develop

detailed integration plans and achieve our shared vision of scaling

their offering over the next few years under the YouGov Group."

Lars Nordmark, Interim CEO and CFO GfK, commented:

"With YouGov, we firmly believe we have found the perfect future

owner for GfK's Consumer Panel Business and a solution in the best

interests of all parties involved - especially for our clients and

employees."

Enquiries

YouGov plc

Stephan Shakespeare / Alex McIntosh

/ Hannah Jethwani +44 (0) 20 7012 6000

Morgan Stanley (Lead Financial Advisor)

Laurence Hopkins / Dominique Cahu /

Conrad Griffin +44 (0) 20 7425 8000

Numis Securities (NOMAD and Joint

Broker)

Nick Westlake / Iqra Amin +44 (0) 20 7260 1000

Berenberg (Joint Broker)

Mark Whitmore / Richard Andrews / Alix

Mecklenburg-Solodkoff +44 (0) 20 3207 7800

FTI Consulting

Charles Palmer / Emma Hall +44 (0) 20 3727 1000

About YouGov

YouGov is an international online research data and analytics

technology group.

Our mission is to offer unparalleled insight into what the world

thinks.

Our innovative solutions help the world's most recognised

brands, media owners and agencies to plan, activate and track their

marketing activities better.

With operations in the UK, the Americas, Europe, the Middle

East, India, and Asia Pacific, we have one of the world's largest

research networks.

At the core of our platform is an ever-growing source of

consumer data that has been amassed over our twenty years of

operation. We call it Living Data. All of our products and services

draw upon this detailed understanding of our 24+ million registered

individuals to deliver accurate, actionable consumer insights.

As innovators and pioneers of online market research, we have a

strong reputation as a trusted source of accurate data and

insights. Testament to this, YouGov data is regularly referenced by

the global press, and we are the most quoted market research source

in the world.

Important notices

The person responsible for arranging for the release of this

announcement on behalf of YouGov is Alex McIntosh (CFO).

This Announcement is for information only and does not itself

constitute or form part of an offer to sell or issue or the

solicitation of an offer to buy or subscribe for securities

referred to herein in any jurisdiction including, without

limitation, the United States, any other Restricted Territory (as

defined below) or in any jurisdiction where such offer or

solicitation is unlawful. No public offering of securities will be

made in connection with any securities referred herein in the

United Kingdom, the United States, any other Restricted Territory

or elsewhere. This Announcement is restricted and is not for

publication, release, distribution or forwarding, in whole or in

part, directly or indirectly, in or into the United States of

America (including its territories and possessions, any state of

the United States and the District of Columbia (collectively, the

"United States"), Australia, Canada, the Republic of South Africa,

Japan (each a "Restricted Territory") or any other jurisdiction in

which such release, publication, distribution or forwarding would

be unlawful. No public offering of the securities referred to

herein is being made in any such jurisdiction or elsewhere. This

information has not been approved by the London Stock Exchange, nor

is it intended to be so approved.

The securities referred to herein have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "Securities Act"), or with any securities regulatory

authority of any state or other jurisdiction of the United States,

and may not be offered, sold or transferred directly or indirectly

in or into the United States, except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the Securities Act and in compliance with the securities laws of

any state or any other jurisdiction of the United States. No public

offering of any securities referred to herein is being made in the

United States.

Persons distributing this Announcement must satisfy themselves

that it is lawful to do so. This Announcement is for information

purposes only and shall not constitute an offer to sell or issue or

the solicitation of an offer to buy, subscribe for or otherwise

acquire securities in any jurisdiction. Any failure to comply with

this restriction may constitute a violation of the securities laws

of such jurisdictions.

No offering document or prospectus will be made available in any

jurisdiction in connection with the matters contained or referred

to in this Announcement and no such offering document or prospectus

is required (in accordance with the EU Prospectus Regulation or UK

Prospectus Regulation) to be published.

Certain statements in this announcement are forward-looking

statements, including with respect to YouGov's expectations,

intentions and projections regarding its future performance,

strategic initiatives, anticipated events or trends and other

matters that are not historical facts and which are, by their

nature, inherently predictive, speculative and involve risks and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future. All

statements that address expectations or projections about the

future, including statements about operating performance, strategic

initiatives, objectives, market position, industry trends, general

economic conditions, expected expenditures, expected cost savings

and financial results are forward -- looking statements. Any

statements contained in this announcement that are not statements

of historical fact are, or may be deemed to be, forward -- looking

statements. These forward-looking statements, which may use words

such as "aim", "anticipate", "believe", "could", "intend",

"estimate", "expect", "may", "plan", "project" or words or terms of

similar meaning or the negative thereof, are not guarantees of

future performance and are subject to known and unknown risks and

uncertainties. There are a number of factors including, but not

limited to, commercial, operational, economic, and financial

factors, that could cause actual results, financial condition,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond

YouGov's ability to control or estimate precisely, such as changes

in taxation or fiscal policy, future market conditions, currency

fluctuations, the behaviour of other market participants, the

actions of governments or governmental regulators, or other risk

factors, such as changes in the political, social and regulatory

framework in which YouGov operates or in economic or technological

trends or conditions, including inflation, recession and consumer

confidence, on a global, regional or national basis. Given those

risks and uncertainties, readers are cautioned not to place undue

reliance on forward-looking statements. Forward-looking statements

speak only as of the date of this announcement. YouGov and its

affiliates, and any of its or their respective directors, officers,

partners, employees, advisers, or agents (collectively,

"Representatives") expressly disclaim any obligation or undertaking

to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise

unless required to do so by applicable law or regulation.

In particular, no statement in this announcement is intended to

be a profit forecast or profit estimate and no statement of a

financial metric (including estimates of EBITDA, profit before tax,

free cash flow or net debt) should be interpreted to mean that any

financial metric for the current or future financial years would

necessarily match or exceed the historical published position of

YouGov and its subsidiaries. The acquisition of the Consumer Panel

Business by YouGov is structured as a carve out transaction. There

is no standalone audited financial information available relating

to the Consumer Panel Business. YouGov's assessment of the

financial performance of the Consumer Panel Business and of the

prospective target margins is based upon unaudited financial

information and projections provided by GfK combined with YouGov's

management assessment of the expected financial performance of the

Consumer Panel Business. The position may be subject to change.

Certain statements in this announcement may contain estimates. The

estimates set out in this announcement have been prepared based on

numerous assumptions and forecasts, some of which are outside of

YouGov's influence and/or control, and is therefore inherently

uncertain and there can be no guarantee or assurance that it will

be correct. The estimates have not been audited, reviewed, verified

or subject to any procedures by YouGov's auditors. Undue reliance

should not be placed on them and there can be no guarantee or

assurance that they will be correct.

This announcement is being issued by and is the sole

responsibility of YouGov. No representation or warranty, express or

implied, is or will be made as to, or in relation to, and no

responsibility or liability is or will be accepted by or on behalf

of YouGov (apart from the responsibilities or liabilities that may

be imposed by the Financial Services and Markets Act 2000, as

amended or the regulatory regime established thereunder) or by its

affiliates or any of its Representatives as to, or in relation to,

the accuracy, adequacy, fairness or completeness of this

announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers or any other statement made or purported to be made by or

on behalf of YouGov or any of its affiliates or any of its

Representatives in connection with YouGov and any responsibility

and liability whether arising in tort, contract or otherwise

therefore is expressly disclaimed.

Morgan Stanley & Co. International plc ("Morgan Stanley"),

which is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential

Regulation Authority in the United Kingdom, is acting exclusively

as financial adviser to YouGov and no one else in connection with

the Acquisition. In connection with such matters, Morgan Stanley,

its affiliates and their respective directors, officers, employees

and agents will not regard any other person as their client, nor

will they be responsible to anyone other than YouGov for providing

the protections afforded to clients of Morgan Stanley nor for

providing advice in connection with the Acquisition, the contents

of this announcement or any matter referred to herein.

Numis Securities Limited ("Numis"), which is authorised and

regulated in the United Kingdom by the FCA, is acting exclusively

for YouGov and no one else in connection with the Acquisition and

will not be responsible to anyone other than YouGov for providing

the protections afforded to clients of Numis nor for providing

advice in relation to the Acquisition or any other matter referred

to herein. Neither Numis nor any of its group undertakings or

affiliates owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Numis in connection with the Acquisition or any matter referred

to herein.

Citigroup Global Markets Limited ("Citi"), which is authorised

by the Prudential Regulation Authority and regulated in the UK by

the Financial Conduct Authority and the Prudential Regulation

Authority, is acting exclusively for YouGov and for no one else in

connection with the Acquisition and will not be responsible to

anyone other than YouGov for providing the protections afforded to

clients of Citi nor for providing advice in connection with the

Acquisition, or any other matters referred to in this announcement.

Neither Citi nor any of its affiliates, directors or employees owes

or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, consequential, whether in contract, in

tort, in delict, under statute or otherwise) to any person who is

not a client of Citi in connection with this announcement, any

statement contained herein, the Acquisition or otherwise.

1 Revenue derived from multi-year contracts and one-year contracts

expected to renew.

(2) YouGov financials based on audited published financial information

for the 12-month period ended 31 July 2022, GfK financials

based on management estimates and calendarized to July-YE.

Pro-Forma numbers are calculated based on these standalone

figures. The FY2022 operating profit margin for YouGov increases

from 16.4% to 17.8% on a pro forma basis.

(3) Gross revenue retention measures how much of the monthly recurring

revenue is retained each month after subtracting the effects

of churn or downgrades to lower-priced products, but not the

effects of upgrades.

(4) Revenue derived from multi-year contracts and one-year contracts

expected to renew.

(5) EPS accretion calculated using the pro-forma financials based

on standalone financials of YouGov (based on analyst consensus)

and calendarized financials of GfK CPB based on management

estimates.

(6) Based on YouGov management estimates.

(7) Financial information is based on unaudited financial information

provided in relation to the Consumer Panel Business which has

been assessed by and on behalf of YouGov.

(8) Net leverage calculated by dividing proforma net debt by Adjusted

EBITDA (YouGov values based on analyst consensus (July-YE),

including related acquisition financing, and Consumer Panel

Business values based on management estimate calendarized to

July-YE).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQMZGGNVVDGFZM

(END) Dow Jones Newswires

July 06, 2023 12:21 ET (16:21 GMT)

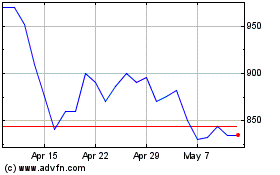

Yougov (LSE:YOU)

Historical Stock Chart

From Apr 2024 to May 2024

Yougov (LSE:YOU)

Historical Stock Chart

From May 2023 to May 2024