Bank of America's Earnings Move Higher - Update

16 July 2018 - 10:29PM

Dow Jones News

By Rachel Louise Ensign

Bank of America Corp. said Monday that second-quarter earnings

rose 33%, as higher interest rates continued to lift the bank's

results.

Quarterly profit at the Charlotte, N.C.-based bank, the second

largest in the U.S. by assets, was $6.784 billion, compared with

$5.106 billion a year ago. Per share, earnings were 63 cents.

Analysts had expected 57 cents per share. Shares rose about 0.6%

premarket.

The bank's second-quarter revenue fell slightly, to $22.609

billion, down from $22.829 billion a year ago, when the bank posted

a one-time gain related to the sale of a business. Without that

gain, revenue would have been up 3%. Analysts had expected revenue

of $22.286 billion.

Earnings benefited from the recent corporate tax cut as well as

interest rates. Rising rates are typically good for banks because

lenders turn a profit on the difference between what they pay on

deposits and the rate they collect on loans. In the quarter, the

Federal Reserve raised its benchmark rate for a seventh time.

Banks have been able to pocket most of the benefits from the

rate increases because customers aren't broadly demanding more

interest on their deposits. The rate the bank paid on U.S.

interest-bearing deposits was 0.38%, compared with 0.30% in the

first quarter.

Loan growth, which has slowed across the banking industry since

the 2016 presidential election, was 2% over the year-earlier

period. Deposits, meanwhile, grew nearly 4% in the second quarter.

The largest national banks have been able to continue growing

deposits despite the fact that they are paying relatively low

interest to retail customers.

Despite modest predictions during the quarter, trading revenue,

excluding an accounting adjustment, rose nearly 7% to $3.596

billion from $3.369 billion in the second quarter of last year.

Quarterly expenses fell 5% to $13.284 billion, from $13.982

billion a year ago.

Bank of America's return on equity was 10.75% in the second

quarter, above the bank's theoretical 10% cost of capital. The key

metric has continued to improve at the bank, aided by the recent

corporate tax cut. It stood at 7.75% in the second quarter of

2017.

After a huge run-up after the 2016 election, investors have

shown little enthusiasm for bank stocks this year. Since the start

of 2018, the KBW Nasdaq bank index is down 2%. Bank of America's

shares are down 3.3% so far this year.

Investors have grown wary of bank stocks, analysts say, because

of a bond-market development known as the flattening of the yield

curve: a narrowing of the difference in the yields of shorter- and

longer-term Treasurys.

A flatter yield curve can be bad for banks because they earn

less on loans and securities tied to longer-term Treasurys. The

narrowing also potentially signals problems ahead for the

economy.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

July 16, 2018 08:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

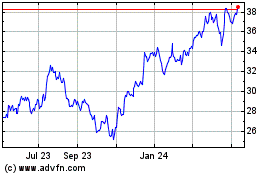

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2024 to May 2024

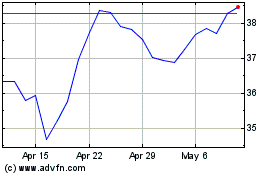

Bank of America (NYSE:BAC)

Historical Stock Chart

From May 2023 to May 2024