false

0001903382

0001903382

2024-12-06

2024-12-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 6, 2024

Bluerock Homes Trust, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland |

001-41322 |

87-4211187 |

(State or other jurisdiction of incorporation

or organization) |

(Commission File

Number) |

(I.R.S. Employer

Identification

No.) |

1345 Avenue of the Americas, 32nd Floor

New York, NY 10105

(Address of principal executive offices)

(212) 843-1601

(Registrant’s telephone number, including

area code)

None.

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of

the Exchange Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Class

A Common Stock, $0.01 par value per share |

BHM |

NYSE

American |

Check the appropriate box below if the Form 8-K/A filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2

of this chapter).

Emerging growth company x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| ITEM 2.01 | COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS |

The disclosure below describes

our acquisition of the Allure Property. All figures provided below are approximate.

As previously disclosed by

Bluerock Homes Trust, Inc., a Maryland corporation (the “Company”), in its Current Report on Form 8-K filed with the U.S.

Securities and Exchange Commission (the “SEC”) on November 26, 2024, on November 20, 2024, the Company, through BHM Allure,

LLC (“BHM Allure”), a Delaware limited liability company and wholly-owned subsidiary of the Company’s operating partnership,

Bluerock Residential Holdings, L.P., a Delaware limited partnership (the “Operating Partnership”) and BR S2 Allure JV, a Delaware

limited liability company and majority-owned subsidiary of the Operating Partnership (“Purchaser”), entered into a Contribution

Agreement (the “Contribution Agreement”) with S2 Allure REIT Subsidiary LLC, a Texas limited liability company (“S2

Subsidiary”), S2C REIT OP, LP, a Delaware limited partnership (“S2C REIT OP”), and S2 Allure BEVE LLC, a Delaware limited

liability company, S2 Allure ARO LLC, a Delaware limited liability company, S2 Allure VAU LLC, a Delaware limited liability company, and

S2 Allure LLC, a Delaware limited liability company (collectively, the “S2 TIC Subsidiaries,” and collectively with S2C REIT

OP and S2 Subsidiary, “Seller”), an unaffiliated seller, to acquire in fee simple a 350-unit apartment complex known as Allure

at Southpark, located in Charlotte, North Carolina (the “Allure Property”), for a total purchase price of approximately $92.0

million.

Acquisition of Allure

Property

On December 6, 2024, the

Company, through BHM Allure and Purchaser, acquired the Allure Property from Seller for a total purchase price of approximately $92.0

million.

The acquisition of the Allure

Property was based on arm’s length negotiations with an unaffiliated seller. In evaluating the Allure Property as a potential investment,

a variety of factors were considered, including overall valuation of net rental income, expected capital expenditures, submarket demographics,

community features and amenities, location, price per unit and occupancy. The Allure Property is subject to a Property Management Agreement

with S2 NC Management, LLC, a Delaware limited liability company (“Allure Manager”), an affiliate of Seller, pursuant to which

Allure Manager will manage the Allure Property for a property management fee of 3.0% of annual gross cash and resident fee revenues, payable

monthly.

Following the acquisition

of the Allure Property, the organizational structure with respect to the ownership of the Allure Property is such that the Allure Property

is wholly owned by BR Allure, LP (“Allure Owner”), a Delaware limited partnership and majority-owned subsidiary of Purchaser,

which is majority-owned by BHM Allure, which is wholly owned by the Operating Partnership.

The acquisition of the Allure

Property was funded with (i) approximately $39.31 million of gross equity from the Company (inclusive of certain transaction costs, operating

expenses, and operating and lender reserves), and (ii) a senior mortgage loan made by KeyBank National Association on behalf of Fannie

Mae (the “Allure Lender”) to Allure Owner in the original principal amount of approximately $55.17 million (the “Allure

Loan”).

Senior Loan Financing

and Guaranty Obligations for the Acquisition of the Allure Property

The Allure Loan is secured

by the Allure Property and matures on January 1, 2030. Beginning February 1, 2025 and continuing on the first day of each calendar month

thereafter through maturity, Allure Owner is required to make interest only payments calculated by (i) multiplying the unpaid principal

balance of the Allure Loan by the interest rate of 5.58%, (ii) dividing the product by three hundred sixty (360), and (iii) multiplying

the quotient obtained by the actual number of days elapsed in the applicable month.

From December 6, 2024 through

and including December 30, 2027, prepayment of the Allure Loan is permitted with a prepayment premium equal to the greater of (a) 1.0%

of the amount of principal being prepaid or (b) a yield maintenance amount calculated as set forth in the loan agreement. Thereafter,

prepayment is permitted (i) from December 31, 2027 through and including September 29, 2029 with a prepayment premium of 1.0%; and (ii)

from September 30, 2029 through maturity with no prepayment premium.

In conjunction with the closing of the Allure Loan, the Company entered into a Guaranty

of Non-Recourse Obligations to provide certain standard scope non-recourse carveout guarantees of the liabilities of Allure Owner under

the Allure Loan.

LLC Agreement of Purchaser

Following the Company’s

investment in the Allure Property, the Company holds an indirect equity interest of approximately 98.05% in the Allure Property through

Purchaser, in which the Company owns an indirect equity interest of approximately 98.05% and S2 Subsidiary, a wholly owned subsidiary

of S2C REIT OP, owns a direct equity interest of approximately 1.95%. Pursuant to the Amended and Restated Limited Liability Company Agreement

of Purchaser, BHM Allure, a wholly-owned subsidiary of the Operating Partnership, is the sole manager of Purchaser. Major decisions with

respect to Purchaser must be unanimously approved by the members. These major decisions include: (i) any amendment of the limited liability

company agreement of either Purchaser or Allure Owner in a manner that materially and disproportionately affect the rights of S2 Subsidiary;

(ii) the admission of new members to the extent the same would disproportionately dilute any member (other than in the case of material

breach); (iii) an election that would cause Purchaser or Allure Owner to be (a) treated as a corporation for tax purposes or (b) classified

as an entity other than a partnership for federal income tax purposes; (iv) permit or cause Purchaser to purchase or invest in real property

(other than the Allure Property) to the extent such real property is not adjacent and/or complimentary to the Allure Property; (v) make

loans using funds of Purchaser to affiliates of a member; (vi) enter into any transactions with or pay any fees to affiliates of any member

to the extent not on an arms-length basis on market terms; and (vii) dissolution of Purchaser in advance of the disposition of the Allure

Property.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

| (a) |

Financial Statements of Real Estate Acquired |

Because it is impracticable

to provide the required financial statements for the acquired real property described in Item 2.01 at the time of this filing and no financial

statements (audited or unaudited) are available at this time, we hereby confirm that we intend to file the required financial statements

on or before February 21, 2025 by amendment to this Current Report on Form 8-K.

| (b) |

Pro Forma Financial Information |

See paragraph (a) above.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

BLUEROCK HOMES TRUST, INC. |

| |

|

| Date: December 12, 2024 |

By: |

/s/ Christopher J. Vohs |

| |

|

Christopher J. Vohs |

| |

|

Chief Financial Officer and Treasurer |

v3.24.3

Cover

|

Dec. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 06, 2024

|

| Entity File Number |

001-41322

|

| Entity Registrant Name |

Bluerock Homes Trust, Inc.

|

| Entity Central Index Key |

0001903382

|

| Entity Tax Identification Number |

87-4211187

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

1345 Avenue of the Americas

|

| Entity Address, Address Line Two |

32nd Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10105

|

| City Area Code |

212

|

| Local Phone Number |

843-1601

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Stock, $0.01 par value per share

|

| Trading Symbol |

BHM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

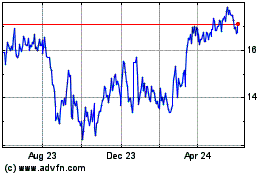

Bluerock Homes (AMEX:BHM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bluerock Homes (AMEX:BHM)

Historical Stock Chart

From Dec 2023 to Dec 2024