Barnwell Industries, Inc. Adopts Limited-Duration Shareholder Rights Plan

27 January 2025 - 10:00PM

Barnwell Industries, Inc. (NYSE American: BRN) (“Barnwell” or the

“Company”) today announced that the Board of Directors (the

“Board”) of Barnwell has adopted a limited-duration shareholder

rights plan (“Rights Plan”) designed to protect the interests of

the Company and all of its shareholders. The Rights Plan is also

intended to provide the Board sufficient time to make informed

judgments and take actions that are in the best interests of

Barnwell and all of its shareholders.

The Rights Plan was adopted in response to the

significant ownership position of Ned Sherwood and his affiliates

(the “Sherwood Group”), which, based on public records, is

approximately 30.00% of Barnwell’s outstanding common stock, and

the refusal of the Sherwood Group to extend the Cooperation and

Support Agreement, entered into by Alexander Kinzler, the former

CEO of the Company, and Secretary and General Counsel of the

Company, and the Sherwood Group, following its pending

expiration.

A special committee of the Board of Directors

(“Special Committee”), consisting of Kenneth Grossman and Joshua

Horowitz, was established by the Board on November 7, 2024, to

review, consider and make recommendations to the Board with respect

to certain corporate governance matters.

The Special Committee recommended to the Board

that the Rights Plan be adopted to protect all shareholders of the

Company from any entity, person or group achieving control over the

Company through a “creeping” acquisition or otherwise. Such

“creeping” control would, in the Special Committee’s view, among

other things, not be in the best interest of the shareholders of

the Company.

The Board believed it was prudent to adopt the

Rights Plan after concerted efforts by the Special Committee to

engage with the Sherwood Group were rebuffed. Notwithstanding the

statements made by Ned Sherwood to members of the Board and

management of the Company that he will obtain control of the

Company in the new year and will bring fresh ideas and perspectives

to address the Company’s operations, the Sherwood Group has not

offered any ideas regarding the Company’s businesses, made any

recommendations to improve shareholder value or provided any new

investment opportunities or alternative investment strategies,

despite repeated requests to do so.

The Rights Plan is designed to enable Barnwell’s

shareholders to realize the long-term value of their investment,

provide an opportunity for shareholders to receive fair and equal

treatment in the event of any proposed takeover of Barnwell and

guard against tactics to gain control of Barnwell without paying

shareholders an appropriate premium for that control. The Rights

Plan is not intended to deter good faith offers to purchase its

shares or preclude the Board or the Special Committee from taking

action that it believes is in the best interest of the Company and

its shareholders.

The Special Committee recognizes that the

Sherwood Group has a large share position and welcomes engagement

with them, and any other shareholder, that is consistent with the

Company’s status as a 70-year-old oil & gas exploration and

development company. If the Sherwood Group were to gain control,

and based upon interaction with the Sherwood Group Board designees,

the Special Committee believes it is highly likely that the

Sherwood Group would seek to modify the Company’s core business and

strategy, including but not limited to exiting the Company’s oil

& gas businesses at discounts to their value in order to seek

undefined and vague “opportunities”.

With the new Rights Plan, the Board seeks to

deter the Sherwood Group from its efforts to take “creeping”

control of the Company by purchasing more shares. The Special

Committee remains willing to engage with the Sherwood Group and

other shareholders to develop constructive ideas for the future of

the Company. However, at this point the Special Committee can only

conclude that the Sherwood Group intends to pursue its goals by

running its board slate for election at the next annual meeting,

without informing stakeholders what it intends to do if it achieves

full control of the Board. The Company has been clear with

shareholders about its commitment to maintaining the business in

which shareholders invested and has honored that commitment.

The Rights Plan is similar to other common stock

rights plans adopted by other publicly held companies. Under the

Rights Plan, Barnwell will issue one right for each Barnwell common

share outstanding as of the close of business on February 7, 2025.

All shareholders will receive one right for each share owned. The

rights will initially trade with Barnwell’s common stock and will

become exercisable only if a person acquires 20% or more of

Barnwell’s outstanding common stock. Any shareholders with

beneficial ownership of 20% or more of Barnwell’s outstanding

common stock (including the Sherwood Group) prior to this

announcement are grandfathered at their beneficial ownership levels

at the date the Rights Plan was adopted but are not permitted to

acquire additional common stock representing 0.25% or more of the

outstanding common stock, subject to limited exceptions, without

triggering the Rights Plan. The Rights Plan is effective

immediately and will expire in one year, unless the rights are

earlier redeemed or exchanged. Any extension would be subject to

prior approval by the Company’s shareholders.

Pursuant to the Rights Plan, should it be

triggered, the Board may decide that:

- Each right will entitle shareholders (other than the acquiring

person, whose rights will have become void and will not be

exercisable) to purchase a specific number of shares of Barnwell

common stock at an effectively half price.

- Alternatively, (on a cashless basis) each outstanding right

(other than the rights held by the acquiring person, whose rights

will have become void) will be exchanged for one share of common

stock.

Further details about the Rights Plan will be

contained in a Form 8-K and Form 8-A to be filed by the Company

with the U.S. Securities and Exchange Commission.

The information contained in this press release

contains “forward-looking statements,” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. A forward-looking

statement is one which is based on current expectations of future

events or conditions and does not relate to historical or current

facts. These statements include various estimates, forecasts,

projections of Barnwell’s future performance, statements of

Barnwell’s plans and objectives, and other similar statements.

Forward-looking statements include phrases such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “predicts,”

“estimates,” “assumes,” “projects,” “may,” “will,” “will be,”

“should,” or similar expressions. Although Barnwell believes that

its current expectations are based on reasonable assumptions, it

cannot assure that the expectations contained in such

forward-looking statements will be achieved. Forward-looking

statements involve risks, uncertainties and assumptions which could

cause actual results to differ materially from those contained in

such statements. The risks, uncertainties and other factors that

might cause actual results to differ materially from Barnwell’s

expectations are set forth in the “Forward-Looking Statements,”

“Risk Factors” and other sections of Barnwell’s annual report on

Form 10-K for the last fiscal year and Barnwell’s other filings

with the Securities and Exchange Commission. Investors should not

place undue reliance on the forward-looking statements contained in

this press release, as they speak only as of the date of this press

release, and Barnwell expressly disclaims any obligation or

undertaking to publicly release any updates or revisions to any

forward-looking statements contained herein.

| CONTACT: |

Kenneth S.

Grossman |

| |

Vice Chairman of the Board of Directors |

| |

Phone: (516) 482-8841 |

| |

Email: kensgrossman@gmail.com |

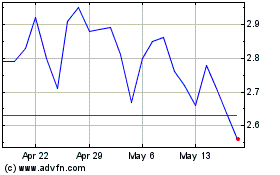

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Jan 2025 to Feb 2025

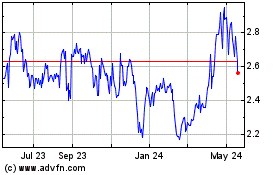

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Feb 2024 to Feb 2025