Many commodities have seen a solid start to 2014, as products like

coffee and sugar have crushed the market in the first two months of

the year. However, this commodity boom hasn’t been felt across the

space, as many key resources in the base metal world haven’t seen

any gains to start the year.

In fact, copper is now approaching a double digit loss for the

year, while it is nearing its 52 week low as well. This is despite

a reasonably solid jobs report in the U.S. as well as good

manufacturing data, suggesting that events in China are really

weighing on the red metal now (see China ETF Investing 101).

China in Focus

It hasn’t exactly been smooth sailing for the world’s second

biggest economy lately as concerns over defaults and the banking

system have riled the nation’s markets. Additionally, a broad shift

away from emerging markets hasn’t helped matters either, leading to

some volatile trading in many Chinese securities.

Growth rates in China are also expected to come down, with some

looking for GDP growth to fall below 7% this year. And since China

makes up roughly 40% of global copper demand, this lower growth

rate and lower level of manufacturing activity could reduce demand

for copper, keeping prices depressed in the near term.

"Until the Chinese economy picks up and starts using up the supply

that is out there, I can't see copper trading much higher," said

James Cordier, a principal at Liberty Trading Group for a WSJ

article. "Unfortunately, there are no signs of that happening right

now."

Copper ETFs

With this sluggish backdrop for the top consumer of copper, it

shouldn’t be too surprising to note that a trio of copper ETF

options on the market have been seeing weakness lately, and could

continue to stumble in the weeks ahead. Investors should definitely

monitor these options, as they represent easy ways for the average

investor to tap into the copper market, and could continue to see

volatility in the months ahead should Chinese economic picture

remains cloudy:

iPath Dow Jones UBS Copper ETN (JJC)

This ETN offers investors exposure to front month copper futures

tracking the Dow Jones UBS Copper Index. The note has just under

$90 million under management, while its expense ratio comes in at

75 basis points a year (see all the Industrial Metal ETFs

here).

The product is easily the most popular that is focused on the

futures market, though investors have a few other options to choose

from such as

CUPM. Investors should also note

that, as an ETN, JJC carries with it the credit from of Barclays,

though an ETN will have no tracking error.

JJC crumbled on Friday trading on elevated volume, plunging by 4.1%

on the day.

Global X Copper Miners ETF (COPX)

This ETF represents an equity option for copper investors, tracking

the Solactive Global Copper Miners Index. This benchmark holds 25

stocks in its basket, while it charges investors 65 basis points a

year in fees for the exposure.

Investors should note that the fund has a definite skew towards

smaller securities as large caps account for just one-third of the

total. Meanwhile, American firms make up just 5% of assets, leaving

a third for Canada, 14% for Australia, and 11% for the UK.

COPX tumbled by about 3.2% on Friday trading, slumping along with

its underlying metal (see all the Materials ETFs here).

First Trust ISE Global Copper Index Fund (CU)

This copper mining ETF follows the ISE Global Copper Index for

exposure, tracking 25 companies across the globe. The fund uses an

equal weight methodology, giving roughly the same weights to each

security in the portfolio, while it charges investors 70 basis

points a year in fees for the exposure.

Large caps make up roughly 40% of assets in this fund, followed by

about one-third in mid cap stocks. U.S. copper miners make up just

7% of assets, while Canada (32%) and the UK (20%) dominate from a

country look.

This ETF fell about 3.5% in Friday trading, a relatively big loss

compared to the S&P 500’s flat performance for the session.

Bottom Line

It doesn’t really seem to matter how the economy is doing in the

U.S. for copper, as the jobs report was decent, while the recent

manufacturing data has been solid. Instead, copper is trading off

of Chinese news and the outlook for the economy in that nation (see

China ETFs Tumble to Start 2014).

And unfortunately for copper investors, that outlook doesn’t appear

to be very robust as growth expectations are falling, and concerns

over debt are building. A turnaround will definitely be needed here

before gains can come back to copper, so until then, it may be best

to stay on the sidelines instead of jumping into any of the

aforementioned copper-focused ETFs.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

GLBL-X COPPER (COPX): ETF Research Reports

FT-ISE GLBL COP (CU): ETF Research Reports

IPATH-DJ-A COPR (JJC): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

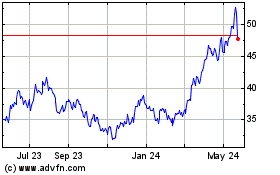

Global X Copper Miners (AMEX:COPX)

Historical Stock Chart

From Jan 2025 to Feb 2025

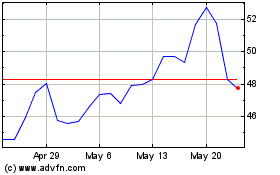

Global X Copper Miners (AMEX:COPX)

Historical Stock Chart

From Feb 2024 to Feb 2025