AmericaFirst Funds Trust Announces Changes to Board of Trustees

10 September 2024 - 11:00PM

AmericaFirst Funds, a subsidiary of DSS, Inc. (NYSE American: DSS),

today announced that effective August 9, 2024, David Friedensohn,

Monica Himes and Allan Siegel have resigned from their positions as

independent directors.

The Trust is pleased to announce the election of three new

independent directors by shareholder proxy vote: Dr. Prabir Datta,

Darryl Robinson and Mark Gronet. These individuals are seasoned

senior investment executives who bring a wealth of experience and

expertise in asset management, risk management, investment

operations and sales.

"We are appreciative for the service and commitment by our

outgoing directors," said Daniel Lew, CFA, Chief Investment Officer

of AmericaFirst Wealth Management, adviser to the Trust. "We are

excited to welcome our new directors, who will undoubtedly enhance

the Trust's expertise and provide valuable insights to support the

Trust's growth and success."

The new directors' biographies are as follows:

- Dr. Prabir Datta is an accomplished

senior executive within the asset management industry, with

significant experience in operations, risk management, and

regulatory compliance. Noteworthy experiences include his pivotal

role as the Chief Operating Officer at Constellation Capital

Management, a top-tier Boutique Credit Hedge Fund, where he was

instrumental in restructuring processes and ensuring regulatory

compliance. Dr. Datta has a PhD in Finance from University of

Illinois at Urbana-Champaign, an MBA in Finance from Indian

Institute of Management (IIM) Calcutta, India, and a BS in

Mechanical Engineering from Birla Institute of Technology and

Science (BITS), Pilani India.

- Darryl Robinson is a seasoned

professional with a remarkable career spanning the real estate

industry. Darryl is currently a Managing Principal at NewQuest

Crosswell with a proven track record as a commercial real estate

developer, disciplined investor and insightful operator. He is also

a partner with NewQuest Properties, a vertically integrated firm

managing a portfolio exceeding $2 billion in assets. Additionally,

Darryl is a co-founder and manager at C2R Capital Management that

engages in private real estate lending. He holds a degree in

Finance and Real Estate from the University of Alabama.

- Mark Gronet is a seasoned

professional whose career in the finance and business world is

marked by remarkable achievements and contributions. Notably, Mark

was a managing director and led institutional sales at Buckingham

Research, an established boutique Wall Street equity research and

trading firm and was highly successful in growing the research

sales business substantially. He also had an earlier career in

human resources where he rose to the position of President at

Robert Olivier & Associations, a human resource consulting

firm. Mark has a BS in Business Economics from the College of New

Jersey.

The Trust looks forward to benefiting from the new directors'

expertise and perspectives as it continues to navigate the evolving

investment landscape and deliver value to its shareholders.

About AmericaFirst Funds

AmericaFirst Funds is a mutual fund trust dedicated to providing

investors with access to a range of investment strategies that

encompass income, capital growth, and opportunistic approaches. Our

investment process encompasses top-down and bottom-up analysis,

analyzing the geopolitical and macroeconomic environment, monetary

and interest rate policy, fundamental and trend analysis,

quantitative and technical analysis. We provide in-depth weekly

investment outlooks and analysis for our clients and provide

accessibility for our clients to our key investment

professionals.

For more information, please

visit: www.americafirst.fund

About DSS, Inc.

DSS is a multinational company with a presence across a range of

dynamic market sectors, including Product Packaging, Biotechnology,

Commercial Lending, Securities and Investment Management,

Alternative Trading, and Alternative Energy. Leveraging strategic

acquisitions and asset development, DSS enhances shareholder value

through selective IPO spin-offs. Since 2019, under the guidance of

new leadership, DSS has laid a robust foundation for sustainable

growth, establishing a diverse portfolio of companies poised to

excel in multiple high-growth industries.

For more information on DSS visit https://www.dssworld.com

Investors should carefully consider the investment

objectives, risks, charges and expenses of AmericaFirst Funds. This

and other important information about our Funds is contained in the

prospectus, which can be obtained on this website, or by calling

1-877-217-8501. Read the prospectus carefully before

investing.

Mutual fund investing involves risk. Principal loss is

possible.

The AmericaFirst Fund’s are distributed by Arbor Court Capital,

LLC, Member FINRA/SIPC

Safe Harbor Disclosure

This press release contains forward-looking statements that are

made pursuant to the safe harbor provisions within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Such

forward-looking statements include, but are not limited to,

statements related to the Company's intended use of proceeds and

other statements that are not historical facts. Forward-looking

statements are based on management's current expectations and are

subject to risks and uncertainties that may cause actual results or

events to differ materially from those projected. These risks and

uncertainties, many of which are beyond our control, include: risks

relating to our growth strategy; our ability to obtain, perform

under and maintain financing and strategic agreements and

relationships; risks relating to the results of development

activities; our ability to attract, integrate and retain key

personnel; our need for substantial additional funds; patent and

intellectual property matters; competition; as well as other risks

described in our SEC filings, including, without limitation, our

reports on Forms 8-K, 10-K and 10-Q, all of which can be obtained

on the SEC website at www.sec.gov. Readers are cautioned not to

place undue reliance on the forward-looking statements, which speak

only as of the date on which they are made and reflect management's

current estimates, projections, expectations, and beliefs. We

expressly disclaim any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in our expectations or any

changes in events, conditions, or circumstances on which any such

statement is based, except as required by law.

Contact:DSS Inc. Investor RelationsIR@dssworld.com+1 (585)

565-2422

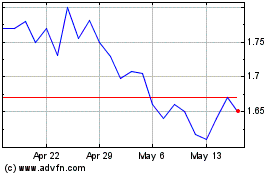

DSS (AMEX:DSS)

Historical Stock Chart

From Oct 2024 to Nov 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Nov 2023 to Nov 2024