Can These Emerging Market ETFs Continue to Outperform? - ETF News And Commentary

14 October 2013 - 11:01PM

Zacks

With taper talk and a focus on the U.S. market, many emerging

nations have struggled lately. Several were beaten down more than

10% (and remain depressed) in the past six months as many investors

abandoned these risky markets.

In fact, countries like India and Indonesia are still struggling

with some expecting more losses in these huge markets to close out

the year. However, the ride hasn’t been as bumpy across the

emerging Asia-Pacific space, as a few have managed to see solid

performances in the time frame (read 4 Unbeatable ETF Strategies

for Q4).

Generally speaking, the top performers have been Asian markets

that have decent GDP growth, low inflation levels, and are

reasonably developed. Markets that have a good current account

balance and robust forex reserves have also been well-insulated

from the general market woes, and could be better picks if the

markets get rocky once more.

For investors searching for two such markets, we have found them by

looking to both South Korea and Taiwan. These borderline developed

nations both have seen strong performances lately, and could be

well-positioned as each both have inflation rates below 1.5%, GDP

growth above 2% for 2013, and forex reserves above $300 billion

(read Emerging Market ETFs: How to Pick Winners).

How to Play

The options for South Korea and Taiwan aren’t that diverse from an

ETF perspective, though each have a huge iShares fund tracking

their market. This includes the

iShares MSCI South Korea

Capped ETF (EWY) and the

iShares MSCI Taiwan Index

Fund (EWT).

Both funds have more than $2.5 billion in assets and see solid

volume levels, so trading costs shouldn’t be too high for either

one. Plus, both have a huge focus on the technology sector and have

thoroughly beaten out broad emerging markets over the past six

months, posting performances of 7.8% (for EWT) and 11.7% (EWY) in

the time frame.

Given the relative strength of their economies, their recent

outperformance, and the solid sector focus, and these could be two

emerging market ETFs to watch as we enter the tail end of the year.

This is particularly true if more turmoil hits the developing

world, as these appear better positioned than most to deal with any

issues that might crop up (see Two Asia Pacific ETFs Avoiding the

Crash).

For more on these solid emerging market ETFs, watch our short video

on the subject below:

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-MS INDON (EIDO): ETF Research Reports

WISDMTR-IN EARN (EPI): ETF Research Reports

ISHARS-TAIWAN (EWT): ETF Research Reports

ISHARS-S KOREA (EWY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

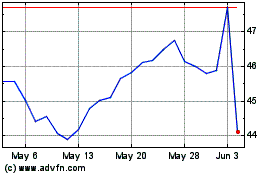

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Jan 2025 to Feb 2025

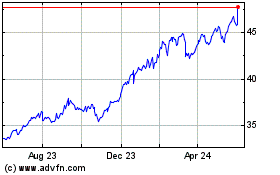

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Feb 2024 to Feb 2025