Most Popular Gold Mining ETF to Shift Its Index - ETF News And Commentary

11 September 2013 - 10:07PM

Zacks

Gold miners have had a terrible year so far in the wake of

tumbling gold prices. Although there was a brief period of gains in

July, and then more recently on geopolitical worries, the space

remains in a downward trend (Read: Gold ETF Slump Continues, Drags

Down Mining Stocks).

Gold miners: A cautious bet?

During the first seven months this year, gold miners were battling,

losing by a pretty wide margin of 40%. While gold miners had high

hopes for the long run of the QE, which could have favored the

situation, data and comments from members of the Fed suggest that

this might not be the case.

However, we have some good news too. Lately, trading in the segment

has been decidedly more bullish, leading many to believe that the

worst might be over for the segment (read: 3 Mining ETFs Finally on

the Upswing).

While many think that the yellow metal has bottomed out of the

commodity space, what lies ahead is still a surprise to many.

Analysts comment that the current market conditions will force the

industry to rebuild itself, though at a much tepid pace.

Yet even in this environment, the

Market Vectors Gold

Miners ETF (GDX) remains the most popular way for

investors to play the gold mining space in basket form. The product

is both quite liquid and has a huge asset base, so it is definitely

the preferred choice for most investors seeking to get in on the

segment (Read: Gold Mining ETF Investing 101)

NYSE to Modify Gold Miners Index

However, investors should note that the product will be undergoing

some major changes, thanks to a shift in the holdings for its

underlying index, the NYSE Arca Gold Miners Index.

The index which has major exposure in North America, is going to

add many non-U.S. listed stocks and is not going to allocate to

small companies any more. In fact, companies which have a

market-cap of less than $750 million will exit the benchmark

enitrely.

Moreover, the index is also going to include more American

Depository Receipts (ADRs) and Global Depository Receipt (GDRs).

The change is expected to be effective from Sep 20 this year and

will give more global exposure to the holders of GDX.

More About GDX

Launched in May 2006, GDX is easily one of the most popular and

liquid product. It tracks the NYSE Arca Gold Miners Index and puts

focus on large cap gold miners. The fund charge investors 52bps in

fees annually and has a good average daily trading volume of 26.8

million shares a day (Find more Materials ETFs here).

The product holds 30 securities in its basket and puts a major

focus in North America. The fund is more concentrated in its top 10

holdings, which jointly contribute a share of about 67%. Meanwhile,

the product is quite popular as it has a huge asset base of $5.6

billion.

Bottom Line

This is an important change for this ultra-popular product, and it

will likely make comparisons between performance before and after

the switch date irrelevant. However, it will help to keep the

holdings of this ETF separate from those in junior gold mining

products like GDXJ, and likely even after the switch, GDX will be

the most popular, and arguably best, way for investors to achieve

broad exposure to the space in fund form.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

BARRICK GOLD CP (ABX): Free Stock Analysis Report

MKT VEC-GOLD MI (GDX): ETF Research Reports

MKT VEC-JR GOLD (GDXJ): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

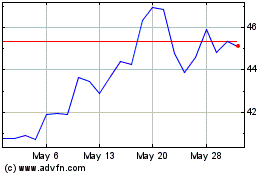

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

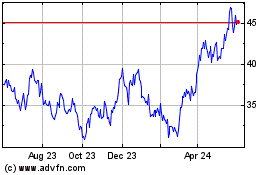

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Nov 2023 to Nov 2024