Comstock Inc. (NYSE: LODE) (“Comstock,” “our,” and the “Company”)

today announced its third quarter 2024 results, certain business

and investment updates and an updated business outlook, with

significant progress from each business, corporate and collectively

across the system.

“Our fuels and metals businesses have commercial

validation of their plans,” stated Corrado De Gasperis, Comstock’s

Executive Chairman and Chief Executive Officer. “Our business teams

are dedicated, and our commercialization efforts have gained

tremendous traction. We are 100% focused on execution, across the

platform, for delivering the technical breakthroughs and

operational developments that will drive exponential growth over

the coming years.”

Selected Segment Highlights for the Third Quarter of

2024

Comstock Fuels

- Executed international engineering, licensing and equity

agreements for three industry scale fuel hubs;

- Delivered customer samples of commercially available

Hydrodeoxygenated Bioleum Oil (“HBO”);

- Validated industry-leading higher yields of 125 Gasoline Gallon

Equivalents (GGEs) per ton of feedstock;

- Identified carbon capture and utilization opportunity for

further increasing yields by 15-20 GGEs;

- Completed preliminary engineering for our demonstration scale,

lignocellulosic production facility;

- Expanded research and development activities targeting further

cost and capital reductions;

- Finalized project plans and activities aggressively designed

for achieving petroleum cost parity; and

- Executed an exclusive license and cooperative research and

development agreement with the DoE’s National Renewable Energy

Laboratory (“NREL”) for breakthrough lignocellulosic

conversions.

“Our first three industry scale projects and

license agreements with South Asia Carbon Limited (“SACL”) are

expected to deliver foundational engineering fees and ongoing

royalty-based economics plus equity stakes that are expected to

establish our global leadership in low carbon fuel solutions,” said

De Gasperis. “Our breakthrough yields feature a highly

differentiated level of performance. We have completed the

preliminary engineering of our own, commercial demonstration scale

facility for producing low carbon fuels like Sustainable Aviation

Fuels (“SAF”).”

David Winsness, President of Comstock Fuels,

added, “Our existing commercial process unlocks and converts

wasted, unused, and purpose grown woody biomass into renewable

fuels at extraordinary yields and carbon intensities, essentially

creating an endless oilwell hidden in plain sight. Our planned

commercial facilities have been designed to tap into that oilwell

to produce an array of intermediates and fuels. However, further

developing and integrating the NREL and MIT technologies into our

process could give us the additional ability to maximize aromatic

content and quality specifically for high value use in addressing

the recent global surge in demand for SAF.”

Comstock Metals

- Recorded first revenues from the sale of recycled aluminum, and

commenced regular outbound shipments;

- Announced contracts with multiple new customers for the

decommissioning and disposal of solar panels;

- Demonstrated 100% recovery of all glass, metal, and mineral

materials, ensuring a zero-landfill solution;

- Secured county permits for the first industry-scale expansion,

including a waste-panel storage solution;

- Advanced work on state operating permits necessary for

operating the first industry-scale expansion;

- Received approval for operating three shifts and expanded the

dedicated team to 13 full time employees;

- Advanced agreements on long term supply arrangements to

continue receiving solar panels; and

- Advanced agreements on offtake arrangements for all segments of

recovered materials.

“Our combined Metals revenues, including

deferred revenues, nearly tripled from last quarter to over

$200,000, and we expect this growth rate to continue in the fourth

quarter, especially as both panel decommissioning and shipments of

recycled materials increase,” said De Gasperis. “This increase

reflects our team’s success in capturing more of these end-of-life

business opportunities, including decommissioning services that

also feeds our recycling panel flow.”

Comstock Mining

- Updated our internal preliminary mine and reclamation plan for

the Dayton Mine plan (“Dayton”);

- Increased the magnitude of Dayton’s estimated economic

mineralized material and planned free cash flows;

- Assessed productive post-mining land uses and identified

prerequisites for post-mining development; and

- Continued assessment and development on the profitable

recoverability of recycled silver from solar panels.

“The combination of rapidly rising industrial

silver demand and ongoing geopolitical concerns, compounded by

decades of questionable monetary policy, creates an unprecedented

setup for gold and silver prices over the next several years. Our

Nevada mining assets, including the historic Comstock and Silver

City lodes, offer a tremendous opportunity for nearer-term

production as we advance our efforts to activate these plans,” said

De Gasperis.

Corporate

Comstock’s wholly owned subsidiary, Comstock IP

Holdings LLC (“Comstock Innovations”), recently executed an

Exclusive License Agreement (“ELA”) and a Cooperative Research and

Development Agreement (“CRADA”) with the Alliance for Sustainable

Energy LLC (“Alliance”), the managing and operating contractor of

the U.S. Department of Energy’s (“DOE”) National Renewable Energy

Laboratory (“NREL”), involving technologies developed by NREL and

the Massachusetts Institute of Technology (“MIT”) for conversion of

lignocellulosic biomass into aromatic sustainable aviation fuel

(“SAF”). Comstock Innovations is focused on continuously improving

the proven performance and operations of Comstock Fuel’s commercial

refining solutions, including increasing feedstock diversity, bulk

conversion yields, and product quality for use in SAF while

decreasing total variable and capital costs.

“Our existing commercial processes are already

leading the acceleration of systemic decarbonization across

transportation and mobility, but we believe that we can accelerate

the breadth and rate of global market adoption with continued

innovation to produce the world’s first 100% renewable SAF at costs

that approach parity with fossil fuels. Our combined Comstock and

NREL teams believe that feat can be achievable by advancing and

integrating our combined technologies,” stated Mr. De Gasperis.

“Higher energy, simpler processes, lower all-in sustaining

costs.”

Comstock also recently executed a binding

agreement with Deep Interstellar Research LLC (“DIR”), and Quantum

Generative Materials LLC (“GenMat”) wherein Comstock will

effectively acquire substantially all of the equity in GenMat’s

artificial intelligence materials discovery platform, materials

synthesis, and related assets, business, and substantially all of

the related material science development team. Concurrently, as

part of the acquisition of GenMat, Mr. Deep Prasad, GenMat’s

founder, through a new venture called StarVasa, will be receiving

GenMat’s consolidated low earth orbit (“LEO”) satellite, mission

control software, related LEO assets, and the space-based

technology team.

As a result, Comstock will assume control of and

continue the development and commercialization of its breakthrough

physics-based artificial intelligence products and services to

discover new materials and other technologies.

“Our interest in artificial intelligence (“AI”)

was and remains grounded in the critical application of artificial

intelligence for materials and mineral discovery, as applied to

breakthrough energy applications and other mature industries with

large addressable markets,” said De Gasperis. “Material

science-based AI is even more critical today, as rapidly evolving

AI platforms have begun to accelerate the pace of global innovation

and redefine industries. Frankly, anyone that is not integrating AI

into their systems will likely either be disrupted or

replaced.”

Comstock also recently announced the execution

of an indicative term sheet for $325 million ($315 million, net of

transaction fees) in funding through SBC Commerce LLC (“SBCC”), a

U.S. based, globally positioned, private equity group, subject to

final due diligence and any applicable regulatory approvals,

including $200 million into Comstock Fuels Corporation; $22 million

into Comstock Metals; $50 million into a Comstock Mining segment;

and, $50 million for the sales of the Company’s real estate and

water rights in Silver Springs, NV. This significant series of

transactions, representing a combination of direct investments and

asset sales, recognizes significant valuations for the Company’s

three businesses and secures timely and essential growth capital to

commercialize fuels, metals and mining.

“We have been diligently advancing our efforts

with SBCC, including due diligence, site visits, structuring,

etc.,” stated Mr. De Gasperis. “We are actively working to advance

each of these tranches while our businesses continue innovating,

advancing, commercializing and expanding. The direct subsidiary

investments represent the amount of capital that enables each of

our three businesses to accelerate commercialization and achieve

ongoing profitability.”

Consolidated Financial Highlights

For the nine-month period ending September 30, 2024, as compared

to the comparable prior period, we:

- Increased revenues to $1.4 million, from $0.8 million in the

comparable 2023 period;

- Decreased selling, general and administrative expenses to $9.5

million from $10.0 million;

- Increased research and development expenses to $4.9 million

from $4.4 million;

- Impaired intangible assets of $8.7 million, primarily

associated with LINICO developed technologies;

- Recognized a loss attributable to Comstock of $30.5 million, or

a net loss per share of $0.20;

- Decreased total assets to $103.7 million, down from $106.5

million at December 31, 2023;

- Increased total liabilities to $35.6 million, up from $28.2

million at December 31, 2023;

- Increased total debt to $11.2 million, up from $9.9 million at

December 31, 2023; and

- Outstanding common shares were 206,634,788 and 209,251,865 at

September 30, 2024 and October 18, 2024, respectively.

OUTLOOK

Comstock Fuels

Comstock Fuels objectives for the remainder of 2024 include:

- Execute multiple, revenue generating commercial agreements for

industry-scale joint developments;

- Advance and expand our innovation network for even higher

yields and lower costs; and

- Expand our integrated bio-intermediate production system,

including cellulosic ethanol and HBO.

Our commercialization plans also includes

multiple, international joint development projects, with each joint

development project, like SACL, with the potential for generating

in millions of dollars of technical services and engineering

revenues and license agreements for additional production

facilities that generate royalty revenues.

Additionally, advancing the $200 million SBCC

investment, in debt and/or equity, enables our first commercial

demonstration facility which is designed to be profitable and to

confirm the scale of multiple industry facilities. Then, the

Company plans to build its own, three U.S. based industrial scale

facilities. These are designed for inputs of up to one million tons

per year of woody biomass feedstock and can produce up to 125

million GGE of advanced biofuels, including sustainable aviation

fuels. Comstock is securing offtake and feedstock agreements for

the U.S. based plants.

Comstock Metals

Comstock Metals objectives for the remainder of

2024 include:

- Commence three-shift production from the demonstration scale

production facility;

- Confirm the ability to fully and cleanly reprocess and reuse

all residual materials;

- Advance the technology readiness for broader material

recycling, prioritizing photovoltaics to TRL 7;

- Expand our existing revenue generating decommissioning, supply

and offtake commitments;

- Submit permit applications for our first “industrial-scale”

facility;

- Complete the site selection for the next two “industrial-scale”

facilities and commencing permitting; and

- Finalize plans for expansion beyond the southwest region in the

medium term.

Comstock Metals is operating its demonstration

scale production facility in Silver Springs, NV, and has also

secured the initial county level permits for industry-scale

operations and storage and is actively engaged in garnering

expanded revenue generating supply. Additionally, our closing on

the $22 million investment, in debt and/or equity, accelerates the

deployment of the next two commercial demonstration

facilities. Comstock Metals has also expanded its business

into decommissioning services both profitable and a feeder for our

recycling business. Comstock Metals has also established markets

for the sale of all its residual materials including sales of

aluminum, glass and silver-rich fines.

Comstock Mining

Comstock Mining’s objectives for the remainder

of 2024 include:

- Receive cash proceeds of more than $2 million from mineral

leases leveraging the Northern District claims;

- Commercialize mineral development agreements that enable

expansion of the Central District resources;

- Advance the engineering of impactful social and economic

benefits from the southern district claims; and

- Establish a long-term framework for reclamation and post-mining

development of the Comstock district.

The Company’s 2024 efforts apply economic

analysis to our existing gold and silver resources progressing

toward full economic feasibility for the southern part of the

district and the ultimate development of full mine and reclamation

plans and post productive land and community development plans.

Additionally, closing on the SBCC $50 million investment, in debt

and/or equity, accelerates the development of the Dayton Resource

Area mine plan, broader resource expansions for the southern

district claims and the engineering of the post productive real

estate and community development plans.

CONFERENCE CALL DETAILS

Comstock will host a conference call today,

Tuesday, October 22, 2024, at 4:30pm ET. We invite all investors

and other interested parties to register for the webinar at the

link below.

Date: Tuesday, October 22,

2024

Time: 4:30pm ET

Register: Webinar

Registration

HAVE QUESTIONS? There will be an allotted time

following the results presentation for a Q&A session.

Unaddressed questions will be reviewed by management and responded

to accordingly. You may submit your question(s) beforehand in the

registration form (linked above) or by email at

ir@comstockinc.com.

About Comstock

Comstock Inc. (NYSE: LODE) commercializes

innovative technologies that contribute to global decarbonization

by efficiently converting under-utilized natural resources,

primarily, woody biomass into net zero renewable fuels, end-of-life

metal extraction, and generative AI-enabled advanced materials

synthesis and mineral discovery. To learn more, please visit

www.comstock.inc.

Comstock Social Media

Policy

Comstock Inc. has used, and intends to continue

using, its investor relations link and main website at

www.comstock.inc in addition to its Twitter, LinkedIn and YouTube

accounts, as means of disclosing material non-public information

and for complying with its disclosure obligations under Regulation

FD.

CONTACTS:

For investor inquiries: RB Milestone Group

LLCTel (203) 487-2759ir@comstockinc.com

For media inquiries or questions: Comstock

Inc., Tracy SavilleTel (775)

847-7573questions@comstockinc.com

Forward-Looking Statements

This press release and any related calls or

discussions may include forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements, other than statements of historical facts, are

forward-looking statements. The words “believe,” “expect,”

“anticipate,” “estimate,” “project,” “plan,” “should,” “intend,”

“may,” “will,” “would,” “potential” and similar expressions

identify forward-looking statements but are not the exclusive means

of doing so. Forward-looking statements include statements about

matters such as: future market conditions; future explorations or

acquisitions; future changes in our research, development and

exploration activities; future financial, natural, and social

gains; future prices and sales of, and demand for, our products and

services; land entitlements and uses; permits; production capacity

and operations; operating and overhead costs; future capital

expenditures and their impact on us; operational and management

changes (including changes in the Board of Directors); changes in

business strategies, planning and tactics; future employment and

contributions of personnel, including consultants; future land and

asset sales; investments, acquisitions, joint ventures, strategic

alliances, business combinations, operational, tax, financial and

restructuring initiatives, including the nature, timing and

accounting for restructuring charges, derivative assets and

liabilities and the impact thereof; contingencies; litigation,

administrative or arbitration proceedings; environmental compliance

and changes in the regulatory environment; offerings, limitations

on sales or offering of equity or debt securities, including asset

sales and associated costs; business opportunities, growth rates,

future working capital, needs, revenues, variable costs, throughput

rates, operating expenses, debt levels, cash flows, margins, taxes

and earnings. These statements are based on assumptions and

assessments made by our management in light of their experience and

their perception of historical and current trends, current

conditions, possible future developments and other factors they

believe to be appropriate. Forward-looking statements are not

guarantees, representations or warranties and are subject to risks

and uncertainties, many of which are unforeseeable and beyond our

control and could cause actual results, developments, and business

decisions to differ materially from those contemplated by such

forward-looking statements. Some of those risks and uncertainties

include the risk factors set forth in our filings with the SEC and

the following: adverse effects of climate changes or natural

disasters; adverse effects of global or regional pandemic disease

spread or other crises; global economic and capital market

uncertainties; the speculative nature of gold or mineral

exploration, and lithium, nickel and cobalt recycling, including

risks of diminishing quantities or grades of qualified resources;

operational or technical difficulties in connection with

exploration, metal recycling, processing or mining activities;

costs, hazards and uncertainties associated with precious and other

metal based activities, including environmentally friendly and

economically enhancing clean mining and processing technologies,

precious metal exploration, resource development, economic

feasibility assessment and cash generating mineral production;

costs, hazards and uncertainties associated with metal recycling,

processing or mining activities; contests over our title to

properties; potential dilution to our stockholders from our stock

issuances, recapitalization and balance sheet restructuring

activities; potential inability to comply with applicable

government regulations or law; adoption of or changes in

legislation or regulations adversely affecting our businesses;

permitting constraints or delays; challenges to, or potential

inability to, achieve the benefits of business opportunities that

may be presented to, or pursued by, us, including those involving

battery technology and efficacy, quantum computing and generative

artificial intelligence supported advanced materials development,

development of cellulosic technology in bio-fuels and related

material production; commercialization of cellulosic technology in

bio-fuels and generative artificial intelligence development

services; ability to successfully identify, finance, complete and

integrate acquisitions, joint ventures, strategic alliances,

business combinations, asset sales, and investments that we may be

party to in the future; changes in the United States or other

monetary or fiscal policies or regulations; interruptions in our

production capabilities due to capital constraints; equipment

failures; fluctuation of prices for gold or certain other

commodities (such as silver, zinc, lithium, nickel, cobalt,

cyanide, water, diesel, gasoline and alternative fuels and

electricity); changes in generally accepted accounting principles;

adverse effects of war, mass shooting, terrorism and geopolitical

events; potential inability to implement our business strategies;

potential inability to grow revenues; potential inability to

attract and retain key personnel; interruptions in delivery of

critical supplies, equipment and raw materials due to credit or

other limitations imposed by vendors; assertion of claims, lawsuits

and proceedings against us; potential inability to satisfy debt and

lease obligations; potential inability to maintain an effective

system of internal controls over financial reporting; potential

inability or failure to timely file periodic reports with the

Securities and Exchange Commission; potential inability to list our

securities on any securities exchange or market or maintain the

listing of our securities; and work stoppages or other labor

difficulties. Occurrence of such events or circumstances could have

a material adverse effect on our business, financial condition,

results of operations or cash flows, or the market price of our

securities. All subsequent written and oral forward-looking

statements by or attributable to us or persons acting on our behalf

are expressly qualified in their entirety by these factors. Except

as may be required by securities or other law, we undertake no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise. Neither this press release nor any related calls or

discussions constitutes an offer to sell, the solicitation of an

offer to buy or a recommendation with respect to any securities of

the Company, the fund, or any other issuer.

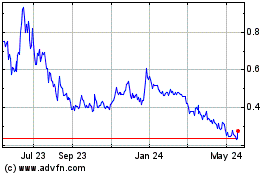

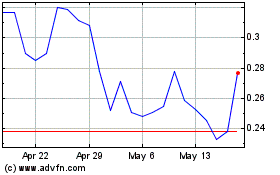

Comstock (AMEX:LODE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Comstock (AMEX:LODE)

Historical Stock Chart

From Dec 2023 to Dec 2024