ETF Trading Report: Real Estate, Europe ETFs in Focus - ETF News And Commentary

07 August 2012 - 2:43AM

Zacks

American stocks began the week on a winning note, although many

of the gains evaporated on a light volume day in the final hour of

the session. Thanks to this trend, the Dow and S&P 500 finished

the day higher by just 0.2% each, while the Nasdaq held up a little

better, adding 0.7% to start the week.

In terms of sector performances, no one segment stood out,

although big banks, tech, and smaller oil firms all were among the

leaders. On the downside, big pharma, staples, and utilities were

seen leading the way, while some of the smaller financial firms

were also in the red during the first session of the week.

Still, the dollar was pretty much flat against many of the

world’s major currencies while European bond rates declined across

the board in both the safe haven and risky economies in the region.

Meanwhile, commodities were surprisingly resilient on the day, as

crude oil added about 0.7% while gold also rose, but just by $4/oz.

in Monday trading (read Beyond Corn: Three Surging Commodity

ETFs).

In the world of ETFs, volume was shockingly light for many of

the top products, as SPY, GLD, and QQQ, all saw volume less than

half of their usual averages. However, volume wasn’t that light

across the entire segment, as a few European funds, currency ETFs,

and bond products traded more than normal in Monday’s session.

One fund that saw a great deal of added volume was the

iShares S&P Developed Markets ex U.S Property Index

Fund (WPS). This product usually does just over 19,600

shares in volume but saw a spike to over 330,000 shares in Monday

trading (See Real Estate ETFs: Unexpected Safe Haven).

However, investors should note that heavy block trading at the

beginning of the session made up the vast majority of this daily

volume, leaving just a smattering of shares to change hands over

the next several hours. Still, the fund didn’t really move that

much higher on the volume increase, adding 0.5% on the day. While

this was enough to beat out others in the space, it did help propel

WPS even closer to its 52 week high.

Another ETF that saw a great deal of interest was the

iShares MSCI EMU Index Fund (EZU). This product

usually has volume just over 465,000 shares but saw more than 2.8

million shares move hands during this session (read Play Europe

with this ETF Pair Trade).

This volume increase as well as the solid performance out of the

Spanish market undoubtedly were some of the main drivers for EZU’s

1.3% gain on the day. It also didn’t hurt that bond yields fell

below 6% for Italy while they slide under the 6.75% mark for Spain,

suggesting less worries over these troubled countries and more

demand for equities, at least for now.

(see more in the Zacks ETF Center)

ISHARS-EMU IDX (EZU): ETF Research Reports

ISHARS-SP WRLD (WPS): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

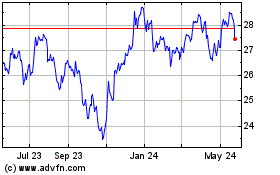

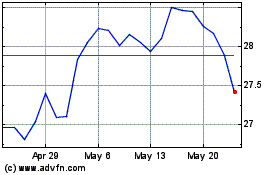

iShares International De... (AMEX:WPS)

Historical Stock Chart

From Dec 2024 to Jan 2025

iShares International De... (AMEX:WPS)

Historical Stock Chart

From Jan 2024 to Jan 2025