TIDMAQX

RNS Number : 1316N

Aquis Exchange PLC

21 September 2023

21 September 2023

Aquis Exchange PLC

("Aquis", the "Company" or the "Group")

Interim results for the six months ended 30 June 2023

Continued momentum with increased revenue across all

divisions

Aquis Exchange PLC (AQX.L), the creator and facilitator of

next-generation financial markets, is pleased to announce its

unaudited results for the six months ended 30 June 2023.

Highlights:

-- Net revenue up 17% to GBP9.7m (H122: GBP8.3m)

-- EBITDA up 26% to GBP1.7m (H122: GBP1.3m)

-- Profit before tax up 64% to GBP1.1m (H122: GBP0.7m)

-- Basic earnings per share 3.8p (H122: 2.5p)

-- Cash and cash equivalents of GBP13.9m (H122: GBP13.3m)

-- All four divisions were profitable in the period:

o Aquis Markets - Further diversification of the product suite, with addition of Dark to Lit

Sweep

o Aquis Technologies - Contract pipeline continues to develop in line with expectations

o Aquis Data - Revenues up 34%; significant progress towards an EU consolidated tape

o Aquis Stock Exchange - Welcomed five new listings despite tough market conditions and low

admissions throughout the market

Post-period highlights:

-- Change to Aquis' proprietary trading rule announced, further enhancing range of execution

options available to members

-- Investment in OptimX Markets adds additional connectivity to Aquis Matching Pool (AMP) and

provides clients with ability to cross large blocks

Aquis CEO, Alasdair Haynes said:

"2023 so far has been a year of continued momentum for Aquis,

with revenues continuing to increase across all divisions.

"Following the successful integration of the Aquis Matching Pool

in 2022, Aquis Markets has seen increased revenues. We have also

worked to further diversify the products that will be made

available to members, adding block trading via OptimX Markets and

changing our proprietary trading rule to give members greater

execution choice along with best execution outcomes. These changes

are laying the foundations for future growth in market share over

the medium-term.

"Our technology contract pipeline has continued to develop as

expected, with a renewal and an extension over the period

demonstrating the long-term nature of these relationships.

"Within Aquis Data, we were pleased to see significant progress

towards an EU consolidated tape during the period, which is likely

to disproportionately benefit Aquis.

"And finally despite challenging market conditions, we remain

positive on the long-term potential of the Aquis Stock Exchange ,

which remains profitable.

"With economic uncertainty continuing to affect all market

participants, we are pleased to be delivering continued growth,

strategic progress and value for shareholders. We have had a

positive start to 2023, with continued revenue growth across all

divisions and trading remains in line with Board expectations for

the full year."

An overview of the results from Alasdair Haynes is available to

view on this link.

The Group will be hosting webinars for analysts and retail

investors today at 9.30 and 16.00 respectively.

If you would like to register for the analyst webinar, please

contact aquis@almapr.co.uk . Investors who would like to attend the

retail investor webinar can sign up to Investor Meet Company for

free and add themselves to the meeting via

https://www.investormeetcompany.com/aquis-exchange-plc/register-investor

. Investors who have already registered will be automatically

invited.

Enquiries:

Aquis Exchange PLC Tel: +44 (0)20 3597

6321

Alasdair Haynes, CEO

Richard Fisher, CFO Tel: +44 (0)20 3597

Adele Gilbert, Head of Marketing 6329

Investec Bank plc (Nominated Adviser and Tel: +44 (0)20 7597

Broker) 4000

David Anderson

Bruce Garrow

Lydia Zychowska

St John Hunter

Canaccord Genuity Limited (Joint Broker) Tel: +44 (0) 20 7523

Emma Gabriel 8000

George Grainger

VSA Capital Limited (AQSE Corporate Adviser)

Andrew Raca Tel: +44(0)20 3005

5000

Alma PR (Financial PR Adviser) Tel: +44 (0)20 3405

0209

Josh Royston aquis@almapr.co.uk

Rebecca Sanders-Hewett

Kieran Breheny

Notes to editors:

About Aquis Exchange PLC

Aquis Exchange PLC ("Aquis") is a creator and facilitator of

next-generation financial markets, through the provision of

accessible, simple and efficient stock exchanges, trading venues

and technology .

Aquis consists of four divisions:

Aquis Markets operates lit and dark order books, covering 16

European markets. For its lit books, Aquis uses a subscription

pricing model which works by charging users according to the

message traffic they generate, rather than a percentage of the

value of each stock that they trade.

Aquis Technologies is the software and technology division of

Aquis. It focuses on building better markets via the creation and

licensing of cutting-edge, cost-effective exchange infrastructure

technology and services, including matching engine and trade

surveillance solutions.

Aquis Stock Exchange (AQSE) is a stock market providing primary

and secondary markets for equity and debt products. It is

authorised as a Recognised Investment Exchange, which allows it to

operate a regulated listings venue. The AQSE Growth Market is

divided into two segments 'Access' and 'Apex' ; the Access market

focuses on earlier stage growth companies, while Apex is the

intended market for larger, more established businesses.

Aquis Data generates revenue from the sale of data derived from

Aquis Markets and Aquis Stock Exchange to non-Member market

participants.

Aquis is authorised and regulated by the UK Financial Conduct

Authority and France's Autorité de contrôle prudentiel et de

résolution and L'Autorité des marchés f inanciers to operate

Multilateral Trading Facility businesses in the UK &

Switzerland markets and in EU27 markets respectively. Aquis

Exchange PLC is quoted on the Aquis Stock Exchange and on the AIM

Market (AIM) of the LSE. For more information, please go to

www.aquis.eu .

Interim Report

The six months to 30 June 2023 has been another strong period of

profitable growth as revenues increase across all divisions , as we

build on our achievements in 2022. Alongside this, we have

continued to make good operational progress in all areas to expand

our market opportunity. Achieving this despite challenging economic

circumstances reflects our strong operational resilience and the

continued demand for our offering across all three divisions.

Operational Review

We have continued our planned investment in key business areas

such as growing our technology development team. These investments

enable us to maintain our internally used Aquis technology set and

support the ongoing growth in our technology licencing

business.

The performance of Aquis Markets has progressed well. Exchange

revenue increased by GBP0.8m (14%) from GBP5.1m to GBP5.9m. Since

Aquis Matching Pool (AMP) was launched in 2022, trading volumes

have increased with a closing 0.76% market share by 30 June 2023

(0.84% at 30 December 2022) demonstrating the resilience of the

Aquis platform despite difficult market conditions.

The Aquis Technologies contract pipeline has developed in line

with expectations, and multiple renewals and/or extensions over the

period continues to demonstrate customer loyalty and stickiness of

revenue. The average maturity of a technology contract has

increased further to 3.4 years.

On Aquis Stock Exchange, issuer revenue increased by 29%,

reaching GBP0.8m as the number of admissions continues to grow

despite a generally challenging economic climate for raising

finance and a reduction in new issues. There are currently 104

securities on AQSE.

Aquis Markets

Continued revenue growth in the core business; ongoing success

of AMP despite challenging market conditions; foundations laid for

future market share gains through additional products and

innovative rule change

Aquis Markets is the Group's pan-European secondary trading

equities market. It comprises the UK MTF (AQXE) and the French MTF

serving EU markets (AQEU). Aquis Markets currently offers over

2,100 stocks and ETFs across 16 European markets. A significant

proportion of Markets activity is now being executed on AQEU, the

Group's French MTF serving EU markets.

Average market share in 1H23 was 5.1% (5.0% 1H22). Market

conditions remain challenging with lower lit market volumes across

the board, but in the period Aquis has continued to grow its

product offering with the introduction of our D ark to Lit Order S

weep functionality and also seen strong growth in our Auction on

Demand (AoD) product.

Aquis Matching Pool: Following the acquisition of the business

assets comprising the UBS MTF, Aquis has seen pleasing levels of

activity with the number of members and levels of trading

experienced to date growing from those seen at acquisition, with

Management confident of future opportunities to grow.

Post-period end, Aquis Markets announced a change to the

proprietary trading rule on its UK and EU trading platforms. In

response to member demand, the rule change will allow liquidity

providers the option to choose if they wish to interact with

aggressive non-client proprietary trading or not; providing members

with greater choice and immediacy of execution. We expect this to

positively contribute to our growth in market share over the medium

term.

Aquis Technologies

Progress made on a number of projects with continuing revenues

from existing relationships

Aquis licenses its leading exchange-related technology through

its Aquis Technologies division. Aquis Technologies creates and

licenses technology for high volume, low latency trading platforms,

complex connectivity solutions and real-time trade monitoring and

surveillance systems for banks, brokers, investment firms and

exchanges.

Aquis recognises license revenue on completion of project

delivery in accordance with IFRS accounting standards , which can

lead to lumpy revenue recognition, period on period. Despite the

financial reporting requirements under revenue recognition

standards, these contracts provide consistent long-term cash

inflows for the business.

During 1H23 , significant progress was made on several projects,

namely where regulatory work had been completed on behalf of one

customer and additional licences were provided to another existing

customer. The work undertaken by the technologies team will pave

the way for further offerings in the future. As a result, net

revenues in the technology division have remained steady at GBP1.1m

in 1H23 (GBP1.1m in 1H22).

In Q1 2023 Aquis Equinox, the world's first 24/7, no downtime,

matching engine was launched, and the division continues to make

exciting progress in its cloud services offering which will not

only lead to future synergies within the Group's trading platforms,

but also for new and existing technology licencing customers.

Aquis Technologies currently has seven contracts, on which five

have recognised revenue. Management expects that revenue will be

recognised on one of the two remaining contracts in H2 2023.

Aquis Data

Aquis generates revenue from the sale of data derived from Aquis

Markets (AQXE & AQEU) and Aquis Stock Exchange to non-Member

market participants. The total number of market data customers by

30 June 2023 was 85.

Revenue from market data vendors increased significantly by

GBP0.5m (34%) to GBP1.8m for the six-month period compared to the

2022 equivalent, with continued growth in both terminal use and

non-display licences across the period.

The creation of a consolidated tape in both the UK and EU

presents opportunity for future revenue. There was progress made on

the EU consolidated tape during the period, with administrative

process to follow. The advent of an equities consolidated tape in

either jurisdiction would disproportionately benefit Aquis.

Aquis Stock Exchange (AQSE)

Momentum building despite wider slowdown in market activity

Aquis Stock Exchange is a modern market for modern businesses,

bringing positive disruption and competition to the listed SME

sector. As one of the only two existing options for growing SMEs

looking to IPO in the UK, Aquis' vision is for Aquis Stock Exchange

to become the home for quality growth businesses, applying core

Aquis values such as transparency and innovation.

Five admissions were completed during 1H23 (six at our principal

competitor) compared to 12 during 1H22. This was reflective of a

general slowdown in IPO activity across the market due to

challenging economic conditions.

All Aquis Stock Exchange IPOs were well supported and there is a

very strong pipeline of high growth and 'new economy'

businesses.

Having achieved profitability ahead of forecasts in 2022, it is

good to see the resilience of earnings with profitability

maintained despite challenging IPO market conditions.

Financial Review

Net revenue increased 17% to GBP9.7m (1H22: GBP8.3m) and the

EBITDA profit for the half year was GBP1.7m, a 26% increase on the

EBITDA profit of GBP1.4m generated in 1H22. This EBITDA profit and

the profit before tax of GBP1.1m includes GBP0.3m of income

recognised from an impairment credit per IFRS 9 consistent with the

1H22 impairment credit.

Divisional revenue:

6 months to 6 months to

June 2023 (GBP'000s) June 2022 (GBP'000s)

---------------------- ----------------------

Markets 5,869 5,112

Technologies 1,132 1,087

Data 1,840 1,376

Aquis Stock Exchange 832 699

---------------------- ----------------------

9,673 8,274

---------------------- ----------------------

EBITDA has improved with revenue growth ahead of the controlled

increase in costs during 1H 2023 and the back end of last year as

the Group continued to invest in personnel and technological

resources. The Group will continue to invest in the future to

maintain the business's growth momentum.

Operating costs have increased by 15% to GBP8.0m (H1 2022:

GBP6.9m) reflecting primarily increased headcount in the period as

well as inflation on both staff cost and data centre costs and

increased data costs. Aquis continues to seek and be able to

recruit top talent. A focus continues to be recruitment in the

development team, where a broadly stable proportion of costs is

capitalised and then amortised over three years reflecting the

ongoing value derived from these activity sets. Physical hardware

acquired is capitalised and depreciated over a three year useful

economic life. Other costs are recognised as operating in nature

and reflected in the P&L as incurred.

The Group continues to maintain a strong balance sheet and cash

equivalents at 30 June 2023 were GBP13.9m (30 June 2022: GBP13.3m

). The Group continues to generate cash above operational

requirement which has allowed the ongoing transfer of funds to the

Group Trusts which have purchased shares in support of the Group

share schemes.

Summary and Outlook

2023 so far has been a year of continued momentum for Aquis,

with revenues continuing to increase across all divisions.

Following the successful integration of the Aquis Matching Pool

in 2022, Aquis Markets has seen increased revenues. We have also

worked to further diversify the products that will be made

available to members, adding block trading via OptimX Markets and

changing our proprietary trading rule to give members greater

execution choice along with best execution outcomes. These changes

are laying the foundations for future growth in market share over

the medium-term.

Our technology contract pipeline has continued to develop as

expected, with a renewal and an extension over the period

demonstrating the long-term nature of these relationships.

Within Aquis Data, we were pleased to see here was significant

progress towards an EU consolidated tape during the period, which

is likely to disproportionately benefit Aquis.

And finally, despite challenging market conditions, we remain

positive on the long-term potential of the Aquis Stock Exchange ,

which remains profitable.

With economic uncertainty continuing to affect all market

participants, we are pleased to be delivering continued growth,

strategic progress and value for shareholders. We have had a

positive start to 2023, with continued revenue growth across all

divisions and trading remains in line with Board expectations for

the full year.

AQUIS EXCHANGE PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE

SIX MONTHSED 30 JUNE 2023

6 months ended

30/06/2023 Year ended 31/12/2022 6 months ended 30/06/2022

Note GBP'000 GBP'000 GBP'000

Income Statement

Revenue 3 9,342 19,930 7,849

Impairment

credit/(charge) on

contract assets 4 331 132 425

Impairment credit /

(charge) on trade and

other receivables 4 - (13) 26

Administrative expenses (7,976) (14,239) (6,956)

Operating profit 1,697 5,810 1,344

Investment income 5 169 29 4

Depreciation and

amortisation 7,8 (672) (1,259) (627)

Net finance costs 19 (49) (53) (22)

Profit before taxation 1,145 4,527 699

Income tax

(charge)/credit 11 (99) 157 -

Profit after taxation 1,046 4,684 699

========================= ====================== ==========================

Other comprehensive

income

Items that may be

reclassified subsequently

to profit or loss:

Foreign exchange

differences on

translation of foreign

operations, net of tax 18 (37) 181 (42)

Other comprehensive loss for the

year (37) 181 (42)

Total comprehensive profit for

the year 1,009 4,865 657

========================= ====================== ==========================

Earnings per share

(pence)

Basic

Ordinary shares 6 3.8 17.0 2.5

Diluted

Ordinary shares 6 3.6 16.5 2.5

The consolidated statement of comprehensive income has been

prepared on the basis that all operations are continuing

operations.

AQUIS EXCHANGE PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30

JUNE 2023

6 months ended

30/06/2023 Year ended 31/12/2022 6 months ended 30/06/2022

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Goodwill 7 83 83 83

Intangible assets 7 1,253 1,032 772

Property, plant and

equipment 8 3,829 4,156 4,263

Deferred tax asset 10 1,594 1,594 1,292

Trade and other

receivables 9 5,938 5,352 4,714

12,697 12,217 11,124

Current assets

Trade and other

receivables 9 4,970 4,135 2,786

Cash and cash equivalents 13,905 14,171 13,320

18,875 18,306 16,106

Total assets 31,572 30,523 27,230

------------------------- ---------------------- --------------------------

Liabilities

Current liabilities

Trade and other payables 12 4,495 4,268 4,453

Non-current liabilities

Lease liabilities 19 2,667 2,875 3,214

Total liabilities 7,162 7,143 7,667

------------------------- ---------------------- --------------------------

Net assets 24,410 23,380 19,563

========================= ====================== ==========================

Equity

Called up share capital 13 2,752 2,751 2,751

Share premium account 14 11,810 11,785 11,780

Other reserves 15 2,320 1,813 1,860

Treasury shares 17 (3,798) (3,350) (3,001)

Retained earnings 16 11,363 10,317 6,332

Foreign currency

translation reserve 17 (37) 64 (159)

Total equity 24,410 23,380 19,563

========================= ====================== ==========================

The notes to the financial statements on pages 10 to 22 form an

integral part of these financial statements. The interim financial

statements were approved by the board of directors and authorised

for issue on 21 September 2023 and are signed on its behalf by:

R Fisher A Haynes

Director Director

AQUIS EXCHANGE PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE

SIX MONTHSED 30 JUNE 2023

Note Share Share Other Treasury Retained Foreign Total

Capital Premium Reserves Shares Earnings Currency

Translation

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2022 2,751 11,771 1,118 (1,527) 5,633 (117) 19,629

Profit for the

6-month

period ended

30/06/2022 699 699

Issue of new

shares 9 9

Movement in share

option reserve 742 742

Movement in treasury

shares (1,474) (1,474)

Foreign exchange

differences

on translation of

foreign operations (42) (42)

--------- --------- ---------- --------- ---------- ------------- --------

Balance at 30 June

2022 2,751 11,780 1,860 (3,001) 6,332 (159) 19,563

--------- --------- ---------- --------- ---------- ------------- --------

Profit for the 6 month period

ended

31/12/2022 3,985 4,180

Issue of new

shares 5 5

Movement in share option

Reserve (47) (47)

Movement in treasury shares (349) (349)

Foreign exchange differences

on translation of foreign

operations 223 28

--------- ---------- --------- ---------- ------------- --------

Balance at 31

December

2022 2,751 11,785 1,813 (3,350) 10,317 64 23,380

--------- --------- ---------- --------- ---------- -------------

Profit for the 6-month period

ended

30/06/2023 1,046 1,046

Issue of new

shares 13,14 1 25 26

Movement in

share

option

reserve 15 507 507

Movement in

treasury

shares 17 (448) (448)

Foreign

exchange

differences

on

translation

of

foreign

operations 18 (101) (101)

Balance at 30

June 2023 2,752 11,810 2,320 (3,798) 11,363 (37) 24,410

========= ========= ========== ========= ========== ============= ========

AQUIS EXCHANGE PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE SIX

MONTHSED 30 JUNE 2023

Note 6 months ended Year ended 31/12/2022 6 months ended

30/06/2023 30/06/2022

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash generated/absorbed

by operations 20 1,101 3,962 1,082

Overseas tax paid (219) - -

Finance expense on lease

liabilities 19 49 53 22

Net cash inflow from operating

activities 931 4,015 1,104

----------------------- ---------------------- -----------------------

Investing Activities

Recognition of

intangible assets 7 (509) (778) (282)

Purchase of property,

plant and equipment 8 (57) (769) (480)

Interest received 5 169 35 4

Net cash used in / generated by

investing activities (397) (1,512) (758)

----------------------- ---------------------- -----------------------

Financing Activities

Proceeds from share

issue 13,14 26 14 9

Purchase of treasury

shares 17 (448) (1,956) (1,000)

Principal portion of

lease liability 19 (257) (301) (39)

----------------------- ---------------------- -----------------------

Net cash (used in)/ generated by

financing activities (679) (2,243) (1,030)

----------------------- ---------------------- -----------------------

Net increase/(decrease) in cash and

cash equivalents (145) 260 (684)

----------------------- ---------------------- -----------------------

Cash and cash equivalents at the

beginning of the period 14,171 14,046 14,046

Effect of exchange rate changes on

cash and cash equivalents (121) (135) (42)

Cash and cash equivalents at the

end of the period 13,905 14,171 13,320

======================= ====================== =======================

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS

1. Basis of preparation of half-year report

This condensed consolidated interim financial report for the

half-year reporting period beginning 1 January 2023 and ending 30

June 2023 ("interim period") has been prepared in accordance with

Accounting Standard IAS 34 Interim Financial Reporting.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2022 and any public announcements made by

Aquis Exchange PLC ("Aquis" or the "Company") during the interim

reporting period.

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting

period.

2. Significant post balance sheet events

On 7 August 2023 Aquis Exchange PLC acquired a minority stake in

OptimX Markets Inc. (OptimX ), a US-based financial services

start-up focused on the block trading market (the "Investment").

The i nvestment is split into two tranches: Aquis will subscribe

US$0.75m out of a total first tranche of US$3.0m payable in cash,

followed by a second tranche in 12 months of a further US$0.75m out

of a total $3.0m payable in cash. It is expected that Jonathan

Clelland, COO of Aquis, will join the board of OptimX as a

Non-Executive Director in due course. OptimX is a new venture and

so has not yet generated any profits or losses.

3. Revenue

An analysis of the Group's revenue is as follows:

6 months ended 30/06/2023 Year ended 31/12/2022 6 months ended 30/06/2022

GBP'000 GBP'000 GBP'000

Exchange Fees 6,154 10,869 5,387

Licence Fees 801 5,035 662

Issuer Fees 547 1,023 424

Data Vendor Fees 1,840 3,003 1,376

9,342 19,930 7,849

-------------------------- ---------------------- --------------------------

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued )

4. Expected credit loss

The expected credit loss on licensing contract assets has been

calculated in accordance with IFRS 9:

GBP'000

As at 31/12/2021 1,478

Expected credit loss reversal for

the period (425)

------------

As at 30/06/2022 1,053

Expected credit loss charge for

the period 293

------------

As at 31/12/2022 1,346

Expected credit loss reversal for

the period (331)

------------

As at 30/06/2023 1,015

------------

The expected credit loss on trade receivables has been

calculated in accordance with IFRS 9:

GBP'000

As at 31/12/2021 46

Expected credit loss reversal for

the period 27

---------

As at 30/06/2022 73

Expected credit loss charge for

the period (14)

---------

As at 31/12/2022 59

Expected credit loss reversal for -

the period

---------

As at 30/06/2023 59

---------

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

5. Investment income

6 months ended 30/06/2023 Year ended 31/12/2022 6 months ended 30/06/2022

GBP'000 GBP'000 GBP'000

Interest income on bank

deposits 169 29 4

-------------------------- ---------------------- --------------------------

6. Earnings per share

6 months ended 30/06/2023 Year ended 31/12/2022 6 months ended 30/06/2022

Number of Shares ('000)

Weighted average number of

ordinary shares for basic

earnings per share 27,510 27,509 27,509

Weighted average number of

ordinary shares for diluted

earnings per share 28,796 28,425 28,431

Earnings (GBP'000)

Profit for the period from

continued operations 1,046 4,684 699

Basic and diluted earnings per

share (pence)

Basic earnings per ordinary share 3.8 17.0 2.5

Diluted earnings per ordinary

share 3.6 16.5 2.5

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

7. Intangible assets

Other Intangibles

Group Developed Trading Platforms

Goodwill

GBP'000 GBP'000 GBP'000

Cost

As at 31/12/2021 3,011 37 83

Additions 282 - -

------------------------------------ ------------------ -----------

As at 30/06/2022 3,293 37 83

Additions 324 172 -

------------------------------------ ------------------ -----------

As at 31/12/2022 3,617 209 83

Additions 468 41 -

As at 30/06/2023 4,085 250 83

------------------------------------ ------------------ -----------

Accumulated amortisation and impairment

As at 31/12/2021 2,286 8 -

Charge for the period 258 6 -

------------------------------------ ------------------ -----------

As at 30/06/2022 2,544 14 -

Charge for the period 228 8 -

------------------------------------ ------------------ -----------

As at 31/12/2022 2,772 22 -

Charge for the period 268 20 -

As at 30/06/2023 3,040 42 -

------------------------------------ ------------------ -----------

Carrying amount

As at 31/12/2021 725 29 83

As at 30/06/2022 749 23 83

As at 31/12/2022 845 187 83

As at 30/06/2023 1,045 208 83

------------------------------------ ------------------ -----------

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

8. Property, plant and equipment

Fixtures, fittings and Computer Equipment Right of Use Asset Total

equipment

GBP'000 GBP'000 GBP'000 GBP'000

Cost

As at 31/12/2021 324 2,389 4,239 6,952

Additions & disposals 168 312 - 480

As at 30/06/2022 492 2,701 4,239 7,432

Additions & disposals - 290 - 290

As at 31/12/2022 492 2,991 4,239 7,722

Additions & disposals - 44 13 57

As at 30/06/2023 492 3,035 4,252 7,779

----------------------------- ------------------- ------------------- --------

Accumulated depreciation and

impairment

As at 31/12/2021 230 2,075 501 2,806

Charge for the period 38 152 173 363

As at 30/06/2022 268 2,227 674 3,169

Charge for the period 27 146 224 397

As at 31/12/2022 295 2,373 898 3,566

Charge for the period 30 160 194 384

As at 30/06/2023 325 2,533 1092 3,950

----------------------------- ------------------- ------------------- --------

Carrying amount

As at 31/12/2021 94 314 3,738 4,146

As at 30/06/2022 224 474 3,565 4,263

As at 31/12/2022 197 618 3,341 4,156

As at 30/06/2023 167 502 3,160 3,829

----------------------------- ------------------- ------------------- --------

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

9. Trade and other receivables

Current

-------------------------------------------------------

As at 30/06/2023 As at 31/12/2022 As at 30/06/2022

GBP'000 GBP'000 GBP'000

Trade receivables net of impairment 4,042 3,421 2,096

Prepayments 810 636 683

Other receivables 129 78 7

4,981 4,135 2,786

----------------- ----------------- -----------------

Non-Current

-------------------------------------------------------

As at 30/06/2023 As at 31/12/2022 As at 30/06/2022

GBP'000 GBP'000 GBP'000

Trade receivables net of impairment 5,588 5,010 4,079

Other receivables 339 342 635

5,927 5,352 4,714

----------------- ----------------- -----------------

Trade receivables are stated net of any credit impairment

provision as set out previously in Note 3 in accordance with IFRS

9, as illustrated below:

As at 30/06/2023 As at 31/12/2022 As at 30/06/2022

GBP'000 GBP'000 GBP'000

Gross trade receivables 10,704 9,837 7,319

Expected credit losses on contract assets (1,015) (1,347) (1,055)

Provisions against trade receivables (59) (59) (73)

----------------- ----------------- -----------------

Trade receivables net of impairment 9,630 8,431 6,175

----------------- ----------------- -----------------

Impairment includes the expected credit loss on licencing

contract assets stated in Note 4.

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

10. Deferred tax asset

A deferred tax asset was initially recognised in the year ended

31 December 2020, due to the Group becoming profitable for the

first time. The Group is expected to continue to be profitable in

future years, with the value of the deferred tax asset to be

reassessed annually at year end.

As at 30/06/2023 As at 31/12/2022 As at 30/06/2022

GBP'000 GBP'000 GBP'000

----------------- ----------------- -----------------

Deferred tax asset 1,594 1,594 1,292

----------------- ----------------- -----------------

11. Income tax

The income tax charge/(credit) can be reconciled to the result

per the Statement of Comprehensive Income as follows:

6 months to 30/06/2023 Year ended 31/12/2022 6 months to 30/06/2022

GBP'000 GBP'000 GBP'000

Current tax

UK Corporation tax charge - - -

Overseas tax charges on foreign

operations 99 144 -

Total tax charge 99 144 -

----------------------- ---------------------- -----------------------

Deferred tax

Origination and reversal of - (229) -

timing differences

Effect of changes in tax rates - (72) -

Total deferred tax (credit) - (301) -

----------------------- ---------------------- -----------------------

6 months to 30/06/2023 Year ended 31/12/2022 6 months to 30/06/2022

GBP'000 GBP'000 GBP'000

Profit before tax 1,145 4,527 699

-------------------------------- ----------------------- ---------------------- -----------------------

Expected tax charge based on a

corporation tax charge of 19% 195 860 100

Expected tax charge based on

effective overseas rates of

25% 99 177 61

Fixed asset differences (182) (40) (111)

Expenses not deductible for tax

purposes 87 109 53

Other differences (7) (89) (46)

Remeasurement of deferred tax

for changes in tax rates (93) (72) (57)

Movement in deferred tax not - (1,069) -

recognised

Movement in deferred tax not - (33) -

recognised at overseas rates

Tax charge/(credit) for the

period 99 (157) (1,030)

----------------------- ---------------------- -----------------------

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

12. Trade and other payables

As at 30/06/2023 As at 31/12/2022 As at 30/06/2022

Trade payables 244 510 499

Accruals 1,035 1,509 1,076

Social security and

other taxation 663 221 755

Deferred revenue 1,959 1,358 1,604

Short term lease

liabilities 527 523 434

Overseas corporation

tax payable 23 144 -

Derivatives 40 - -

Other payables 4 3 85

----------------- ----------------- -----------------

4,495 4,268 4,453

----------------- ----------------- -----------------

In January 2023 forward contracts were taken by the Company

in order to economically hedge against foreign exchange

movements in contract asset balances denominated in US

Dollars (see note 9). These derivatives are remeasured

at each reporting sheet date with the movement recognised

in Profit and Loss. The year to date loss on these items

is GBP40k.

13. Called up share capital

As at 30/06/2023 As at 31/12/2022 As at 30/06/2022

GBP'000 GBP'000 GBP'000

Ordinary share capital

Issued and fully paid

27,149,559 Ordinary shares of 10p each 2,751 2,751 2,751

Issue of new shares following exercise of 3,999 EMI - - -

share options

Issue of new shares following exercise of 7,333 EMI 1 - -

share options

Ordinary share capital 2,752 2,751 2,751

----------------- ----------------- -----------------

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

14. Share premium account

As at 30/06/2023 As at 31/12/2022 As at 30/06/2022

GBP'000 GBP'000 GBP'000

Share premium

At beginning of year 11,785 11,771 11,771

Issue of new shares following exercise of 3,999 EMI

share options - 14 9

Issue of new shares following exercise of 7,333 EMI 25 - -

share options

Share premium 11,810 11,785 11,780

----------------- ----------------- -----------------

15. Other Reserves

GBP'000

As at 31/12/2021 1,118

Share-based payment expense for the 6-month

period ended 30/06/2022 742

As at 30/06/2022 1,860

Share-based payment expense for the 6-month

period ended 31/12/2022 (47)

As at 31/12/2022 1,813

Share-based payment expense for the 6-month

period ended 30/06/2023 507

As at 30/06/2023 2,320

--------

The reserves relating to share-based payments reflects the

estimated value of the approved employee share option schemes,

which include the EMI, CSOP, PPO and Restricted Share options. The

valuation of the options granted is estimated using a US binomial

or Black Scholes model. Also included in the share-based payment

reserve are the treasury shares purchased by the Trust under the

Share Incentive Plan.

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

16. Retained earnings

GBP'000

As at 31/12/2021 5,633

Profit for the 6-month period

ended 30/06/2022 699

As at 30/06/2022 6,332

Profit for the 6-month period

ended 31/12/2022 3,985

As at 31/12/2022 10,317

Profit for the 6-month period

ended 30/06/2023 1,046

As at 30/06/2023 11,363

17. Treasury shares

Treasury shares are purchased by the Trusts under the Employee

Share Plans. The Trusts are consolidated within the Group financial

statements and the value of the shares held at the balance sheet

date is shown below.

As at 30/06/2023 As at 31/12/2022 As at 30/06/2022

GBP'000 GBP'000 GBP'000

At beginning of period 3,350 1,527 1,527

Purchase of treasury shares 448 1,823 1,474

Treasury shares at close of period 3,798 3,350 3,001

----------------- ----------------- -----------------

18. Foreign currency translation reserve

The translation of the European subsidiary into the functional

currency of the group results in foreign exchange differences that

have been recognised in Other Comprehensive Income ('OCI') for the

group which have been accumulated in a separate component of equity

as illustrated below.

6 months ended 30/06/2023 Year ended 31/12/2022 6 months ended 30/06/2022

GBP'000 GBP'000 GBP'000

At the beginning of the

year/period 64 (159) (117)

Foreign exchange differences on

translation of foreign

operations recognised in OCI (101) 223 (42)

At the end of the year/period (37) 64 (159)

-------------------------- ---------------------- --------------------------

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

19. IFRS 16 Leases

The impact on the Group's assets and liabilities, and the related effects on profit and loss, of the Group's

leasing activities

(the Group as a lessee) are detailed below.

Right of Use Asset

Property

GBP'000

------------------------------------- ---------

Carrying amount at 1 January 2022 3,738

Depreciation for the period (173)

Carrying amount at 30 June 2022 3,565

Depreciation for the period (225)

Carrying amount at 31 December 2022 3,340

Remeasurement of lease 13

Depreciation for the period (194)

Carrying amount at 30 June 2023 3,159

------------------------------------- ---------

Rent deposit asset

Rent deposit asset

GBP'000

---------------------------------------------- -------------------

Carrying amount at 1 January 2022 616

Finance income on rent deposit asset for the

period 11

Carrying amount at 30 June 2022 627

Finance income on rent deposit asset for the

period 4

Recovery of rent deposit (274)

Carrying amount at 31 December 2022 357

Remeasurement of lease (12)

Finance income on rent deposit asset for the

period 5

Carrying amount at 30 June 2023 350

---------------------------------------------- -------------------

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

Lease liability

Lease liability

GBP'000

--------------------------------------------------- ----------------

Carrying amount at 1 January 2022 3,630

Finance expense on lease liability for the period 33

Lease payments made during the period (39)

Carrying amount at 30 June 2022 3,629

Finance expense on lease liability for the period 35

Lease payments made during the period (262)

Carrying amount at 31 December 2022 3,397

Finance expense on lease liability for the period 54

Lease payments made during the period (257)

Carrying amount at 30 June 2023 3,194

--------------------------------------------------- ----------------

Of which are:

Current 527

Non-current 2,667

3,194

--------------------------------------------------- ----------------

Net finance expense on leases

6 months ended Year ended 6 months ended

30/06/2023 31/12/2022 30/06/2022

GBP'000 GBP'000 GBP'000

--------------------- -------------------- --------------------- --------------------

Finance expense on

lease liability 54 68 33

Finance income on

rent deposit asset (5) (15) (11)

Net finance expense

relating to leases 49 53 22

--------------------- -------------------- --------------------- --------------------

The finance income and finance expense arising from the Group's leasing activities as a lessee have been shown

net where applicable

as is permitted by IAS 32 where criteria for offsetting have been met.

Amounts recognised in profit and loss

6 months ended Year ended 6 months ended

30/06/2023 31/12/2022 30/06/2022

GBP'000 GBP'000 GBP'000

--------------------- -------------------- --------------------- --------------------

Depreciation expense

on right-of-use

assets (194) (397) (173)

Finance expense on

lease liability (54) (68) (33)

Finance income on

rent deposit asset 5 15 11

Net impact of leases

on profit or loss (243) (450) (195)

--------------------- -------------------- --------------------- --------------------

The total cash outflow for leases amounted to GBP217k in

the 6 months to 30 June 2023.

AQUIS EXCHANGE PLC

NOTES TO THE FINANCIAL STATEMENTS (continued)

20. Cash generated from operations

6 months Year 6 months

ended ended ended

30/06/2023 31/12/2022 30/06/2022

GBP'000 GBP'000 GBP'000

Profit after tax 1,046 4,684 699

Adjustments for:

Income tax 99 144 -

Deferred tax - (301) -

Foreign exchange (gains)/losses (13) 116 -

Investment revenue (169) (29) (4)

Amortisation and impairment of

intangible assets 288 499 264

Depreciation of property, plant

and equipment 384 761 363

Equity settled share-based payment

expense 507 820 289

Other (gains)/losses (69) 58 (4)

Movement in working capital:

Increase in trade and other receivables (1,199) (1,594) (986)

Increase in trade and other payables 227 (1,196) 461

Cash generated by operations 1,101 3,962 1,082

------------ ------------ ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SESFASEDSEDU

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

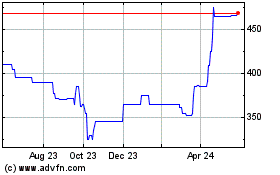

Aquis Exchange (AQSE:AQX)

Historical Stock Chart

From Jan 2025 to Feb 2025

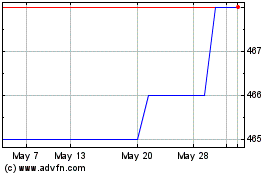

Aquis Exchange (AQSE:AQX)

Historical Stock Chart

From Feb 2024 to Feb 2025