TIDMHUM

RNS Number : 0131H

Hummingbird Resources PLC

25 July 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

25 July 2023

Hummingbird Resources pl c

("Hummingbird", the "Group", or the "Company")

Q2-2023 Operational and Trading Update

Strong quarter with H1-2023 production of >51 Koz &

Kouroussa ramping up to steady state production

Hummingbird (AIM: HUM) is pleased to provide a Group operational

and trading update for the second quarter of 2023, ending June 30

2023 ("Q2-2023").

Operational update

Yanfolila, Mali

-- 23,885 ounces ("oz") of gold produced in Q2-2023, an increase

of c.19% on the previous year (Q2-2022: 20,013 oz), with a total of

51,147 oz produced in the first half of 2023 ("H1-2023") up c.44%

versus H1-2022 (H1-2022: 35,561 oz).

-- AISC of US$1,234 per oz in Q2-2023, a decrease of c.34% on

the previous period last year (Q2-2022: US$1,859), with an H1-2023

AISC of US$1,170 per oz, a decrease of c.42% versus US$2,019 in

H1-2022.

-- 24,770 oz of gold sold at an average realised price of

US$1,981 per oz and $1,927 per oz for H1-2023 (H1-2022: US$1,819).

The Company held 1,831 oz of gold inventory on 30 June 2023.

Kouroussa, Guinea

-- Ramp-up of the Kouroussa operation is on track, with

processing plant availability currently at c.68%, the first gold

pour recorded on 8 June 2023 and regular gold pours commencing in

July.

-- Gold ounces poured at Kouroussa are scheduled to increase

during H2-2023. The operation is anticipated to reach steady state

production in Q4-2023 and expected to produce circa 30,000 oz for

H2-2023.

Corporate update

-- Group adjusted EBITDA of c.US$15.5 million for Q2-2023 and

c.US$33.1 million for H1-2023 - a material positive Group

turnaround compared to the negative Group adjusted EBITDA of US$2.3

million for Q2-2022 and the negative Group adjusted EBITDA of

US$9.3 million in H1-2022.

-- Group loss time injury frequency rate ("LTIFR") of 0.69 per

million hours worked for the quarter, within the Group target rate

of under 1.20 per million hours worked.

-- A strategic review of the Dugbe Project remains ongoing with

the Company's joint venture partner, Pasofino Gold Limited

("Pasofino").

Outlook

-- Following a strong H1-2023, Yanfolila is well positioned to

meet its FY-2023 production guidance of 80,000 - 90,000 oz at an

AISC of under US$1,500 per oz.

-- Updated Group FY-2023 production outlook to be given in the

Q3-2023 operating and trading update once Kouroussa is closer to

steady state production.

Dan Betts, CEO of Hummingbird, commented:

"This quarter has rounded off a six-month period that has seen a

strong performance by the Company as demonstrated by the more than

51 Koz of gold produced at an H1-2023 AISC profile of US$1,170 per

oz and Group adjusted EBITDA of c.US$33 million.

Yanfolila is performing more in alignment with our mine plans,

providing better consistency for the Group, and our first gold pour

at Kouroussa in June, currently in the ramp up production phase, is

a major milestone, making the Company a multi-asset,

multi-jurisdiction gold producer of which we are very proud.

As we look forward, our key focus for the coming months and the

second half of the year is to fully ramp up production safely at

Kouroussa to reach steady state production and to continue to

demonstrate stable quarterly production at Yanfolila, generating

solid free cashflows from both assets that strengthen our balance

sheet. Further, a core focus for the second half of 2023 is to

begin to implement our detailed exploration plans to extend the

life of mine at both Yanfolila and Kouroussa, coupled with a

positive solution on Dugbe in Liberia to benefit key stakeholders

at that asset."

Operational update

Unit Q2-2022 Q3-2022 Q4-2022 Q1-2023 Q2-2023 H1-2023

---------------------- ------ ---------- ---------- ---------- ---------- -------- ----------

Gold poured oz 20,013 16,827 28,264 27,262 23,885 51,147

====== ========== ========== ========== ========== ======== ==========

Mined BCMs BCMs 2,726,205 1,539,947 1,303,770 1,557,793 592,360 2,150,153

====== ========== ========== ========== ========== ======== ==========

Ore mined t 511,449 361,755 529,496 647,869 262,911 910,781

====== ========== ========== ========== ========== ======== ==========

Ore processed t 357,837 290,756 382,683 366,622 364,459 731,081

====== ========== ========== ========== ========== ======== ==========

Avg. grade mill feed g/t 1.87 1.90 2.45 2.41 2.21 2.31

====== ========== ========== ========== ========== ======== ==========

Recovery % 94.8% 92.8% 94.3% 94.4% 94.1% 94.2%

====== ========== ========== ========== ========== ======== ==========

Gold inventory

incl SMO oz 2,418 2,187 2,057 2,810 1,831 1,831

====== ========== ========== ========== ========== ======== ==========

Note: Ore mined includes high grade, low grade, and marginal

material. Ore processed is a blend based on preferential feed of

high grade and low grade , with marginal ore added as an

incremental feed source.

Yanfolila, Mali: Q2-2023 operational s ummary

-- As of the end of Q2-2023, the Yanfolila operation recorded a

rolling 12 month average LTIFR of 0.87 per million hours worked,

within the Company's LTIFR target of less than 1.20 per million

hours worked.

-- Gold produced totalled 23,885 oz in Q2-2023 and 51,147 oz in

H1-2023. As noted above, Yanfolila is well positioned to meet its

FY-2023 production guidance of 80,000 - 90,000 at AISC of less than

US$1,500 per oz, with the Company expecting a solid H2-2023

production profile from Yanfolila.

-- Mined BCMs reduced from Q1-2023 levels to 592,360 tonnes

("t"), driven by mining the bottom of the Komana East ("KE") open

pit. However, ore processed totalled 364,459 t, another good

consecutive quarter, with the Company utilising stockpile ore to

blend with the ore mined tonnes.

-- Q2-2023 saw another good quarter of average grade mill feed

at 2.21 grammes a tonne ("g/t") and processing plant recovery of

94.1%.

-- Mining at the KE open pit deposit was finalised in recent

weeks, with the last open pit blast taking place and the processing

of this ore to now occur in the current Q3-2023 quarter. The

finalisation of the KE open pit has allowed increased advancement

of the Komana East underground mine ("KEUG"), and progress is

expected to accelerate further in H2-2023.

-- Mining at the Sanioumale East ("SE") open pit deposit

commenced during Q2-2023, ahead of schedule, to allow increased ore

to the mill from the SE deposit to be processed in H2-2023,

alongside ore feed mix from other deposits including Sanioumale

West ("SW") and Komana West ("KW").

Yanfolila Resource extension drilling re-commenced during

Q2-2023:

-- During Q2-2023, drilling on brownfield deposits in the

Yanfolila license restarted, including SW and Gonka South ("GS").

The SW drilling will test for further mineralisation along the

north-east and south-west strike zones to extend the SW Resources.

The GS Resource upgrade drilling is complete and awaiting assay

results ahead of further analysis.

-- The Company expects H2-2023 exploration drilling at Yanfolila

to accelerate at near pit opportunities as well as some of the

historical Resources, with a key focus on increasing Yanfolila

Resources at known deposits and ultimately adding to the Yanfolila

Reserves base.

Yanfolila ESG:

-- SE village resettlement began in Q1-2023 and has been

completed ahead of schedule, allowing mining at the SE deposit to

begin during Q2-2023 as noted above. The SE resettlement has

resulted in the housing of over 40 families, all completed under

the guidance of West African specialist consultants Environmental

and Social Development Company ( " ESDCO").

-- Company supplied water infrastructure implementation and

support remain a key focus, with two deep water boreholes drilled

during the quarter, with water supply systems currently being

installed, to be completed in Q3-2023.

Kouroussa, Guinea: Q2-2023 operational s ummary

-- As of the end of Q2-2023, the Kouroussa operation recorded a

rolling 12 month LTIFR of 0.40 per million hours worked, within the

Company's LTIFR target rate of less than 1.20 million hours

worked.

-- Following the commencement of mining in early Q1-2023 and the

hot commissioning of the processing plant in Q2-2023, Kouroussa

achieved its first gold pour on 8 June 2023, ahead of the end of

the Q2-2023 schedule, and on budget . With regular gold pours

commencing in July, the ramp up of the Kouroussa operations is on

track towards steady state production, expected to occur in

Q4-2023.

-- The processing plant's availability has reached c.68%, with

the plant able to run as per design. A key focus area for the plant

team over the coming months will be to increase the running of the

plant at full availability on a 24-hour basis.

-- Mining operations commenced in early Q1-2023 and accelerated

during Q2-2023, with ROM stockpiles at the end of Q2-2023 of

approximately 120,000 tonnes of initial low grade material from the

mining of the top layer at the key KoeKoe open pit . The Company

expects the mill feed grade profile to incrementally improve during

H2-2023 as mining of the top layer at Koekoe is completed, allowing

access to deeper, higher-grade ore for mining and processing.

-- Other key areas of focus for the Kouroussa operations team to

safely reach steady state production during H2-2023 include:

o The management and monitoring of mining and other on-site

contractors to maximise the operational performance for the

Group.

o The implementation of wet weather procedures to protect access

to higher-grade ore for processing during H2-2023.

o Finalisation and efficient implementation of HR operational

plans.

o Efficient operation of the newly constructed mine camp,

allowing the company to end offsite residential requirements.

o Ongoing monitoring and following of safety protocols and

procedures.

Kouroussa exploration programme:

-- The Company is finalising exploration plans for H2-2023 and

FY-2024, with several targets identified within the current mining

license area for further drilling and analysis with the focus on

increasing Kouroussa's existing Reserves base of 647,000 oz at 4.15

g/t.

Kouroussa ESG:

-- Progress on community livelihood initiatives and projects

continued to advance. As part of Kouroussa's reforestation

strategy, 650 seedlings were planted during the quarter around the

mining camp area.

-- Additionally, the medical team conducted a malaria awareness

campaign during the quarter on site and in surrounding villages to

the mine.

Dugbe, Liberia

-- As noted above, the strategic review of options to best

realise the maximum value of Dugbe for all stakeholders remains

ongoing with our joint venture partner Pasofino.

Financial update

Unit Q2-2022 Q3-2022 Q4-2022 Q1-2023 Q2-2023 H1-2023

------------------ ------- -------- -------- -------- -------- -------- --------

Gold sales oz 20,490 16,917 27,860 26,380 24,770 51,149

================== ======= ======== ======== ======== ======== ======== ========

Avg. gold sale

price $/oz 1,851 1,713 1,726 1,878 1,981 1,927

======= ======== ======== ======== ======== ======== ========

Operating cash

costs $'000 38,253 36,179 34,581 28,996 29,996 58,992

======= ======== ======== ======== ======== ======== ========

AISC on gold

sold $/oz $,859 2,161 $1,248 1,109 1,234 1,170

======= ======== ======== ======== ======== ======== ========

Group Adjusted

EBITDA $m (2.3) (8.9) 11.2 17.6 15.5 33.1

======= ======== ======== ======== ======== ======== ========

Net (debt)

/ cash $'m (64.4) (84.7) (128.7) (110.8) (122.8) (122.8)

======= ======== ======== ======== ======== ======== ========

Net (debt)

/ cash inc gold

inventory value $'m (60.1) (81.0) (125.0) (105.2) (119.3) (119.3)

======= ======== ======== ======== ======== ======== ========

-- Q2-2023 AISC on gold sold from Yanfolila operations totalled

US$1,234 per oz, an 11% increase on Q1-2023, leading to an average

H1-2023 AISC of US$1,170 per oz. The Company expects H2-2023 AISC

to be higher than H1-2023 levels at Yanfolila, as more open pits

are mined, however FY-2023 AISC is to remain within guidance of

under US$1,500 per ounce.

-- Capital expenditure ("capex") of approximately c.US$16

million in the quarter (c.US$12 million for the project completion

at Kouroussa and c.US$4 million for expansion capex in Mali).

Expectations for H2-2023 Group capex to be materially lower versus

H1-2023 levels with the Kouroussa plant build complete.

-- Net debt position of c.US$122.8 million at the end of Q2-2023

(c.US$119.3 million including gold inventory value) with

deleveraging expected to commence in H2-2023. For the quarter

end:

-- Gross debt of c.US$128.6 million.

-- Cash at bank of c.US$5.8 million.

-- Gold inventory value of c.US$3.5 million.

**ENDS**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold producing Company, member of the World Gold

Council and founding member of Single Mine Origin

(www.singlemineorigin.com). The Company currently has two core gold

projects, the operational Yanfolila Gold Mine in Mali, and the

Kouroussa Gold Mine in Guinea, which will more than double current

gold production once at commercial production. Further, the Company

has a 51% controlling interest in the Dugbe Gold Project in Liberia

that is being developed by joint venture partners, Pasofino Gold

Limited. The final feasibility results on Dugbe demonstrate 2.76Moz

in Reserves and strong economics such as a 3.5-year capex payback

period once in production, and a 14-year life of mine at a low AISC

profile. The Company's vision is to continue to grow our asset

base, producing profitable ounces, while adhering to the highest

international standards of Environmental, Social & Governance

("ESG") policies and practices.

For further information, please visit hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Edward Montgomery,

CD

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Gordon Hamilton Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Oonagh Reidy Financial PR/IR 5000

George Pope Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFLRDTISFIV

(END) Dow Jones Newswires

July 25, 2023 02:00 ET (06:00 GMT)

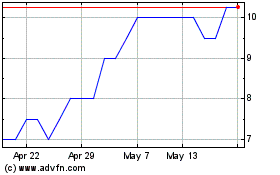

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024