TIDMHUM

RNS Number : 0128W

Hummingbird Resources PLC

07 December 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

7 December 2023

Hummingbird Resources pl c

("Hummingbird", the "Group" or the "Company")

Corporate strategy update, equity placement & TVR

Hummingbird (AIM: HUM) is pleased to announce a corporate

strategy update and an underwritten equity placement, part of which

is subject to, inter alia, shareholder approval.

Highlights

-- Hummingbird is undertaking an equity placement of up to US$30

million (the "Placement") at a price of 11.2625 pence per

Subscription Share (the "Placement Price"), underwritten by a

partially conditional US$25 million investment by the Company's

largest shareholder and strategic investor CIG SA ("CIG"), to

accelerate its growth strategy, increase exploration, and

strengthen its balance sheet to provide capital support for the

Group's operations.

-- In addition to the Placement, the Company will offer

shareholders the opportunity to subscribe for shares at the same

price as the Placement through an open offer to be launched in due

course (the "Open Offer").

-- Hummingbird is in the process of converting its 51% interest

in the Dugbe Gold Project, Liberia (the "Project"), into a 51%

controlling shareholding interest in TSX-V listed Pasofino Gold

Limited ("Pasofino"). The conversion simplifies the ownership

structure of the Project, providing clear visibility and control to

facilitate more efficient decision-making and project

advancement.

-- The Group intends to enter into a near term revenue

protection strategy through a gold price cost collar over a portion

of the Company's production for the first three quarters of FY-2024

in the order of c.60,000 ounces ("oz"), as the Company materially

deleverages its balance sheet .

-- Yanfolila remains on track to meet its FY-2023 production

guidance of 80,000 - 90,000 oz with AISC under US$1,500 per oz and

the ramp-up at Kouroussa continues to progress towards full scale

commercial production in early FY-2024.

-- The Company is on track to produce c.200,000 oz in FY-2024.

Formal FY-2024 Group production and AISC guidance will be provided

at the Q4-2023 operational and trading update, expected at the end

of January FY-2024.

Dan Betts, CEO of Hummingbird, commented:

"Today's announcement of an equity placement, corner-stoned by

CIG demonstrates the ongoing support for Hummingbird to implement

our growth strategy. The Placement strengthens our balance sheet,

increases our exploration activities, and advances the Dugbe Gold

Project, through the soon to be controlling interest we have now

established in Pasofino. The revenue protection strategy also locks

a portion of our FY-2024 gold production as we move to materially

deleverage and strengthen our balance sheet.

With the ramp-up of Kouroussa progressing, we are set to reach

full commercial production in early FY-2024, and remain on track to

be a c.200,000 oz per year gold producer next year."

Yacouba Sare, Managing Director of CIG SA, commented:

"Our strategic investment is an endorsement of Hummingbird's

strategy for growth to a be multi-asset, multi-jurisdictional gold

producer. With a strengthened balance sheet, accelerated

exploration plans and the soon to be controlling interest in

Pasofino, we believe the Company is well on its way to achieving

its near and longer term growth ambitions."

Management interview and Webcasts

An interview with Dan Betts, CEO and Interim Chairman on this

release is available on the Company's website - Media - Hummingbird

Resources Plc .

Additionally, the Company plans to hold a webcast via the

Investor Meet Company platform following the release of the

Circular. The Company invites attendees to pre-send questions to

the Company via IR@hummingbirdresources.co.uk .

Equity Placement

The Company is undertaking an equity placement of up to US$30

million, subject to, inter alia, shareholder approval, comprised of

a partially conditional US$25 million investment by CIG (the "CIG

Investment") and up to US$5 million from other investors. The

Placement involves the issue of up to 210,491,795 new ordinary

shares of GBP0.01 of the Company ("Ordinary Shares") (the

"Subscription Shares") split across two tranches:

-- A firm first tranche of US$5.5 million, which involves the

issue of 38,576,805 Subscription Shares (the "First Tranche

Shares"), including the issue of 35,057,991 Subscription Shares to

CIG, which will result in a CIG holding of 29.9% in the Company,

and;

-- A conditional second tranche, subject to, inter alia,

shareholder approval, of up to US$24.5 million, which involves the

issue of up to approximately 171,914,990 Subscription Shares (the

"Second Tranche Shares"), which, before the effect of the below

mentioned Open Offer, is expected to see CIG establish a holding of

up to c.43% in the Company.

The placement price is 11.2625 pence per Subscription Share (the

"Subscription Price").

In addition, the Company will offer shareholders the opportunity

to subscribe for new Ordinary Shares at the Subscription Price

through an open offer to be launched in due course (the "Open

Offer"). Further details, including how qualifying shareholders can

participate in the Open Offer, will be provided in the coming weeks

with the publication of a shareholder circular containing full

details of the Placement (the "Circular").

CIG is conditionally subscribing for up to 142,522,475 of the

Second Tranche Shares subject to, inter alia, the granting of a

Rule 9 waiver by The Panel on Takeovers and Mergers (the "Panel"),

to be approved by shareholders independent of CIG, of the

obligations that would otherwise fall upon CIG pursuant to Rule 9

of The City Code on Takeovers and Mergers to make an offer for the

entire issued share capital of the Company as a result of the

potential issue of the Second Tranche Shares to CIG, which will

lead to its interest in the Company increasing to over 30 per cent,

and potentially up to approximately 43 per cent. dependent on the

level of acceptances for the Open Offer. Further details on the

Rule 9 waiver will be set out in the Circular.

The First Tranche Shares are expected to be admitted to trading

on AIM on 12 December 2023. Conditional upon, inter alia,

shareholder approval being granted at the General Meeting for the

issue of the Second Tranche Shares, the Second Tranche Shares will

be admitted to trading on AIM as soon as practicable following the

General Meeting.

The Company intends to publish the Circular shortly, which will

include a notice of General Meeting, and a further announcement

will be made as and when appropriate.

Use of proceeds

The Company will allocate the net proceeds to strengthen the

balance sheet of the business and advance multiple growth

initiatives as part of the Company's growth strategy. These

initiatives encompass exploration activities at both the Yanfolila

and Kouroussa Gold Mines, as well as maximising the value of the

Dugbe Gold Project.

Hummingbird intends to utilise the proceeds of the Placement as

follows:

-- Exploration Activities: c.US$5 million of the funds will be

directed towards increased exploration activities at the Yanfolila

and Kouroussa Gold Mines.

o Hummingbird's exploration team has developed a comprehensive

exploration plan from FY-2024 onwards, focused on high-probability

targets aimed at increasing Resources to Reserves for the Group,

thereby extending the Life of Mine ("LOM") at both operating

assets.

-- Dugbe Gold Project Advancement : c.US$2 million of the

proceeds will be dedicated to progressing the Dugbe Gold Project in

Liberia, bringing this highly valuable asset closer to

production.

o The funds will be used to optimise the 2022 Definitive

Feasibility Study ("DFS") through FY-2024 and further progress the

Project. Hummingbird and Pasofino have identified several

opportunities to maximise the value of Dugbe and reduce the overall

project capex profile, including the optimisation of power usage,

improvements to the metallurgical recovery rates and additional

exploration activities.

-- Balance Sheet Strengthening : The remainder of the proceeds

will be used to strengthen the Company's balance sheet through

deleveraging and operational initiatives.

o The funds will be allocated to provide additional capital

support for the Group as it completes operational initiatives at

Yanfolila including, the Komana East Underground operation, and the

ramp up of Kouroussa to commercial production in early FY-2024, as

well as supporting the deleveraging of the balance sheet.

Conversion of the Ownership of the Dugbe Gold Project

Following the exercise of Pasofino Gold Limited's ("Pasofino" -

TSXV: VEIN) option, Hummingbird will, upon approval of its Personal

Information Form by the TSX Venture Exchange ("TSXV"), convert its

51% interest in the Dugbe Gold Project into a 51% controlling

shareholding interest in Pasofino. The conversion simplifies the

ownership structure of the Project, providing clear visibility and

control over one of West Africa's largest undeveloped gold projects

and facilitating more efficient decision-making and project

advancement.

With a pre-tax and post-tax NPV5% (at US$1,700/oz gold price) of

US$690 million and USD524 million respectively (Pre-tax NPV5% at

US$1,850/oz of US$920 million), 4.0 million oz in Resources and 2.8

million oz in Reserves, and a production profile of 200,000 oz for

the first 5 years of the fourteen years LOM, Dugbe is a strategic

asset with significant value upside for Hummingbird's shareholders.

For the next 12 months, the Company plans to optimise the Dugbe

Definitive Feasibility Study ("DFS") completed by Pasofino to

maximise value and progress the Project towards construction. (Full

details of the DFS can be found - www.pasofinogold.com),

The conversion is being undertaken pursuant to Pasofino's

exercise of its right under an Option Agreement entered in 2020 to

acquire Hummingbird's 51% interest in the issued and outstanding

shares of Hummingbird Resources (Liberia) Inc. ("HBL"), which holds

the interest in Dugbe, and all shareholder loans made by

Hummingbird to HBL (the "Dugbe Interest"). This transaction will

result in Pasofino becoming the sole owner of the Dugbe Gold

Project, subject to the 10% carried interest of the Government of

Liberia, and be classified as a subsidiary of Hummingbird.

In consideration for the ownership conversion, Pasofino will

issue 54,027,783 new common shares to Hummingbird, granting the

Company a 51% shareholding interest in Pasofino, and consequently

establishing Hummingbird as a "control person" under the TSXV

policies. Pasofino's shareholders approved Hummingbird control

person status at the annual general and special meeting held on

August 23, 2023. Closing remains subject to the TSXV approving

Hummingbird's personal information form, which approval is expected

in the near-term.

In order to affect the ownership conversion, Hummingbird,

Pasofino, and its wholly-owned subsidiary, ARX Resources Limited,

are entering into a share exchange agreement ( " Share Exchange

Agreement " ), effective upon the Personal Information Form filed

by Hummingbird being approved by the TSXV The Share Exchange

Agreement mandates that Pasofino and Hummingbird enter into an

investor rights agreement ("Investor Rights Agreement"), pursuant

to which the Company is entitled to appoint three members to the

board of Pasofino, of which two members have been appointed and the

third member will be appointed in due course.

In this regard, in liaison with the Company, Pasofino will

appoint Dan Betts (Non-executive Chairman), Stephen Dattels

(Non-executive Deputy Chairman), and Thomas Hill (Non-executive

Director) to the Board, effective as of the closing, in addition to

two of the existing directors - Sava Sahin and Robert Metcalfe, who

will continue as directors of the Board. These directors will serve

on the Board until they seek re-election at the next annual meeting

of Pasofino's shareholders.

Further details can be found in the announcement by Pasofino via

the following link: www.pasofinogold.com/news

CIG Investment Details

CIG will be issued 35,057,991 First Tranche Shares and up to a

further 142,522,475 Second Tranche Shares, subject to, inter alia,

shareholder approval. In total, it is expected that CIG will be

issued up to 177,580,466 Subscription Shares and will have a

holding of up to approximately 43% per cent in the Company's share

capital as enlarged by the issuance of the Subscription Shares, and

prior to the effect of the Open Offer.

The terms of the CIG Investment are set out in an investment

agreement entered between CIG and the Company and include:

-- An undertaking by CIG that it will not (save in limited

circumstances) dispose of the Subscription Shares for a period of

12 months from the date of admission of the First Tranche Shares

(in the case of the First Tranche Shares) or 12 months from the

date of admission of the Second Tranche Shares (in the case of the

Second Tranche Shares); and

-- The granting to CIG of a pre-emption right in relation to

further equity issues by the Company while it holds 20% or more of

the Ordinary Shares.

As noted in the Company's 7 February 2023 announcement, CIG is

party to a relationship agreement with the Company and the

Company's nominated adviser, Strand Hanson Limited, which imposes

certain obligations on CIG in its position as a substantial

shareholder (as defined under the AIM Rules) in the Company to

ensure that the Company will at all times be capable of carrying on

its business independently of CIG and the members of its group. The

relationship agreement remains in force for so long as CIG's

holding remains at 10% or above. Under the terms of the CIG

Investment agreement, CIG has also agreed not to make an offer for

the Company without the recommendation of the Company's board, for

so long as its holding is at 15% or more, subject to limited

exceptions.

Related Party Transaction

CIG is classified as a Substantial Shareholder of the Company

pursuant to the AIM Rules for Companies (the "AIM Rules"). The

Company entering into the CIG Investment is accordingly classified

as a related party transaction pursuant to the AIM Rules. In this

regard, the directors of the Company confirm, having consulted with

the Company's nominated adviser, Strand Hanson Limited, that they

consider that the terms of the CIG Investment to be fair and

reasonable insofar as its shareholders are concerned.

Admission and Total Voting Rights

Application has been made to the LSE for the admission of the

38,576,805 First Tranche Shares , which is expected to take effect

on or around 12 December 2023. ("Admission").

Following Admission (of the First Tranche Shares), the Company's

issued share capital will consist of 640,495,504 Ordinary Shares,

all with voting rights. The Company currently does not hold shares

in treasury. The total number of voting rights in the Company

following Admission is therefore 640,495,504, which may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in the Company under the FCA's

Disclosure Guidance and Transparency Rules.

A further announcement will be made in respect of the admission

of the Second Tranche Shares.

(1) CIG is controlled by the same principal as the Company's primary lending bank .

**ENDS**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold producing Company, member of the World Gold

Council and founding member of Single Mine Origin

(www.singlemineorigin.com). The Company currently has two core gold

projects, the operational Yanfolila Gold Mine in Mali, and the

Kouroussa Gold Mine in Guinea, which will more than double current

gold production once at commercial production. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by joint venture partners, Pasofino Gold

Limited. The final feasibility results on Dugbe showcase 2.76Moz in

Reserves and strong economics such as a 3.5-year capex payback

period once in production, and a 14-year life of mine at a low AISC

profile. Our vision is to continue to grow our asset base,

producing profitable ounces, while central to all we do being our

Environmental, Social & Governance ("ESG") policies and

practices.

For further information, please visit hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Edward Montgomery,

CD

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Oonagh Reidy Financial PR/IR 5000

George Pope Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDQDLBBXLLXFBK

(END) Dow Jones Newswires

December 07, 2023 02:00 ET (07:00 GMT)

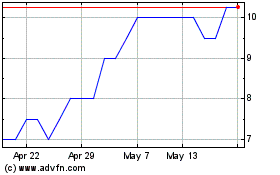

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025