TIDMMPL

RNS Number : 1087E

Mercantile Ports & Logistics Ltd

27 June 2023

THIS ANNOUNCEMENT (THE "ANNOUNCEMENT") AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE

OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO THE UNITED STATES OF AMERICA, ITS STATES, TERRITORIES AND

POSSESSIONS ("UNITED STATES"), AUSTRALIA, CANADA, JAPAN, SINGAPORE,

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH

SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE PROHIBITED BY

ANY APPLICABLE LAW.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE

OR THE SOLICITATION TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY

SECURITIES.

THIS ANNOUNCEMENT WAS DEEMED BY THE COMPANY (DEFINED BELOW) TO

CONTAIN INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF

REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK LAW PURSUANT TO

THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK

MAR").

27 June 2023

Mercantile Ports & Logistics Limited

("MPL" or the "Company" and, together with its subsidiaries, the

"Group")

Further Subscription to raise GBP399,999.99

Mercantile Ports & Logistics Limited (AIM: MPL), which is

operating and continuing to develop a port and logistics facility

in Navi Mumbai, Maharashtra, India, is pleased to announce that,

following the closing of the GBP9.04 million equity fundraising

announced by the Company on 8 June 2023 (the "Previous

Fundraising"), which is expected to close on 28 June 2023, as

further detailed in the announcement by the Company at 3.56 p.m.

today, the Company was approached by an existing institutional

shareholder to invest GBP399,999.99 (before expenses) by way of the

conditional subscription for 13,333,333 new ordinary shares of no

par value ("Ordinary Shares") (the "Subscription Shares") at the

issue price of 3 pence per share (the "Issue Price") per

Subscription Share (the "Subscription"). The Issue Price of the

Subscription is the same as the issue price per Ordinary Share in

the Previous Fundraising.

Net proceeds from the Subscription will, together with the net

proceeds from the Previous Fundraising, enable the Group to

strengthen the balance sheet and to provide working capital for the

Group. The Company is in advanced discussions to refinance its

existing debt facilities, and the net proceeds from the

Subscription and the Previous Fundraising will assist the Company

in such discussions.

Completion of the Subscription is conditional, inter alia, upon

approval of the Shareholders at a general meeting of the

Shareholders (the " General Meeting ") . The Company will notify

Shareholders of the date, time and location of the General Meeting

in a shareholder circular (the "Circular"), which will be published

and despatched by the Company in due course. The Circular will

contain further details of the Subscription and the notice of the

General Meeting to, inter alia, approve the resolutions required to

implement the Subscription. Following its publication, the Circular

will be available on the Group's website at

https://www.mercpl.com/article/investor-relations/shareholder-circulars/9.

For the purposes of UK MAR, the person responsible for arranging

release of this announcement on behalf of the Company is Jay Mehta,

Managing Director.

For further information, please visit www.mercpl.com or

contact:

MPL c/o SEC Newgate

+44 (0) 20 3757 6880

Cenkos Securities plc Stephen Keys

(Nomad and Broker) +44 (0) 20 7397 8900

------------------------------

SEC Newgate Elisabeth Cowell/ Bob Huxford

(Financial Communications) +44 (0) 20 3757 6880

mpl@newgatecomms.com

------------------------------

Notes:

References to times in this Announcement are to London time

unless otherwise stated.

The times and dates set out in the expected timetable of

principal events above and mentioned throughout this Announcement

may be adjusted by the Company in which event the Company will make

an appropriate announcement to a Regulatory Information Service

giving details of any revised dates and the details of the new

times and dates will be notified to London Stock Exchange plc (the

"London Stock Exchange") and, where appropriate, Shareholders.

Shareholders may not receive any further written communication.

IMPORTANT NOTICE

This Announcement, and the information contained herein is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in or into or from the United States, Canada,

Australia, Singapore, Japan or the Republic of South Africa, or any

other jurisdiction where to do so might constitute a violation of

the relevant laws or regulations of such jurisdiction (the

"Restricted Jurisdictions").

This Announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The Subscription Shares referred to herein have not

been and will not be registered under the US Securities Act of

1933, as amended, and may not be offered or sold in the United

States, expect pursuant to an applicable exemption from

registration. No public offering of Subscription Shares is being

made in the United States.

This Announcement does not constitute or form part of an offer

to sell or issue or a solicitation of an offer to buy, subscribe

for or otherwise acquire any securities in any jurisdiction

including, without limitation, the Restricted Jurisdictions or any

other jurisdiction in which such offer or solicitation would be

unlawful. This Announcement and the information contained in it is

not for publication or distribution, directly or indirectly, to

persons in a Restricted Jurisdiction, unless permitted pursuant to

an exemption under the relevant local law or regulation in any such

jurisdiction.

No action has been taken by the Company or Cenkos Securities plc

("Cenkos Securities") or any of their respective directors,

officers, partners, agents, employees or affiliates that would

permit an offer of the Subscription Shares or possession or

distribution of this Announcement or any other publicity material

relating to such Subscription Shares in any jurisdiction where

action for that purpose is required. Persons receiving this

Announcement are required to inform themselves about and to observe

any restrictions contained in this Announcement.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

This Announcement has not been approved by the London Stock

Exchange or any other securities exchange.

This Announcement is not being distributed by, nor has it been

approved for the purposes of section 21 of (the Financial Services

and Markets Act 2000, as amended ("FSMA") by Cenkos Securities or

any other person authorised under FSMA. This Announcement is being

distributed and communicated to persons in the United Kingdom only

in circumstances in which section 21(1) of FSMA does not apply.

No prospectus or offering document will be made available in

connection with the matters contained in this Announcement and no

such prospectus is required (in accordance with the EU Prospectus

Regulation or the UK Prospectus Regulation ) to be published.

Certain statements in this Announcement are forward-looking

statements which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "could", "intend",

"estimate", "expect" and words of similar meaning, include all

matters that are not historical facts. These forward-looking

statements involve risks, assumptions and uncertainties that could

cause the actual results of operations, financial condition,

liquidity and dividend policy and the development of the industries

in which the Group's businesses operate to differ materially from

the impression created by the forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties and other factors that

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements. Given

those risks and uncertainties, prospective investors are cautioned

not to place undue reliance on forward-looking statements.

Forward-looking statements speak only as of the date of such

statements and, except as required by the UK Financial Conduct

Authority ("FCA"), the London Stock Exchange or applicable law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Any indication in this Announcement of the price at which the

Ordinary Shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. Persons needing

advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

and no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Group.

Cenkos Securities, which is authorised and regulated in the

United Kingdom by the FCA, is acting for the Company and for no one

else in connection with the Subscription and will not be

responsible to anyone other than the Company for providing the

protections afforded to clients of Cenkos Securities or for

providing advice in relation to the Subscription Shares, or any

other matters referred to in this Announcement.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by or on behalf of the Company, Cenkos

Securities, or by their affiliates or their respective agents,

directors, officers and employees as to, or in relation to, the

accuracy or completeness of this Announcement or any other written

or oral information made available to or publicly available to any

interested party or its advisers, and any liability therefor is

expressly disclaimed.

The Subscription Shares to be issued pursuant to the

Subscription will not be admitted to trading on any stock exchange

other than to trading on AIM, being the market of that name

operated by the London Stock Exchange.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

The Subscription Shares are being issued pursuant to applicable

securities laws.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSEWFMWEDSELM

(END) Dow Jones Newswires

June 27, 2023 12:49 ET (16:49 GMT)

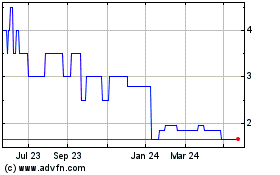

Mercantile Ports and Log... (AQSE:MPL.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

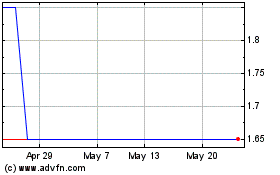

Mercantile Ports and Log... (AQSE:MPL.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024