TIDMMPL

RNS Number : 4246E

Mercantile Ports & Logistics Ltd

29 June 2023

29 June 2023

Mercantile Ports & Logistics Limited

("MPL" or the "Company")

Full Year Results

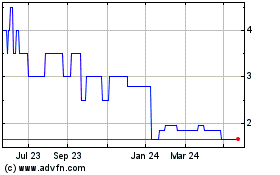

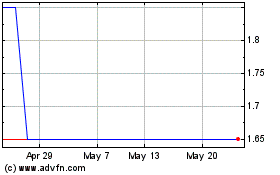

Mercantile Ports & Logistics Limited (AIM: MPL) which is

operating and continuing to develop a port and logistics facility

in Navi Mumbai, Maharashtra, India, is pleased to announce its

preliminary results for the year ended 31 December 2022.

Chairman's Statement

2022 was the first full year of uninterrupted operation for

Karanja Port. The coal jetty handled almost 1.0 Mn MT of coal,

Memorandum of Undertakings ("MOUs") with JM Baxi and new contracts

were also signed.

Revenue achieved during the year 2022 was GBP4.8 Mn. That

momentum has continued with Q1 CY2023 revenue being GBP1.6 Mn, a

more than double the GBP0.77 Mn for Q1 of 2022.

Dry bulk traffic is a fundamental foundation for facilitating

infrastructure development in the region. Karanja Port is well

positioned to attract this bulk cargo.

We were proud of our performance for our first customer, Tata

Daewoo, throughout the year. Tata Daewoo will shortly deliver the

last few blocks of the Mumbai Trans Harbour Link, which has been

constructed at the Facility. We were proud to have played our part

in this achievement, but can also, look forward to using the

concrete paved land being vacated by them in the next few months,

which will be utilised for our container business operations. This

25 acre reinforced concreted land parcel can handle a throughput of

almost 0.4 Mn TEUs per annum. We expect to achieve this throughput

within 7 years, with there being a significant shift in the revenue

mix from bulk cargo to container cargo.

The Company enhanced its business development team during the

period and this additional resource is delivering results, with

momentum expected to continue during the course of 2023.

The Company is pleased to report that it is in early stage

discussions with a number of large shipping lines to handle

containers at the Facility. This development is welcomed and will

ensure over time both stable and predictable revenue streams. The

Facility's location is well placed to handle containers both from a

road logistics perspective as well as by barge transportation.

Contracts for container cargo provide predictable and long term

revenue and the Company is hopeful of being able to announce

progress in this regard during 2023.

One of the Board's principal priorities for 2022 was to further

enhance the terms of its debt Facility, to match the principal

repayment with the cash flows that the business will generate in

the next 2-3 years. Whilst that was not concluded during the year,

as announced in the Company's recent fundraising, the Board is

confident that this will be achieved.

The Company's original plan of making Karanja Port a hub for

container handling is expected to take a major step in becoming a

reality in 2023. The management worked in 2022 to get all approvals

in place for getting this done including allotment of JNPA

code.

The pick-up in Container handling business coupled with the

growing Bulk Cargo handling businesses will drive further

operational activity at the Port. The resulting increase in

revenues coupled with the submission of proposal to the current

lenders for restructuring of existing term debt to further 7 years

(including 2 years moratorium on principal repayment) as well as

moratorium on interest servicing for 12 months, will position the

company to move ahead on its path to deliver the shareholder

value.

On behalf of the Board, I should like to thank our investors for

their continued support, as MPL builds towards its goal of being a

key part of the logistics infrastructure in the region and a

successful profitable company.

Finally, I should like to thank all our employees for their

continued hard work during 2022.

Jeremy Warner Allen

Chairman

Mercantile Ports & Logistics Limited

29 June, 2023

Operational Review

Indian Economy

On 6 December, 2022, the World Bank revised its GDP growth

outlook for India for 2022-23 from 6.5% to 6.9%, (Source: India is

better positioned to navigate global headwinds than other major

emerging economies: New World Bank report

https://www.worldbank.org/en/news/press-release/2022/12/05/india-better-positioned-to-navigate-global-headwinds-than-other-major-emerging-economies-new-world-bank-report)

on the back of the economy's strong performance in Q2. The World

Bank went on to say that the nation was "well placed" to steer

through any potential global headwinds in 2023. The International

Monetary Fund (IMF) expects India to grow by 5.9% in FY 2023-24 and

by an average rate of 6.1% over the next five years.

Despite the global turmoil as a result of the dual shocks

emerging from COVID and the Ukraine-Russia war, the long-term

growth story of the Indian economy remains intact.

India emerged as the world's fifth-largest economy, overtaking

the United Kingdom (UK) in 2022. It is set to surpass Japan and

Germany to become the world's third-largest economy by 2029.

(Source: India to emerge third-largest economy of world by 2029;

Likely to surpass Germany by 2027, and Japan by 2029 (Source

:newsonair.gov.in)

However, capital investment, especially in the private sector,

has lagged so far. India is an attractive investment destination is

a point well emphasized.

Operations Update

From an operations perspective, 2022 was the first full year of

uninterrupted operations for the Port, with Karanja Port able to

handle over c1.0 Mn MT of Cargo. The Facility was able to

demonstrate its ability to be a 24X7 facility with the commencement

of night navigation enabling berthing / de-berthing of vessels at

night. With all key aspects of port and logistics operation,

including vessel navigation, yard operations and transportation,

being carried out in a seamless manner, the Facility successfully

handled over multiple types of cargo including coal, cement,

olivine flux, metal scrap during the period. The volume of coal

handled during this period, was in line with expectation and

achieved the volume expectation set with the customer.

The Facility received positive feedback from its customers

regarding the overall efficiency of operations and appreciation for

the fact that no demurrage was incurred by any customer over this

period.

MPL continues to strengthen its business development and

operations team, including on the container side of the business as

it prepares to start handling containers during the course of 2023.

Karanja Port is being positioned as an evacuation alternative for

containers coming to Jawaharlal Nehru Port Authority ("JNPA"),

where currently, 6.0 Mn TEUs flow into JNPA. With the fourth

terminal of JNPA becoming active this year, the number of TEUs

flowing into JNPA is expected to increase to 9.0 - 10.0 mn TEUs in

the next 3-4 years. (Source: https://jnPort.gov.in/projects_ongoing

(10 million).

It is important to note that Karanja Port and JNPA have the same

customs jurisdiction, the Jawaharlal Nehru Customs House

(JNCH).

Further, the Facility has all other approvals in place

(including allotment of code by JNPA & its terminals) to make

the evacuation of TEUs, flowing into JNPA, from Karanja Port a

reality. This will include both (1) containers that need only

evacuation, storage and transportation - DPD containers the are

Full Container Load (FCL); (2) containers that are yet to undergo

Customs examination; and (3) containers that need to undergo

de-stuffing operations that are not FCL.

Karanja Port Container Terminal aspires to be one of the largest

container handling facilities in the state of Maharashtra and one

of the few with a waterfront.

Going Concern

Fiscal year 2022 was the first full year of uninterrupted

operations at the Facility. During the period from January 2022 to

December 2022 alone, the port handled bulk cargo volumes to the

tune of 1.2 Mn. MT. The Board has assessed the Group's ability to

operate as a going concern for the next 18 months from the date of

signing the financial statements, based on the financial model

which was prepared as part of approving the 2023 budget.

The Directors considered the cash forecasts prepared for

twenty-four months beginning from 1 January 2023 up to 31st

December 2024, together with certain assumptions for revenue and

costs, to satisfy themselves of the appropriateness of the going

concern used in preparing the financial statements.

The Group had considered the following inflows in the budget

model prepared to mitigate funding risk as well as ensuring

continuity in business:

a) GBP0.56 million cash balance as at 31 December 2022;

b) Additional line of unsecured credit from Hunch Ventures amounting to GBP4.5Mn;

c) Share subscription (balance) amount due from Hunch GBP1.1Mn;

d) The recent fund-raise of GBP8.2Mn (net of cost) which has

just been concluded and closed

e) Expected cash flows from operations through to December, 2024.

The Directors took into account the risks and uncertainties,

facing the business as set out on page 20, and a sensitivity

analysis on the key revenue growth assumption and the effectiveness

of available mitigating actions was carried out in the model.

The Indian subsidiary has been in discussion with its consortium

of banks for restructuring the existing debt facility. The

Directors are confident that a restructured debt facility will be

afforded to the company, that will include an increase in the term

of the loan by an additional 7 years as well as moratorium on

principal repayments for a period of 2 years and a moratorium on

interest payable for 12 months.

The existing consortium banks had previously restructured the

debt facility in 2021 as a relief owing to the Covid-19

pandemic.

Based on the above indicators, after taking into account the

recent fundraising and the renegotiation on the debt restructuring,

the Directors believe that it remains appropriate to continue to

adopt the going concern in preparing the forecasts.

However, the fact that the debt restructure has not been

completed to date represents the existence of a material

uncertainty which may cast significant doubt on the Group's ability

to continue as a going concern. The financial statements do not

include the adjustments that would result if the Group was unable

to continue as a going concern.

Conclusion

The Port is ramping up bulk cargo operations and is all set to

commence container cargo operations in 2023. It is well on its way

to ramp up capacity utilization to achieve its targeted revenues

and diversify its commodity mix towards handling a wider variety of

bulk cargo as well as containers and liquids.

The Indian economy is expected to remain buoyant. With the level

of containerization in India remaining far below the global

average, and overall Port capacity in the country remaining short

of demand, the business case for a Port & logistics facility

like Karanja Port continues to stay robust.

Through the course of 2023, MPL will look to deepen its

engagement with existing lenders on the one side and new and

existing customers for incremental volumes on the other side. The

focus will be to diversify its product / commodity mix towards

container and liquid business, delivering enhanced and growing

revenues through its container business.

Consolidated Statement of Comprehensive Income

for the Year ended 31 December 2022

Notes Year ended Year ended

31 Dec 31 Dec 21

22 GBP000

GBP000

-------------------------------------------- ------ ----------- -----------

CONTINUING OPERATIONS

Revenue 5 4,872 1,801

Cost of sales 6 (1,449) (307)

----------- -----------

Gross margin 3,423 1,494

Administrative expenses 7 (9,978) (8,373)

OPERATING LOSS (6,555) (6,879)

Finance income 8(a) 38 40

Gains from extinguishment of debt 8(a) -- 5,408

Finance cost 8(b) (5,543) (4,576)

----------- -----------

NET FINANCING COST (5,505) 872

----------- -----------

LOSS BEFORE TAX (12,060) (6,007)

Tax income /(expense) for the year 9 2,421 (14)

----------- -----------

Loss FOR THE YEAR (9,639) (6,021)

=========== ===========

Loss for the year attributable

to:

Non-controlling interest (18) (5)

Owners of the parent (9,621) (6,016)

----------- -----------

LOSS FOR THE YEAR (9,639) (6,021)

=========== ===========

Other Comprehensive (Loss)/income:

Items that will not be reclassified

subsequently to profit or (loss)

Re-measurement of net defined benefit

liability 24 1 8

Items that will be reclassified

subsequently to profit or (loss)

Exchange differences on translating

foreign operations 808 (673)

----------- -----------

Other comprehensive expense for

the year 809 (665)

----------- -----------

Total comprehensive expense for

the year (8,830) (6,686)

=========== ===========

Total comprehensive expense for the year

attributable to:

Non-controlling interest (18) (5)

Owners of the parent (8,812) (6,681)

----------- -----------

(8,830) (6,686)

=========== ===========

Earnings per share (consolidated):

Basic & Diluted, for the year attributable *(0.232p) *(0.231p)

to ordinary equity holders 11

*1. On 13 September 2021 group has consolidated its share by way

of issuing one new share for every hundred shares held.

2. The accompanying notes on page 56 to 90 form part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 December 2022

Notes Year ended Year ended

31 Dec 31 Dec 21

22 GBP000

GBP000

Assets

Property, plant and equipment 12(a) 127,382 131,344

Intangible asset 12(b) 14 4

Non-current tax assets 19 (a) 2,108 --

------------ -----------

Total non-current assets 129,504 131,348

Inventory of traded goods 96 --

Trade and other receivables 13 14,110 18,484

Cash and cash equivalents 14 558 4,783

------------ -----------

Total current assets 14,764 23,267

Total assets 144,268 154,615

============ ===========

Liabilities

Non-current

Employee benefit obligations 17 53 43

Borrowings 18 39,165 39,932

Lease liabilities payable 20 1,611 1,562

Non-current liabilities 40,829 41,537

------------ -----------

Current

Employee benefit obligations 17 529 449

Borrowings 18 2,307 1,037

Current tax liabilities 19 (b) 17 415

Lease liabilities payable 20 817 795

Trade and other payable 20 8,388 10,171

------------ -----------

Current liabilities 12,058 12,867

------------ -----------

Total liabilities 52,887 54,404

============ ===========

Net assets 91,381 100,211

============ ===========

Equity

Stated Capital 16 143,851 143,851

Retained earnings 16 (26,022) (16,402)

Translation Reserve 16 (26,429) (27,237)

------------ -----------

Equity attributable to owners

of parent 91,400 100,212

------------ -----------

Non-controlling Interest (19) (1)

------------ -----------

Total equity 91,381 100,211

============ ===========

1. The accompanying notes on page 56 to 90 form part of these

consolidated financial statements.

2. The consolidated financial statements have been approved and

authorized for issue by the Board on 29 June, 2023.

Jay Mehta

Director

CONSOLIDATED STATEMENT OF CASH FLOWS

for the Year ended 31 December 2022

-----------------------------------------------------------------------------

Notes Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

------ ----------- -----------

CASH FLOW FROM OPERATING ACTIVITIES

Loss before tax (12,060) (6,007)

Non cash flow adjustments 22 11,748 5,149

----------- -----------

Operating (loss) before working

capital changes (312) (858)

Net changes in working capital 22 305 (4,669)

Taxes paid (85) --

----------- -----------

Net cash used in operating activities (92) (5,527)

----------- -----------

CASH FLOW FROM INVESTING ACTIVITIES

Used in purchase of property, plant

and equipment (1,425) (2,107)

Finance Income 8 38 27

Net cash used in investing activities (1,387) (2,080)

----------- -----------

CASH FLOW FROM FINANCING ACTIVITIES

From issue of additional shares 16 -- 9,224

From borrowing -- 984

Subscription money received 2,452 --

Repayment of bank borrowing principal (881) (641)

Interest paid on borrowings (4,217) (810)

Principal repayment of lease liabilities (138) (96)

Interest payment on leasing liabilities

principal -- (131)

Net cash from financing activities (2,784) 8,530

----------- -----------

Net change in cash and cash equivalents (4,262) 923

Cash and cash equivalents, beginning

of the year 4,783 3,895

Exchange difference on cash and

cash equivalents 37 (35)

----------- -----------

Cash and cash equivalents, end

of the year 558 4,783

=========== ===========

The accompanying notes on page 56 to 90 form part of these

consolidated financial statements .

Consolid ated St atement of Changes in Equity

for the Year ended 31 December 2022

Stated Translation Retained Other Non- controlling Total

Capital Reserve Earnings Components Interest Equity

of equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- ------------ ---------- ------------ ----------------- --------

Balance at

1 January 2022 143,851 (27,237) (16,402) -- (1) 100,211

Transaction with owners -- -- -- -- -- --

in their capacity as owners

--------- ------------ ---------- ------------ ----------------- --------

Loss for the year -- -- (9,621) -- (18) (9,639)

Foreign currency translation

difference for foreign

operations -- 808 -- -- -- 808

Re-measurement of net defined

benefit liability -- -- -- 1 -- 1

Re-measurement of net defined

benefit liability transfer

to retained earning -- -- 1 (1) -- --

Total comprehensive income

for the year -- 808 (9,620) -- (18) (8,830)

--------- ------------ ---------- ------------ ----------------- --------

Balance at

31 December 2022 143,851 (26,429) (26,022) -- (19) 91,381

========= ============ ========== ============ ================= ========

Balance at

1 January 2021 134,627 (26,564) (10,394) -- 4 97,673

Issue of share capital 10,102 -- -- -- -- 10,102

Share Issue cost (878) -- -- -- -- (878)

--------- ------------ ---------- ------------ ----------------- --------

Transaction with owners 143,851 (26,564) (10,394) -- 4 106,897

--------- ------------ ---------- ------------ ----------------- --------

Loss for the year -- -- (6,016) -- (5) (6,021)

Foreign currency translation

difference for foreign

operations -- (673) -- -- -- (673)

Re-measurement of net defined

benefit liability -- -- -- 8 -- 8

Re-measurement of net defined

benefit liability transfer

to retained earning -- -- 8 (8) -- --

--------- ------------ ---------- ------------ ----------------- --------

Total comprehensive income

for the year -- (673) (6,008) -- (5) (6,686)

--------- ------------ ---------- ------------ ----------------- --------

Balance at

31 December 2021 143,851 (27,237) (16,402) -- (1) 100,211

========= ============ ========== ============ ================= ========

The accompanying notes on page 56 to 90 form part of these

consolidated financial statements .

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. CORPORATE INFORMATION

Mercantile Ports & Logistics Limited (the "Company") was

incorporated in Guernsey under The Companies (Guernsey) Law, 2008

with registered number 52321 on 24 August 2010. Its registered

office and principal place of business is 1st Floor, Tudor House,

Le Bordage Rd, Guernsey GY1 1DB. It was listed on the Alternative

Investment Market ('AIM') of the London Stock Exchange on 7 October

2010.

The consolidated financial statements of the Company comprise of

the financial statements of the Company and its subsidiaries

(together referred to as the "Group"). The consolidated financial

statements have been prepared for the year ended 31 December 2022,

and presented in UK Sterling (GBP).

The principal activities of the Group are to develop, own and

operate a port and logistics facilities. As of 31 December 2022,

the Group had 44 (Forty-four) (2021: 47 (Forty-seven))

employees.

2. SIGNIFICANT ACCOUNTING POLICIES

a) BASIS OF PREPARATION

The consolidated financial statements have been prepared on a

historical cost basis except where otherwise stated. The

consolidated financial statements of the Group have been prepared

in accordance with International Financial Reporting Standards

("IFRS") and interpretations as adopted by the European Union and

also to comply with The Companies (Guernsey) Law, 2008.

Going Concern

Fiscal year 2022 was the first full year of operations at the

facility. During the period from January 2022 to December 2022

alone, the port handled bulk cargo volumes to the tune of 1.2 Mn

MT. The Board has assessed the Group's ability to operate as a

going concern for the next 18 months from the date of signing the

financial statements, based on the financial model which was

prepared as part of approving the 2023 budget.

The Directors considered the cash forecasts prepared for

Twenty-four months effective from 1 January 2023 up to 31st

December 2024, together with certain assumptions for revenue and

costs, to satisfy themselves of the appropriateness of the going

concern used in preparing the financial statements.

The group had considered the following inflows in the budget

model prepared to mitigate funding risk as well as ensuring

continuity in business:

a) GBP0.56 million cash balance as at 31 December 2022;

b) Additional line of unsecured credit from Hunch Ventures amounting to GBP4.5Mn;

c) Share subscription (balance) amount due from Hunch GBP1.1Mn;

d) The recent fund-raise of GBP8.2Mn (net of cost) which has just been concluded and closed

e) Expected cash flows from operations through to December, 2024.

The Directors took into account the risks and uncertainties

facing the business referred to below, and a sensitivity analysis

on the key revenue growth assumption and the effectiveness of

available mitigating actions was carried out in the model.

The Indian subsidiary has been in discussion with its consortium

of banks for restructuring the existing debt facility. The

Directors are confident that a restructured debt facility will be

afforded to the company, that will include an increase in the term

of the loan by an additional 7 years as well as moratorium on

principal repayments for a period of 2 years and a moratorium on

interest payable for 12 months.

The existing consortium banks had previously restructured the

debt facility in 2021 as a relief owing to the Covid-19

pandemic.

Based on the above indicators, after taking into account the

recent fundraising and the renegotiation on the debt restructuring,

the Directors believe that it remains appropriate to continue to

adopt the going concern in preparing the forecasts.

However, the fact that the debt restructure has not been

completed to date represents the existence of a material

uncertainty which may cast significant doubt on the Group's ability

to continue as a going concern. The financial statements do not

include the adjustments that would result if the Group was unable

to continue as a going concern.

(b) BASIS OF CONSOLIDATION

The consolidated financial statements incorporate the results of

the Company and entities controlled by the Company (its

subsidiaries) up to 31 December 2022. Subsidiaries are entities

over which the Company has the power to control the financial and

operating policies. The Company obtains and exercises control

through holding more than half of the voting rights. The financial

statements of the subsidiaries are prepared for the same period as

the Company using consistent accounting policies. The fiscal year

of Karanja Terminal & Logistics Private Limited (KTPL) ends on

March 31 and its accounts are adjusted for the same period for

consolidation.

Amounts reported in the financial statements of subsidiaries

have been adjusted where necessary to ensure consistency with the

accounting policies adopted by the Group.

Non-controlling interest

Non-controlling interest, presented as part of equity, represent

the portion of a subsidiary's profit or loss and net assets that is

not held by the Group. The Group attributes total comprehensive

income or loss of subsidiaries between the owners of the parent and

the non-controlling interests based on their respective ownership

interest.

(c) LIST OF SUBSIDIARIES

Details of the Group's subsidiaries which are consolidated into

the Company's financial statements are as follows:

Subsidiary Immediate Country of % Voting Rights % Economic

Parent Incorporation Interest

----------------------- -------------------- ---------------- ---------------- -----------

Karanja Terminal Mercantile

& Logistics (Cyprus) Ports & Logistics

Ltd Limited Cyprus 100.00 100.00

Karanja Terminal Mercantile

& Logistics Private Ports & Logistics

Limited* Limited India 7.08 7.08

Karanja Terminal Karanja Terminal

& Logistics Private & Logistics

Limited* (Cyprus) Ltd. India 92.70 92.70

* Financial year end for Karanja Terminal & Logistics

Private Limited ("KTLPL") is April to March, as same is governed by

Companies Act 2013, but for preparing group financials we have

considered January to December period.

(d) FOREIGN CURRENCY TRANSLATION

The consolidated financial statements are presented in UK

Sterling (GBP), which is the Company's functional currency. The

functional currency for all of the subsidiaries within the Group is

as detailed below:

-- Karanja Terminal & Logistics (Cyprus) Ltd ("KTLCL") - Euro

-- Karanja Terminal & Logistics Private Limited ("KTLPL") - Indian Rupees

Foreign currency transactions are translated into the functional

currency of the respective Group entity, using the exchange rates

prevailing at the date of the transactions (spot exchange rate).

Foreign exchange gains and losses resulting from the settlement of

such transactions and from the retranslation of monetary items

denominated in foreign currency at the year-end exchange rates are

recognised in the Consolidated Statement of Comprehensive

Income.

Non-monetary items are not retranslated at year-end and are

measured at historical cost (translated using the exchange rates at

the transaction date).

In the Group's financial statements, all assets, liabilities and

transactions of Group entities with a functional currency other

than GBP are translated into GBP upon consolidation.

On consolidation, the assets and liabilities of foreign

operations are translated into GBP at the closing rate at the

reporting date. The income and expenses of foreign operations are

translated into GBP at the average exchange rates over the

reporting period. Foreign currency differences are recognised in

other comprehensive income in the translation reserve. When a

foreign operation is disposed of, in part or in full, the relevant

amount in the translation reserves shall be transferred to the

profit or loss in the Consolidated Statement of Comprehensive

Income.

(e) REVENUE RECOGNITION

Revenue mainly consists of services relating to use of the port

by customers and includes services such as hiring of land,

wharf-age, hiring of equipment, loading/unloading, stevedoring,

storage and from value added activities viz. trading which is

incidental to providing port services.

To determine whether to recognise revenue, the Group follows a

5-step process:

1. Identifying the contract with a customer

2. Identifying the performance obligations

3. Determining the transaction price

4. Allocating the transaction price to the performance obligations

5. Recognizing revenue as and when performance obligation(s) are satisfied.

The total transaction price for a contract is allocated amongst

the various performance obligations based on their relative

standalone selling prices. The transaction price for a contract

excludes any amounts collected on behalf of third parties.

Revenue is recognised either at a point in time or over time,

when (or as) the Group satisfies performance obligations by

transferring the promised goods or services to its customers.

The Group recognises contract liabilities for consideration

received in respect of unsatisfied performance obligations and

reports these amounts as other liabilities in the statement of

financial position. Similarly, if the Group satisfies a performance

obligation before it receives the consideration, the Group

recognises either a contract asset or a receivable in its statement

of financial position, depending on whether something other than

the passage of time is required before the consideration is due.

Invoicing for services is set out in the contract.

The group does not believe there are elements of financing in

the contracts. There are no warranties or guarantees included in

the contract.

The specific recognition criteria described below must also be

met before revenue is recognised.

Port operation and logistics services

Revenue from port operation services including cargo handling,

storage, other ancillary port and logistics services including the

end to end value added services with respect to coal supply and

delivery are measured based upon cargo handled at rates specified

under the contract and charged on per metric tonne basis.

The performance obligation is satisfied using the output method;

this method recognises revenue based on the value of services

transferred to the customer, for example, quantity of cargo loaded

and unloaded and/or transported.

Revenue is recognized in the accounting period in which the

services are rendered and completed till reporting date.

Management determines if there are separate performance

obligations from which customer are being able to benefit from, for

example, barging, stevedoring or transportation.

Each of these services are distinct from the other. Customer may

choose one or more of these distinct services and revenue

recognition would be based on per metric tonne basis on

satisfaction of each service obligation.

Revenue from sale of traded goods

Revenue from sale of traded goods is recognized on transfer of

control to the customers, which is generally on dispatch of goods

and no significant uncertainty exists regarding the amount of the

consideration that will be derived from the sale of goods. Sales

are stated exclusive of Goods and Service Tax ("GST").

Income from long term leases

As a part of its business activity, the Group sub-leases land on

long term basis to its customers. Leases are classified as finance

lease whenever the terms of lease transfer substantially all the

risks and rewards of ownership to the lessee. All other leases are

classified as operating lease. In some cases, the Group enters into

cancellable lease / sub-lease transaction agreement, while in other

cases, it enters into non-cancellable lease / sub-lease agreement.

The Group recognises the income based on the principles of leases

as set out in IFRS 16 "Leases" and accordingly in cases where the

land lease / sub-lease agreement are cancellable in nature, the

income in the nature of upfront premium received / receivable is

recognised on operating lease basis i.e. on a straight line basis

over the period of lease / sub-lease agreement / date of memorandum

of understanding takes effect over lease period and annual lease

rentals are recognised on an accrual basis.

Interest income

Interest income is reported on an accrual basis using the

effective interest method.

(f) Borrowing cost

Borrowing costs directly attributable to the construction of a

qualifying asset are capitalised during the period of time that is

necessary to complete and prepare the asset for its intended use.

Other borrowing costs are expensed in the period in which they are

incurred and reported under finance costs.

(g) EMPLOYEE BENEFITS

i) Defined contribution plan (Provident Fund)

In accordance with Indian Law, eligible employees receive

benefit from Provident Fund, which is a defined contribution plan.

Both the employee and employer make monthly contributions to the

plan, which is administrated by the government authorities, each

equal to the specific percentage of employee's basic salary. The

Group has no further obligation under the plan beyond its monthly

contributions. Obligation for contributions to the plan is

recognised as an employee benefit expense in the Consolidated

Statement of Comprehensive Income when incurred.

ii) Defined benefit plan (Gratuity)

In accordance with applicable Indian Law, the Group provides for

gratuity, a defined benefit plan (the Gratuity Plan) covering

eligible employees. The Gratuity Plan provides a lump sum payment

to vested employees, at retirement or termination of employment,

and amount based on respective last drawn salary and the years of

employment with the Group. The Group's net obligation in respect of

the Gratuity Plan is calculated by estimating the amount of future

benefits that the employees have earned in return for their service

in the current and prior periods; that benefit is discounted to

determine its present value. Any unrecognised past service cost and

the fair value of plan assets are deducted. The discount rate is a

yield at reporting date on risk free government bonds that have

maturity dates approximating the term of the Group's obligation.

The calculation is performed annually by a qualified actuary using

the projected unit credit method. When the calculation results in a

benefit to the Group, the recognised asset is limited to the total

of any unrecognised past service cost and the present value of the

economic benefits available in the form of any future refunds from

the plan or reduction in future contribution to the plan.

The Group recognises all re-measurements of net defined benefit

liability/asset directly in other comprehensive income and presents

them within equity.

iii) Short term benefits

Short term employee benefit obligations are measured on an

undiscounted basis and are expensed as a related service provided.

A liability is recognised for the amount expected to be paid under

short term cash bonus or profit-sharing plans if the Group has a

present legal or constructive obligation to pay this amount as a

result of past service provided by the employee and the obligation

can be estimated reliably.

(h) Leases

As a lessee

The Company mainly has lease arrangements for converting the

waterfront into reclamation of land for construction of Port for

terminal and logistics operations. The land thus reclaimed consist

of the open space and also offices, warehouse spaces and

equipment.

The Group assesses whether a contract contains a lease at

inception of the contract. The Group recognises a right-of-use

asset and corresponding lease liability in the statement of

financial position for all lease arrangements where it is the

lessee, except for short-term leases with a term of twelve months

or less and leases of low value assets. For these leases, the Group

recognises the lease payments as an operating expense on a

straight-line basis over the term of the lease.

The lease liability is initially measured at the present value

of the future lease payments from the commencement date of the

lease. The lease payments are discounted using the interest rate

implicit in the lease or, if not readily determinable, the asset

and company specific incremental borrowing rates. Lease liabilities

are recognised within borrowings on the statement of financial

position. The lease liability is subsequently measured by

increasing the carrying amount to reflect interest on the lease

liability (using the effective interest method) and by reducing the

carrying amount to reflect the lease payments made. The Group

re-measures the lease liability, with a corresponding adjustment to

the related right-of-use assets, whenever:

-- The lease term changes or there is a significant event or

change in circumstances resulting in a change in the assessment of

exercise of a purchase option, in which case the lease liability is

re-measured by discounting the revised lease payments using a

revised discount rate;

-- The lease payments change due to the changes in an index or

rate or a change in expected payment under a guaranteed residual

value, in which case the lease liability is re-measured by

discounting the revised lease payments using an unchanged discount

rate;

-- A lease contract is modified, and the lease modification is

not accounted for as a separate lease, in which case the lease

liability is re-measured based on the lease term of the modified

lease by discounting the revised lease payments using a revised

discount rate at the effective date of modification.

The right-of-use assets are initially recognised on the SOFP at

cost, which comprises the amount of the initial measurement of the

corresponding lease liability, adjusted for any lease payments made

at or prior to the commencement date of the lease, any lease

incentive received and any initial direct costs incurred, and

expected costs for obligations to dismantle and remove right-of use

assets when they are no longer used. Right-of-use assets are

recognised within property, plant and equipment on the statement of

financial position. Right-of-use assets are depreciated on a

straight-line basis from the commencement date of the lease over

the shorter of the useful life of the right-of-use asset or the end

of the lease term.

The Group enters into lease arrangements as a lessor with

respect to some of its time charter vessels. Leases for which the

Group is an intermediate lessor are classified as finance or

operating leases by reference to the right-of-use asset arising

from the head lease. Income from operating leases is recognised on

a straight-line basis over the term of the relevant lease. Amounts

due from lessee under finance leases are recognised as receivables

at the amount of the Group's net investment in the leases. Finance

lease income is allocated to accounting periods so as to reflect a

constant periodic rate of return on the Group's net investment

outstanding in respect of these leases.

As a lessor

Lease income from operating leases where the Company is a lessor

is recognized in income on a straight-line basis over the lease

term unless a systematic basis more representative of the pattern

in which benefit from the use of the underlying asset is diminished

is suitable. The respective leased assets are included in the

balance sheet based on their nature.

Initial direct costs incurred in negotiating and managing an

operating lease are added to the cost of the leased asset and

recognized as an expense over the term on the same basis as the

lease income.

(i) INCOME TAX

Tax expense recognised in profit or loss comprises the sum of

deferred tax and current tax not recognised in other comprehensive

income or directly in equity. Current income tax assets and/or

liabilities comprise those obligations to, or claims from, fiscal

authorities relating to the current or prior reporting periods,

that are unpaid at the reporting date. Current tax is payable on

taxable profit, which differs from profit or loss in the financial

statements. Calculation of current tax is based on tax rates and

tax laws that have been substantively enacted by the end of the

reporting period.

Deferred tax

The accounting for income tax are accounted under the asset and

liability method, which requires the recognition of deferred tax

assets and liabilities for the expected future tax consequences of

events that have been included in the financial statements. Under

this method, we determine deferred tax assets and liabilities on

the basis of the differences between the financial statement and

tax bases of assets and liabilities by using enacted tax rates in

effect for the year in which the differences are expected to

reverse. The effect of a change in tax rates on deferred tax assets

and liabilities is recognized in income in the period that includes

the enactment date.

Deferred tax assets are recognized to the extent that management

believes that these assets are more probable than not to be

realized. In making such a determination, it considers all

available positive and negative evidence, including future

reversals of existing taxable temporary differences, projected

future taxable income, tax-planning strategies, and results of

recent operations. If it is determined that it would be able to

realize the deferred tax assets in the future in excess of the net

recorded amount, the necessary adjustment would be made to the

deferred tax asset valuation allowance, which would reduce the

provision for income tax.

(j) FINANCIAL ASSETS

The Financial assets and financial liabilities are recognised

when the Group becomes a party to the contractual provisions of the

financial instrument.

Financial assets are derecognised when the contractual rights to

the cash flows from the financial asset expire, or when the

financial asset and substantially all the risks and rewards are

transferred. A financial liability is derecognised when it is

extinguished, discharged, cancelled or expires .

Classification and initial measurement of financial assets

Except for those trade receivables that do not contain a

significant financing component and are measured at the transaction

price in accordance with IFRS 15, all financial assets are

initially measured at fair value adjusted for transaction costs

(where applicable).

Financial assets, other than those designated and effective as

hedging instruments, are classified into the following

categories:

-- amortised cost

-- fair value through profit or loss ("FVTPL")

-- fair value through other comprehensive income ("FVOCI").

In the periods presented, the corporation does not have any

financial assets categorised as FVOCI.

The classification is determined by both:

-- the entity's business model for managing the financial asset

-- the contractual cash flow characteristics of the financial asset.

All income and expenses relating to financial assets that are

recognised in profit or loss are presented within finance costs,

finance income or other financial items, except for impairment of

trade receivables which is presented within other expenses.

Subsequent measurement of financial assets

Financial assets at amortised cost

Financial assets are measured at amortised cost if the assets

meet the following conditions (and are not designated as

FVTPL):

-- they are held within a business model whose objective is to

hold the financial assets and collect its contractual cash

flows

-- the contractual terms of the financial assets give rise to

cash flows that are solely payments of principal and interest on

the principal amount outstanding

After initial recognition, these are measured at amortised cost

using the effective interest method. Discounting is omitted where

the effect of discounting is immaterial. The Group's cash and cash

equivalents, trade and most other receivables fall into this

category of financial instruments as well as listed bonds that were

previously classified as held-to-maturity under IAS 39.

Impairment of financial assets

IFRS 9's impairment requirements use more forward-looking

information to recognise expected credit losses - the 'expected

credit loss (ECL) model'. This replaces IAS 39's 'incurred loss

model'. Instruments within the scope of the new requirements

included loans and other debt-type financial assets measured at

amortised cost and FVOCI, trade receivables, contract assets

recognised and measured under IFRS 15 and loan commitments and some

financial guarantee contracts (for the issuer) that are not

measured at fair value through profit or loss.

(k) FINANCIAL LIABILITIES

Classification and measurement of financial liabilities

As the accounting for financial liabilities remains largely the

same under IFRS 9 compared to IAS 39, the Group's financial

liabilities were not impacted by the adoption of IFRS 9. However,

for completeness, the accounting policy is disclosed below.

The Group's financial liabilities include borrowings, trade and

other payables and derivative financial instruments.

Financial liabilities are initially measured at fair value, and,

where applicable, adjusted for transaction costs unless the Group

designated a financial liability at fair value through profit or

loss.

Subsequently, financial liabilities are measured at amortised

cost using the effective interest method except for derivatives and

financial liabilities designated at FVTPL, which are carried

subsequently at fair value with gains or losses recognised in

profit or loss (other than derivative financial instruments that

are designated and effective as hedging instruments).

All interest-related charges and, if applicable, changes in an

instrument's fair value that are reported in profit or loss are

included within finance costs or finance income.

(l) PROPERTY, PLANT AND EQUIPMENT

Items of property, plant and equipment are measured at cost less

accumulated depreciation and impairment losses.

The Group is in the process of constructing its initial project;

the creation of a modern and efficient port and logistics facility

in India. All the expenditures directly attributable in respect of

the port and logistics facility under development are carried at

historical cost under Capital Work in Progress as the Board

believes that these expenses will generate probable future economic

benefits. These costs include borrowing cost, professional fees,

construction costs and other direct expenditure. After

capitalisation, management monitors whether the recognition

requirements continue to be met and whether there are any

indicators that capitalised costs may be impaired.

Cost includes expenditures that are directly attributable to the

acquisition of the asset and income directly related to testing the

facility is offset against the corresponding expenditure. The cost

of constructed asset includes the cost of materials,

sub-contractors and any other costs directly attributable to

bringing the asset to a working condition for its intended use.

Purchased software that is integral to the functionality of the

related equipment is capitalised as part of that equipment.

Parts of the property, plant and equipment are accounted for as

separate items (major components) on the basis of nature of the

assets.

Depreciation is recognised in the Consolidated Statement of

Comprehensive Income over the estimated useful lives of each part

of an item of property, plant and equipment. For items of property,

plant and equipment under construction, depreciation begins when

the asset is available for use, i.e. when it is in the condition

necessary for it to be capable of operating in the manner intended

by management. Thus, as long as an item of property, plant and

equipment is under construction, it is not depreciated. Leasehold

improvements are amortised over the shorter of the lease term or

their useful lives.

Depreciation is calculated on a straight-line basis.

The estimated useful lives for the current year are as -

Assets Estimated Life of assets

Lease hold Land Development Over the period of Concession

Agreement by Maharashtra Maritime

board (MMB) .

Marine Structure, Dredged Channel Over the period of Concession

Agreement by Maharashtra Maritime

board (MMB) .

Non Carpeted road other than RCC 3 Years

Office equipment 3-5 Years

Computers 2-3 Years

Computer software 5 Years

Plant & machinery 15 Years

Furniture 5-10 Years

Vehicles 5-8 Years

Depreciation methods, useful lives and residual value are

reassessed at each reporting date.

Gains or losses arising on the disposal of property, plant and

equipment are determined as the difference between the disposal

proceeds and the carrying amount of the assets are recognised in

profit or loss within other income or other expenses.

Impairment of Property, Plant and Equipment

Internal and external sources of information are reviewed at the

end of the reporting period to identify indications that the

property, plant and equipment may be impaired. When impairment

indicators exist the management compares the carrying value of the

property, plant and equipment with the fair value determined as the

higher of fair value less cost of disposal or value in use, also

refer note 3.

Property, plant and equipment is stated at cost, net of

accumulated depreciation and/or impairment losses, if any. There is

currently no impairment of property, plant and equipment.

(m) Trade receivables and payables

Trade receivables are financial assets at amortised costs,

initially measured at the transaction price, which reflects fair

value, and subsequently at amortised cost less impairment. In

measuring the impairment, the Group has applied the simplified

approach to expected credit losses as permitted by IFRS9. Expected

credit losses are assessed by considering the Group's historical

credit loss experience, factors specific for each receivable, the

current economic climate and expected changes in forecasts of

future events. Changes if any in expected credit losses are

recognised in the Statement of Comprehensive Income.

Trade payables are financial liabilities at amortised cost,

measured initially at fair value and subsequently at amortised cost

using an effective interest rate method.

(n) Advances

Advances paid to the EPC contractor and suppliers for

construction of the facility are categorised as advances and will

be offset against future work performed by the contractor.

(o) Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and bank

deposits that can easily be liquidated into known amounts of cash

and which are subject to an insignificant risk of changes in

value.

(p) Stated capital and reserves

Shares have 'no par value'. Stated capital includes any premiums

received on issue of share capital. Any transaction costs

associated with the issuing of shares are deducted from stated

capital, net of any related income tax benefits.

Foreign currency translation differences are included in the

translation reserve. Retained earnings include all current and

prior year retained profits.

(q) New standard and interpretation

There are no accounting pronouncements, which have become

effective from 1 January 2023 that have a significant impact on the

Group's consolidated financial statements.

(r) Standards, amendments and interpretations to existing

standards that are not yet effective and have not been adopted

early by the group

Following new standards or amendments that are not yet effective

and have been issued by the IASB which are not applicable or have

material impact on the Group.

-- IFRS 17 Insurance Contracts

-- Amendments to IFRS 17 Insurance Contracts (Amendments to IFRS 17 and IFRS 4)

-- Effective date of amendments on disclosure of accounting policies

-- Amendments to IAS 8 on accounting estimates

-- Amendments to IAS 12 on deferred tax related to Assets and

Liabilities from a single transaction.

-- Classification of Liabilities as Current or Non-current (Amendments to IAS 1)

3. SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

The following are significant management judgements in applying

the accounting policies of the Group that have the most significant

effect on the financial statements.

Recognition of income tax liabilities

MPL group's Indian subsidiary had filed a writ petition in

Hon'ble High court for seeking relief against the order passed by

the Income Tax Appellate Tribunal (ITAT) for the two assessment

years 2011-12 and 2012-13, which was decided in favour of the

group's Indian subsidiary. As per these orders, the matter was sent

back to the files of Principal Commissioner of Income Tax (Appeals)

for re-adjudication following the ITAT orders for assessment years

2013-14 to 2015-16.

The Principal Commissioner of Income Tax (Appeals) vide its

order dated 20(th) March, 2023, issued an order in favour of the

Group's subsidiary for the assessment years 2011-12 and

2012-13.

By virtue of this order, the demand made by the Income tax

department at present is not recoverable. As such the order of the

Principal Commissioner of Income Tax (Appeals) is of a protective

nature, hence the management has decided to prudently reverse the

provisions and the interest accrued on the same for the subject

years.

However, since the Income tax department has preferred an appeal

in Supreme Court. In light of the uncertainty of the final outcome,

the Group has disclosed the same under the head of contingent

liability in note no 25.

Impairment Review

The Audit Committee considered the significant judgements,

assumptions and estimates made by management in preparing the

impairment review to ensure that they were appropriate. In

particular, the cash flow projections, port capacity, tariffs used,

margins, discount rates, inflation and sensitivity analysis were

reviewed. The Audit Committee also considered external market

factors to assess reasonableness of management assumptions.

The Committee also considered the valuation done by an

independent external expert valuer.

As per the valuation report, the value of the cash generating

unit (CGU) group (considering the discounting rate of 13.40%) was

determined to be GBP131.53 Mn.

The review did not result in any impairment during the year,

however there was minimal headroom in the calculation.

The group carried out sensitivity analysis on the following:

a) reduction in Revenue by 10%, the assets would be impaired by GBP 16.17 Mn.

b) reduction in EBIDTA by 10%, the assets would be impaired by GBP 11.70 Mn.

c) increase in the discounting rate by 1%, the assets would be impaired by GBP 11.20 Mn.

Considering the above sensitivity analysis, the group's asset

would be impaired.

Taking the above into account, together with the documentation

presented and the explanations given by management, the committee

is satisfied with the thoroughness of the approach and judgements

taken.

4. SEGMENTAL REPORTING

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The Board of Directors of are identified as the Chief operating

decision maker. The Group has only one operating and geographic

segment, being the project on hand in India and hence no separate

segmental report presented.

5. REVENUE FROM OPERATION

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

----------- -----------

Sale of goods 561 --

Cargo handling income 1,968 710

Lease income 1,728 1,091

Other operating income 615 --

----------- -----------

4,872 1,801

=========== ===========

The Company has given certain land portions on operating lease.

These lease arrangement is for a period 40 months. Lease is

renewable for further period on mutually agreeable terms.

The total future minimum lease rentals receivable at the SOFP

date is as under:

Payments falling due As on As on

31 Dec 22 31 Dec 22

INR in million GBP million

2023 46.92 0.48

2024 9.60 0.10

2025 9.60 0.10

2026 9.60 0.10

Fifth year and above 48.00 0.49

---------------- -------------

Total 123.72 1.27

================ =============

6. COST OF SALES

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

------------------------- ----------- -----------

Wharf-age expense 411 72

Other operating expense 1,134 235

Changes in inventory (96) --

1,449 307

=========== ===========

7. ADMINISTRATIVE EXPENSES

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

----------------- -----------------

Employee costs 635 577

Directors' remuneration and fees 476 423

Operating lease rentals 9 13

Foreign exchange loss 68 84

Depreciation 6,231 3,132

Other administration costs 2,559 4,144

----------------- -----------------

9,978 8,373

----------------- -----------------

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

-------------- -----------------

Interest on bank deposits 38 40

-------------- -----------------

Gain from extinguishment of debt* -- 5,408

-------------- -----------------

8. (a) FINANCE INCOME

* During the previous year, Group had received sanction from

lenders for one-time restructuring (OTR) of loan. The Management

has tested the OTR for debt modification under IFRS 9. The revised

cash out flow discounted at original EIR 13.45% resulted in net

gain of GBP 5.41 million and was effected accordingly in 2021. The

corresponding effect of debt modification has been considered in

2022 financials.

8. (b) FINANCE EXPENSES

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

----------- -----------

Interest on term loan 4,726 1,977*

Interest others 817 2,599

----------- -----------

5,543 4,576

=========== ===========

* Interest on the term loan is capitalized against assets under

construction up to March 2021. As major construction work is

completed and assets under construction transferred into service,

the capitalization of interest ceased on that part and interest

expensed out to the profit and loss account from April 2021

onwards.

The capitalization rate used to determine the amount of

borrowing costs to be capitalized is the weighted average interest

rate applicable to the entity's general borrowings during the year,

in this case 13.45% up to 10 June 2021 and 9.5% effective from 11

June 2021.

The lenders have reset the interest rate from 9.5% pa to 9.55%

p.a. on Term Loan and from 10.50% pa to 10.55% pa on FITL with

effect from June 2022.

9. INCOME TAX

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

-------------------- -------------------

Loss Before Tax (12,060) (6,007)

Applicable tax rate in India* 26.00% 26.00%

-------------------- -------------------

Expected tax credit (3,136) (1,562)

Reconciling items

Non-deductible losses of MPL and Cyprus

entities 320 994

Un-recognised deferred tax asset 2,025 --

Non-deductible expenses 791 568

Reversal of outstanding tax liability

and interest thereon pertaining to earlier

years 2,421 (14)

2,421 (14)

==================== ===================

* Considering that the Group's operations are presently based in

India, the effective tax rate of the Group of 26% (prior year 26%)

has been computed based on the current tax rates prevailing in

India. In India, income earned from all sources (including interest

income) are taxable at the prevailing tax rate unless exempted.

However, administrative expenses are treated as non-deductible

expenses until commencement of operations.

MPL group's subsidiary had filed a writ petition in Hon'ble High

court for seeking relief against the order passed by the Income Tax

Appellate Tribunal (ITAT) for the two assessment years 2011-12 and

2012-13, which was decided in favour of the Group. As per these

orders, the matter was sent back to the files of Principal

Commissioner of Income Tax (Appeals) for re-adjudication following

the ITAT orders for assessment years 2013-14 to 2015-16.

The Principal Commissioner of Income Tax (Appeals) vide its

order dated 20(th) March, 2023, issued an order in favour of the

Group's subsidiary for the assessment years 2011-12 and

2012-13.

By virtue of this order, the demand made by the Income tax

department at present is not recoverable. As such the order of the

Principal Commissioner of Income Tax (Appeals) is of a protective

nature, hence the management has decided to prudently reverse the

provisions and the interest accrued on the same for the subject

years.

However, since the Income tax department has preferred an appeal

in Supreme Court, in light of the uncertainty of the final outcome,

the Group has disclosed the same under the head of contingent

liability in note no 25.

The Company is incorporated in Guernsey under The Companies

(Guernsey) Law 2008, as amended. The Guernsey tax rate for

companies is 0%. The rate of withholding tax on dividend payments

to non-residents by companies within the 0% corporate income tax

regime is also 0%. Accordingly, the Company will have no liability

to Guernsey income tax on its income and there will be no

requirement to deduct withholding tax from payments of dividends to

non-resident shareholders.

In Cyprus, the tax rate for companies is 12.5% with effect from

1 January 2014. There is no tax expense in Cyprus.

Due to uncertainty that Indian entity will generate sufficient

future taxable income to offset business losses incurred to realise

deferred tax assets, the management has not recognised the Deferred

Tax Asset amounting to INR: 67.46 crore (GBP6.76 Mn.) (2021- INR:

47.88 crore (GBP4.77 Mn.).

10. AUDITORS' REMUNERATION

The following are the details of fees paid to the auditors,

Grant Thornton UK LLP and Indian auditors, in various capacities

for the year:

Year ended Year ended

31 Dec 31 Dec 21

22

GBP000 GBP000

----------- -----------

Audit Fees

Fees payable to the auditor for the audit of

the Group's financial statements * 171 130

Non-audit service:

Interim Financial Statement Review 10 9

Non -audit services 110 80

291 219

----------- -----------

* This includes prior year overruns charged during the year

aggregating to GBP 12,500 (2021: GBP 7,210).

11. EARNINGS PER SHARE

Both basic and diluted earnings per share for the year ended 31

December 2022 have been calculated using the loss attributable to

equity holders of the Group of GBP9.621 million (prior year loss of

GBP6.02 million).

Year ended Year ended

31 Dec 22 31 Dec 21

Loss attributable to equity holders GBP (9,621,000) GBP (6,016,000)

of the parent

Weighted average number of shares

used in basic and diluted earnings

per share 41,499,699 26,000,334

EARNINGS PER SHARE

Basic and Diluted earnings per share (0. 232p) (0. 231p)

On 9th September 2021 The group has successfully completed fund

raise by placing 2,244,947,810 new Ordinary Shares at a price of

0.45 pence per share. Also on 13 September 2021 group has

consolidated its share capital by way of issuing 1 share for every

100 shares.

12 (a). PROPERTY, PLANT AND EQUIPMENT

Details of the Group's property, plant and equipment and their

carrying amounts are as follows:

Computers Office Furniture Vehicles Plant Port Right Capital Total

Equipment & Asset of use Work in

Machinery Progress

Asset

--------- --------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------- ----------- ---------- --------- ---------- --------- -------- ---------- ---------

Gross

carrying

amount

Balance 1 Jan

2022 42 535 345 586 47 109,523 1,721 24,149 136,948

Net Exchange

Difference 0 4 2 3 0 777 10 140 936

Additions 7 31 125 36 16 233 304 605 1,357

Transfers -- -- -- -- -- -- -- -- --

from

CWIP ^

Disposals -- -- -- -- -- -- -- -- --

Balance 31

Dec

2022 49 570 472 625 63 110,533 2,035 24,894 139,241

---------

Depreciation

Balance 1 Jan

2022 (36) (115) (91) (362) (4) (4,668) (328) -- (5,604)

Net Exchange

Difference (1) (1) (0) (2) (0) (26) (3) -- (33)

Charge for

the

year (4) (111) (23) (48) (4) (5,774) (258) -- (6,222)

Disposals -- -- -- -- -- -- -- -- --

Balance 31

Dec

2022 (41) (227) (114) (412) (8) (10,468) (589) -- (11,859)

---------

Carrying

amount

31 Dec 2022 8 343 358 213 55 1,00,065 1,446 24,894 127,382

-------------- ---------- ----------- ---------- --------- ---------- --------- -------- ---------- ---------

The Group has leased various assets including land and

buildings. As at 31 December 2022, the net book value of recognised

right-of use assets relating to land and buildings was GBP 1.45

million (2021: GBP 1.39 million). The depreciation charge for the

period relating to those assets was GBP 0.26 million (2021: GBP

0.09 million).

Borrowing costs capitalised during 2022 - Nil (2021: GBP

1,051).

Amounts recognised in the statement of income are detailed

below:

Particular GBP000 GBP000

31 Dec 2022 31 Dec 2021

Depreciation on right-of-use

assets 258 95

----------------- -----------------

Interest expense on lease liabilities 181 175

----------------- -----------------

Expense relating to short-term

leases 9 13

----------------- -----------------

Expense relating to low-value

leases 0 1

----------------- -----------------

448 284

----------------- -----------------

Computers Office Furniture Vehicles Plant Port Right Capital Total

Equipment & Machinery Asset of use Work in

Progress

Asset

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------- ---------- ----------- ---------- --------- ------------ -------- -------- ---------- --------

Gross

carrying

amount

Balance 1 Jan

2021 41 136 262 577 25 50,214 1,733 80,801 133,789

Net Exchange

Difference (1) (1) (2) (3) (1) (352) (12) (566) (938)

Additions 2 13 19 12 -- -- -- 4,051 4,051

Transfers

from CWIP

^ -- 387 66 -- 23 59,661 -- (60,137) --

Disposals -- -- -- -- -- -- -- -- --

Balance 31

Dec 2021 42 535 345 586 47 109,523 1,721 24,149 136,948

--------

Depreciation

Balance 1 Jan

2021 (30) (69) (64) (320) (3) (1,725) (235) -- (2,446)

Net Exchange

Difference (2) 1 -- 2 1 (29) 2 -- (27)

Charge for

the year (4) (45) (27) (44) (2) (2,914) (95) -- (3,131)

Disposals -- -- -- -- -- -- -- -- --

Transfer from -- -- -- -- -- -- -- -- --

computer

to software

-------------- ---------- ----------- ---------- --------- ------------ -------- -------- ---------- --------

Balance 31

Dec 2021 (36) (115) (91) (362) (4) (4,668) (328) -- (5,604)

-------------- ---------- ----------- ---------- --------- ------------ -------- -------- ---------- --------

Carrying

amount

31 Dec 2021 6 420 254 224 43 104,855 1,393 24,149 131,344

-------------- ---------- ----------- ---------- --------- ------------ -------- -------- ---------- --------

^ During 2021, Company has capitalized an additional 22 acres of

land, 340 meter of jetty and various support infrastructure cost

and accordingly GBP 60,137 thousand has been transferred from CWIP

to under various head i.e. Port Asset GBP 59,661 thousand, plant

and machinery GBP 23 thousand, Furniture GBP 66 thousand and office

equipment GBP 387 thousand.

The Group has leased various assets including land and

buildings. As at 31 December 2021, the net book value of recognised

right-of use assets relating to land and buildings was GBP 1.39

million (2020: GBP 1.49 million). The depreciation charge for the

period relating to those assets was GBP 0.09 million (2020: GBP

0.15 million).

Assets provided as security

-- The following asset are provided as security for lease

liability payable as described in Note 20:

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

Vehicles 214 224

------------ ------------

214 224

------------ ------------

The vehicles, which are free from encumbrances, will also form

as a subservient charge of hypothecation towards securitisation of

debt.

All other immovable and movable property with a carrying value

of GBP 127,172,000 (2021: GBP131,124,000) is under hypothecation in

favour of the "Term lenders".

The Port facility being developed in India has been hypothecated

by the Indian subsidiary as security for the bank borrowings

(revised outstanding as against the borrowing limit sanctioned in

2021 as per OTR is INR 462 crore [GBP46.32 million]. (2021: INR

475.57 crore (GBP47.41 million)) for part financing the build out

of the facility.

The Indian subsidiary has estimated the total project cost of

INR 1,404 crore (GBP138.10 million) towards construction of the

port facility. Out of the aforesaid project cost, the contract

signed with the major contractor is INR 1,049 crores (GBP105.21

million). As of 31 December 2022, the contractual amount (net of

advances) of INR 48.03 crores (GBP4.82 million) work is unexecuted.

There were no other material contractual commitments.

12 (b). Intangible Asset

Intangible

Asset -

Asset

Software

Software

GBP000

----------------------------- -----------

Gross carrying amount

Balance 1 Jan 2022 14

Exchange Difference 0

Additions 19

Disposals --

Balance 31 Dec 2022 33

-----------

Depreciation

Balance 1 Jan 2022 (10)

Exchange Difference (0)

Charge for the year (9)

Disposals --

----------------------------- -----------

Balance 31 Dec 2022 (19)

----------------------------- -----------

Carrying amount 31 Dec 2022 14

----------------------------- -----------

Intangible

Asset -

Asset

Software

Software

GBP000

----------------------------- -----------

Gross carrying amount

Balance 1 Jan 2021 13

Exchange Difference (1)

Additions 2

Disposals --

Balance 31 Dec 2021 14

-----------

Depreciation

Balance 1 Jan 2021 (9)

Exchange Difference --

Charge for the year (1)

Disposals --

----------------------------- -----------

Balance 31 Dec 2021 (10)

----------------------------- -----------

Carrying amount 31 Dec 2021 4

----------------------------- -----------

13. TRADE AND OTHER RECEIVABLES

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

----------- -----------

Deposits 1,442 2,493

Advances

- Related Party 1,160 3,612

- Others 10,483 12,077

Accrued Interest of fixed deposits 3 2

Accrued Income 126 16

Debtors

- Related Party 107 107

- Prepayment 102 134

- Others 687 43

----------- -----------

14,110 18,484

----------- -----------

Advances include payment to EPC contractor of GBP 7.29 million

(2021: GBP 7.09 million) towards mobilisation advances and quarry

development. These advances will either be recovered as a deduction

from the invoices being raised by the contractor over the contract

period or refunded.

The debtors - other include trade receivable other GBP 0.00

million (2021: GBP Nil million) which is past due for 30 days'

management estimate that amount is fully realisable hence no

provision for expected credit loss is made for the same amount.

The Group applies the IFRS 9 simplified approach to measuring

expected credit losses using a lifetime expected credit loss

provision for trade and other receivable. To measure expected

credit losses on a collective basis, trade and other receivables

are grouped based on similar credit risk and aging. The assets have

similar risk characteristics to the trade receivables for similar

types of contracts.

The expected loss rates are based on the Group's historical

credit losses experienced. The historical loss rates are then

adjusted to reflect current and forward-looking information, any

known legal and specific economic factors, including the credit

worthiness and ability of the customer to settle the

receivables.

The Group renegotiations or modifications of contractual cash

flows of a financial asset, which results in de-recognition, the

revised instruments are treated as a new or else the group

recalculates the gross carrying amount of the financial asset.

14. CASH AND CASH EQUIVALENTS

Year ended Year ended

31 Dec 22 31 Dec 21

GBP000 GBP000

----------- -----------

Cash at bank and in hand 389 4,571

Deposits* 169 212

----------- -----------

558 4,783

----------- -----------

Cash at bank earns interest at floating rates based on bank

deposit rates. The fair value of cash and short-term deposits is

GBP0.56 million (2021: GBP4.78 million).

Included in cash and cash equivalents is GBP0.00 million (2021:

GBP0.74 million) that is within a bank account in the name of Hunch

Ventures (Karanja), as a result of the 2018 and 2021 share sale.

The Company is the beneficiary of the account. During the year, we

have been able to draw money out of this account to cover working

capital throughout the year.