Wynnstay Properties PLC Result of AGM, GM and Trading Update (0216T)

20 July 2022 - 12:18AM

UK Regulatory

TIDMWSP

RNS Number : 0216T

Wynnstay Properties PLC

19 July 2022

WYNNSTAY PROPERTIES PLC

("Wynnstay" or the "Company")

Results of Annual General Meeting and General Meeting

and

Trading Update

19 J uly 2022

Results of Annual General Meeting and General Meeting

The Company announces that at its Annual General Meeting ("AGM")

and General Meeting ("GM") held earlier today all resolutions put

to the meetings were duly passed by poll vote.

The full text of the resolutions considered at the AGM is set

out in the Notices of AGM and GM, appended to the Annual Report

2022 and Share Buy-Back Circular respectively and available on the

Company's website at www.wynnstayproperties.co.uk .

Trading Update

At the AGM Philip Collins, Chairman, informed shareholders that

the Board had reviewed the Company's trading position, budget for

the year, and portfolio at its Board meeting prior to the AGM and

reported as follows:

Rent collection: Of the rents due at 24 June 2022, for all

practical purposes 100% of rents due to Wynnstay have been

collected, with just under GBP2,000 outstanding in total.

Occupancy: The portfolio is fully let and income producing. Thus

at present Wynnstay has no unforeseen property costs, such as empty

business rates, insurance, security or other costs.

Demand and market conditions: Despite all the economic and

political uncertainties, there continues to be strong occupational

demand for industrial, including trade counter, units which

comprise the majority of Wynnstay's portfolio, and this has

undoubtedly contributed to the portfolio being fully let as well as

to a number of good rent reviews negotiated over the past four

months. The demand reflects, in part, shortage of supply of good

quality units in the right locations to meet tenants' requirements.

The increases in interest rates this year appear to have resulted

in reported upward movement in yields on transactions in the

investment market from those prevailing in 2021. This may result in

calmer market conditions later in the year to those seen over the

past 18 months, with a greater focus on rental growth

opportunities. The market for the rest of the year and beyond will

be greatly influenced by the evolving economic conditions, changes

in interest rates and government actions to control inflation and

stimulate growth in the economy.

For further information please contact:

Wynnstay Properties plc

Philip Collins (Chairman)

020 7554 8766

WH Ireland Limited (Nominated Adviser and Broker):

Chris Hardie, Ben Thorne, Megan Liddell

020 7220 1666

LEI number is 2138006MASI24JYW5076.For more information on

Wynnstay visit: www.wynnstayproperties.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGZKLFFLDLFBBQ

(END) Dow Jones Newswires

July 19, 2022 10:18 ET (14:18 GMT)

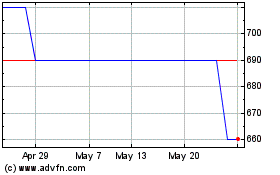

Wynnstay Properties (AQSE:WSP.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

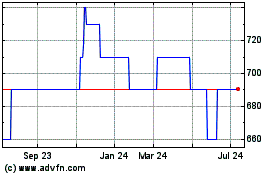

Wynnstay Properties (AQSE:WSP.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024