ANZ, Citi, Deutsche Bank Face Trial in Australian Criminal Cartel Case

08 December 2020 - 4:57PM

Dow Jones News

By Alice Uribe

SYDNEY--Australia and New Zealand Banking Group Ltd., Deutsche

Bank AG, and a unit of Citigroup along with six of their senior

banking executives will stand trial in Australia's federal court on

criminal cartel charges, Australia's competition regulator

said.

The charges relate to ANZ's 2.5 billion Australian dollars

(US$1.85 billion) institutional share placement in August, 2015,

and how the investment banks, in their capacity as joint

underwriters, managed a shortfall in shares.

The Australian Competition and Consumer Commission on Tuesday

alleged that ANZ and each of the bank executives were knowingly

concerned in some or all of the cartel conduct.

"As this matter involves criminal charges, we will not be

commenting further at this time," said ACCC Chair Rod Sims.

Deutsche Bank in a statement said it would vigorously defend the

charges. The bank and its staff, including two former employees,

acted in a manner consistent with the regulator's market integrity

rules, it said. Citi also denied the allegations made against its

Citigroup Global Markets Australia Pty Ltd. unit, while an ANZ

spokesperson declined to comment.

For each criminal cartel charge, the banks could be fined up to

A$10 million or three times the benefit obtained by the alleged

offenses or 10% of the company's annual turnover in Australia,

whichever is greater.

An individual convicted of a criminal-cartel offense could be

sentenced for up to 10 years in jail or fined up to A$420,000, or

both.

The case was referred to the federal court from a lower court on

Tuesday. Procedural matters are due to be heard on December 15.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

December 08, 2020 00:42 ET (05:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

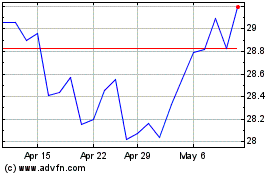

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Dec 2024 to Dec 2024

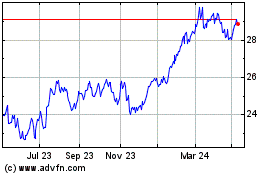

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Dec 2023 to Dec 2024