Bain Capital Closes $3 Billion Asia Private-Equity Fund

14 December 2015 - 3:00PM

Dow Jones News

HONG KONG—Global private-equity firm Bain Capital LLC has raised

$3 billion for a new Asia-focused fund, according to a person

familiar with the situation, adding to the sector's dry powder

focused on cutting deals in the region.

The new fund, which closed having raised more than its initial

target of $2.5 billion, will be Bain Capital's third dedicated to

Asia. It will begin making investments next year, the person

said.

The fresh cash comes as capital is becoming scarcer across Asia,

with lenders cutting back and fewer companies launching initial

public offerings. Private-equity firms across the region are,

meanwhile, hunting for bargains as valuations for many

once-highflying companies come back to earth.

The new fund will invest in a range of sectors from consumer

products to financial services, the person said. In recent years

Bain Capital has carved out a reputation for savvy investing in the

restaurant-chain business globally, following successful buyout

deals for the operators of Burger King, Dunkin' Donuts, and

Domino's Pizza chains.

It has continued to invest in those types of businesses in Asia,

including buying Japan's biggest restaurant operator Skylark Co. in

a 2011 buyout. Last year, Bain listed Skylark in a $600

million-plus initial public offering and has continued to pare its

stake this year. It also made a hefty return on its investment in

the Japanese operator of the Domino's Pizza franchise when it sold

a 75% stake in the business to Australia's Domino's Pizza

Enterprises Ltd. in 2013. Bain Capital has kept its remaining 25%

stake in that business.

Bain's latest $3 billion fund adds to a list of big fundraisings

this year in Asia by private-equity firms. RRJ Capital closed a new

$4.5 billion fund in September and Baring Asia Private Equity

raised a $4 billion fund in February. KKR & Co.'s Asian fund,

raised in 2013, remains the region's largest at $6 billion. Those

firms have been among the most active deal makers in the region,

but still have significant amount of capital to put to work.

Bain's second pan-Asia fund, which oversees $2.3 billion, has

been largely invested and is among the better-performing funds in

the region since it was raised in 2012. That fund has generated a

net internal rate of return of 13.8% as of the end of September,

according to one person familiar with the figures.

The Boston-based private-equity firm, which manages $75 billion

across a range of asset classes, first expanded into Asia in 2006.

It hired Chinese deal maker Jonathan Zhu from Morgan Stanley that

year to build the firm's operations. Mr. Zhu remains in charge,

alongside David Gross-Loh in Japan and Amit Chandra in India.

Bain Capital's own executives have committed $250 million to

invest alongside the fund, the person said.

Returning cash has been a major issue for private-equity funds

in Asia, where minority stakes, regulatory hurdles and share

lockups can often leave money tied up in companies longer than

expected, dragging down returns. Pension funds and endowments are

often eager to see cash returned so they can meet their obligations

to policyholders and recycle funds into new opportunities.

Write to Rick Carew at rick.carew@wsj.com

(END) Dow Jones Newswires

December 13, 2015 22:45 ET (03:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

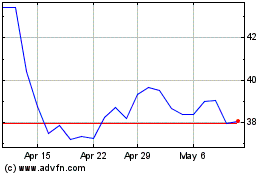

Dominos Pizza Enterprises (ASX:DMP)

Historical Stock Chart

From Dec 2024 to Dec 2024

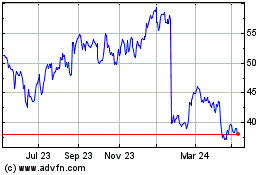

Dominos Pizza Enterprises (ASX:DMP)

Historical Stock Chart

From Dec 2023 to Dec 2024