Life360 Surpasses One Million Paying Members Valuing the Company at Over $1 Billion for the First Time

28 July 2021 - 8:30AM

Business Wire

Annualized Monthly Revenue surpasses $100

million marking record quarter for leading family safety app;

Acquisition of Jiobit in final stages

Life360, Inc. (ASX:360) today announced a milestone quarter for

the company surpassing 1 million subscribers (Paying Circles), $100

million in Annualized Monthly Revenue, and the company crossed the

$1B market valuation on strong share price growth. Life360 also

announced the signing of definitive agreements for the acquisition

of Jiobit, the Chicago-based provider of wearable location devices,

strengthening the company’s position as the leading family safety

platform and accelerating its entrance into new markets, namely

children under ten, small pets, and seniors.

“The last 18 months have shed a bright light on the need for

family safety. Our confidence that a COVID recovery would drive a

return to significant growth is being borne out in these needs,”

said Chris Hulls, founder and CEO of Life360. “This incredible

growth is a clear indicator that our expanded product offerings and

move to a membership model are resonating with families around the

world and strengthens our belief that our product roadmap and

funding path were the right decisions for our company.”

In addition to the financial milestones, Life360 also reached

No. 1 in the App Store charts in more than 11 countries during the

last quarter. Driven by a viral surge in downloads from teens

primarily through TikTok, Life360 delivered a record quarter of

Monthly Active Users (MAU) ending the quarter with 32.3

million.

“The turnaround we’ve had with our teen community is nothing

short of amazing,” continued Hulls. “It was risky, but listening,

engaging and working with this community to help shape the

technology is paying off in spades.”

June 2021 Quarter Highlights

- Underlying revenue growth of 28% year-on-year to $25 million.

Annualized Monthly Revenue (AMR) in June 2021 was $105.9 million, a

year-on-year increase of 36%.

- Global MAU base of 32.3 million, an increase of 4.2 million

from the March 2021 quarter or 15%, driven by the viral surge from

teens.

- US MAU base of 20.3 million, an increase of 2.1 million, or 12%

from the March 2021 quarter. International MAU base of 12 million,

an increase of 2.1 million, or 22%, from the March 2021

quarter.

- 1 million global subscribers (Paying Circles), an increase of

10% for the quarter. US Paying Circles increased 22% year-on-year,

benefiting from the launch of the new Membership offering in July

2020. Net subscriber additions of more than 90,000 were an all-time

record.

- Cumulative new and upsell subscribers in the Membership plans

of 327,000, comprising Silver (14%), Gold (78%) and Platinum

(8%).

- Average Revenue Per Paying Circle (ARPPC) increased 21%

year-on-year, and 5% versus the March 2021 quarter. ARPPC for new

cohort Membership subscribers was a 37% uplift from the first half

of 2020.

- Paid User Acquisition spend of $1.3 million compared with $1.2

million in the March 2021 quarter and $0.2 million in the June 2020

quarter when spend was deliberately scaled back to respond to

COVID-19. Investment in Paid User Acquisition including TV channel

spend amounted to $2.5 million compared with $2.2 million in the

March 2021 quarter.

Visit www.life360.com to learn more about Life360. The Life360

app can be downloaded from the Apple App Store and Google Play.

About Life360

Life360 operates a platform for today’s busy families, bringing

them closer together by helping them better know, communicate with

and protect the people they care about most. The Company’s core

offering, the Life360 mobile app, is a market leading app for

families, with features that range from communications to driving

safety and location sharing. Life360 is based in San Francisco and

had more than 32 million monthly active users (MAU) as of June

2021, located in more than 195 countries.

Life360’s CDIs are issued in reliance on the exemption from

registration contained in Regulation S of the US Securities Act of

1933 (Securities Act) for offers of securities which are made

outside the US. Accordingly, the CDIs, have not been, and will not

be, registered under the Securities Act or the laws of any state or

other jurisdiction in the US. As a result of relying on the

Regulation S exemption, the CDIs are ‘restricted securities’ under

Rule 144 of the Securities Act. This means that you are unable to

sell the CDIs into the US or to a US person who is not a QIB for

the foreseeable future except in very limited circumstances until

after the end of the restricted period, unless the re-sale of the

CDIs is registered under the Securities Act or an exemption is

available. To enforce the above transfer restrictions, all CDIs

issued bear a FOR Financial Product designation on the ASX. This

designation restricts any CDIs from being sold on ASX to US persons

excluding QIBs. However, you are still able to freely transfer your

CDIs on ASX to any person other than a US person who is not a QIB.

In addition, hedging transactions with regard to the CDIs may only

be conducted in accordance with the Securities Act.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210727006162/en/

Kat Madariaga (415) 602-4395 Kat@thekeypr.com

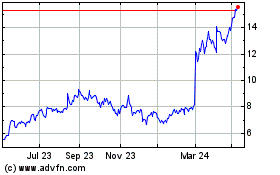

Life360 (ASX:360)

Historical Stock Chart

From Jan 2025 to Feb 2025

Life360 (ASX:360)

Historical Stock Chart

From Feb 2024 to Feb 2025