MARKET COMMENT: S&P/ASX 200 Poised to Fall As US Data Disappoint

04 April 2013 - 10:29AM

Dow Jones News

2259 GMT [Dow Jones] Australia's S&P/ASX 200 is poised to

extend Wednesday's 0.6% fall, with IG strategist Evan Lucas tipping

a 0.8% opening decline to 4917, after disappointing U.S. economic

data weighed on offshore equities and commodity prices. ADP said

U.S. private sector jobs growth for March fell to 158,000 vs the

192,000 expected by the market, suggesting Friday's U.S. non-farm

payrolls report will also disappoint. ISM's U.S. services sector

PMI fell to 54.4 in March from 56 in February. Combined with

increasing tensions on the Korean Peninsula, weak economic data saw

the S&P 500 fall 1.1%, with the financials, materials and

energy sectors leading declines. BHP's (BHP.AU) ADRs fell 1.2% to

A$31.84, with spot iron ore down 0.4%, LME copper down 1.0% and

Nymex crude down 2.8% (high inventories weighed on oil). With spot

gold down 1.1% to US$1,557.45, Newcrest (NCM.AU) should remain

weak. Lower metal price forecasts from UBS and Credit Suisse should

also weigh on the materials sector. Credit Suisse slashed its price

targets on Fortescue (FMG.AU), BHP (BHP.AU) and Rio Tinto (RIO.AU).

The outcome of the BOJ's board meeting will be in focus amid

expectations of further stimulus, while the ECB is due to meet

later Thursday. Domestic retail sales and building approvals data

are due at 0030 GMT. The S&P/ASX 200 index closed Wednesday at

4957.5. (david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

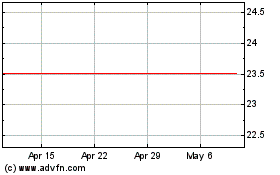

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

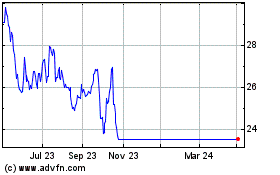

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Jul 2023 to Jul 2024