Newmont Sells Stake in Aussie Gold Mine to Northern Star for $800 Million

17 December 2019 - 10:36AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Newmont Goldcorp (NEM) has agreed to a

deal to sell its half of a giant open-pit gold mine in Australia's

outback to Northern Star Resources Ltd. (NST.AU) in a US$800

million deal.

The sale will put the Super Pit mine, until just a few years ago

the country's largest open-cut gold mine, in the hands of

Australian companies after Saracen Mineral Holdings Ltd. (SAR.AU)

recently snapped up Barrick Gold Corp.'s (ABX.T) 50% stake.

In a statement Tuesday, Northern Star said it would buy

Newmont's half of the Kalgoorlie Consolidated Gold Mines joint

venture in Western Australia for US$775 million and another US$25

million for assets including a separate parcel of land owned by the

U.S. miner.

The price is more than the US$750 million that local gold

producer Saracen recently paid Barrick for its half of the venture,

though Colorado-based Newmont is operator of the mine.

The Super Pit dates back to the late 19th century and the gold

rush era in Australia's west. It is still one of the biggest

gold-mining operations in Australia, producing on average about

660,000 troy ounces annually over the past five years. However,

output in the year through June was 490,000 ounces after the mine

was hit by the failure of a pit wall in 2018. Repairs are underway

and are expected to take more than three years.

Northern Star Executive Chairman Bill Beament said the company

and Saracen had established track records of unlocking value from

acquisitions and would be able to pool skills and experience at

Super Pit.

"This is one of the world's greatest gold systems," he said.

With the acquisition, Northern Star said its total resources

would rise to 28.3 million ounces across four key assets and would

add between 120,000 and 140,000 ounces to its production in the

2020 financial year, taking overall output for the year to

920,000-1.04 million ounces.

The company also has an option to buy Newmont's power business

in Western Australia, which feeds the Kalgoorlie venture.

Northern Star said it would help fund the acquisition with a 765

million Australian dollars (US$526.7 million) institutional share

placement, a share purchase plan to raise as much as A$50 million,

and tap A$480 million in debt.

Previously, Saracen said its purchase of Barrick's half of the

venture would establish it as one of the country's biggest gold

producers, adding exposure to a top-tier mine with an estimated

reserve of about 7.3 million ounces and options to extend the life

of the operation through the resource base and exploration.

Saracen's annual output will jump to more than 600,000 ounces from

about 400,000 now from two mines in the Kalgoorlie area.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 16, 2019 18:21 ET (23:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

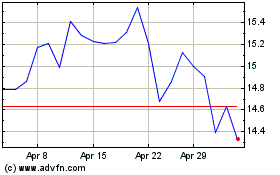

Northern Star Resources (ASX:NST)

Historical Stock Chart

From Jan 2025 to Feb 2025

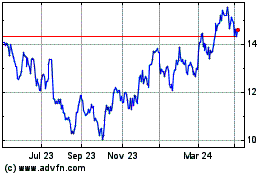

Northern Star Resources (ASX:NST)

Historical Stock Chart

From Feb 2024 to Feb 2025