A.M. Best Comments on the Ratings of National General Holdings Corp. Following Announced Transaction with QBE North America

17 July 2015 - 12:58AM

Business Wire

A.M. Best has commented that the financial strength

rating and the issuer credit ratings (ICR) of the property/casualty

subsidiaries of National General Holdings Corp. (National

General) (Delaware) (NASDAQ:NGHC), along with the ICR and the issue

ratings of National General, are unchanged following its recently

announced transaction with QBE North America (QBE NA), a division

of QBE Insurance Group Limited (ASX:QBE). Under the terms of

the transaction, National General has agreed to acquire QBE NA’s

lender-placed insurance business. The transaction includes the

acquisition of certain assets, as well as the assumption of all

related insurance liabilities in a reinsurance transaction through

which National General will receive the loss reserves, unearned

premium reserves and invested assets at closing. The purchase price

will be approximately $90 million, payable at closing, which is

expected to occur within 90 days, subject to customary closing

conditions and regulatory approvals.

National General has historically maintained an excellent level

of risk-adjusted capitalization and reported favorable earnings

with a focus on personal lines business. This transaction will

provide product diversification to National General, which

currently writes largely personal auto and homeowners business.

Although this transaction will expose National General’s

performance to increased variability from weather and catastrophe

events, A.M. Best anticipates that any future losses from

additional property exposures will be mitigated to a manageable

level via National General’s use of reinsurance, including

additional protection purchased upon the close of the transaction.

A.M. Best expects National General to maintain its excellent

risk-adjusted capitalization through raising additional capital to

support the business acquired in this transaction.

This press release relates to rating(s) that have been

published on A.M. Best's website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please visit A.M.

Best’s Ratings & Criteria Center.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2015 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150716005994/en/

A.M. BestBrian O’Larte, 908-439-2200, ext.

5138Senior Financial

Analystbrian.o'larte@ambest.comorMichael Lagomarsino, CFA,

908-439-2200, ext. 5810Assistant Vice

Presidentmichael.lagomarsino@ambest.comorChristopher

Sharkey, 908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

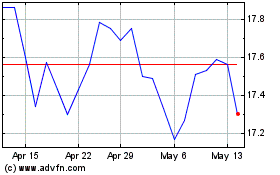

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Nov 2024 to Dec 2024

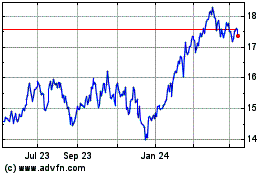

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Dec 2023 to Dec 2024