Companies Took Insurers to Court for not Paying out on Covid-19 Claims - Here's What's Happening Now -- Financial News

19 November 2020 - 9:52PM

Dow Jones News

By Berengere Sim

Of Financial News

The Financial Conduct Authority's business interruption

insurance case is back in the headlines--but this time it is for a

four-day appeal in the Supreme Court.

Why are the FCA and insurers in the court?

The appeal is the latest twist in the business interruption

case, which the City's watchdog took to court to bring clarity to

small and medium-sized enterprises who suffered losses as they were

forced to shutter their doors during the first nationwide

lockdown.

On May 1, the regulator announced that it was taking the case to

court. "We have been clear that we believe in the majority of

cases, business interruption insurance wasn't purchased to, and is

unlikely to, cover the current emergency," Christopher Woolard, the

interim chief executive of the regulator, said on May 1.

"Our intended court action is designed to resolve a selected

number of key issues causing uncertainty as promptly as possible

and to provide greater clarity for all parties, both insured and

insurers."

Later, eight insurer defendants--Hiscox Ltd., QBE Insurance

Group Ltd., Zurich Insurance Group AG, MS Amlin Underwriting, RSA

Insurance Group PLC, Ecclesiastical Insurance Office PLC, Argenta

Syndicate Management and Arch Insurance--agreed to participate in

the test case after 56 were approached by the regulator for

information on their business interruption policies and how they

intended to deal with claims.

The FCA represented the interests of policyholders and is

represented by law firm Herbert Smith Freehills.

The tension surrounding business interruption insurance is in

fact not unique to the U.K.; there have been similar cases in the

US, as well as in France.

What happened next?

On Sept. 15, the High Court in London ruled in favor of "most"

of the companies who said their business interruption insurance

policies should cover lockdown and pandemic-related losses.

The judgment pointed to disease clauses in certain business

interruption insurance policies that would provide cover, but added

that each policy will have to be considered against the judgment to

work out what it means. If it hadn't been appealed, the judgment

would have been legally binding to the eight insurers.

However, on Sept. 30, the FCA applied to "leapfrog" the case to

the Supreme Court, "which we believe is the fastest way to get

legal clarity as quickly as possible for all parties," the

regulator said in a statement.

On Nov. 2, the Supreme Court granted permission to appeal, to

the regulator and the Hiscox Action Group, as well as all the

insurance firms except Zurich Insurance and Ecclesiastical

Insurance. The wordings for both Zurich and Ecclesiastical don't

provide cover for business interruption, as confirmed by the

judgment.

How have things been going in the Supreme Court?

On Nov. 16, the first day of the appeal, Reuters reported that

insurance companies told judges that thousands of small companies

impacted by the Covid-19 pandemic weren't eligible for payouts. It

was "reverse engineering" to suggest they would be.

The following day, Reuters reported the Supreme Court heard

Colin Edelman QC, the FCA's lawyer, say: "[Insurers] are saying:

'We insure perils but not ones that are going to cost us a huge

amount of money. We never contemplated that'. Well that isn't an

answer."

What is at stake?

At the centre of the case is whether 28 clauses in 21 policy

wordings by the insurers should cover disruption caused by

responses to the pandemic. If they do have to cover the losses, the

case could affect hundreds of types of policies and thousands of

policyholders, with billions of pounds of claims in the

balance.

Meanwhile, the industry has been trying to find other ways to

better prepare and collaborate on pandemic-related issues in the

future. On July 1, insurance marketplace Lloyd's of London proposed

the creation of a "Black Swan Re" reinsurance framework.

The framework would provide reinsurance for commercial

non-damage business interruption cover in future catastrophic

"Black Swan" events. It would use industry-pooled capital and be

back by the government if the pool had insufficient funds.

What happens now?

The hearing continues into its final day.

The Supreme Court has yet to set down a date on which it will

publish its ruling.

Website: www.fnlondon.com

(END) Dow Jones Newswires

November 19, 2020 05:37 ET (10:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

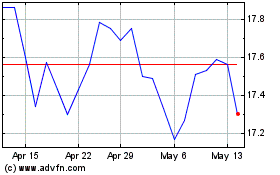

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Nov 2024 to Dec 2024

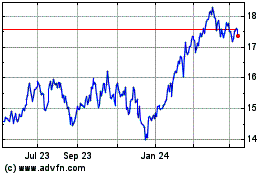

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Dec 2023 to Dec 2024