Telstra Aims to Grow Dividends, Return Excess Cash to Shareholders

16 September 2021 - 9:15AM

Dow Jones News

By Stuart Condie

SYDNEY--Telstra Corp. Ltd. aims to increase its dividend and

return excess cash to shareholders as key components of the

Australian telecommunications firm's new capital management

framework.

Australia's No.1 communications provider by market share said it

was confident of maintaining its current annual payout of 16

Australian cents (11.7 U.S. cents) per share, and was focused on

growing earnings to maximize dividend imputation. It aims to grow

the dividend over time.

Telstra said it was targeting annual underlying

earnings-per-share growth in the high teens from the 2023 fiscal

year through fiscal 2025, with underlying earnings before interest,

tax, depreciation and amortization growing annually in the

mid-single digits over the same period.

It said it would invest in growth and return excess cash to

shareholders.

Telstra last month launched a A$1.35 billion share buyback after

lifting its annual profit and flagging a return to underlying

growth in fiscal 2022. It funded the imitative by selling a 49%

stake in its mobile towers infrastructure, also paying down

debt.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

September 15, 2021 19:00 ET (23:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

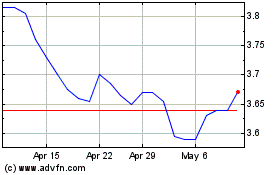

Telstra (ASX:TLS)

Historical Stock Chart

From Dec 2024 to Jan 2025

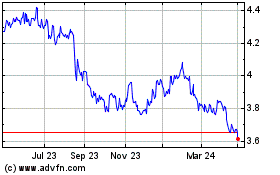

Telstra (ASX:TLS)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Telstra Corporation Limited (Australian Stock Exchange): 0 recent articles

More Telstra Corporation Limited News Articles