Australia PM Avoids Mine Tax Talk In Key Marginal Electorate

17 August 2010 - 6:34PM

Dow Jones News

Australia's Prime Minister Julia Gillard gave a campaign stump

speech to miners in resource-rich Queensland state Tuesday without

once mentioning her center-left Labor party's controversial

mining-profits tax proposal.

The tax is a pivotal issue that could help decide the outcome of

Saturday's general election, particularly in line ball electorates

like this one, the central Queensland seat of Flynn, held by Labor

MP Chris Trevor with a margin of a little over 2.0%. Coal mining is

the life blood of the electorate's large inland town of Emerald,

around 650 kilometers north of the state capital Brisbane.

Voter polls indicate Saturday's election could be a photo

finish, especially in the key swing states of Queensland and New

South Wales. Gillard blitzed marginal seats in northern Queensland

Tuesday, including Herbert, Dawson and Flynn.

The initial proposal for a 40% tax on mining profits contributed

to the June ouster of former Prime Minister Kevin Rudd in a Labor

party coup, amid fears he was damaging the party's electoral

chances.

The revised proposal--softening the headline rate of the tax to

30% from 40% and excluding all minerals except iron ore and

coal--was notably absent in a speech by his successor, Gillard, to

around 40 dusty coal miners who downed tools at the Gregory-Crinum

mine near Emerald, for a lunch time barbecue of chicken, coleslaw

and steak sandwiches Tuesday.

The mine is a 50:50 joint venture between BHP Billiton Ltd.

(BHP.AU) and Mitsubishi Development Pty Ltd, a wholly-owned unit of

Mitsubishi Corporation (8058.TO).

The audience seemed a little nonplussed by Gillard's

arrival--and it was an awkward backdrop for the well-dressed prime

minister--though the miners were polite listeners and there were no

interruptions during her speech.

While avoiding a mention of the proposed tax, Gillard did

acknowledge the sector's contribution to Australia's A$1.3 trillion

economy. Australia was one of few developed nations to avoid a

recession last year due partly to ongoing demand from developing

countries like China for the country's vast natural resources.

"Core to everything in this campaign is keeping the economy

strong," Gillard told the gathering.

"You obviously work in a great industry in a prosperous part of

the country. We want to make sure our economy stays strong and

keeps giving the benefits of work to people right around the

nation," she added.

The prime minister later brushed off suggestions from reporters

she was embarrassed by the tax proposal--of which Rudd and

Treasurer Wayne Swan were the chief initial architects.

Gillard noted she had visited the mine in May to discuss the

mining tax. "Of course my economic plan includes the minerals

resource rent tax," she added.

Gillard thrashed out the compromise deal on the tax with the

country's three biggest miners, BHP Billiton, Rio Tinto Ltd.

(RIO.AU) and Xstrata PLC (XTA.LN) a week after Rudd was

deposed.

But many smaller miners are unhappy with the deal, arguing the

amended plan favors the big three. They argue it has damaged

Australia's reputation as an investment destination and is

hampering their ability to raise capital. Led by the Association of

Mining and Exploration Companies, they are mounting a three-week

campaign against it in the midst of the election campaign.

New Hope Corp. Ltd. (NHC.AU), Australia's fifth-biggest

independent coal miner by production, earlier Tuesday urged its

Australia shareholders to consider the impact of the proposed tax

in the Aug. 21 ballot.

The main opposition Liberal-National coalition of center-right

parties has vowed to scrap the tax, warning it will "choke the

golden goose" that spared Australia from recession. The coalition

has also said it will provide A$418 million of exploration rebates

for smaller miners if it wins power.

In a letter to shareholders, New Hope Corp. warned long-term

shareholder returns will be reduced by more than 10% as a result of

the new tax.

"I ask that you consider the potential impact of the current

government's proposed mineral resource rent tax when casting your

vote in the forthcoming election," Chairman Robert Millner

wrote.

New Hope operates mainly thermal coal mines in the southeast of

Queensland.

In a separate letter to shareholders released late Monday in his

capacity as chairman of investment company Washington H. Soul

Pattinson & Co. Ltd. (SOL.AU), Millner also said the tax could

impact future earnings of that company.

Washington H. Soul Pattinson owns 60% of New Hope.

-By Rachel Pannett, Dow Jones Newswires; +61-2-6208-0901;

rachel.pannett@dowjones.com

(David Fickling in Sydney contributed to this article)

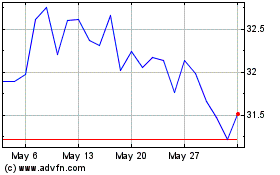

Washington H Soul Pattin... (ASX:SOL)

Historical Stock Chart

From Apr 2024 to May 2024

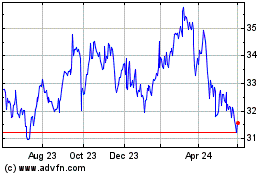

Washington H Soul Pattin... (ASX:SOL)

Historical Stock Chart

From May 2023 to May 2024