UPDATE: Whitehaven Coal Offers A$142 Million For Coalworks

07 May 2012 - 1:51PM

Dow Jones News

Whitehaven Coal Ltd. (WHC.AU) moved Monday to wrap up its

control of coal projects in eastern Australia with a A$142 million

(US$144 million) offer for smaller Coalworks Ltd. (CWK.AU),

following its recent A$2.3 billion takeover of Aston Resources

Ltd.

Coalworks shareholders will be offered A$1 cash for each share,

a 17% premium to the closing price Friday, Whitehaven said in a

statement.

Whitehaven already owns a 17.3% stake in Coalworks after

acquiring Aston and unlisted Boardwalk Resources, which is jointly

exploring with Coalworks the latter's Ferndale coking and thermal

coal project in New South Wales.

"The acquisition of Coalworks represents a logical next

step...which will allow Whitehaven to consolidate its development

and exploration portfolio," said Tony Haggarty, managing director

of Whitehaven.

Whitehaven's move on Aston this year created Australia's biggest

independent coal-only mining company, bulking up its resource base

to better compete against giant diversified mining companies such

as BHP Billiton Ltd. (BHP) and Xstrata PLC (XTA.LN). Dealmaking in

Australia's coal sector has been hot in recent months, with Yanzhou

Coal Mining Co. (YZC) seeking to buy Gloucester Coal Ltd. (GCL.AU)

and U.S. producer Peabody Energy Corp. (BTU) last year acquiring

Australia's Macarthur Coal Ltd. for A$4.9 billion.

Industry analysts had speculated Whitehaven would extend its

reach with a bid for Coalworks. After Whitehaven launched its offer

in December for Aston and Boardwalk, Coalworks appointed Pitt

Capital Partners as an adviser.

There was no immediate response to the offer from Coalworks, a

spokesman said.

Coalworks last month raised A$17.4 million via a share placement

at A$0.78 each, through which commodities trader Noble Group Ltd.

(N21.SG) increased its stake to 9%.

Whitehaven's Haggarty said the takeover bid is at a significant

premium to the placement price, and offers cash in exchange for the

risk associated with funding and developing of Coalworks' assets.

The Vickery South and Ferndale projects are capital intensive, and

can be more efficiently development in combination with

Whitehaven's assets, he said.

The Vickery South project is next to Whitehaven's Vickery coking

and thermal coal development in New South Wales.

Coalworks also has a 33.4% stake in Orpheus Energy Ltd. (OEG.AU)

that Whitehaven said it would seek to sell.

Whitehaven, which has plans to boost production to about 25

million metric tons a year by 2016 from 4.7 million in the last

financial year, said its offer is conditional on confirmation that

a corporate advisory arrangement between Coalworks and Noble can be

ended without any termination fee and Coalworks not declaring any

dividends.

Grant Samuel Corporate Finance and Goldman Sachs Australia are

acting as financial advisers to Whitehaven.

-By Robb M. Stewart, Dow Jones Newswires; +61 3 9292 2094;

robb.stewart@dowjones.com

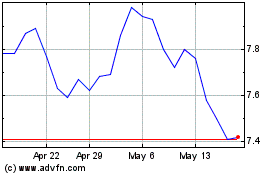

Whitehaven Coal (ASX:WHC)

Historical Stock Chart

From Apr 2024 to May 2024

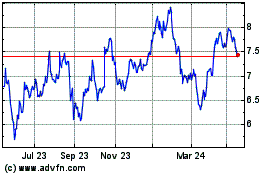

Whitehaven Coal (ASX:WHC)

Historical Stock Chart

From May 2023 to May 2024