Enel Plans Asset Sales to Cut Debt, Boost Investment as Part of 2023-25 Strategy

22 November 2022 - 7:00PM

Dow Jones News

By Giulia Petroni

Enel SpA plans asset sales worth around 21 billion euros ($21.5

billion) to cut net debt and reposition its businesses, as well as

a boost to investments as part of its strategy for the 2023-25

period.

Italy's biggest utility on Tuesday said the bulk of its disposal

plan will be carried out by the end of next year as the company

aims to strategically reposition its geographies and focus on six

core countries that include Italy, Spain, the U.S., Brazil, Chile

and Colombia.

The group also aims to invest around EUR37 billion in the

period, 60% of which will be allocated toward generation, customers

and energy services, while grids should account for the remaining

40%.

"In the next three years, we will focus on integrated business

models, digital know-how as well as businesses and geographies that

can add value despite the current challenging scenario, embracing a

leaner structure and a more robust set of financial ratios," Chief

Executive Officer Francesco Starace said.

Enel targets adjusted net profit--or net ordinary income--of

EUR7 billion to EUR7.2 billion by 2025 from an estimated EUR5

billion-EUR5.3 billion in the current year.

Adjusted for one-offs including acquisitions or disposals,

earnings before interest, taxes, depreciation and amortization--or

ordinary Ebitda--are expected to reach EUR22.2 billion-EUR22.8

billion in 2025 from an estimated EUR19 billion-EUR19.6 billion in

2022.

Enel aims to maintain a dividend per share of EUR0.43 for

2023-25, up from 0.40 euros in 2022. The EUR0.43 dividend per share

is to be considered as "a sustainable minimum" in 2024-25, the

company said.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

November 22, 2022 02:45 ET (07:45 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

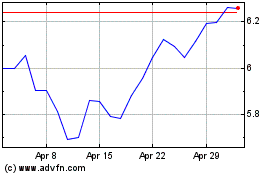

Enel (BIT:ENEL)

Historical Stock Chart

From Mar 2025 to Apr 2025

Enel (BIT:ENEL)

Historical Stock Chart

From Apr 2024 to Apr 2025