UPDATE: HAL Accepts 51% Safilo Bonds, Waives Previous Threshold

01 December 2009 - 5:58AM

Dow Jones News

Debt-laden Safilo Group SpA (SFL.MI) is likely to avoid

bankruptcy after Dutch investor HAL Holding NV (HAL.AE) said Monday

it will move forward with its offer for the world's second-largest

eyewear maker and waived a previous 60% threshold for the Safilo

bond offer.

HAL said its offer to Safilo bondholders, which is conditional

on the Dutch fund's acquisition of a majority stake in the company,

had been accepted by the representatives of investors holding

50.99% of the firm's bonds.

HAL, which holds a 2% stake in the company, agreed last month to

increase its stake in Safilo to between 32.23% and 49.9% and to

help in the recapitalization by injecting around EUR283 million

into the Italian debt-laden company.

But the agreement was conditional on HAL buying at least 60% of

EUR195 million worth of outstanding high-yield 2013 notes linked to

Safilo by Nov. 18.

On Monday the Dutch investor said it had decided to accept 51%

of Safilo bonds and to waive the 60% condition, as 50.1% is all it

needs to change the debt covenants attached to Safilo's bonds.

This month Safilo said in a statement that in the event that

HAL's tender offer wasn't successful, "the company would again be

in a highly leveraged situation and will, in all likelihood,

default under its banking facilities by the year-end."

The acquisition of HAL's equity interest in Safilo is expected

to be closed in the first quarter of 2010, HAL said. The Dutch fund

said that the completion of the acquisition is subject to several

conditions, including approval by the relevant antitrust and

regulatory market authorities and by the extraordinary shareholders

meeting of Safilo.

The Italian eyewear maker has said it hopes to receive

regulatory approval for the capital increase by Dec. 14 and

scheduled a new shareholders' meeting on Dec. 14, 15, or 16 to

approve the capital increase.

The Italian company's main creditors are Italy's two biggest

banks, Intesa Sanpaolo SpA (ISP.MI) and UniCredit SpA (UCG.MI).

At the end of September, its net debt was EUR586.3 million.

Based in Padua, Safilo makes eyewear under license for brands

including Gucci, Giorgio Armani and Dior. If the deal goes through,

some analysts say Safilo is likely to become a tough competitor for

Luxottica (LUX), the major player in the high-end eyewear

industry.

Company Web site: www.safilo.com

-By Chiara Vasarri and Sabrina Cohen, Dow Jones Newswires; 39 02

58 21 9904; chiara.vasarri@dowjones.com

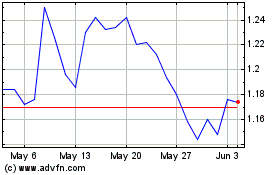

Safilo (BIT:SFL)

Historical Stock Chart

From Nov 2024 to Dec 2024

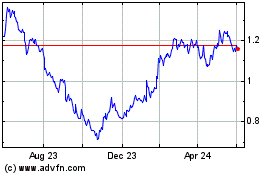

Safilo (BIT:SFL)

Historical Stock Chart

From Dec 2023 to Dec 2024