UniCredit Plans to Shake Up Managers -- WSJ

23 May 2016 - 5:02PM

Dow Jones News

Board members agree that bank needs a CEO from outside the

company

By Giovanni Legorano

ROME -- Italian lender UniCredit SpA is heading for a management

overhaul that is likely to see its chief executive step down as

early as next week, people close to the bank's board said

Friday.

Board members are already looking for a new CEO to replace

Federico Ghizzoni, who has been at the helm of the bank since 2010,

but they have so far failed to agree on the right profile for the

job, say people familiar with the situation.

However, they all agree the bank needs an executive from outside

the company who would have the credibility to raise billions of

fresh capital -- one of the people said some board members think

the bank needs up to EUR9 billion ($10.10 billion) in additional

capital -- either through a rights issue or asset sales, or

both.

One of the person said the bank could call a directors' meeting

for May 24 to decide on the next steps and could ratify Mr.

Ghizzoni's resignation.

A spokesman for the bank declined to comment.

Shareholders have grown increasingly unhappy with the leadership

of Mr. Ghizzoni and are now seeking a CEO who can shake up a bank

that suffers from low profitability, large bad loans and a

sprawling international network that has failed to live up to

expectations. UniCredit is Italy's largest bank and the only one

regulated as a global systematically important bank.

UniCredit has been under pressure for some time, suffering from

the same factors that have weighed heavily on Italy's banking

system as a whole.

Low interest rates have pulled profitability down in a bank that

remains heavily dependent on traditional lending activities.

Efforts to expand into other fee-generating activities have had

limited success. Earlier this month, UniCredit reported its net

interest income dropped 3% in the first quarter compared with the

same period in 2015, while fees and commissions were down 3.4%.

UniCredit is also struggling with EUR80 billion in bad loans,

more than any other bank in Europe. While it has written down the

value of bad loans and past acquisitions by EUR76 billion and

raised EUR18 billion in new capital, its capital cushion is still

quite thin -- leading some analysts to say the bank needs to raise

more capital.

The bank also reported lower core capital for the first quarter.

Its management has consistently denied that it needs to raise fresh

funds, but in the past it often conceded the lender needs to shore

up its capital buffer.

Mr. Ghizzoni has also been criticized for the bank's decision

last fall to underwrite the EUR1.5 billion capital increase of

Banca Poplare di Vicenza SpA.

It had agreed to provide a backstop for the transaction, but

after a rout this year in Italian banking stocks, regulators grew

concerned that the capital increase would fail -- in turn leaving

UniCredit owning the troubled bank. As a result, the government

orchestrated a fund supported by Italian financial institutions

that stepped in and underwrote the deal.

UniCredit's shares have lost 42% so far this year.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

May 23, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

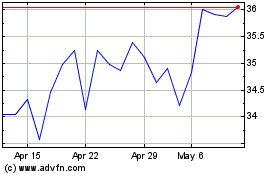

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to May 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From May 2023 to May 2024