Cardano (ADA) Q2 Digest: Major Double-Digit Decrease Across Four Vital Metrics

28 August 2024 - 1:00PM

NEWSBTC

According to a recent report by data intelligence firm Messari,

Cardano and its native token, ADA, experienced a notable decline in

the second quarter (Q2) of 2024, reflecting the broader downturn

affecting the cryptocurrency market. Key performance indicators

also showed significant decreases in various metrics. Price Plunge,

Market Cap Dips To $14 Billion According to the report, ADA’s price

plummeted 39.7% to $0.39, while its market capitalization fell by

39.4% quarter-over-quarter (QoQ) to $14 billion. Messari

noted that this decline was influenced by a slight increase in

circulating supply, which accounted for the minor discrepancy in

market cap figures. Consequently, ADA’s market cap ranking dropped

from 9th to 10th place. Related Reading: Toncoin (TON) Price

Performance 5 Days Post-Durov Arrest: What’s Next? Transaction fees

on the Cardano network, which are essential for processing

transactions and covering storage costs, also suffered. Revenue in

USD decreased by 44.3% QoQ to $0.74 million, while revenue measured

in ADA fell by 28.0% to 1.60 million. The platform’s average

daily transactions also decreased by 27.5% QoQ to approximately

51,400, and the number of daily active addresses (DAAs) fell by

33.2% to 31,800. Additionally, the average transaction fee in

USD dropped 23.1%, from $0.21 to $0.16. However, the average fee in

ADA saw only a marginal decline of 0.6%, remaining at 0.34.

Treasury Balance Grows Despite these setbacks, the ratio of

transactions to active addresses increased by 8.4% QoQ to 1.62,

suggesting a rise in “power users” engaging more frequently with

the platform. In terms of staking metrics, total ADA staked

and the staking rate increased slightly, although the total value

of staked ADA in USD decreased significantly by 39.6% to $8.9

billion, primarily due to the falling price of ADA. Cardano’s

treasury balance, measured in ADA, rose 5.8% QoQ to 1.57 billion,

although its dollar value decreased by 36.7% to $604.7 million.

Currently, 20% of transaction fees are allocated to the treasury.

Decentralized application (DApp) activity on Cardano also saw

declines, with average daily DApp transactions falling 35.7% QoQ to

34,300 and average daily decentralized exchange (DEX) volume in USD

decreasing by 42.5% to $4.2 million. Cardano TVL Drop Amid

Market Downturn Total value locked (TVL) on Cardano dropped 41.2%

QoQ to $219 million, following a peak of $506 million in March

2024, driven by a broader crypto market downturn rather than

Cardano-specific factors. Moreover, for the first time since

the introduction of Cardano’s stablecoins in late 2022, the

stablecoin market cap on the platform decreased by 12.4% QoQ to

$19.6 million. Average daily non-fungible token (NFT) sales also

took a hit, plummeting 57.4% QoQ to under 730 transactions. Related

Reading: Dogecoin Set For A Drop: Bearish Forces Eye $0.0914 Target

Despite these challenges, the report highlights ongoing

developments within Cardano’s ecosystem. The emergence of new

stablecoins like USDM and MyUSD saw their market caps rise

dramatically, indicating a shift in the landscape.

Additionally, upcoming upgrades, such as the Chang Hard Fork,

promise to increase Cardano’s governance capabilities, moving the

network closer to achieving its long-term goals of

self-sustainability and participatory decision-making. At the time

of writing, ADA was trading at $0.34, down 0.7% for the 24-hour

period. Featured image from DALL-E, chart from TradingView.com

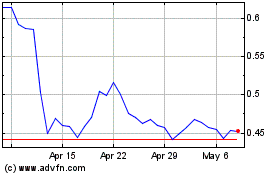

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024