Ethereum’s Rocky Road To $4,000: Will SEC Hurdles Derail Its Bullish Journey?

26 March 2024 - 11:00AM

NEWSBTC

Ethereum (ETH) stands at a crucial juncture, with its eyes set on

the $4,000 price mark. Amid this ambitious pursuit, the digital

asset faces a significant challenge that could influence its

trajectory: scrutiny from the US Securities and Exchange Commission

(SEC). Despite this potential regulatory hurdle, some analysts

remain optimistic about Ethereum’s prospects. A detailed analysis

by Captain Faibik, a market watcher, highlighted a bullish pattern

in ETH’s four-hour candlestick chart, suggesting that the $4,000

threshold is within reach. Related Reading: Market Alert: Ethereum

Faces Potential Downfall As Dencun Upgrade Looms – Here’s Why

Ethereum Eyes $4,000 Milestone This optimism stems from a

descending wedge pattern observed by Faibik, indicating an end to

Ethereum’s consolidation phase and signaling a possible price

breakout. The technical analysis paints a promising picture for

Ethereum, suggesting that the asset could reclaim its lost

valuation. $ETH #Ethereum Descending Broadening Wedge Upside

Breakout is Confirmed on the 4hrs timeframe Chart..✅ $4,000

incoming ⌛️📈 https://t.co/qrKE5jiXon pic.twitter.com/MLIXefVsd8 —

Captain Faibik (@CryptoFaibik) March 25, 2024 However, the recent

market conditions have posed challenges for Ethereum, with the

asset experiencing a more than 15% drop over two weeks, further

exacerbated by the broader Bitcoin market correction. This decline

saw ETH trading below the $3,500 mark, with a significant dip to

$3,070 on March 20, amid reports of the SEC’s increasing interest

in classifying Ethereum as a security. Particularly, reports

indicate that the commission has been seeking financial records

from US companies engaged with the Ethereum Foundation,

intensifying the debate over Ethereum’s classification. Such

regulatory scrutiny casts a shadow over Ethereum’s path to $4,000,

introducing uncertainty into its future. ETF analyst James Seyffart

suggests that the SEC’s stance could lead to the denial of spot

Ethereum ETF applications by May 23, 2024. He cites a lack of

engagement on Ethereum specifics, contrasting with the approach

taken for Bitcoin ETFs. My cautiously optimistic attitude for ETH

ETFs has changed from recent months. We now believe these will

ultimately be denied May 23rd for this round. The SEC hasn’t

engaged with issuers on Ethereum specifics. Exact opposite of

#Bitcoin ETFs this fall. https://t.co/TyAzAOrAC5 — James Seyffart

(@JSeyff) March 19, 2024 Ethereum’s Network Activity: A Silver

Lining Despite these challenges, Ethereum’s network has witnessed

notable growth, with increases in daily active users and

transaction volumes signaling a bullish outlook for the

cryptocurrency. An upsurge in network activity typically indicates

heightened demand, a positive sign for Ethereum’s price potential.

From January 3, the number of daily active Ethereum addresses

surged by over 46%, coinciding with a significant price rally. This

increased activity and price appreciation period highlights

Ethereum’s resilience and potential for growth, even in the face of

regulatory uncertainties. As Ethereum navigates through these

regulatory and market challenges, the coming weeks will be critical

in determining its ability to breach the $4,000 mark. The

juxtaposition of technical bullish signals against the backdrop of

SEC scrutiny presents a complex scenario for ETH. Related Reading:

Ethereum Is Not Done: Crypto Analyst Sets New $5,000 Target

However, the strength of its network and the increasing user

engagement offer a glimmer of hope for Ethereum enthusiasts and

investors. Featured image from Unsplash, Chart from TradingView

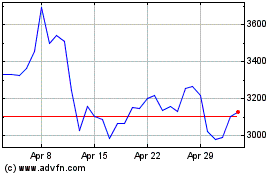

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024