Spot Ethereum ETFs End 6-Day Drought With $90 Million Inflow — Will Ether Price Respond?

25 November 2024 - 1:30AM

NEWSBTC

Investor interest in the spot Ethereum ETFs (exchange-traded funds)

appeared to have waned after failing to register a net inflow day

for six consecutive days. However, the cryptocurrency products

ended the week on a high with a substantial capital influx on

Friday, November 22. This capital inflow represents a shift in

investor sentiment, which has not particularly been positive over

the past few days. Nonetheless, the market would be hoping that

this newly found momentum would persist and perhaps also trigger

some bullish action for the ETH price. Can Ethereum ETFs Ensure

ETH’s Price Recovery? According to the latest data from SoSoValue,

the United States-based spot Ethereum ETFs witnessed a net inflow

of $91.21 million on Friday. This positive single-day performance

represents the first net inflow for the exchange-traded funds since

November 13. Related Reading: This Analyst Correctly Predicted The

Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Market data shows that a significant portion of the inflows came

from BlackRock’s iShares Ethereum Trust (with the ticker ETHA). The

crypto product registered around $99.7 million in total daily

inflows to close the previous week. Fidelity’s Ethereum Fund (with

the ticker FETH) and Bitwise’s Ether ETF (ETHW) were the only other

products to post capital inflows on Friday, recording $5.76 million

and $4.96 million, respectively. Grayscale’s ETHE and ETH

registered outflows of over $18.5 million and $621,000,

respectively. As earlier mentioned, Friday’s performance represents

a return to positive inflows for the Ethereum ETFs. Prior to this

showing, the crypto products posted six consecutive outflow days,

draining a cumulative total of $225.6 million within this period.

The price of ETH, which initially seemed to have found its footing,

also slowed down during this period of the Ethereum ETFs outflow.

This trend highlights the significant influence of the

exchange-traded funds on price action — both for the world’s

largest cryptocurrency Bitcoin and Ethereum. With the fortunes of

the US-based Ethereum ETFs seemingly turning around, the price of

ETH has also taken an upward swing in the last couple of days.

Investors will be hoping that the positive momentum for the

Ethereum ETFs continues and translates into the altcoin’s price.

Ethereum Price At A Glance As of this writing, the price of ETH

stands at around $3,423, reflecting a 2.1% increase in the past

day. The altcoin is up by more than 9% on the weekly timeframe,

according to data from CoinGecko. Related Reading: Bitcoin Price

Mirrors 2017 Pattern, Is The Top Only 2 Weeks Away After Hitting

$100,000? Featured image created by Dall-E, chart from TradingView

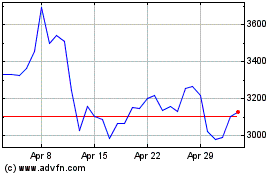

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024