Bitcoin Sets New ATH Above $104,000, Yet Investors Don’t Want To Sell

06 December 2024 - 10:00PM

NEWSBTC

Bitcoin has set a new all-time high (ATH) beyond the $104,000 mark

during the past day, but on-chain data shows investors are still

unwilling to sell. Bitcoin Exchange Netflow Has Remained Negative

During Latest Rally As explained by an analyst in a CryptoQuant

Quicktake post, Bitcoin has continued to leave exchanges recently.

The on-chain metric of relevance here is the “Exchange Netflow,”

which, as its name suggests, keeps track of the net amount of BTC

that’s entering into or exiting out of the wallets attached to

centralized platforms. Related Reading: Bitcoin 30-Day Trader

Profits Back In ‘Healthy’ Range, Is BTC Ready For $100,000? When

the value of this metric is positive, it means the investors are

making net deposits to the exchanges. As one of the main reasons

why holders use these platforms is for selling-related purposes,

this kind of trend can have a bearish implication for BTC. On the

other hand, the indicator being negative implies there are a higher

amount of exchange outflows happening than inflows. Such a trend

can be a sign that the investors want to hold onto their coins into

the long-term, which is something that can naturally be bullish for

the asset’s price. Now, here is a chart that shows the trend in the

Bitcoin Exchange Netflow over the last couple of years: As

displayed in the above graph, the Bitcoin Exchange Netflow has

observed significant negative spikes during the last month or so,

suggesting some large withdrawals have occurred. This net outflow

spree has come even though the cryptocurrency has observed a

massive run to new ATHs. The chart shows that this wasn’t the case

during the rally in the first quarter of this year. Outflows were

happening back then for sure, but there were also notable net

inflow spikes between them, implying that demand was present for

selling the asset. The recent negative Exchange Netflow has

maintained for Bitcoin through the latest rally beyond $100,000, a

sign that investors are still unwilling to part with their BTC even

at these high prices. Related Reading: Ethereum To $10,000: Analyst

Reveals Mid & Long-Term ETH Targets If this trend continues,

it’s possible that this run could still have more room to run.

However, it remains to be seen how long holders can stay quiet.

Generally, the higher the investor profits, the more likely they

become to participate in a mass selloff. So, with Bitcoin

continuing to perform well, it may only be a matter of time before

a large profit-taking spree arrives. BTC Price Bitcoin has finally

broken free of its recent consolidation phase with a more than 7%

surge during the last 24 hours. The asset briefly broke above the

$104,000 mark in this rally, but its price has since seen a minor

pullback to $103,500. Featured image from Dall-E, CryptoQuant.com,

chart from TradingView.com

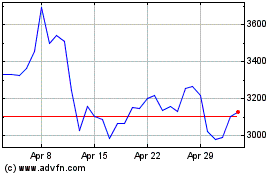

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024