Ethereum May Retest $3,700 Before a Major Rally, Analyst Predicts

17 December 2024 - 6:00AM

NEWSBTC

Ethereum relatively sluggish price performance compared to

Bitcoin’s continuous rise appears to have captured the attention of

crypto analysts. While Bitcoin has created a new peak above

$106,000 earlier today, Ethereum’s price still sits below $4,000

with a current trading price of $3,943, marking a modest 1.4%

increase over the past 24 hours. However, despite this slow pace,

some analysts see signs of strength and potential growth for

Ethereum in the near term. Related Reading: Ethereum Battles

Bearish Retail Sentiment Amid Surging ETF Demand Retest Before The

Major Rally One notable analyst, CryptoBullet, shared his insights

on X, drawing comparisons between the current market environment

and Ethereum’s January 2021 rally. “Second consecutive weekly

candle closed above the resistance,” the analyst observed. “The

shape of the candle and overall environment reminds me of January

2021. We might wick to $3,700 this week, but it will be bought back

up quickly. Don’t ignore this ETH strength.” CryptoBulllet further

emphasized that Ethereum’s ability to hold its position above key

resistance levels is a strong indicator of bullish momentum,

suggesting that a significant price movement could be on the

horizon. $ETH 1W update Second consecutive weekly candle closed

above the Resistance 👌😁 The shape of the candle and overall

environment reminds me of January 2021 We might wick to $3700 this

week but it will be bought back up quickly 📈 Don’t ignore this #ETH

strength! https://t.co/rIamWMSAb6 pic.twitter.com/29bs5aTUd3 —

CryptoBullet (@CryptoBullet1) December 16, 2024 Titan of Crypto,

another renowned analyst in the community echoed this optimism,

noting Ethereum’s highest weekly candle close since 2021 as a major

milestone. “Ethereum New ATH Incoming. ETH just achieved its

highest weekly candle close since 2021, a major milestone,” he

wrote. “A successful retest could propel it to its previous ATH and

beyond.” These observations indicate growing confidence among

market participants that Ethereum could soon reclaim its all-time

high of $4,878, last achieved in November 2021. Ethereum Traders

Faces Liquidation Despite these bullish projections, Ethereum’s

recent price action has not been favorable for all market

participants. According to data from Coinglass, 123,021 traders

were liquidated over the past 24 hours, resulting in a total of

$396.41 million in liquidations across the crypto market. Ethereum

accounted for approximately $53.12 million of these liquidations,

with long positions taking the larger hit at $28.4 million, while

short positions saw liquidations worth $24.69 million. Notably,

liquidation occurs when a trader’s position is forcibly closed by

an exchange due to insufficient funds to cover losses. In the case

of Ethereum, the higher volume of liquidations, particularly among

long positions, reflects a level of over-leverage among traders

betting on the asset’s upward momentum. Featured image created with

DALL-E, Chart from TrangView

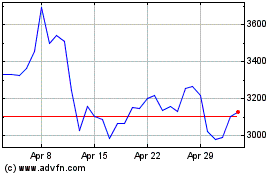

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024