Arbitrum (ARB) Price Displays Strength, Backed By On-Chain Activity

02 May 2023 - 11:00PM

NEWSBTC

The Arbitrum (ARB) price has retraced in line with the market-wide

correction over the past few days, falling close to a critical

support level. In the current environment, altcoins in general

continue to show weakness across the board. However, one altcoin

that is exhibiting relative strength, backed by on-chain activity,

is ARB. Arbitrum is an optimistic L2 rollup with the main purpose

of helping Ethereum scale by enabling L2 transactions with much

faster confirmation time. The project has established itself as one

of the top names in decentralized finance (DeFi) in recent months.

Remarkably, it also houses the most popular perpetual DEX with GMX.

ARB Price Shows Relative Strength A look at the ARB/BTC chart

(2-hour chart) shows that the altcoin has formed an uptrend in

recent days. The ascending triangle has its resistance line at

0.00004737. If ARB writes further higher lows against BTC despite

the generally pressured altcoins market, it could ultimately break

through the resistance and rally towards 0.00004850. The 4-hour

chart ARB/USDT reveals that Arbitrum is currently holding just

above the most crucial support level at $1.29. If the price level

is breached to the downside, the $1.20 to $1.24 range would be key.

Related Reading: Bullish Momentum Expected For ARB As Arbitrum

Completes DAO Airdrop To the upside, the key resistance is at

$1.42. However, on the way up the 200-day EMA, currently sitting at

$1.35, could also provide some minor headwinds. Fueled by a Bitcoin

rally, however, the resistance at $1.42 seems within reach without

further ado. Should BTC break above $30,000, ARB bulls could even

target a move up to $1.56. Arbitrum On-Chain Activity Remains Ultra

Strong Arbitrum’s current technical strength on the charts

coincides with its on-chain activity. Most metrics for Arbitrum are

at an all-time high. Most importantly, the growth of the

Arbitrum ecosystem has remained solid after the airdrop, showing

increased activity, as researched by analyst Francesco, who states:

Contrary to what was expected after the airdrop, TVL is rising: GMX

still remains the best perpetual DEX, and Arbitrum still remains

the home of DeFi due to its composability, cheap fees, and fast

confirmation times. Related Reading: Arbitrum Soars 44% To Record

Highs As Whales Splash Millions On ARB Tokens Arbitrum leads on

almost every metric, especially TVL. The fact that more users have

switched to zkSync is most likely due to airdrop hunters.

Arbitrum’s TVL is currently over $2.2 billion, an increase of over

100% compared to the fourth quarter of 2022. The primary reason for

this is the perpetual DEX called GMX, which is Arbitrum’s leading

protocol with over $500 million or 26% of TVL. However, with

Radiant, Stargate and Camelot DEX, Arbitrum based projects also

occupy three more places within the top 6 decentralized exchanges,

underlining the growth of the entire ecosystem. Furthermore,

Arbitrum ranks 4th among all blockchains by TVL, just behind the

layer-1’s Ethereum, Tron, and BSC. Featured image from Nansen,

charts from TradingView.com

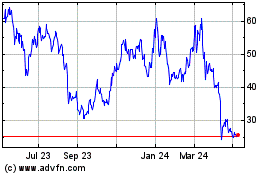

GMX (COIN:GMXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

GMX (COIN:GMXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024