Bitcoin Holds At $93,257 As Bulls Struggle To Avoid Deeper Losses

27 November 2024 - 2:00AM

NEWSBTC

Bitcoin (BTC) stands firm at $93,257, a crucial support level that

could determine its next major move. As the battle between bulls

and bears intensifies, the stakes are high: a successful defense

could spark renewed momentum, while a break below might trigger

significant losses. As the market navigates this pivotal

moment, this article aims to analyze BTC’s current position at the

critical $93,257 support level, exploring the factors influencing

its price movement. By examining key technical indicators and

market dynamics, the goal is to assess whether the bulls can defend

this level and potentially drive a rebound or if a break below

could cause deeper losses. Analyzing The Recent Price Action Of

Bitcoin Bitcoin is facing a bearish trend, attempting to break

below the $93,257 support level. If this continues, BTC could test

the 100-day SMA on the 4-hour chart, which could act as support or

signal further weakness. A failure to hold above this level might

lead to a deeper correction and possibly more notable losses toward

lower support zones. The 4-hour Relative Strength Index (RSI)

analysis shows that BTC may continue its decline, as the RSI has

dropped to 35%, indicating increasing selling pressure. A reading

below 50% suggests a weakening bullish trend and raises the

likelihood of more declines. If the RSI continues to dip, it could

signal that Bitcoin is entering a prolonged bearish phase. Related

Reading: Bitcoin Rally Pauses Before $100K—Here’s What Could Happen

Next Despite trading above the key 100-day SMA, Bitcoin is showing

strong negative momentum on the daily chart, highlighted by bearish

candlesticks and increasing selling pressure. This suggests that

the crypto asset is struggling to sustain its upward strength, and

if the downtrend continues, it may lead to large corrections and

test lower support levels. Lastly, the RSI on the daily chart has

dropped to 63% from the overbought zone, signaling a shift in

market sentiment. This implies that buying pressure is easing, and

the bullish momentum may be weakening. A move away from the

overbought area could signal the start of a consolidation phase or

the onset of a corrective pullback. Potential Scenarios: Rebound Or

Breakdown? As Bitcoin tests key support levels, a rebound or a

breakdown is expected. Thus, if the bulls manage to defend critical

levels like $93,257, BTC witness a rebound, gaining upside strength

and targeting its previous high of $99,575. Furthermore, a break

above this level may pave the way for the digital asset to set new

highs, extending the bullish trend. Related Reading: Analyst Sounds

Bearish Alarm For Bitcoin As $100,000 Presents Psychological

Resistance However, if selling pressure intensifies and BTC

successfully breaks below the $93,257 mark, it could drop through

key support zones, potentially triggering further declines toward

the $85,211 support range and beyond. Featured image from Adobe

Stock, chart from Tradingview.com

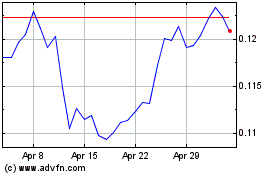

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024