NexTech AR Solutions (NexTech) (OTCQB: NEXCF) (CSE: NTAR) (FSE:

N29), an emerging leader in augmented reality (AR) for eCommerce,

AR learning applications, and AR-enhanced video conferencing and

virtual events, reported record results for its second quarter

ended June 30, 2020. All figures are prepared in accordance with

International Financial Reporting Standards (IFRS) unless otherwise

indicated.

Q2 2020 highlights:

- Revenue grows 290% to $3.5 million

- Gross Profit grows 484% to $2.1 million with a 61% margin

- Working Capital of $5.6 million

- Total Bookings $3.7 million

- Full report has been filed and is available on SEDAR

Q2 earnings will be released after the close today at

4:30pm

Bridge Name: NexTech AR

SolutionsConference ID: 597-9019Dial in: +1 (435) 777-2200Toll-Free

+ 1 (800) 309-2350

Evan Gappelberg, CEO of NexTech comments, “We are extremely

pleased to report that our record second quarter 2020 results are

continuing into Q3 and are showing strong momentum across our

business segments. These results were driven by new customer

additions, expansion of product lines and increases in conversions

from our e-commerce channels. He continues “We are uniquely

positioned with our augmented reality, e-commerce and InfernoAR

video conferencing and virtual events business units to thrive in

this new economy being led by a digital transformation across

technology. There has never been more business opportunity in our

lifetime for augmented reality, virtual learning, virtual

conferences, or virtual events, and e-commerce and we see strong

business trends continuing in Q3 and beyond.”

Kashif Malik, CFO of NexTech comments, “Q2 has been an amazing

quarter and I am thrilled to see the team firing on all cylinders

by delivering on sales. With the successful integration of our

Jolokia acquisition in Q2 we are now positioned for a rapid

acceleration in our business as we continue to land more deals and

look for additive acquisitions that further expand and grow our

business.”

NexTech AR Solutions Corp.Condensed

Consolidated Interim Statements of Financial Position(Unaudited -

Expressed in Canadian dollars)

| |

|

|

|

|

|

|

June 30, 2020 |

December 31, 2019 |

|

|

|

$ |

$ |

|

ASSETS |

|

|

|

|

Current assets |

|

|

|

|

Cash |

|

6,282,197 |

|

2,849,344 |

|

|

Receivables (Note 4) |

|

264,104 |

|

403,651 |

|

|

Prepaid expenses and deposits |

|

195,990 |

|

200,650 |

|

|

Inventory |

|

1,681,465 |

|

1,353,584 |

|

|

Total current assets |

|

8,423,756 |

|

4,807,229 |

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

Equipment (Note 5) |

|

242,303 |

|

146,555 |

|

|

Intangible assets (Note 6) |

|

2,250,734 |

|

1,420,552 |

|

|

Goodwill (Note 6) |

|

3,997,440 |

|

2,262,527 |

|

|

Total non-current assets |

|

6,490,477 |

|

3,829,634 |

|

|

|

|

|

|

|

TOTAL ASSETS |

|

14,914,233 |

|

8,636,863 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

LIABILITIES |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable and accrued liabilities (Note 7) |

|

1,748,473 |

|

1,243,528 |

|

|

Other payables (Note 8) |

|

- |

|

230,174 |

|

|

Contingent consideration (Note 3) |

|

1,067,181 |

|

- |

|

|

Total current liabilities |

|

2,815,654 |

|

1,473,702 |

|

|

|

|

|

|

|

Long-term liabilities |

|

|

|

|

Deferred income tax liability |

|

48,478 |

|

96,956 |

|

|

Total Long-term liabilities |

|

48,478 |

|

96,956 |

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

2,864,132 |

|

1,570,658 |

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

Share capital (Note 10) |

|

23,562,376 |

|

15,210,041 |

|

|

Convertible debentures (Note 9) |

|

- |

|

1,025,595 |

|

|

Reserves (Note 10) |

|

2,565,234 |

|

1,407,330 |

|

|

Deficit |

|

(14,077,509 |

) |

(10,576,761 |

) |

|

TOTAL SHAREHOLDERS’ EQUITY |

|

12,050,101 |

|

7,066,205 |

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

14,914,233 |

|

8,636,863 |

|

NexTech AR Solutions Corp.Condensed

Consolidated Interim Statements of Comprehensive LossFor the

three and six months ended June 30, 2020 and 2019(Unaudited -

Expressed in Canadian dollars)

| |

For the three months ended June 30, |

For the six months ended June 30, |

|

|

2020 |

2019 |

2020 |

2019 |

|

|

$ |

$ |

$ |

$ |

|

Revenue |

3,529,029 |

|

905,915 |

|

6,021,014 |

|

1,807,025 |

|

|

Cost of sales |

(1,359,294 |

) |

(534,094 |

) |

(2,503,430 |

) |

(1,068,187 |

) |

|

Gross profit |

2,169,735 |

|

371,821 |

|

3,517,584 |

|

738,838 |

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

Sales and marketing |

1,547,995 |

|

558,743 |

|

3,047,310 |

|

1,255,695 |

|

|

General and administrative |

1,927,105 |

|

462,116 |

|

2,690,187 |

|

844,170 |

|

|

Research and development |

563,671 |

|

164,867 |

|

937,002 |

|

748,776 |

|

|

Amortization (Note 6) |

132,458 |

|

31,476 |

|

220,711 |

|

62,951 |

|

|

Depreciation (Note 5) |

17,434 |

|

8,249 |

|

27,283 |

|

24,342 |

|

|

Foreign exchange loss (gain) |

6,283 |

|

70,334 |

|

7,977 |

|

27,352 |

|

|

Total operating expenses |

4,194,946 |

|

1,295,785 |

|

6,930,470 |

|

2,963,287 |

|

|

|

|

|

|

|

|

Operating loss |

(2,025,211 |

) |

(923,964 |

) |

(3,412,886 |

) |

(2,224,449 |

) |

|

Loss before income taxes |

(2,025,211 |

) |

(923,964 |

) |

(3,412,886 |

) |

(2,224,449 |

) |

|

Deferred income tax recovery |

24,239 |

|

- |

|

48,478 |

|

- |

|

|

Net loss |

(2,000,972 |

) |

(923,964 |

) |

(3,364,408 |

) |

(2,224,449 |

) |

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

|

|

Exchange differences on translating foreign operations |

(308,552 |

) |

- |

|

179,764 |

|

- |

|

|

Total comprehensive loss |

(2,309,524 |

) |

(923,964 |

) |

(3,184,644 |

) |

(2,224,449 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share |

|

|

|

|

|

Basic and diluted loss per common share |

(0.04 |

) |

(0.02 |

) |

(0.05 |

) |

(0.04 |

) |

|

Weighted average number of common shares outstanding |

65,713,035 |

|

53,790,361 |

|

63,147,313 |

|

52,356,663 |

|

NexTech AR Solutions Corp.Condensed

Consolidated Interim Statements of Changes In Shareholders'

EquityFor the six months ended June 30, 2020 and 2019(Unaudited -

Expressed in Canadian dollars)

| |

|

|

|

|

|

|

|

|

Number of shares |

Share capital |

Equity portion of convertible debenture |

Reserves |

Deficit |

Total |

|

|

|

$ |

$ |

$ |

$ |

$ |

|

Balance, December 31, 2018 |

43,687,872 |

|

6,365,393 |

|

|

- |

|

|

423,463 |

|

|

(2,345,482 |

) |

|

4,443,374 |

|

|

Partial escrow cancellation |

(400,000 |

) |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

Acquisition of AR Ecommerce LLC |

2,000,000 |

|

1,620,000 |

|

|

- |

|

|

- |

|

|

- |

|

|

1,620,000 |

|

|

Shares released from escrow for services |

- |

|

60,000 |

|

|

- |

|

|

- |

|

|

- |

|

|

60,000 |

|

|

Shares issued for exercise of warrants |

8,461,500 |

|

2,605,750 |

|

|

- |

|

|

- |

|

|

- |

|

|

2,605,750 |

|

|

Shares issued for acquisition payable |

100,000 |

|

66,630 |

|

|

- |

|

|

- |

|

|

- |

|

|

66,630 |

|

|

Private placement |

566,000 |

|

339,600 |

|

|

- |

|

|

- |

|

|

- |

|

|

339,600 |

|

|

Stock-based compensation |

- |

|

- |

|

|

- |

|

|

523,702 |

|

|

- |

|

|

523,702 |

|

|

Net loss |

- |

|

- |

|

|

- |

|

|

- |

|

|

(2,224,449 |

) |

|

(2,224,449 |

) |

|

Balance, June 30, 2019 |

54,415,372 |

|

11,057,373 |

|

|

- |

|

|

947,165 |

|

|

(4,569,931 |

) |

|

7,434,607 |

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2019 |

60,509,250 |

|

15,210,041 |

|

|

1,025,595 |

|

|

1,407,330 |

|

|

(10,576,761 |

) |

|

7,066,205 |

|

|

Convertible debentures |

1,910,163 |

|

1,161,935 |

|

|

(1,025,595 |

) |

|

- |

|

|

(136,340 |

) |

|

- |

|

|

Shares issued for exercise of warrants |

2,057,504 |

|

1,734,861 |

|

|

- |

|

|

- |

|

|

- |

|

|

1,734,861 |

|

|

Shares issued for exercise of options |

1,195,666 |

|

381,600 |

|

|

- |

|

|

- |

|

|

- |

|

|

381,600 |

|

|

Shares issued for purchase of Jolokia |

1,000,000 |

|

1,491,889 |

|

|

- |

|

|

- |

|

|

- |

|

|

1,491,889 |

|

|

Shares issued to settle related party liability |

47,799 |

|

38,239 |

|

|

- |

|

|

- |

|

|

- |

|

|

38,239 |

|

|

Share-based payment |

810,006 |

|

648,005 |

|

|

- |

|

|

864,899 |

|

|

- |

|

|

1,512,904 |

|

|

Private placement |

1,528,036 |

|

3,208,876 |

|

|

- |

|

|

- |

|

|

- |

|

|

3,208,876 |

|

|

Share issuance costs |

- |

|

(313,070 |

) |

|

- |

|

|

113,241 |

|

|

- |

|

|

(199,829 |

) |

|

Net loss |

- |

|

- |

|

|

- |

|

|

- |

|

|

(3,364,408 |

) |

|

(3,364,408 |

) |

|

Translation of foreign operations |

- |

|

- |

|

|

- |

|

|

179,764 |

|

|

- |

|

|

179,764 |

|

|

Balance as at June 30, 2020 |

69,058,424 |

|

23,562,376 |

|

|

- |

|

|

2,565,234 |

|

|

(14,077,509 |

) |

|

12,050,101 |

|

NexTech AR Solutions Corp.Condensed

Consolidated Interim Statements of Cash FlowsFor the three and six

months ended June 30, 2020 and 2019(Unaudited - Expressed in

Canadian dollars)

| |

For the three months ended June 30, |

For the six months ended June 30, |

|

|

2020 |

2019 |

2020 |

2019 |

|

|

|

|

|

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

Net loss |

(2,000,972 |

) |

(923,964 |

) |

(3,364,408 |

) |

(2,224,449 |

) |

|

|

|

|

|

|

|

Items not affecting cash: |

|

|

|

|

|

Amortization of intangible assets |

132,458 |

|

31,476 |

|

220,711 |

|

62,951 |

|

|

Deferred income tax recovery |

(24,239 |

) |

- |

|

(48,478 |

) |

- |

|

|

Depreciation of property and equipment |

17,434 |

|

8,249 |

|

27,283 |

|

24,342 |

|

|

Shares issued to settle related party liability |

- |

|

- |

|

38,239 |

|

|

|

Share-based payments |

861,958 |

|

161,851 |

|

1,512,904 |

|

523,702 |

|

|

Shares released from escrow for services |

- |

|

- |

|

- |

|

60,000 |

|

|

Option and warrant exercised shares outstanding |

(183,737 |

) |

- |

|

(183,737 |

) |

- |

|

|

|

|

|

|

|

|

Changes in non-cash working capital items |

|

|

|

|

|

Receivables |

356,792 |

|

(262,168 |

) |

139,547 |

|

(475,643 |

) |

|

Prepaid expenses and deposits |

23,735 |

|

(237,958 |

) |

4,660 |

|

(647,845 |

) |

|

Inventory |

(83,071 |

) |

(399,609 |

) |

(327,881 |

) |

(667,458 |

) |

|

Accounts payable and accrued liabilities |

673,907 |

|

(709,979 |

) |

480,787 |

|

(879,459 |

) |

|

Other payables |

(97,771 |

) |

- |

|

(230,174 |

) |

- |

|

|

Net cash used in operating activities |

(323,506 |

) |

(2,332,103 |

) |

(1,730,547 |

) |

(4,223,858 |

) |

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

Cash acquired in a business combination |

- |

|

- |

|

- |

|

128,670 |

|

|

Cash paid for acquisition of HootView |

- |

|

- |

|

- |

|

(85,664 |

) |

|

Purchase of equipment |

- |

|

- |

|

- |

|

(12,125 |

) |

|

Net cash used in investing activities |

- |

|

- |

|

- |

|

30,881 |

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

Proceeds from exercise of options and warrants |

1,404,022 |

|

- |

|

2,116,461 |

|

2,605,750 |

|

|

Net proceeds from private placement |

3,009,047 |

|

339,600 |

|

3,009,047 |

|

339,600 |

|

|

Net cash provided by financing activities |

4,413,069 |

|

339,600 |

|

5,125,508 |

|

2,945,350 |

|

|

|

|

|

|

|

|

Foreign exchange |

(117,022 |

) |

(266,280 |

) |

37,892 |

|

(170,541 |

) |

|

|

|

|

|

|

|

Net change in cash |

3,972,541 |

|

(2,258,782 |

) |

3,432,853 |

|

(1,418,168 |

) |

|

Cash, beginning |

2,309,656 |

|

2,487,471 |

|

2,849,344 |

|

1,646,858 |

|

|

Cash, ending |

6,282,197 |

|

228,689 |

|

6,282,197 |

|

228,689 |

|

(Above excerpts from the condensed consolidated

interim financial statements should be read in conjunction with the

financial statement notes).

Non-IFRS MeasuresThis News

Release makes reference to certain non-IFRS measures such as “Total

Bookings” and “Backlog”. These non-IFRS measures are not

recognized, defined or standardized measures under IFRS. Our

definition of Total Bookings and Backlog will likely differ from

that used by other companies and therefore comparability may be

limited.

Total Bookings and Backlog should not be

considered a substitute for or in isolation from measures prepared

in accordance with IFRS. These non-IFRS measures should be read in

conjunction with our condensed consolidated interim financial

statements and the related notes thereto as at and for the three

and six months ended June 30, 2020. Readers should not place undue

reliance on non-IFRS measures and should instead view them in

conjunction with the most comparable IFRS financial measures. See

the reconciliations to these IFRS measures below:

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

Total Bookings |

$ |

3,680,111 |

|

|

$ |

905,915 |

|

|

$ |

6,239,291 |

|

|

$ |

1,807,025 |

|

|

Total Revenue |

|

3,529,029 |

|

|

|

905,915 |

|

|

|

6,021,014 |

|

|

|

1,807,025 |

|

|

Adjustment for bookings |

|

151,082 |

|

|

|

- |

|

|

|

218,277 |

|

|

|

- |

|

|

Adjustment for backlog |

|

(51,000 |

) |

|

|

- |

|

|

|

(118,195 |

) |

|

|

- |

|

|

Backlog |

$ |

100,082 |

|

|

$ |

- |

|

|

$ |

100,082 |

|

|

$ |

- |

|

About NexTech ARNexTech is one of the leaders

in the rapidly growing Augmented Reality market

estimated to grow from USD $10.7B in 2019 and projected to reach

USD $72.7B by 2024 according to Markets & Markets Research; it

is expected to grow at a CAGR of 46.6% from 2019 to 2024.

The company is pursuing four verticals:

InfernoAR: An advanced Augmented Reality

and Video Learning Experience Platform for Events, is a SaaS video

platform that integrates Interactive Video, Artificial Intelligence

and Augmented Reality in one secure platform to allow enterprises

the ability to create the world’s most engaging virtual event

management and learning experiences. Automated closed captions and

translations to over 64 languages. According to Grandview Research

the global virtual events market in 2020 is $90B and expected to

reach more than $400B by 2027, growing at a 23% CAGR. With

NexTech’s InfernoAR platform having augmented reality, AI,

end-to-end encryption and built in language translation for 64

languages, the company is well positioned to rapidly take market

share as the growth accelerates globally.

ARitize™ For eCommerce: The company launched

its SaaS platform for webAR in eCommerce early in 2019. NexTech has

a ‘full funnel’ end-to-end eCommerce solution for the AR industry

including its Aritize360 app for 3D product capture, 3D/AR ads, its

Aritize white label app, its ‘Try it On’ technology for online

apparel, 3D and 360-degree product views, and ‘one click buy’.

ARitize™ 3D/AR Advertising Platform: Launched

in Q1 2020 the ad platform will be the industry's first end-to-end

solution whereby the company will leverage its 3D asset creation

into 3D/AR ads. In 2019, according to IDC, global advertising spend

will be about $725 billion.

ARitize™ Hollywood Studios: The studio is in

development producing immersive content using 360 video, and

augmented reality as the primary display platform.

To learn more, please follow us on Twitter,

YouTube, Instagram, LinkedIn, and Facebook, or visit our website:

https://www.nextechar.com.

On behalf of the Board of NexTech AR Solutions

Corp. “Evan Gappelberg” CEO and Director

For further information, please contact:

Evan GappelbergChief Executive Officerinfo@nextechar.com

The CSE has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Certain information contained herein may

constitute “forward-looking information” under Canadian securities

legislation. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as, “will

be”, “looking forward” or variations of such words and phrases or

statements that certain actions, events or results “will” occur.

Forward-looking statements regarding the Company increasing

investors awareness are based on the Company’s estimates and are

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, levels of activity, performance

or achievements of NexTech to be materially different from those

expressed or implied by such forward-looking statements or

forward-looking information, including capital expenditures and

other costs. There can be no assurance that such statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements and forward-looking information. NexTech

will not update any forward-looking statements or forward-looking

information that are incorporated by reference herein, except as

required by applicable securities laws.

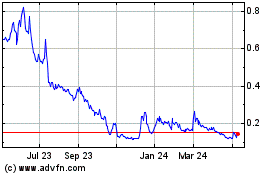

Nextech3D ai (CSE:NTAR)

Historical Stock Chart

From Dec 2024 to Jan 2025

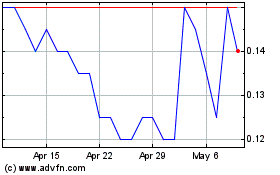

Nextech3D ai (CSE:NTAR)

Historical Stock Chart

From Jan 2024 to Jan 2025