ABN AMRO records incidental net loss of USD 200 million

26 March 2020 - 6:00PM

ABN AMRO records incidental net loss of USD 200 million

ABN AMRO records incidental net loss of USD 200

million

As a result of the unprecedented volumes and volatility in

financial markets following the outbreak of COVID 19, ABN AMRO

Clearing will incur a USD 250 million pretax incidental loss on one

of its US clients. The net loss is approximately USD 200 million

(EUR 183 million). The client had a specific strategy,

trading US options and futures, and failed to meet the minimum risk

and margin requirements following extreme stress and dislocations

in US markets. To prevent further losses, ABN AMRO Clearing decided

to close-out the positions of this client. The impact will be

included in the first quarter 2020 results of ABN AMRO.

ABN AMRO Clearing serves professional clients that are active in

financial markets worldwide. Historically ABN AMRO Clearing has a

track record of low credit losses.

Investor Relations

Press Relations Dies

Donker

Ariën Bikker+31(0)20-6282282

+31

(0)20-6288900investorrelations@nl.abnamro.com

pressrelations@nl.abnamro.com

This press release is published by ABN AMRO Bank N.V. and

contains inside information within the meaning of article 7 (1) to

(4) of Regulation (EU) No 596/2014 (Market Abuse Regulation)

- 20200326 Press Release Clearing UK

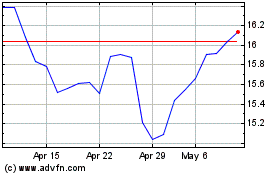

ABN AMRO Bank N.V (EU:ABN)

Historical Stock Chart

From Mar 2024 to Apr 2024

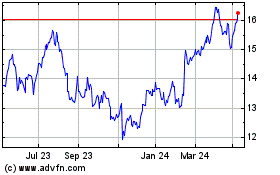

ABN AMRO Bank N.V (EU:ABN)

Historical Stock Chart

From Apr 2023 to Apr 2024