AccorHotels Net Profit Climbs

18 February 2016 - 9:00PM

Dow Jones News

PARIS—AccorHotels SA Thursday said it continues to suffer from

the fallout of November's terrorist attacks in Paris even as the

French hotels group reported a rise in earnings that reflects

recent turnaround efforts and improved revenue in other key

regions.

Europe's largest hotel operator, which makes around 30% of its

sales in France, reported a sharp 6.6% drop in fourth-quarter sales

in France due to the Nov. 13 terror attacks, leading to a 0.5% drop

for the year. That came despite tens of thousands of delegates

coming to Paris for an environmental conference in December, the

company said.

"We're set for a better January but it remains a gradual

improvement," Chief Financial Officer Jean-Jacques Morin said on a

call with reporters.

Mr. Morin said the company's sales in Paris plunged 14% in

November and 17% in December as tourists canceled reservations and

conferences were rescheduled or downsized. In France more widely,

Mr. Morin said sales dropped 4% in November and 7% in December.

"The effect was greatest on the luxury sector," Mr. Morin said.

"People decided not to come to Paris but to go to other capital

cities."

The Paris terrorist attacks dealt a blow to France's tourist

industry and slowed its economy. Sales at Paris hotels dropped by

half in the week after Nov. 13 as tourists canceled bookings for

the Christmas period and beyond. Although new bookings are

returning to normal, companies like AccorHotels are still suffering

from the spate of cancellations immediately after the attacks,

analysts say.

Mr. Morin added that the first quarter this year would also

impacted but that reservations were "good or even very good" after

that, notably due to the European soccer championships in France

starting in June.

Still, the company said Thursday its turnaround efforts paid

dividends in 2015 as it reported a 9.4% jump in net profit to 244

million euros ($271.6 million), up from €223 million the year

before.

The owner of the Ibis and Sofitel chains is in the midst of a

turnaround plan led by Chief Executive Sebastien Bazin, a private

equity specialist. Mr. Bazin has expanded the group's business in

China, increased its exposure to the luxury sector and pursued

acquisitions to ramp up its digital know-how.

Accor in December agreed to acquire the owner of the Fairmont,

Raffles and Swissotel hotel in a deal that values the Toronto-based

company, FRHI Holdings Ltd., at about $3 billion, increasing its

exposure to the U.S. and the upmarket sector.

Full-year earnings before interest and taxes rose 11% to €665

million as an increase in sales in most of the group's key regions

outweighed falling revenue in France and Brazil. Full-year sales

rose 2.3% to €5.58 billion, slightly missing analysts' expectations

of €5.65 billion.

Accor declined to provide any specific financial goals for

2016.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

February 18, 2016 04:45 ET (09:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

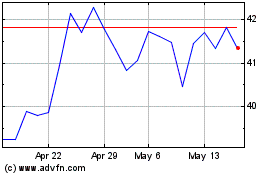

Accor (EU:AC)

Historical Stock Chart

From Nov 2024 to Dec 2024

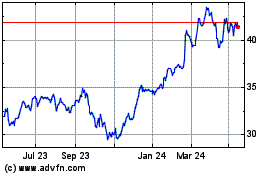

Accor (EU:AC)

Historical Stock Chart

From Dec 2023 to Dec 2024