Air Liquide Successfully Launches a 500 Million Euros Long Term Bond Issuance

14 September 2021 - 3:20AM

Business Wire

Main characteristics are as follows:

- Amount: €500 million

- Issuer: Air Liquide Finance, guaranteed by L’Air Liquide

SA

- Settlement: September 20, 2021

- Maturity: September 20, 2033 (12 years)

- Format: Fixed rate, repayment at maturity

- Coupon: 0.375% p.a.

Regulatory News:

Air Liquide (Paris:AI) has successfully launched a 500

million euros bond issue dedicated to the refinancing of its

September 2021 bond maturity and to the sustainable financing of

the Group’s long term growth, all of this under very competitive

conditions.

This transaction, significantly oversubscribed by

investors, was executed under the Group's Euro Medium Term Note

(EMTN) programme. With this issuance, Air Liquide is raising €500

million with a 12-year maturity at a yield of 0.390%.

This issue will be rated « A » by Standard & Poor’s

and « A3 » by Moody’s.

Jérôme Pelletan, Chief Financial Officer, commented:

“Air Liquide is taking advantage of favorable market conditions

to refinance its bond maturities and to finance over the long term

its sustainable growth in its numerous businesses. The good

conditions in which the Group has realized this bond issue

illustrate the recognition by the investors, and recently by the

credit rating agency Standard & Poor’s, of the continuous

strengthening of the Group's balance sheet notably since the Airgas

acquisition in 2016. It complements the first green bond issue we

made in May to more specifically finance and refinance several

sustainable projects, in particular in hydrogen, biogas and

oxygen.”

A world leader in gases, technologies and services for Industry

and Health, Air Liquide is present in 78 countries with

approximately 64,500 employees and serves more than 3.8 million

customers and patients. Oxygen, nitrogen and hydrogen are essential

small molecules for life, matter and energy. They embody Air

Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Air Liquide’s ambition is to be a leader in its industry,

deliver long term performance and contribute to sustainability -

with a strong commitment to climate change and energy transition at

the heart of its strategy. The company’s customer-centric

transformation strategy aims at profitable, regular and responsible

growth over the long term. It relies on operational excellence,

selective investments, open innovation and a network organization

implemented by the Group worldwide. Through the commitment and

inventiveness of its people, Air Liquide leverages energy and

environment transition, changes in healthcare and digitization, and

delivers greater value to all its stakeholders.

Air Liquide’s revenue amounted to more than 20 billion euros in

2020. Air Liquide is listed on the Euronext Paris stock exchange

(compartment A) and belongs to the CAC 40, EURO STOXX 50 and

FTSE4Good indexes.

www.airliquide.com Follow us on Twitter

@airliquidegroup

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210913005731/en/

Media Relations media@airliquide.com Investor

Relations IRTeam@airliquide.com Group Financing &

Treasury Guillaume Serey +33 (0)1 40 62 51 78 Thomas Lemée +33

(0)1 40 62 58 25

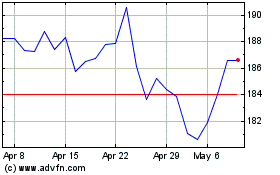

Air Liquide (EU:AI)

Historical Stock Chart

From Mar 2024 to Apr 2024

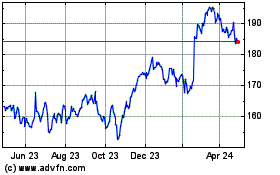

Air Liquide (EU:AI)

Historical Stock Chart

From Apr 2023 to Apr 2024