Atari enters into an agreement to acquire Night Dive Studios and

announces its intention to proceed with the issuance of €30 M bonds

convertible into new Atari shares

Atari enters into an agreement to acquire

Night Dive Studios and announces its intention to proceed with the

issuance of €30 M bonds convertible into new Atari

shares

PARIS, FRANCE (March 22, 2023 - 11.00 pm

CET) - Atari® (the “Company”) — one of

the world's most iconic consumer brands and interactive

entertainment producers — announced that it has entered into an

agreement to acquire 100% of Night Dive Studios Inc.

(“Night Dive”), a full service game development

and publishing company based in Vancouver, Washington, USA.

In addition, Atari, SA also announced that it

intends to proceed in the near-term with a €30 million bond issue

convertible into new shares of Atari (the “Convertible

Bonds”) in order to meet with its capital needs in the

context of the implementation of its new growth strategy and

refinancing of its debt.

AGREEMENT

SIGNED TO ACQUIRE NIGHT DIVE STUDIOS

Led by industry veterans Stephen Kick and Larry

Kuperman, Night Dive is a full service development and publishing

company with expertise in restoring, optimizing, and publishing

classic video games. Night Dive has published over 100 titles and

has garnered critical acclaim for their releases of seminal

industry and fan-favorite titles including System Shock, Doom 64,

and Quake.

Night Dive’s most recent project is a remastered

version of classic FPS game System Shock, which is one of the

most-anticipated retro releases of 2023. System Shock is now

available for pre-order on Steam, GOG and Epic Games.

A key to the success of Night Dive is their

proprietary KEX engine that makes classic games playable on modern

hardware and gives the studio the ability to enhance and improve

upon the original to meet the expectations of contemporary players.

The studio’s reputation and deep industry knowledge have made them

a go-to partner for some of the largest names in gaming and media

and allowed them to develop a diversified portfolio of titles.

For the fiscal year ended December 2022, Night

Dive has reported revenue of approximately US$3.0 million1. The

founders own 87% of the Company’s shares while Wade Rosen, Chairman

and CEO of Atari, owns a minority stake of 13%2.

With this acquisition Atari will enrich its

large library of owned IP, be able to leverage Night Dive’s

proprietary technology, and utilize Night Dive’s publishing

capabilities to support Atari’s retro-focused growth strategy.

This acquisition has been approved unanimously

by the disinterested members of the board of Atari, it being

specified that Wade Rosen did not participate to the vote3.

Wade Rosen, Chairman and CEO of Atari,

commented: “Night Dive’s proven expertise and successful track

record in commercializing retro IP is well-aligned with Atari’s

strategy and I am confident that their combined talent, technology

and IP portfolio will contribute to Atari’s future success.”

Stephen Kick and Larry Kuperman, principals of

Night Dive commented: “Night Dive and Atari have a long history

together and we know that Atari shares our passion for retro games

and our focus on producing high-quality new and remastered games

that do justice to the original IP. As we look to grow our business

and expand our capabilities, we could think of no better long-term

partner than Atari.”

TERMS AND

TIMING OF THE ACQUISITION

The purchase price of Night Dive will consist of

(i) an initial consideration of US$10 million payable half in cash

and half in Atari shares at the closing of the acquisition (see

below) plus (ii) an earn-out of up to US$10 million, payable in

cash over the next three years based on the future performance of

Night Dive.

It is expected that the acquisition of Night

Dive will be completed in April 2023.

FINANCING OF

THE ACQUISITION

- The initial

consideration will be paid half in cash (for US$5 million) and half

in newly issued Atari ordinary shares (for US$5 million)4. The

calculation of the number of Atari shares to be issued will be

based on the 20-day volume weighted average price of Atari shares

on Euronext Growth prior to the tenth day prior to the closing of

the transaction.

- The new Atari

shares will be issued by the Company, represented by the board of

directors of Atari, through a contribution in kind (apport en

nature) of Night Dive shares to Atari acting pursuant to the 18th

resolution of Atari's combined shareholders' meeting held on

September 27, 2022 (the "AGM") and on the basis of

the reports of a court-appointed contribution auditor (commissaire

aux apports) on the value of the contribution in kind and the

fairness of the exchange ratio5.

- The Company and

Irata LLC, a holding company controlled by Wade Rosen (“Irata”),

have agreed that Irata intends to provide bridge financing to Atari

for the payment of the initial consideration, or $5 million.

CONVERTIBLE

BONDS

The Company intends to

issue €30 million in Convertible Bonds through a public offering in

France with a priority subscription period (offre au public avec

délai de priorité) for all the shareholders of Atari.

- A prospectus in

relation to the Convertible Bonds offering will be prepared and

subject to the AMF approval;

- The issuance of

the Convertible Bonds will occur shortly after the completion of

the acquisition;

- The Convertible

Bonds will be issued with a priority subscription period for all

shareholders for a period of three trading days (that does not

result in the creation of negotiable rights) through a public

offering in France (only);

- The main

shareholder of Atari, Irata LLC, holding 29.2% of the share capital

of Atari, has indicated that it intends to subscribe its prorata

share and to provide a firm underwriting for a number of

Convertible Bonds equal to at least to 75% of the total amount of

the offering;

- It is the intent

that Irata will undertake contractually and irrevocably vis-à-vis

the Company not to convert its Convertible Bonds into Atari shares

before at least the 25th of June 2025.

The amount raised

through the Convertible Bonds will mainly be used to:

- Reimburse the $5

million bridge financing provided by Irata in the context of the

acquisition and finance future potential acquisitions Atari may

consider;

- Continued

investment in growth initiatives, notably in the development of

more than 12 new games expected to be launched in the next 18

months;

- General cash

requirements and financial flexibility necessary to pursue the

transformation plan;

- Reimburse the

shareholder loans granted by Irata6 previously granted in

accordance with its support commitment, and accrued interests on

these loans.

About

ATARI

Atari is an

interactive entertainment company and an iconic gaming industry

brand that transcends generations and audiences. The company is

globally recognized for its multi-platform, interactive

entertainment and licensed products. Atari owns and/or manages a

portfolio of more than 200 unique games and franchises, including

world-renowned brands like Asteroids®, Centipede®, Missile

Command®, Pong®, and RollerCoaster Tycoon®. Atari has offices in

New York and Paris. Visit us online at www.atari.com.

Atari shares are

listed in France on Euronext Growth Paris (ISIN Code FR0010478248,

Ticker ALATA).

©2023 Atari

Interactive, Inc. Atari wordmark and logo are trademarks owned by

Atari Interactive, Inc.

Contacts

Atari - Investor RelationsTel + 33 1 83 64 61 57

- investisseur@atari-sa.com | www.atari.com/news/

Calyptus – Marie Calleux

Tel + 33 1 53 65 68 68 – atari@calyptus.net

Listing Sponsor- EurolandTel +33 1 44 70 20

84Julia Bridger - jbridger@elcorp.com

FORWARD-LOOKING STATEMENTSThis

press release contains certain non-factual elements, including but

not restricted to certain statements concerning its future results

and other future events. These statements are based on the current

vision and assumptions of Atari’s leadership team. They include

various known and unknown uncertainties and risks that could result

in material differences in relation to the expected results,

profitability and events. In addition, Atari, its shareholders and

its respective affiliates, directors, executives, advisors and

employees have not checked the accuracy of and make no

representations or warranties concerning the statistical or

forward-looking information contained in this press release that is

taken from or derived from third-party sources or industry

publications. If applicable, these statistical data and

forward-looking information are used in this press release

exclusively for information.

DISCLAIMERThe distribution of

this press release and the offer and sale of the Convertible Bonds

may be restricted by law in certain jurisdictions and persons into

whose possession this document or other information referred to

herein comes should inform themselves about and observe any such

restriction. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction.This press release may not be published, distributed

or transmitted in the United States (including its territories and

dependencies). This press release does not constitute or form part

an offer of securities for sale or any solicitation to purchase or

subscribe for securities or any solicitation of sale of securities

in the United States. The securities referred to herein have not

been and will not be registered under the U.S. Securities Act of

1933, as amended (the “Securities Act”) or the law

of any state or other jurisdiction of the United States, and may

not be offered or sold in the United States absent registration

under the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. Atari does not intend to register all or any

portion of the securities in the United States under the Securities

Act or to conduct a public offering of the Securities in the United

States.This press release and the information contained herein do

not constitute either an offer to sell or purchase, or the

solicitation of an offer to sell or purchase, securities of the

Company.No communication or information in respect of any

securities mentioned in this press release may be distributed to

the public in any jurisdiction where registration or approval is

required. No steps have been taken or will be taken in any

jurisdiction where such steps would be required. The offering or

subscription of the Company’s securities may be subject to specific

legal or regulatory restrictions in certain jurisdictions.

This press release does not, and shall not, in

any circumstances, constitute a public offering, a sale offer nor

an invitation to the public in connection with any offer of

securities. The distribution of this document may be restricted by

law in certain jurisdictions. Persons into whose possession this

document comes are required to inform themselves about and to

observe any such restrictions.

A French prospectus comprising (i) the Company’s

universal registration document filed with the AMF on July 27, 2022

under number D.22-0661, (ii) an amendment to the universal

registration document to be filed with the AMF, (iii) a securities

note (including the summary) relating to the public offering of

convertible bonds and (iii) the summary of the French prospectus

will be submitted to the approval by the AMF and will be published

on the AMF’s website (www.amf-france.org). As from such filing with

the AMF, copies of the prospectus will be available free of charge

at the Company’s registered office.

This announcement is an advertisement and not a

prospectus within the meaning of the Regulation (EU) 2017/1129, as

amended (the "Prospectus Regulation").

With respect to the member states of the

European Economic Area other than France, no action has been

undertaken or will be undertaken to make an offer to the public of

the securities referred to herein requiring a publication of a

prospectus in any relevant member state. As a result, the

securities may not and will not be offered in any relevant member

state except in accordance with the exemptions set forth in Article

1 (4) of the Prospectus Regulation or under any other circumstances

which do not require the publication by the Company of a prospectus

pursuant to Article 3 of the Prospectus Regulation and/or to

applicable regulations of that relevant member state.

The distribution of this press release has not

been made, and has not been approved, by an “authorised person”

within the meaning of Article 21(1) of the Financial Services and

Markets Act 2000. As a consequence, this press release is only

being distributed to, and is only directed at, persons in the

United Kingdom that (i) are “investment professionals” falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (as amended, the

“Order”), (ii) are persons falling within Article

49(2)(a) to (d) (“high net worth companies, unincorporated

associations, etc.”) of the Order, or (iii) are persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of Article 21 of the Financial Services and Markets Act

2000) in connection with the issue or sale of any securities may

otherwise lawfully be communicated or caused to be communicated

(all such persons together being referred to as “Relevant

Persons”). Any investment or investment activity to which

this document relates is available only to Relevant Persons and

will be engaged in only with Relevant Persons. Any person who is

not a Relevant Person should not act or rely on this document or

any of its contents.

This announcement may not be published,

forwarded or distributed, directly or indirectly, in the United

States of America, Canada, Australia, South Africa or Japan.

1 Under US GAAP, based on unaudited financial statements of

Night Dive Studios Inc., under further review in the context of

usual due diligence2 Held by Wade J. Rosen Revocable Trust,

registered under US laws3 As related party in the transaction.4

Subject to customary net debt / working capital adjustment.5 In

accordance with article L. 225-147 of the French code de commerce

and AMF recommendation DOC-2020-06. The reports of the contribution

auditor will be made available on Atari’s website upon issuance by

the auditor.6 Equals to around 8 million euros in principal at the

date of this press release, and excluding any potential shareholder

loans concluded until the issuance of the convertible bonds

- 20230322_Atari_CP_Acquisition-OC-Projet_EN_DEF

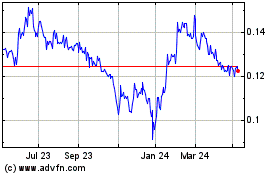

Atari (EU:ALATA)

Historical Stock Chart

From Dec 2024 to Jan 2025

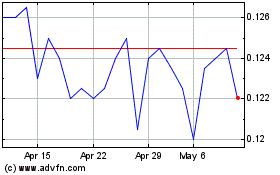

Atari (EU:ALATA)

Historical Stock Chart

From Jan 2024 to Jan 2025