HiPay Group:

HiPay Group

HiPay regains growth momentum with

16% increase in Q3 revenue

- Quarterly payment volume of 1.7

billion euros, an 18% increase compared to the third quarter of

2021

- Revenue1 of 14.3 million euros

for the period, a 16% increase compared to 2021

- Continuous business growth

offering positive prospects, and positioning HiPay as the European

leader in omni-channel payments

Paris, 27 October 2022: HiPay (code ISIN

FR0012821916 – ALHYP), a fintech specialising in omni-channel

payments, announces its third quarter 2022 revenue.

| Q3 - in millions of

euros |

Q3 2022 |

Q3 2021 |

Var. % |

|

Payment volume |

1,748 |

1,478 |

+18 % |

|

Revenue1 |

14.3 |

12.3 |

+16 % |

| |

| From January to September - in

millions of euros |

9M 2022 |

9M 2021 |

Var.% |

|

Payment volume |

5,342 |

4,678 |

+14 % |

|

Revenue1 |

41.8 |

39.1 |

+7 % |

A major increase in payment volumeDuring

the third quarter of 2022, payment volume reached 1.7 billion

euros, which corresponds to an 18% increase compared to the third

quarter of 2021.

This performance reflects an acceleration

compared to the first half of the year, despite a macroeconomic

environment that remains challenging. (Recall that during the first

half of 2022, e-commerce product sales decreased by approximately

15%. Source: Fevad) Growth over the first nine months of 2022 is

now up 14%, an acceleration of two points compared to the first

half. Payment volume growth continues to be spread across our main

market segments: France, iGaming and International.

It’s worth noting that the development of the

omni-channel offering is taking shape. In-store payment volume

represents 9% of flows in France since the beginning of the year

(vs. 3% in 2021). This has enabled HiPay to establish its position

as an omni-channel payment specialist.

An upturn in business once again results in

double-digit quarterly revenue growthThird quarter 2022 revenue

reached 14.3 million euros, an increase of 2 million euros and a

16% increase compared to the third quarter of 2021, despite the end

of Direct Banking payment methods in the iGaming segment, whose

volumes have shifted to other less profitable payment methods.

Adjusted for this unfavourable mix effect, revenue growth reached

an increase of 22% for the quarter, which is in line with

performance over 2019-2021 (CAGR of 25% over the first 9 months of

the year).

The ratio of revenue to payment volumes, which

reflects HiPay's ability to monetise its services, shows

stabilisation. This ratio reached 0.82% in the third quarter of

2022 (vs 0.84% in 2021), impacted by the iGaming payment mix effect

for -1 bp (basis points) and by the growth in payment volumes at

points of sale for -2 bp.

Cumulated over the first 9 months of the year,

the iGaming payment mix effect cost HiPay 2.7 million euros

in revenue, i.e., -7 growth points. The revenue ratio on payment

volume thus reached 0.78% (vs. 0.84% in 2021). The erosion of -6

bps is explained by -5 bps from the iGaming payment method mix and

-3 bps from the growth of payment volume at points of sale.

Consequently, excluding these two mix effects, the monetisation of

payment volume increased by 0.02 pts, which reflects the business

strategy pursued over the course of several half-year periods.

The negative mix effect on revenue caused by the

end of the use of Direct Banking payments in the iGaming segment,

having taken place in 2021, is expected to continue until the end

of the fourth quarter of 2022, but no further.

Robust momentum in HiPay’s business in France

and abroad offers promising future prospectsHiPay’s European

expansion continues through new agreements with the following

retail players:

- In Italy, with the

strengthening of its strategic partnership with IC Intracom, users

of the HiPay MOTO solution, in addition to the launch of the

Salutea parapharmaceutical site

- In Portugal, through the

agreement with Mr Blue, which bolsters HiPay's status as e-commerce

Fashion Retail payment expert in this market

- In Spain, through its work

with Aladinia, the Spanish leader in gift experiences.

- In the United Kingdom,

through the signing of Bludiode.com, an international electronic

goods merchant

Additionally, the iGaming business continues to

grow. HiPay now works with Matchem and its website Genybet.fr

(Paristurf Group) in the French market and also offers physical

payment solutions in Belgian gaming halls through the deployment of

the 'Bancontact QR code' payment method.

In France, HiPay has established its

position as a multi-specialist through several agreements over a

wide variety of industries (beauty, fashion, footwear,

furniture/decor, gardening, cooking/gastronomy), including

Mecatechnic, Reborn and NotShy.

Additionally, the attractiveness of its Unified

Commerce offering has grown significantly, with nearly 20% of new

omni-channel support contracts signed, which is in line with its

set goals for 2022.

This Unified Commerce offering was presented at

the beginning of the quarter at a meeting co-organised with Nepting

& Pebix Avem, longtime partners of HiPay, and is already

enjoying a particularly favourable response from French customers

in the second half of 2022.

2023 financial calendarBelow is HiPay’s

2023 financial calendar. The dates in this calendar are approximate

and are subject to change.

|

Events |

Date |

|

2022 revenue |

23 February 2023 (pre-market hours) |

|

2022 year-end results |

6 April 2023 (pre-market hours) |

|

Annual results presentation |

6 April 2023 at 16:00 |

|

Revenue for the first quarter of 2023 |

11 May 2023 (pre-market hours) |

|

General Meeting 2023 |

1 June 2023 at 10:00 |

|

Revenue for the first half of 2023 |

27 July 2023 (pre-market hours) |

|

Results for the first half of 2023 |

14 September 2023 (pre-market hours) |

|

Presentation of results for the first half of 2023 |

14 September 2023 at 16:00 |

|

Revenue for the third quarter of 2023 |

26 October 2023 (pre-market hours) |

Next financial communication: 23 February

2023 - 2022 revenue

***

About HiPayHiPay is a global payment services provider.

Using the power of payment data, we help our sellers grow by giving

them a 360° overview of their business.More information at

hipay.com. You can also find us on LinkedIn.HiPay Group is listed

on Euronext Growth (ISIN: FR0012821916 – ALHYP).

ContactsPR Annie Hurley (CMO)+33 (0)6 81 16

07 52ahurley@hipay.com

Investor RelationsJérôme Daguet (CFO)+33 (0)7 86 53 93

93jdaguet@hipay.com

This release does not constitute a sale offer or

the solicitation of an offer to purchase HiPay securities. If you

would like more information about HiPay Group, please visit the

Investors section on our website hipay.com. This release may

contain provisional declarations. Although HiPay Group believes

that these declarations are based on hypotheses that are reasonable

on the release’s publication date, they are by nature subject to

risk and uncertainty that can lead to differences between the

actual figures and those indicated or inferred in these

declarations. HiPay Group operates in one of the most volatile

sectors where new risk factors can emerge. HiPay Group does not

have any obligation to update these provisional declarations based

on new information, events or circumstances.

- 20221027-HiPay-Press Release-Q3 2022 Results

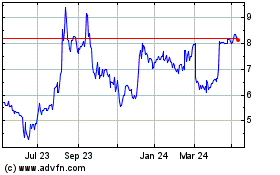

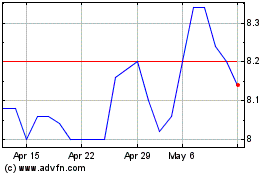

Hipay (EU:ALHYP)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hipay (EU:ALHYP)

Historical Stock Chart

From Mar 2024 to Mar 2025